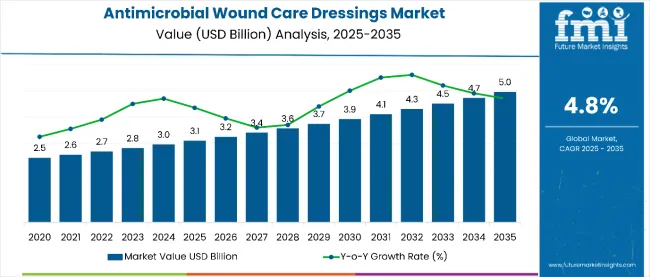

The antimicrobial wound care dressings market is projected to grow steadily from USD 3.1 billion in 2025 to USD 5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% during this period. This growth is driven primarily by the increasing prevalence of chronic wounds globally, alongside heightened awareness about infection prevention and control in both clinical and home care settings. These factors have contributed to a rising demand for advanced wound care solutions that reduce infection risks and promote faster healing.

Technological advancements have played a significant role in expanding the antimicrobial wound care dressings market. Silver-based dressings and hydrocolloid materials have become prominent due to their superior antimicrobial properties and ability to maintain optimal moisture balance for wound healing. These innovations have improved treatment outcomes and patient comfort, thereby encouraging wider adoption in hospitals, wound care centers, and an increasing number of home care environments.

Hospitals and specialized wound care facilities continue to be the primary end users of antimicrobial dressings, driven by the high incidence of surgical wounds, diabetic ulcers, and pressure sores in these settings. However, the home care segment is rapidly gaining traction due to advancements in dressing technology that facilitate ease of use and effective management by patients or caregivers outside traditional healthcare facilities. This shift supports cost-effective care delivery and enhances patient quality of life.

North America holds a significant share of the market owing to its well-established healthcare infrastructure and high adoption rates of advanced wound care products. Europe also contributes substantially, supported by aging populations and government initiatives promoting better wound care practices. Meanwhile, emerging economies in the Asia-Pacific region, especially China and India, are expected to experience robust growth due to expanding healthcare infrastructure, increasing prevalence of diabetes and chronic wounds, and rising patient awareness.

Several notable industry developments underscore the market’s dynamic nature. In October 2024, Imbed Biosciences secured FDA 510(k) clearance for its Microlyte® Ag/Lidocaine dressing, a unique product that combines antimicrobial silver with pain-relieving lidocaine to manage chronic and surgical wounds effectively. Avery Dennison Medical and Polaroid Therapeutics collaborated to develop advanced antimicrobial wound care solutions, showcased at the 2024 European Wound Management Association (EWMA) conference.

AroaBiosurgery’sEndoform® Antimicrobial dressing, cleared by the FDA, offers sustained antimicrobial efficacy and promotes tissue regeneration. Additionally, researchers at the Keck School of Medicine of USC and Caltech are pioneering “smart bandages” capable of real-time wound monitoring and targeted treatment, potentially revolutionizing chronic wound care.

These technological innovations reflect the market’s ongoing commitment to improving clinical outcomes through advanced materials and intelligent solutions. With continued investments in research and development and growing adoption across healthcare and home care settings, the antimicrobial wound care dressings market is expected to maintain steady and robust growth through 2035.

| Attribute | Details |

|---|---|

| Market Size(2025E) | USD 3.1 billion |

| Market Size(2025F) | USD 5 billion |

| Value CAGR (2025 to 2035) | 4.80% |

Antimicrobial wound care dressings are often used in conjunction with other wound care strategies to optimize healing and improve patient outcomes. These dressings not only provide localized infection control but also support other treatments that promote tissue repair and minimize complications.

The antimicrobial wound care dressings market is evolving to meet the complex, multi-morbidity-driven needs of elderly and palliative care patients through precision wound care. These patients often present overlapping conditions thin, atrophic skin, poor vascularization, high infection risk, and limited mobility which necessitates personalized dressing strategies. The focus is shifting from passive coverage to intelligent, minimally invasive, and digitally responsive wound care.

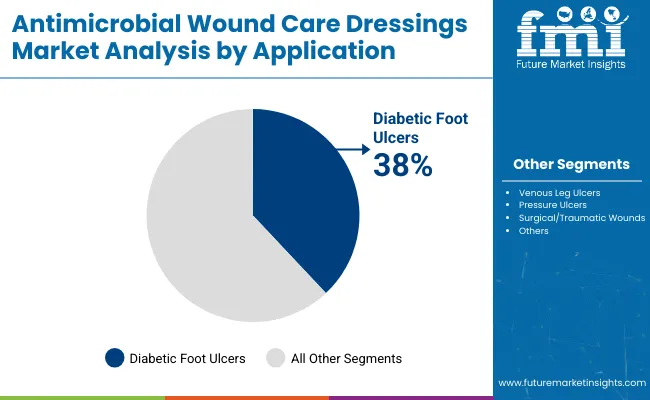

On the basis of application, the diabetic foot ulcers segment accounts for 38% share. Antimicrobial wound dressings are widely used for diabetic foot ulcers (DFUs) due to the high risk of infection associated with diabetes-related complications such as poor circulation and weakened immune response.

These ulcers often become chronic and are prone to bacterial colonization, including antibiotic-resistant strains. Antimicrobial dressings help prevent or manage infections by reducing bacterial load and disrupting biofilms, while also maintaining a moist environment that supports healing.

Their use is crucial in avoiding severe complications like osteomyelitis or amputation. By combining infection control with wound care, these dressings play a vital role in the effective management of diabetic foot ulcers.

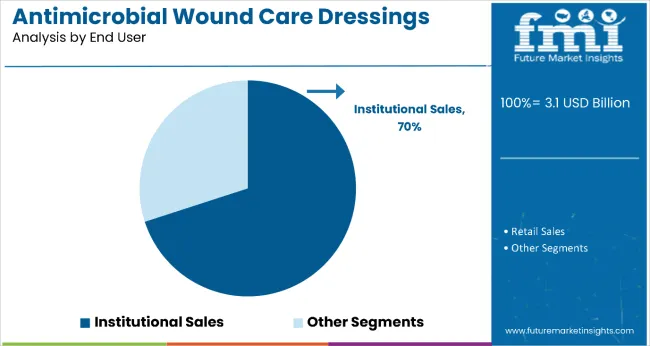

In 2025, institutional sales are set to represent 70% of the antimicrobial wound dressings market. The segment’s dominance is attributed to increased hospital demand for advanced wound care products, especially amid rising surgical volumes and chronic wound cases. Hospitals, specialty clinics, and long-term care centers account for the bulk of purchases, driven by the need to prevent surgical site infections (SSIs) and manage post-operative recovery effectively.

Strict infection control regulations and government healthcare policies have prompted institutions to invest in high-performance, antimicrobial solutions. Bulk procurement, cost-efficiency, and supply reliability from strategic supplier agreements further contribute to this channel’s growth.

Additionally, hospitals benefit from manufacturer support, including training, onboarding, and clinical data to aid adoption. The segment is also fueled by the aging population's heightened vulnerability to wound complications, which leads to increased demand for professional, institutional-grade dressings. With institutional buyers prioritizing standardized care and outcome-based purchasing, this sales channel is expected to remain the leading force in antimicrobial wound dressing adoption.

Significant changes are being observed in the antimicrobial wound care dressings market. Growing demand for advanced wound care solutions is being driven by rising cases of chronic wounds and infections. The adoption of innovative antimicrobial technologies is being prioritized. Market players are focusing on improving healing outcomes and reducing infection rates. Regulatory approvals and healthcare infrastructure improvements are shaping market growth. Increased awareness about patient safety and cost-effective treatments is being noted globally.

New antimicrobial agents are being integrated into wound dressings to enhance infection control. Silver-based dressings and iodine formulations are being widely used due to their broad-spectrum antimicrobial activity. The rise in diabetic foot ulcers, pressure ulcers, and surgical wounds is increasing the demand for effective wound management.

Biocompatible materials are being developed to promote faster healing. Decision makers are adopting advanced wound care products to reduce hospital stays and improve patient comfort. Research in nanotechnology and hydrogel dressings is being accelerated. Personalized treatment options are being explored. The need to reduce antibiotic resistance is driving innovation in antimicrobial dressing formulations.

Expanding applications in home healthcare and ambulatory care settings are creating new growth avenues. Innovative product launches incorporating moisture-retentive properties and oxygen-permeable layers are being introduced. Integration of smart dressings with biosensors for real-time monitoring is gaining attention. Growing interest in natural antimicrobial agents such as honey and plant extracts is observed. Emerging economies are witnessing improved healthcare access, which is increasing product adoption.

Strategic partnerships between manufacturers and healthcare providers are being formed to enhance distribution. Cost-effective alternatives are being developed to address affordability issues. Market players are investing in educational campaigns to increase awareness about advanced wound care benefits.

Stringent regulatory frameworks are being imposed on medical device approvals, delaying product launches. The high cost of advanced antimicrobial dressings limits accessibility in low-income regions. Variability in reimbursement policies across countries is affecting market growth. Clinical evidence requirements for new technologies are becoming more rigorous. The risk of allergic reactions and cytotoxicity associated with some antimicrobials is being monitored.

Lack of standardized treatment protocols leads to inconsistent product usage. Competitive pricing pressures from generic and traditional wound dressings are impacting margins. Limited awareness among healthcare professionals and patients hampers market penetration in some areas. Distribution challenges in remote regions are being reported.

Traditional non-antimicrobial dressings continue to compete due to lower costs and established use. Emerging natural and herbal remedies are attracting a niche customer base. Market fragmentation is increasing with many small and regional manufacturers entering. Patent expirations are leading to increased generic product availability.

Lack of differentiation in some products causes brand switching. Negative perceptions related to chemical antimicrobials impact adoption. Inconsistent product quality among smaller players poses risks. Failure to innovate may lead to loss of market share. Decision makers are focusing on evidence-based products to maintain competitive advantage.

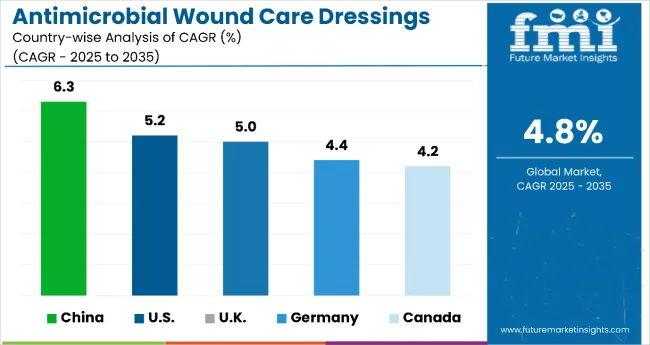

The antimicrobial wound care dressings market is being shaped by evolving healthcare demands, rising incidences of chronic wounds, and global concerns over antimicrobial resistance (AMR). Countries such as China, the United States, and the UK are actively engaged in formulating advanced wound dressings, improving distribution frameworks, and supplying innovative solutions. Growth is being driven by government initiatives, technological advancements, and increased patient awareness.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

| United States | 5.2% |

| United Kingdom | 5.0% |

| Germany | 4.4% |

| Canada | 4.2% |

In the United States, the antimicrobial wound care dressings market is being driven by advanced research, clinical integration, and increasing demand for premium wound care. A projected CAGR of 5.2% reflects steady growth, as healthcare providers focus on chronic wound management and infection prevention. Hospitals and surgical centers are adopting silver-based, iodine-infused, and honey-derived antimicrobial dressings to reduce healing time and hospital stays. Support is being provided through reimbursement schemes and FDA-cleared products.

Telehealth services are being used to enhance access and remote monitoring. The market is also being expanded by AI-driven wound diagnostics and home-based care platforms. USA-based companies are formulating specialized dressings for burn care, diabetic ulcers, and surgical incisions. Export activity is being bolstered by partnerships and international certifications.

Role of germany in the formulation and distribution of antimicrobial wound care dressings is being enhanced by its efficient healthcare model and strong regulatory infrastructure. With a projected CAGR of 4.4%, the market is being supported by the adoption of evidence-based treatment protocols, focusing on early-stage wound infection control. Hospitals are being equipped with hydrocolloid, silver foam, and non-adherent antimicrobial dressings, reducing complications and re-admissions.

Clinical efficiency is being promoted through health insurance reimbursements and professional training programs. German companies are formulating CE-certified wound care products in collaboration with academic institutions and pharmaceutical firms. The domestic supply chain is being optimized for hospital and outpatient use. Public awareness campaigns are being conducted to educate healthcare workers and patients on antimicrobial resistance.

The Canada antimicrobial wound care dressings market is being expanded by public healthcare support, telehealth services, and rising rates of diabetic foot ulcers and pressure injuries. A CAGR of 4.2% is projected from 2025 to 2035. Innovation is being seen in formulations of antimicrobial hydrogel and silver-impregnated dressings, designed for home-based treatment. Government-funded health programs are being aligned with community wound care services, especially in rural and northern regions.

Digital platforms are being deployed for remote wound assessment and care delivery. Canadian manufacturers are focusing on cost-effective, biocompatible dressing solutions, catering to hospital and homecare markets. Distribution channels are being reinforced through provincial supply contracts. Public health campaigns are emphasizing wound prevention, especially among the elderly and diabetic populations.

In the United Kingdom, the antimicrobial wound care dressings market is being promoted through NHS modernization efforts and increasing reliance on community-based healthcare. A projected CAGR of 5.0% reflects consistent demand for cost-effective, AMR-compliant wound care solutions. The NHS has been implementing structured wound care pathways using silver-based, iodine, and foam antimicrobial dressings.

Emphasis is being placed on out-of-hospital care, allowing patients to manage wounds at home through support from district nurses and mobile care units. Digital platforms are being introduced for wound tracking and follow-up. Procurement policies are being aligned with sustainability and cost-efficiency goals. UK-based firms are formulating dressings integrated with moisture control technologies and slow-release antimicrobial agents. International partnerships are being leveraged to improve access and export readiness.

Antimicrobial wound care dressings market in china is being driven by rising healthcare investment, aging population needs, and expanding manufacturing capacity. With a projected CAGR of 6.3%, it is the fastest-growing among major economies. Domestic production of antimicrobial foam, silver-coated dressings, and advanced composite materials is being supported through government subsidies and R&D incentives. Regions like Guangdong and Jiangsu are being turned into manufacturing hubs for wound care products.

Local companies are focusing on affordability and volume, supplying public hospitals and expanding to Southeast Asia. National health campaigns are being launched to promote chronic wound care awareness, especially for diabetic and pressure ulcers. Aging patients in urban centers are being served through improved hospital infrastructure. Digital platforms like WeChat are being used for patient education and online ordering.

The antimicrobial wound care dressings market has been shaped by leading companies such as Smith+Nephew, Mölnlycke Health Care AB, and 3M, recognized for their extensive product portfolios and global reach. These Tier 1 suppliers have focused on advanced wound management solutions, including silver-based and foam dressings.

Tier 2 companies like Convatec Inc., Cardinal Health, and B. Braun SE have emphasized innovation in dressing materials and have expanded their presence in both hospital and home care settings. Other notable players include Coloplast Group, Medline Industries, McKesson Corporation, Hartmann Group, Laboratories Urgo, Integra Lifesciences Corporation, and Advanced Medical Solutions Group PLC, each contributing to market diversity through specialized products and regional strategies.

The market has been driven by the increasing prevalence of chronic wounds, surgical site infections, and the demand for cost-effective, high-efficacy dressings. Companies have invested in research and development to introduce dressings with enhanced antimicrobial properties, moisture management, and patient comfort.

In 2023, 3M Health Care received a USD 34.2 million award to advance the management of traumatic wounds, focusing on improving healing processes from injury to hospital care. Integra Life Sciences Corporation launched Micro Matrix Flex in March 2024, a dual-syringe system designed for precise application of wound care paste in challenging wound sites. Medline Industries introduced the OptiView Transparent Dressing with Hydro Core Technology in January 2024, allowing caregivers to monitor wounds without removing the dressing, thus enhancing patient care and reducing infection risks.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.1 billion |

| Projected Market Size (2035) | USD 5 billion |

| CAGR (2025 to 2035) | 4.80% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Types Analyzed (Product Type) | Barrier Dressings, Hydrogels Dressings, Alginate Dressings, Foam Dressings, Hydrocolloid Dressings, Collagen Dressing, Contact Layer, Super Absorbent Dressings, Semi-permeable Films Dressings, Honey Dressings |

| Dressing Types Analyzed | Silver Dressing, Non-silver Dressing |

| Applications Analyzed | Diabetic Foot Ulcers, Venous Leg Ulcers, Pressure Ulcers, Surgical/Traumatic Wounds, Others |

| End Users Analyzed | Institutional Sales, Retail Sales |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Key Companies Covered | 3M, Smith+Nephew, Mölnlycke Health Care AB, Convatec Inc., Cardinal Health, B. Braun SE, McKesson, Laboratories Urgo, Medline, Coloplast Group, Hartmann Group, Integra Lifesciences Corporation, Advanced Medical Solutions Group PLC, Others |

| Additional Attributes | Increased prevalence of chronic wounds and surgical site infections is driving demand for antimicrobial solutions; advanced wound care technologies such as silver-based and hydrogel dressings are gaining traction; growing elderly population contributes to rising wound incidence; institutional healthcare settings dominate usage while retail sector adoption is steadily increasing. |

By product type, the market is categorized into barrier dressing, hydrogels dressings, alginate dressings, foam dressings, hydrocolloid dressings, collagen dressing, contact layer, super absorbent dressings, semi-permeable films dressings, and honey dressings.

By dressing type, the market is categorized into silver dressing and non-silver dressing.

By application, the market is categorized into diabetic foot ulcers, venous leg ulcers, pressure ulcers, surgical/traumatic wounds, and others.

By end user, the market is categorized into institutional sales and retail sales.

By region, the market is geographically segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The global antimicrobial wound care dressings market is projected to reach USD 3.1 billion by 2025.

The market is anticipated to grow to approximately USD 5 billion by 2035, registering a CAGR of 4.8%.

Key companies include 3M, Smith+Nephew, Mölnlycke Health Care AB, Convatec Inc., Cardinal Health, B. Braun SE, McKesson, Laboratories Urgo, Medline, Coloplast Group, Hartmann Group, Integra Lifesciences Corporation, and Advanced Medical Solutions Group PLC.

Increasing surgical interventions, chronic wound prevalence, and infection control requirements are fueling market expansion.

Advanced formulations like silver-based, iodine-infused, and honey-treated dressings are gaining traction for their broad-spectrum antimicrobial efficacy.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End-use, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End-use, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 77: Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End-use, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End-use, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End-use, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End-use, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 157: MEA Market Attractiveness by Product, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by End-use, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antimicrobial Hospital Textile Market Forecast Outlook 2025 to 2035

Antimicrobial Glass Powder Market Forecast and Outlook 2025 to 2035

Antimicrobial Cap Fitters Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Powder Coating Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Feed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Packaging Ingredients for Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial-coated Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Additives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Antimicrobial Susceptibility Tester Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Wipes Market - by Product Type, Material Type, Sales Channel, End-User, and Region - Trends, Growth & Forecast 2025 to 2035

Antimicrobial Nanocoatings Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Antimicrobial Packaging Ingredients for Food Packaging

Antimicrobial Coil Coating Market Growth - Trends & Forecast 2025 to 2035

Antimicrobial Susceptibility Testing Market Growth – Industry Forecast 2025-2035

Antimicrobial Polymer Films Market Insights – Growth & Forecast 2024-2034

Antimicrobial Packaging Market

Antimicrobial Peptides Market

Antimicrobial Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Car Care Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA