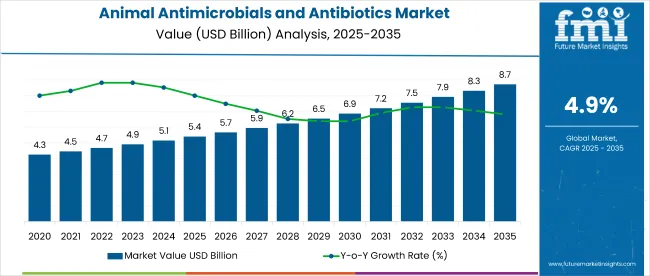

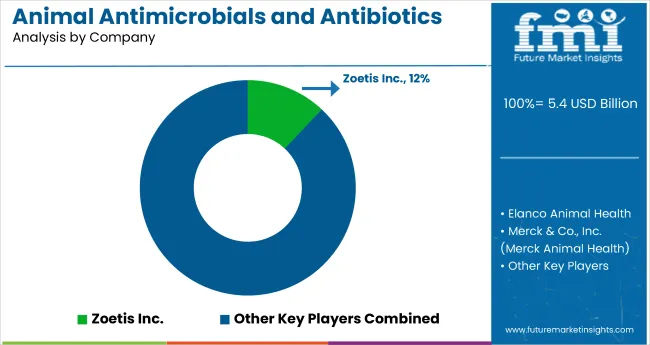

The global animal antimicrobials and antibiotics market is valued at USD 5.4 billion in 2025 and is slated to reach USD 8.7 billion by 2035, reflecting a CAGR of 4.9%.

| Metric | Value |

|---|---|

| Market Size(2025) | USD 5.4 billion |

| Market Size(2035) | USD 8.7 billion |

| Compound Annual Growth Rate | 4.9% |

Demand is expected to be driven by the continuing intensification of livestock production, soaring consumption of animal-derived foods, and heightened vigilance regarding zoonotic disease control. In addition, supportive veterinaryhealth policies and steady innovation in broad-spectrum formulations are anticipated to facilitate sustained market expansion.

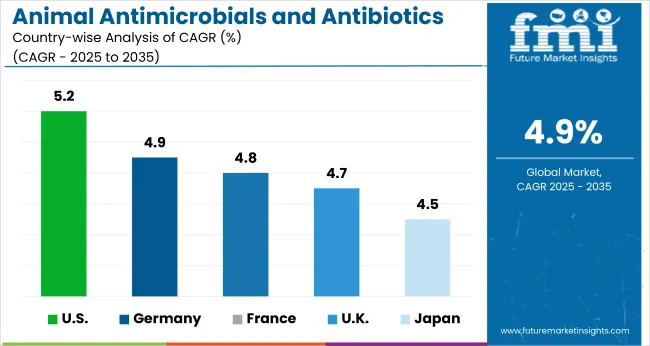

The top three countries projected to register the highest CAGR in the market from 2025 to 2035 among developed economies are the USA (5.2%), Germany (4.9%), and the UK. (4.7%). These countries are experiencing steady market expansion driven by high pet ownership rates, increased veterinary healthcare spending, and advanced livestock management practices.

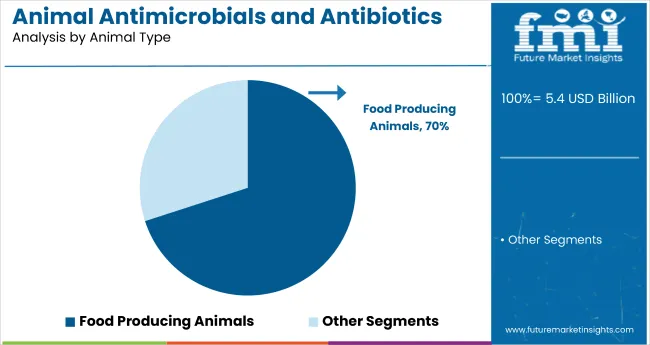

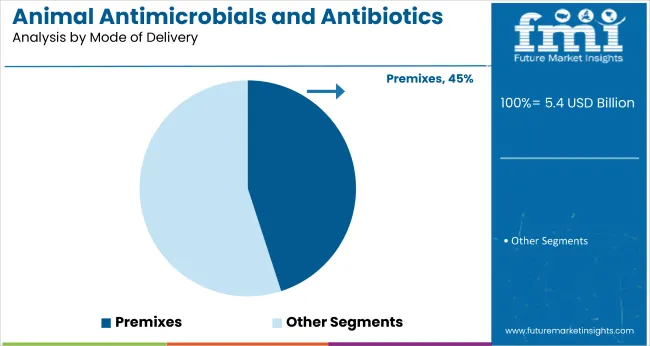

Food-producing animals will dominate the animal type segment with a 70% share, driven by rising global demand for meat, dairy, and other animal-derived products. Premixes are projected to hold the largest market share in the mode of delivery segment, accounting for 45% of total sales, supported by their ease of incorporation into feed and effectiveness in large-scale livestock farming operations.

Recent innovations in the animal antimicrobials and antibiotics market have focused on developing targeted therapies and reducing antimicrobial resistance. Companies are introducing next-generation antibiotics with improved efficacy and reduced withdrawal periods to ensure food safety.

Advances in nanotechnology-based drug delivery systems are enhancing bioavailability and precision in treatment. Additionally, CRISPR gene-editing tools are being explored for customized veterinary solutions, while AI-powered diagnostics are enabling early disease detection.

The market holds a significant position within its parent markets. It accounts for approximately 28% of the overall animal health market, driven by its critical role in disease prevention and treatment. Within the market, it contributes around 35%, reflecting its dominance in therapeutic applications.

In the broader livestock healthcare market, it represents about 30%, supported by high antibiotic use in food-producing animals. Additionally, it forms nearly 20% of the animal feed additives market, where antibiotics are used as growth promoters and disease preventatives, particularly in regions with less stringent regulations.

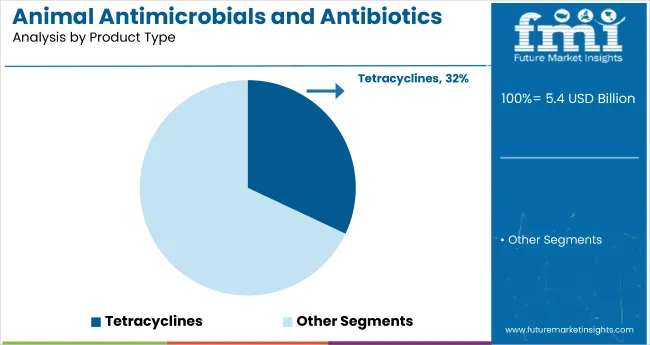

The global market is segmented by product type, animal type, mode of delivery, and region. By product type, the market is segmented into tetracyclines, penicillins, sulfonamides, macrolides, aminoglycosides, lincosamides, fluoroquinolones, cephalosporins, and others (carbapenems, pleuromutilins, and nitrofurans).

Based on animal type, the market is classified into companion animals and food-producing animals. By mode of delivery, the market is divided into premixes, oral powder, oral solution, and injection. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The most lucrative segment in the market by product type is tetracyclines, projected to dominate with a 32% market share in 2025. This dominance is attributed to their broad-spectrum efficacy, affordability, and wide usage across both livestock and companion animals.

The food-producing animals segment is the most lucrative in the market, accounting for approximately 70% market share in 2025. This dominance is driven by the large scale of commercial livestock farming, including poultry, swine, cattle, and aquaculture, where antibiotics are widely used for disease prevention, treatment, and growth promotion.

The premixes segment is expected to hold the largest market share of 45% in 2025 within the mode of delivery category of the animal antimicrobials and antibiotics market. Premixes are widely preferred due to their ease of incorporation into animal feed, allowing for mass medication of livestock efficiently and cost-effectively.

The animal antimicrobials and antibiotics market is growing steadily, driven by rising global demand for animal-derived food products, increasing prevalence of animal diseases, and advancements in broad-spectrum and targeted antibiotic formulations.

Recent Trends in the Animal Antimicrobials and Antibiotics Market

Challengesin the Animal Antimicrobials and Antibiotics Market

Among the top developed economies, the USA leads the market with the highest projected CAGR of 5.2% from 2025 to 2035, followed by Germany at 4.9%, France at 4.8%, the UK at 4.7%, and Japan at 4.5%. This steady growth across countries is fueled by rising veterinary healthcare expenditures, regulatory reforms, and increasing awareness of antimicrobial resistance.

While the USA benefits from strong livestock demand and innovation, European countries are focusing on sustainable practices and stringent antibiotic usage controls, and Japan is seeing demand rise from its growing companion animal health sector.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA animal antimicrobials and antibiotics market is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by high veterinary care expenditure and widespread livestock farming. The USA leads in innovation and stringent regulatory frameworks promoting responsible antibiotic use.

Sales of animal antimicrobials and antibiotics in the UK are expected to grow at a CAGR of 4.7%, with rising awareness about animal health and stricter regulations on antibiotic usage. Emphasis on sustainable farming practices and growing companion animal healthcare demand are key growth drivers.

The animal antimicrobials and antibiotics revenue in Germanyis forecasted to grow at 4.9% CAGR, supported by robust livestock farming and growing regulatory focus on antibiotic resistance. The country emphasizes high standards of animal welfare and innovative veterinary solutions.

Sales of animal antimicrobials and antibiotics in Franceare projected to witness a CAGR of 4.8%, driven by expanding livestock production and rising consumer awareness of antibiotic residues in food. Government policies support reduced antibiotic use while promoting animal health innovations.

The Japan animal antimicrobials and antibiotics market is expected to grow at a CAGR of 4.5%, influenced by advanced veterinary care systems and strict food safety regulations. Companion animal health is a significant growth segment alongside food-producing animals.

The market is moderately consolidated, with several leading multinational companies holding substantial market shares alongside numerous smaller players. Top companies compete through strategies focused on innovation, strategic partnerships, pricing, and geographic expansion.

Key players such as Bayer AG, Zoetis, Merck & Co., Elanco Animal Health, and Boehringer Ingelheim are driving market growth through continuous product launches and strengthening global supply chains. Pricing strategies are carefully balanced to meet regulatory standards and market affordability, especially in developing regions with growing livestock industries.

Recent Animal Antimicrobials and Antibiotics Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.4 billion |

| Projected Market Size (2035) | USD 8.7 billion |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020–2024 |

| Projections Period | 2025–2035 |

| Report Parameters | Revenue in USD billions/Volume in Metric Tons |

| By Product Type | Tetracyclines , Penicillins , Sulfonamides , Macrolides, Aminoglycosides, Lincosamides , Fluoroquinolones, Cephalosporins , Others ( Polymyxins , Nitrofurans , Ionophores , and Pleuromutilins ) |

| By Animal Type | Companion Animals, Food Producing Animals |

| By Mode of Delivery | Premixes, Oral Powder, Oral Solution, Injection |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40 + countries |

| Key Players | Bayer AG, Boehringer Ingelheim GmbH, Ceva Sante Animale , Dechra Pharmaceuticals PLC, Eli Lilly and Company, Merck & Co., Inc., Sanofi, Vetoquinol S.A., Virbac , Zoetis Inc., Elanco Animal Health, Phibro Animal Health, Kyoritsu Seiyaku (Japan), Tianjin Ringpu , HIPRA, Zydus Animal Health, and Inovet . |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The global animal antimicrobials and antibiotics market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the animal antimicrobials and antibiotics market is projected to reach USD 8.5 billion by 2035.

The animal antimicrobials and antibiotics market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in animal antimicrobials and antibiotics market are tetracyclines, penicillins, sulfonamides, macrolides, aminoglycosides, lincosamides, fluoroquinolones, cephalosporins and other antimicrobials and antibiotics.

In terms of animal type, food producing animals segment to command 70.0% share in the animal antimicrobials and antibiotics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antibiotics Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobials Cosmetic Preserving market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA