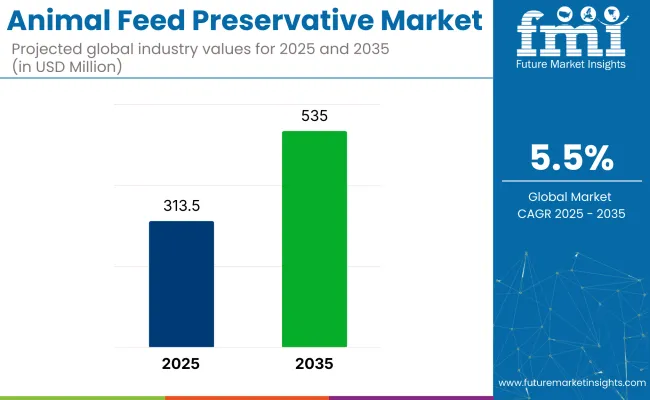

The global animal feed preservative market is expected to experience steady growth, with a projected value of USD 313.5 million in 2025 and USD 535 million by 2035. The market is anticipated to grow at a CAGR of 5.5% throughout the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 313.5 million |

| Market Value (2035F) | USD 535 million |

| CAGR (2025 to 2035) | 5.5% |

The increasing demand for animal feed preservatives is largely driven by the need to maintain feed quality and prevent microbial contamination. As livestock production intensifies, especially in regions with hot and humid climates, the importance of using preservatives to ensure feed safety and reduce spoilage has become more prominent. This growth trajectory signifies the growing reliance on preservatives as a critical component in commercial animal feed manufacturing.

The marketholds a notable yet niche share within its parent markets. Within the animal feed market, preservatives account for 5-7% of the total market, as they are essential for prolonging the shelf life of feed and maintaining its nutritional quality.

In the agricultural chemicals market, animal feed preservatives make up around 2-3%, given the wide range of chemicals used for different purposes across agriculture. In the livestock industry, preservatives contribute about 4-6%, as they are vital for ensuring that feed remains safe and nutritious over time.

In the pet care market, the share of feed preservatives is approximately 3-4%, ensuring that pet food remains fresh. In the food & beverage market, preservatives influence the sector indirectly, contributing roughly 1-2% due to their impact on animal-derived food production.

The driving factor behind the rise of this market is the growing awareness of feed quality maintenance, coupled with the rising cost of feed inputs. With the increasing global demand for livestock products, especially in developing countries, maintaining the nutritional value and safety of feed has become paramount.

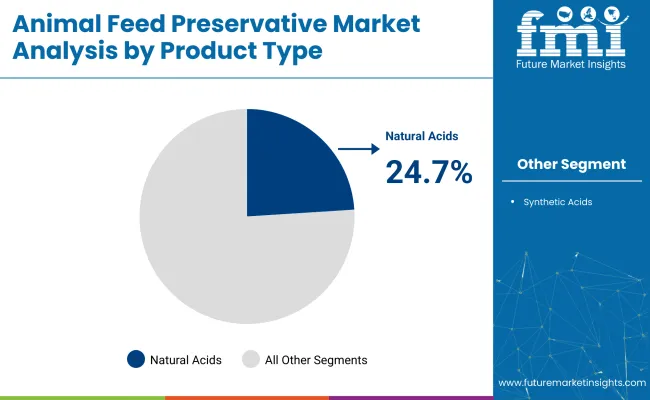

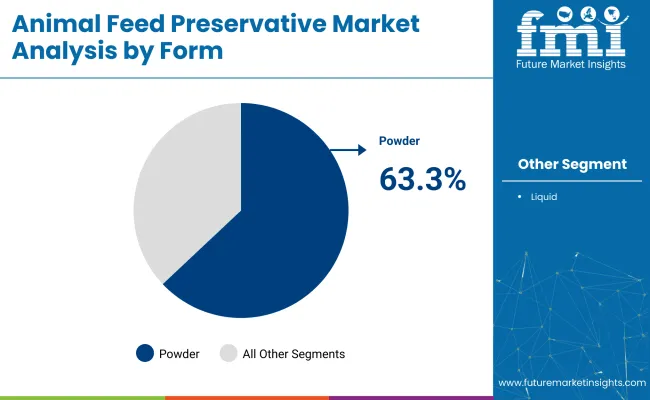

The animal feed preservative market is segmented by product type into synthetic, including organohalogen compounds, aldehydes, glycol ethers, and parabens, and natural, including natamycin, benzyl alcohol, salicylic acid, sorbic acid, natural acids, botanical extracts, and others. By form, the market is divided into powder and liquid.

By end use application, it includes pelleted feeds, mash feeds, silage, hay, grain storage, liquid feeds, and others. The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Natural Acids are projected to lead the product type segment, accounting for 24.7% of the global market share by 2025.

Silage are projected to lead the end user application segment, accounting for 33.1% of the global market share by 2025.

The powder form is the dominant segment, holding a substantial market share.the powder form accounted for over 63.3% of the market share in 2025.

The rising global demand for animal products is driving the need for effective feed preservation to maintain quality and safety, especially in humid climates. There is a shift towards natural, clean-label preservatives, as consumers and regulations push for more sustainable, antibiotic-free solutions.

Rising Demand for Feed Quality Preservation

The increasing global demand for animal products has led to a significant emphasis on preserving feed quality. Animal feed preservatives play a critical role in inhibiting microbial growth, preventing spoilage, and maintaining nutritional integrity.

In regions with hot and humid climates, where feed spoilage is more prevalent, preservatives are essential for ensuring that feed remains safe and effective for livestock consumption. As feed production ramps up to meet the growing demand for meat, dairy, and other animal-based products, the need for effective preservation solutions becomes more pronounced, driving the market for animal feed preservatives.

Shift Toward Natural and Clean-Label Preservatives

There is a growing preference for natural and clean-label preservatives in animal feed as consumers and regulatory bodies push for more environmentally friendly and antibiotic-free solutions. Organic acids, such as formic, propionic, and lactic acids, are being increasingly used due to their ability to naturally inhibit microbial growth without the adverse effects of synthetic chemicals.

This shift towards sustainable, non-synthetic preservatives aligns with global trends toward cleaner production systems in the food and agriculture industries. As regulations surrounding antibiotic growth promoters tighten, natural preservatives are poised to continue gaining market share.

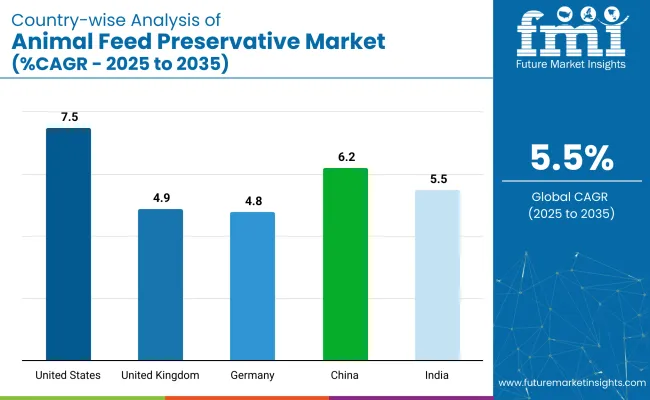

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.5% |

| United Kingdom | 4.9% |

| Germany | 4.8% |

| China | 6.2% |

| India | 5.5% |

India’s momentum is driven by the expanding poultry and dairy sectors, along with a growing focus on improving feed quality and storage through preservatives. China follows closely, with a projected 6.2% CAGR, supported by its rapidly expanding livestock industry and government initiatives to enhance feed quality and sustainability. Developed economies such as Germany (4.8%), the United Kingdom (4.9%), and the United States (7.5%) are expanding at a steady 0.95-1.03x rate.

The United States is leading the demand for feed preservatives due to its large livestock and poultry industries. Germany focuses on efficient preservation methods for livestock feed, especially in the dairy and poultry sectors, while the United Kingdom emphasizes natural and organic preservatives for animal health. As the market grows and adds over USD 500 million by 2035, both high-growth regions like India and China, as well as stable demand from OECD countries, will significantly shape its trajectory.

The USA animal feed preservative market is forecast to expand at a 7.5%CAGR from 2025 to 2035. Growth is supported by the scale of the country’s livestock and poultry industries, which rely on consistent feed stability across distribution and storage.

Regulatory momentum surrounding feed hygiene, antimicrobial resistance, and traceability has elevated the role of preservation agents across feed types. A parallel shift toward clean-label animal nutrition is prompting wider adoption of botanical and acid-based preservatives as alternatives to conventional synthetic inputs.

Demand for animal feed preservative market is projected to grow at a 6.2%CAGR between 2025 and 2035. The expansion is fueled by the country’s large-scale pork and poultry operations, where preservation is critical to maintaining feed integrity across distributed supply chains.

High humidity levels in key production zones elevate spoilage risk, reinforcing the need for mold inhibitors and antimicrobial agents. Regulatory scrutiny and consumer pressure around food safety are also accelerating the transition toward more reliable and traceable preservation practices.

Sales of animal feed preservative in India is expected to grow at a 5.5% CAGR from 2025 to 2035. The country’s expanding dairy and livestock sectors are driving sustained demand for preserved feed, especially in regions where supply chains stretch across rural and semi-urban zones.

Rising consumption of animal protein, coupled with the need to improve feed shelf life in tropical environments, is amplifying the use of preservation agents. Government programs targeting livestock productivity and feed infrastructure are indirectly supporting this segment.

The animal feed preservative market in Germany is forecast to expand at a 4.8% CAGR between 2025 and 2035. The country’s established livestock industry, especially in dairy, poultry, and pork, necessitates consistent feed quality and long shelf life.

Rising demand for organic and non-GMO feed formulations is accelerating the shift toward natural preservative systems. Regulatory enforcement around animal feed safety, food integrity, and traceability is creating a stable growth environment for preservation technologies aligned with compliance standards.

The United Kingdom’s animal feed preservative market is projected to grow at a 4.9% CAGR from 2025 to 2035. Growth is supported by the country’s focus on sustainable livestock practices and alignment with post-antibiotic feed strategies.

As a key European producer, the UK places strong emphasis on feed hygiene and shelf stability to meet both domestic consumption and export standards. The shift toward natural preservatives is further reinforced by consumer preference for feed inputs that meet elevated safety and transparency expectations.

The animal feed preservative market is moderately consolidated, with leading players such as Archer Daniels Midland Company, Adisseo, Ajinomoto Animal Nutrition North America, AlltechInc, BASF SE, Cargill Inc., Chr. Hansen Holding A/S, Danish Agro, DSM, and Evonik Industries AG. These companies dominate by offering a wide range of preservatives that cater to the growing demand for high-quality and safe animal feed across different regions.

For instance, Archer Daniels Midland Company provides innovative feed additives and preservatives aimed at enhancing feed safety and quality, while Adisseo is known for its advanced preservation solutions targeting the nutritional stability of animal feed. Ajinomoto Animal Nutrition North America focuses on functional feed additives that improve livestock health and feed performance, while AlltechInc offers natural and organic feed preservatives to align with sustainable farming practices. BASF SE leads with a wide portfolio of natural and synthetic preservatives, helping livestock producers ensure feed longevity and microbial control.

Recent Animal Feed Preservative Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 313.5 million |

| Projected Market Size (2035) | USD 535 million |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in tons |

| Product Type Analyzed (Segment 1) | Synthetic (Organohalogen Compounds, Aldehydes, Glycol Ethers, And Parabens) And Natural (Natamycin, Benzyl Alcohol, Salicylic Acid, Sorbic Acid, Natural Acids, Botanical Extracts, And Others). |

| Form Analyzed (Segment 2) | Powder And Liquid. |

| End Use Application Analyzed (Segment 3) | Pelleted Feeds, Mash Feeds, Silage, Hay, Grain Storage, Liquid Feeds, And Others. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Archer Daniels Midland Company, Adisseo, Ajinomoto Animal Nutrition North America, Alltech Inc, BASF SE, Cargill Inc., Chr. Hansen Holding A/S, Danish Agro, DSM, and Evonik Industries AG |

| Additional Attributes | D ollar sales, market share, growth rate, key trends, competitive landscape, demand for specific preservatives (natural vs. synthetic), regional insights, and regulatory influences on feed preservation. |

The industry is segmented into synthetic (organohalogen compounds, aldehydes, glycol ethers, and parabens) and natural (natamycin, benzyl alcohol, salicylic acid, sorbic acid, natural acids, botanical extracts, and others).

The segment is divided into powder and liquid.

The industry finds applications pelleted feeds, mash feeds, silage, hay, grain storage, liquid feeds, and others.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 313.5 million in 2025.

It is forecasted to reach USD 535 million by 2035.

The industry is anticipated to grow at a CAGR of 5.5% during this period.

Powder form are projected to lead the market with a 63.3% share in 2035.

North America, particularly the United States, is expected to be the key growth region with a projected growth rate of 7.5%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Growth Promoter Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Digest Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA