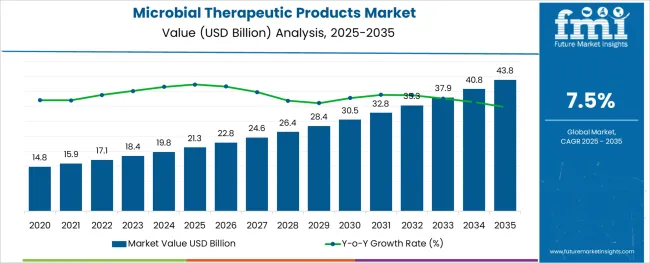

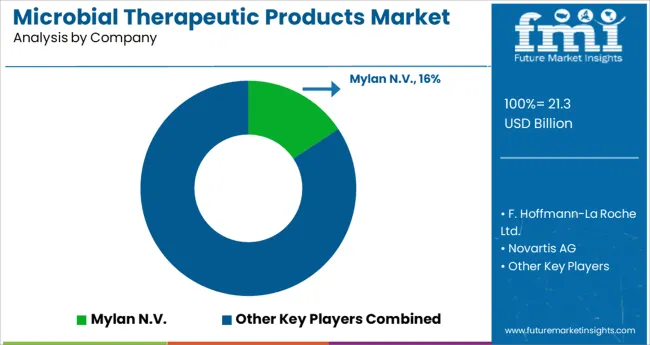

The Microbial Therapeutic Products Market is estimated to be valued at USD 21.3 billion in 2025 and is projected to reach USD 43.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The microbial therapeutic products market is advancing steadily, underpinned by innovations in microbiome modulation, personalized therapeutics, and biologically derived treatment approaches. Increasing focus on gut-brain axis research, chronic inflammatory conditions, and metabolic disorders has elevated microbial-based therapies as promising alternatives or adjuncts to conventional pharmaceuticals.

Regulatory bodies have shown growing acceptance of live biotherapeutic products, prompting accelerated investment from biotechnology firms and pharmaceutical leaders. The shift toward precision medicine is encouraging the development of targeted delivery mechanisms and dose-standardized formulations.

Furthermore, partnerships between academia and industry are fueling pipeline expansion, particularly for conditions with unmet medical needs such as antibiotic-resistant infections and immune modulation therapies. As clinical evidence deepens and manufacturing scalability improves, microbial therapeutics are expected to transition from niche research tools to mainstream therapeutic interventions, offering significant potential across disease prevention, treatment, and wellness.

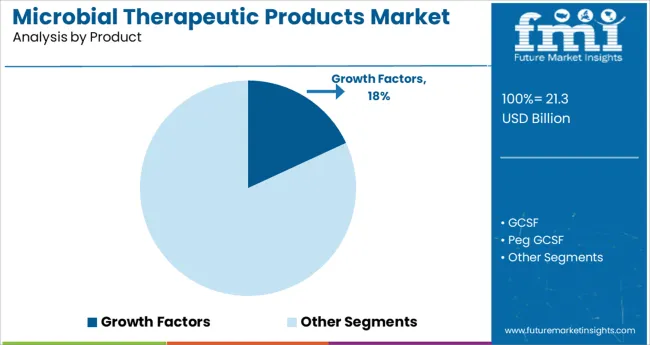

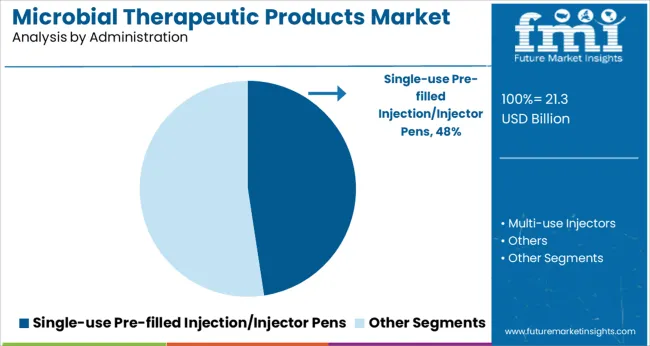

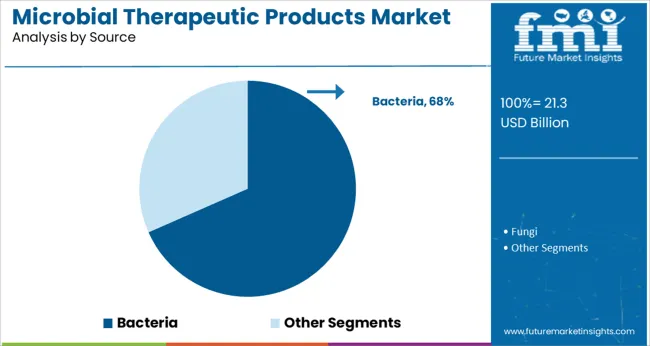

The market is segmented by Product, Administration, Source, Application, and End User and region. By Product, the market is divided into Growth Factors, GCSF, Peg GCSF, Exenatide, Anti-cancer Agents, Immunosuppressants, Enzymes, and Others. In terms of Administration, the market is classified into Single-use Pre-filled Injection/Injector Pens, Multi-use Injectors, and Others. Based on Source, the market is segmented into Bacteria and Fungi.

By Application, the market is divided into Metabolic Disorders, Haematological Disorders, Oncology, Immunological Disorders, Infectious Diseases, Allergic Diseases, and Others. By End User, the market is segmented into Hospitals, Pharmaceuticals & Biopharmaceutical Companies, and Research & Academic Institutions. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The growth factors subsegment is expected to account for 18.1% of the microbial therapeutic products market revenue in 2025, positioning it as a critical component of the product landscape. This segment’s share is driven by the role of microbial-derived growth factors in cell signaling, immune modulation, and tissue regeneration.

Therapeutic applications increasingly depend on precision-controlled biological mechanisms, where microbial systems are leveraged to produce recombinant growth factors with high purity and bioactivity. The ability of these agents to influence cellular repair and immune responses has opened new treatment pathways in oncology, dermatology, and inflammatory diseases.

Manufacturing advantages such as scalability, reproducibility, and cost-efficiency in microbial expression systems have further strengthened this segment’s adoption. Biopharmaceutical firms are actively investing in research and production of microbial-derived growth factors, reinforcing the segment’s continued growth trajectory.

Single-use pre-filled injection or injector pens are projected to dominate the administration category with a 47.6% revenue share in 2025. This leadership is supported by rising demand for patient-centric, minimally invasive delivery systems that ensure accurate dosing and improved compliance.

These devices simplify administration of microbial therapeutic products, particularly for self-use in chronic care, metabolic disorders, and immunotherapy. The convenience, portability, and reduced risk of contamination associated with single-use formats have enhanced patient adherence and health outcomes.

Additionally, pharmaceutical companies are favoring injector pens to reduce administration errors and enhance product differentiation in competitive markets. Innovations in pen technology, such as dose memory and adjustable delivery rates, continue to drive preference among healthcare providers and patients, sustaining the strong position of this segment within the overall market.

Bacteria-based products are anticipated to hold a dominant 68.4% share in the microbial therapeutic products market by 2025, underscoring their foundational role in therapeutic development. The high share is attributed to the extensive clinical validation, safety profiles, and diverse functionalities offered by bacterial strains.

Probiotic and commensal bacteria are being engineered to deliver therapeutic payloads, modulate the immune system, and compete against pathogenic organisms. The adaptability of bacterial platforms enables gene editing, metabolic pathway modulation, and targeted drug delivery within the host.

Additionally, bacteria have demonstrated superior scalability and manufacturing control compared to other microbial sources. Regulatory frameworks are increasingly accommodating bacterial therapeutic candidates, accelerating their clinical progress and commercialization. As synthetic biology advances and bacterial therapeutics expand into oncology, neurology, and infectious disease treatment, the segment is expected to maintain its leadership across therapeutic applications.

| Particulars | Details |

|---|---|

| H1, 2024 | 7.47% |

| H1, 2025 Projected | 7.51% |

| H1, 2025 Outlook | 7.31% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 20 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 16 ↓ |

The market for microbial therapeutic products is subject to changes as per the regulatory impositions and quality control guidelines within its region of jurisdiction, with reference to the macro and industry scale dynamics.

H1-2025 outlook period in comparison to H1-2025 projected period showed a negative growth in terms of Basis Point Share by 20 BPS. However, In H1-2025, the market growth rate of microbial therapeutic products is expected to fall by 16 basis point share (BPS), as per FMI analysis.

The drop in the BPS values observed is due to the initial restrictive impact of the COVID-19 pandemic globally. With the restrictions in production and distribution activities, the market observed a decline in the BPS values. Moreover, the high cost of production of microbial therapeutic products also poses operational cost burden upon manufacturers.

Conversely, with the growing trend of contract manufacturing within developing countries of the Asian region for microbial therapeutic products, the market is set to expand with a positive growth outlook over the forecasted years. The key developments in the market include the expansion of the bioprocess industry into processes with consolidated flow for up-scale of materials.

A microbe, such as a bacteria, yeast, or fungus, is a microscopic living entity. Microbes create microbial treatment products, which are mostly used to make cheese, wine, vinegar, and bread. Enzyme, antibiotic, and nutrition production are all examples of medicinal microbiology.

Microbes have been portrayed as our enemies throughout most of modern medical history; yet, it is now plainly obvious that they can be exploited as therapies. In reality, a growing number of firms currently are focusing on microbial treatment products leading to clinical development in their product pipelines. The few extant live bacterial prophylactic vaccines and more recent efforts employing fecal microbiota transplant demonstrate the potential of therapeutic microbial.

Several studies have found that microbial imbalance is linked to the risk of getting certain diseases. The commercial prospects have improved as the focus on creating therapeutic microbial medicines that treat and successfully mitigate the development of these kinds of diseases has gained traction.

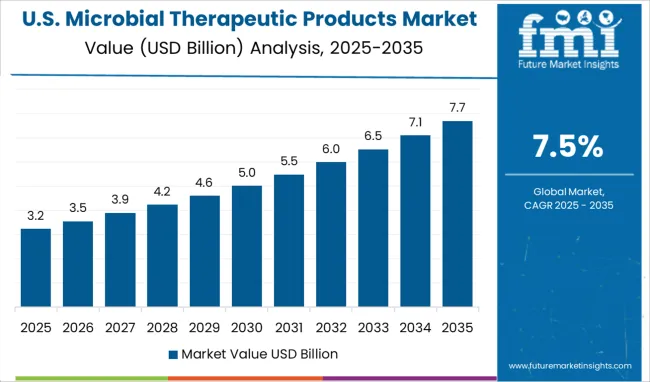

The microbial therapeutic products market expanded at a CAGR of 6.6% from 2020 to 2024, and amassed revenue worth USD 19.8 Billion in 2024. The market is primarily driven by rising prevalence of lifestyle-related chronic diseases and antibiotic resistance.

As a result, market players are scrambling to create novel solutions and products to cure a variety of immunological illnesses and other bodily ailments, consequently expanding the market's scope in the coming years.

Sales of microbial therapeutic products are predicted to surge at a CAGR of 7.5% from 2025 to 2035, with the global market expected to close in on a valuation of USD 43.8 Billion by 2035.

Increasing Cases of Chronic Disorders Fueling Sales of Microbial Therapeutic Products

WHO reports that "Noncommunicable diseases (NCDs) claim the lives of 41 million people each year, accounting for 71% of all deaths worldwide. More than 15 million people between the ages of 30 and 69 die each year from an NCD; 85 percent of these "premature" deaths occur in low- and middle-income nations ".

Chronic diseases, also known as noncommunicable diseases, are long-term illnesses caused by a mix of genetic, physiological, environmental, and behavioural factors. Diabetes, cardiovascular disease, cancer, and asthma are all likely to become more common as the global senior population grows.

Pharmaceutical companies are boosting their research to produce viable therapies against this backdrop. The importance of microbes in human health and disease has become increasingly recognized over time.

By combining non-pathogenic bacteria into living biotherapeutics made up of synthetic microbes, a new study has revealed the possibilities of building live biotherapeutics to address specific disease pathways. Given the rising prevalence of the global population and the growth of numerous lifestyle disorders, emerging economies are anticipated to emerge as potential opportunity centers.

Improved Technologies in Disease Diagnostic Driving Demand for Microbial Therapeutic Solutions

Disease diagnosis is transforming as the global healthcare business faces paradigm transformations. Healthcare institutions are investing in technologically enhanced testing and diagnostic procedures in response to increased demand for shorter turnaround times, multiplexing of reactions, and specificity.

Clinical trials are currently underway to explore in-vivo techniques as well as other minimally invasive procedures to improve patient comfort.

Rising Investments in R&D of Biological Drugs Aiding Sales Microbial Therapeutic Solutions

Governments worldwide have proactively lobbied for increased funding allocation to even further biosimilar medication development research works. The FDA in the United States, for example, has recently approved roughly 300 biologics products, with 87 percent of them being imports.

This is expected to open up new opportunities for the development of future microbial therapeutic products. Europe, on a similar note, has favourable reimbursement regulations for drug development.

Based on these trends, the future of microbial therapeutic products appears to be bright, with major manufacturers striving to establish a consolidated presence across key regions throughout the projected period.

Dearth of Proper Data May Decrease Microbial Therapeutic Enzyme Demand

The scarcity of proper data is a serious challenge for microbial therapy professionals. According to Microbiotica, a famous microbiome researcher, the mapping of diverse bacteria sources is imprecise, making most treatments unnecessary. While identification is possible, the consequences of many strains on human health are unknown.

Furthermore, many of the specific bacteria's functions can be shared by unrelated species. Thus, there may only be one comparable strain within a group of roughly ten germs connected to any given disease. This provides a problem in terms of determining which formulations should be used to ensure the drug's efficacy.

Even though that a variety of treatment options have arisen, there is no universal agreement on which, is most effective. One such option is live bacterial therapies, which, despite being widely used, are still equivocal in terms of effectiveness. Many researchers have been unsuccessful in demonstrating how to live bacteria engraft and persist in the gut after intake.

Increasing Cases of Chronic Disorders Augmenting Sales Growth of North America Market

North America will continue to be the world's largest market for microbial therapeutics products, with global volume sales expected to rise at a rapid pace. The key growth catalyst is the increasing frequency of regulatory approvals for biosimilar candidates. Chronic disease cases are on the rise, which bodes well for market expansion.

According to the NCBI, cancer has been a serious public health concern in Europe since the beginning of the twenty-first century, with a prevalence rate of about 3% and rising to 15% as people get older. The main factor is the growing geriatric population.

Furthermore, the World Health Organization predicts that noncommunicable diseases such as diabetes, chronic respiratory diseases, mental disorders, and cardiovascular diseases (CVDs) account for 86 percent of fatalities and 77 percent of the disease burden in the region. This is partly due to the predominance of sedentary behaviours.

Furthermore, as bacteria strains evolve, the burden of contagious diseases is increasing, as is antibiotic resistance. As a result, pharmaceutical companies are rushing to create a variety of microbial therapeutic solutions.

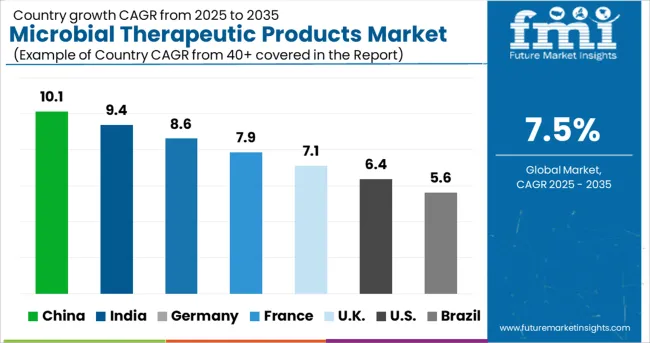

By 2035, the East Asia market is predicted to grow at a dizzying rate. The growing presence of key pharmaceutical companies that are introducing novel drug combinations to address the rising burden of chronic and infectious diseases is largely to blame for the industry's growth.

Rising Cases of Cancer Increasing Demand for Microbial Therapeutic Products

The increased prevalence of cancer in the United States is expected to increase the demand for microbial therapeutic solutions. In the United States, cancer is the second largest cause of death.

"In 2025, there will be a predicted 1.9 Million new cancer cases diagnosed and 609,360 cancer deaths in the United States," according to cancer.org.

Pharmaceutical companies are utilizing microbial treatments, largely bacteria-derived, to regress various forms of cancer and other ailments as a result of this, prompting experts to create a variety of modified bacterial strains.

Presence of Key Pharma Companies Aiding Microbial Therapeutic Products Market Growth

One of the most potential biotechnologies in the globe is biopharmaceutical technology. Biopharmaceuticals are flourishing and increasing rapidly as a worldwide high-tech biotechnology business, providing biopharmaceuticals with unparalleled market possibilities in China and other developing countries, due to the advancement of modern biotechnology.

Growth of biopharmaceutical solutions in the country is increasing because most pharma and biopharma companies are focusing on capitalizing on the expansion, including looking for opportunities to collaborate/partner with local firms, which is assisting the emergence and growth of the microbial therapeutics products market over the forecast period.

Anti-cancer Agents Offer Plethora of Possibilities Due to Increasing R&D Investments by Key Producers

Growing worldwide cancer burden is fuelling rapid improvements in oncology, opening the door for increased anti-cancer drug sales in key regions. The segment is predicted to reach massive volume sales by 2025 end. For a variety of malignancies, a crucial growth stimulant, several precision-based therapy candidates are being investigated.

Simultaneously, demand for antimicrobial growth factors is increasing significantly. Healthcare and pharmaceutical key companies are incorporating this method into their medicine formulations due to the increased possibility for improved tissue regeneration among patients. Through 2035, the segment is expected to expand at a high CAGR.

Single-use Pre-filled Injections/Injector Pens to Remain Eminent Route of Administration

Single-use pre-filled injections will be the most commonly used technique for infusing microbial therapeutic agents by route of delivery. Concerns about infection transmission through multiple-use injections are driving an increase in the use of single-use injection pens.

The others segment is predicted to have the most influence, generating more than 40% of revenue over the forecast period. Eco Therapeutics and fecal microbiota transplants are becoming more common, especially when it comes to changing the gut microbiota.

Wide Availability of Bacteria-based Microbial Therapeutic Products in the Market

Bacterium-derived microbial therapeutic products are likely to remain profitable due to their widespread availability from various sources. Furthermore, microbes have served as the foundation for the development and manufacture of a variety of therapeutic medications, including antibiotics and vitamins.

Because of their benign nature, the gut microbiota has been a popular bacteria culturing source over time. Intestinal bacteria have proven to be quite beneficial in the treatment of digestive problems and food poisoning. As a result, genetic engineering strategies for extracting them have proliferated in recent years.

Oncology to Remain Key Application Area of Microbial Therapeutic Products

Despite significant improvements in cancer treatment, new therapeutic platforms are currently being studied to provide cancer patients with the best possible care. This increased search is projected to result in significant growth potential in the oncology market.

At present, oncology and metabolic disorders are likely to account for 24.2% and 20% of the global market share respectively. While infectious and allergic diseases together are likely to hold 18.8% of the global market share, in 2025.

Bacteriocin antibiotics, enzymes, and peptides, according to research, have a lot of potential for producing anti-cancer medications. Bacteriocins appear to be the most promising candidate for future medication development.

In 2025, haematological disorders and immunological disorders are expected to account for 12.6% and 9.6% of the global market share respectively. The other applications are predicted to hold 14.8% of the global market share currently.

Some of the market players featured in this report are Mylan N.V., F. Hoffmann La-Roche Ltd., Novartis AG, Amgen Inc., Merck & Co. Inc., Biocon, Pfizer Inc., Dr. Reddy’s Laboratories Ltd., Intas Pharmaceuticals Ltd., Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Boehringer Ingelheim, Bristol-Myers Squibb Company, and Abbot Laboratories.

Pfizer Inc., Sanofi S.A., Merck & Co., Amgen Inc., and Novartis AG account for a majority of overall revenue. To commercialize and sell their products, these companies place strong emphasis on collaborative license agreements with other partners.

Furthermore, some market players are concentrating on acquisitions and the launch of biosimilars. Companies are also looking for more favourable regulatory approvals to get into profitable sectors.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Turkey, South Africa and GCC Countries |

| Key Market Segments Covered | Product, Route of Administration, Source, Application, End User, Region |

| Key Companies Profiled | Mylan N.V.; F. Hoffmann La-Roche Ltd.; Novartis AG; Amgen Inc.; Merck & Co. Inc.; Biocon; Pfizer Inc.; Dr. Reddy’s Laboratories Ltd.; Intas Pharmaceuticals Ltd.; Novo Nordisk A/S; Eli Lilly and Company; Sanofi S.A.; Boehringer Ingelheim; Bristol-Myers Squibb Company; Abbot Laboratories |

| Pricing | Available upon Request |

The global microbial therapeutic products market is estimated to be valued at USD 21.3 billion in 2025.

It is projected to reach USD 43.8 billion by 2035.

The market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types are growth factors, gcsf, peg gcsf, exenatide, anti-cancer agents, immunosuppressants, enzymes and others.

single-use pre-filled injection/injector pens segment is expected to dominate with a 47.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microbial Polyketides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Nucleotides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Fermentation Technology Market Size and Share Forecast Outlook 2025 to 2035

Microbial Gene Editing Services Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipids Size and Share Forecast Outlook 2025 to 2035

Microbial Lipase Market - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Microbial Seed Treatment Business

Analysis and Growth Projections for Microbial Food Culture Business

Microbial Protein Used in Feed Market Analysis by Application, Source, and Region Through 2035

Microbial Identification Market Report – Growth & Forecast 2025-2035

Microbial Feed Additives Market – Growth, Probiotics & Livestock Nutrition

Microbial Bioreactors Market

Microbial Rennet Market

Antimicrobial HVAC Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA