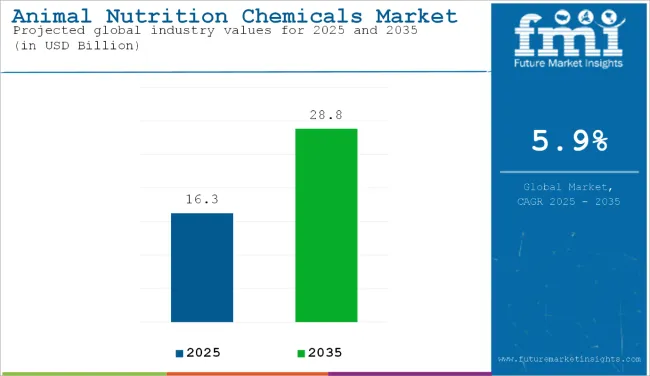

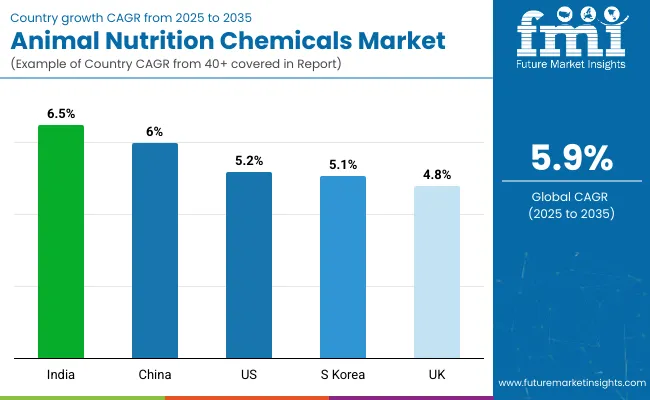

The global animal nutrition chemicals market is projected to grow from USD 16.3 billion in 2025 to approximately USD 28.83 billion by 2035 at a CAGR of 5.9%. This growth is driven by increasing demand for high-quality animal protein, advancements in livestock health management, and the implementation of stricter feed regulations worldwide. Key factors shaping the market include a rising focus on feed efficiency, disease resistance, and performance enhancement across poultry, swine, and ruminant production systems.

Between 2024 and 2025, the adoption of precision feeding technologies, smart sensor systems, and customized nutritional formulations significantly advanced livestock farming practices. These innovations enable farmers to enhance animal performance and reduce feed wastage. Additives such as vitamins, amino acids, and enzymes are increasingly replacing traditional antibiotics, in compliance with global regulations discouraging antimicrobial overuse.

The market is also witnessing a shift towards sustainable and safe animal nutrition solutions. Product categories like organic acids, prebiotics, and trace minerals are being reformulated to improve bioavailability and reduce environmental impact. Regional markets in Asia-Pacific and Latin America show robust expansion due to scaling intensive livestock farming alongside rising animal protein consumption.

In corporate developments, Suresh Narayanan, Chairman and Managing Director of Nestlé India, announced his retirement effective July 2025, after over two decades of leadership. His tenure included navigating the Maggi recall crisis and leading the company through post-pandemic recovery.

His successor, Manish Tiwary, former Country Manager of Amazon India, will assume the role from August 1, 2025. Nestlé India has also indicated possible price adjustments in 2025 to mitigate rising input costs involving key commodities like coffee, cocoa, and edible oils. These adjustments mirror industry-wide cost-management efforts across the food and feed sectors.

These strategic moves reflect broader industry trends emphasizing innovation, responsible sourcing, and resilience amid evolving cost pressures. Demand is expected to rise from continuous investments in ingredient innovation, digital livestock management technologies, and bio-based nutrition solutions. As global regulatory and corporate focus on sustainable protein production intensifies, the market is well-positioned for sustained growth and robustness through 2035.

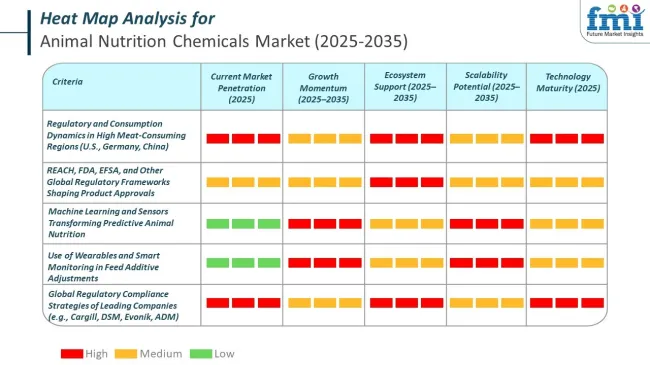

Rising per capita consumption of animal-based protein significantly shapes the animal nutrition chemicals market. Countries with higher meat and dairy intake per person, such as the USA, Germany, and China, show increased demand for feed additives that improve animal growth, immunity, and productivity. This shift places pressure on producers to adopt advanced nutritional solutions to meet consumer expectations and industry efficiency targets.

Machine learning (ML) and sensor technologies are playing a transformative role in the animal nutrition chemicals market. These tools are helping producers move from reactive to predictive nutrition strategies by turning real-time data into actionable insights.

In the highly regulated animal nutrition chemicals market, top companies prioritize regulatory compliance as a core part of product development, manufacturing, and distribution. Compliance ensures global market access, product safety, and trust among livestock producers and feed manufacturers. Regulatory bodies such as the FDA (USA), EFSA (Europe), and FSSAI (India) enforce standards for ingredient safety, additive approvals, and residue limits.

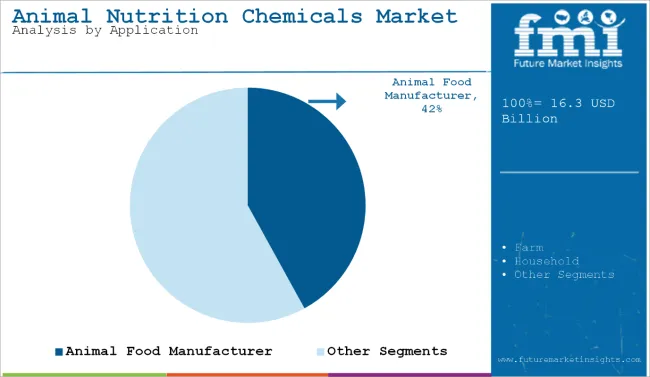

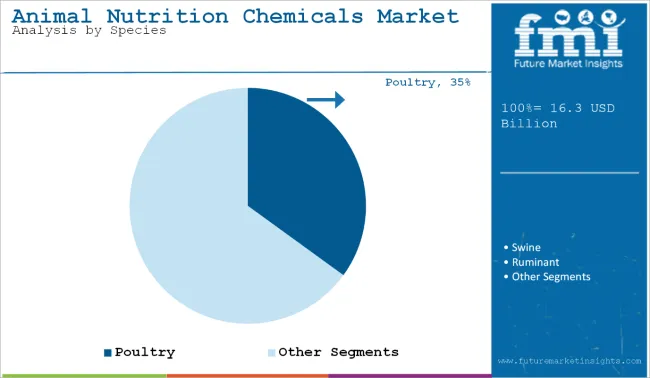

In 2025, animal food manufacturers dominate the animal nutrition chemicals market with a 42% share, driven by demand for key additives. The poultry segment leads by species with 35% market share, supported by rising consumption and sustainable feed practices. Segment analysis includes demand patterns, product adoption, technological integration, and species-specific nutrition strategies shaping market growth.

In 2025, animal food manufacturers are expected to hold the largest share in the animal nutrition chemicals market, accounting for approximately 42% of global demand. This dominance is driven by rising consumption of high-quality meat and dairy products, which increases the need for nutritional additives that enhance animal health and productivity.

Manufacturers are increasingly incorporating key ingredients such as amino acids, vitamins, minerals, and enzymes into animal feed formulations to improve feed efficiency and accelerate animal growth rates. The growing emphasis on sustainable livestock production further accelerates the adoption of these chemicals in feed manufacturing processes.

The integration of advanced technologies and precision nutrition strategies by animal food manufacturers contributes significantly to market growth. By customizing feed compositions according to the specific nutritional requirements of various animal species and production stages, manufacturers optimize nutrient utilization and reduce environmental impact. This tailored approach enhances animal performance while aligning with increasing consumer demand for sustainably produced animal products.

Among animal species, the poultry segment is anticipated to lead the animal nutrition chemicals market in 2025, capturing around 35% market share. This leadership stems from the high global consumption of poultry meat and eggs, driving demand for efficient and nutritious poultry feed formulations. Use of animal nutrition chemicals in poultry feed improves growth rates, feed conversion efficiency, and overall bird health, helping meet growing consumer demand.

Advancements in poultry farming practices-including precision feeding, biosecurity protocols, and improved management-further support growth in this segment. These require specialized feed additives designed to enhance gut health, immunity, and nutrient absorption in poultry.

Demand for amino acids, enzymes, probiotics, and other nutritional chemicals is increasing within the poultry sector. The industry’s focus on reducing antibiotic usage has led to rising adoption of alternative nutritional strategies such as natural feed additives and functional ingredients. This transition aligns with consumer preferences for antibiotic-free poultry products and supports sustainable, long-term growth of the poultry segment in the animal nutrition chemicals market.

The animal nutrition chemicals market is driven by diverse end-user segments, including livestock producers, feed manufacturers, pharmaceutical companies, and specialty ingredient suppliers. Primary demand factors include enhancing animal health, improving feed efficiency, and adhering to stringent regulatory standards focused on sustainability and feed safety.

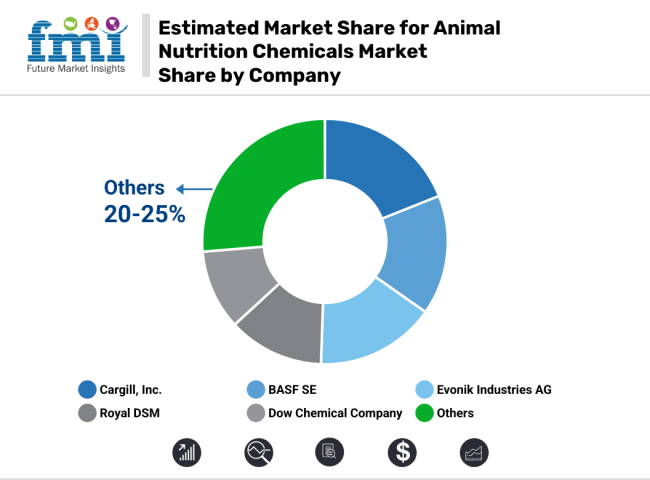

Livestock producers and feed manufacturers represent the largest demand generators for critical feed additives such as amino acids, enzymes, probiotics, and vitamins that promote optimal animal growth, productivity, and disease resistance. Leading market players like Cargill, Inc., BASF SE, Evonik Industries AG, and Royal DSM spearhead innovation in fermentation-based amino acids (e.g., methionine, lysine) and advanced gut health solutions, aligning with evolving clean-label consumer trends and environmental regulations.

The pharmaceutical segment focuses on specialized animal health supplements, including probiotics and immune-modulating compounds, responding to rising demand for antibiotic alternatives and improved disease management in livestock. Specialty ingredient suppliers prioritize natural, sustainable feed components, reflecting increased consumer and regulatory emphasis on eco-friendly and non-GMO products.

Cross-sector innovation opportunities arise from the integration of biotechnology, precision nutrition, and digital feed formulation tools designed to customize nutrient delivery for specific livestock species. These technologies enhance feed conversion ratios while minimizing environmental impact. The competitive landscape is characterized by strategic mergers and acquisitions, joint ventures, and technology partnerships, enabling companies to expand their product portfolios and global reach. Compliance with sustainability frameworks and demonstrable product efficacy remain critical factors for capturing and maintaining market share within this fast-evolving animal nutrition chemicals sector.

The United States animal nutrition chemicals market is projected to grow at a CAGR of 5.2%between 2025 and 2035. This growth is underpinned by the country’s advanced livestock industry, robust research and development capabilities, and a strong regulatory environment focused on sustainable agriculture. Leading feed additive manufacturers in the US are developing innovative chemical formulations that enhance feed efficiency, promote animal health, and improve disease resistance in poultry, swine, and ruminant production systems.

The integration of biotechnology and precision nutrition drives the adoption of performance-enhancing additives, addressing growing consumer demand for high-quality animal protein. Additionally, federal agencies promote sustainability and animal welfare, reinforcing the market's expansion. Strategic partnerships between feed producers, biotechnology firms, and agricultural stakeholders foster continual innovation, positioning the US as a dominant player in the global animal nutrition chemicals industry.

The United Kingdom animal nutrition chemicals market is expected to expand at a CAGR of 4.8% from 2025 to 2035. Growth is largely influenced by the country’s stringent feed safety regulations and increasing consumer preference for ethically produced animal protein. The UK livestock sector prioritizes traceability and sustainability in feed formulations, driving demand for feed additives that enhance nutrient absorption and animal welfare. Regulatory bodies actively support innovation in feed chemical development to comply with environmental and animal health standards.

Key market participants collaborate closely with regulatory agencies to ensure product safety and efficacy. The rising adoption of natural and functional feed additives in poultry, swine, and ruminant nutrition reflects evolving consumer awareness about food quality and sustainability. The UK market's alignment with broader European Union regulations further strengthens its position in the global animal nutrition chemicals landscape.

Germany is poised to experience steady growth in its animal nutrition chemicals market, with a projected CAGR of 4.6% between 2025 and 2035. Government policies promote sustainable livestock farming practices and the use of natural feed additives, aligning with rising consumer demand for organic and high-quality animal products. Germany’s feed additive industry benefits from its strong manufacturing and biotechnology sectors, which enable the development of innovative chemical formulations designed to improve animal health and feed conversion efficiency.

Compliance with European Union feed safety standards and transparent food labeling practices enhances consumer trust. The integration of environmental sustainability initiatives encourages adoption of feed chemicals that reduce emissions and waste in poultry, swine, and ruminant production. Germany’s regulatory framework and research institutions play a pivotal role in fostering innovation, making the country a key market within the European animal nutrition chemicals industry.

The animal nutrition chemicals market in France is forecast to grow at a CAGR of 4.4% through 2035, driven by the country’s unique combination of culinary heritage and increasing health consciousness. French consumers demand high-quality animal protein products derived from animals fed with natural and functional feed additives. National health policies addressing obesity and metabolic diseases support the development of advanced feed chemicals that improve nutrient utilization and animal welfare in poultry, dairy, and meat production.

Research and development in France focuses on reducing the environmental footprint of livestock farming while maintaining product quality. The market benefits from collaboration between government agencies, feed manufacturers, and research institutions to innovate formulations that meet gastronomic standards and sustainability goals. France’s focus on integrating animal nutrition with culinary excellence differentiates its market within Europe.

The animal nutrition chemicals industry in Italy is projected to expand at a CAGR of 4.3% during the forecast period. This growth is supported by the country’s Mediterranean diet influence and consumer preference for health-conscious animal products. Feed additives that enhance digestive health, immunity, and overall animal performance are increasingly incorporated into poultry, swine, and ruminant feed formulations.

Italy’s artisanal food culture encourages the use of high-purity and natural feed chemicals aligned with traditional production methods. Public health initiatives aimed at reducing sugar and fat intake indirectly stimulate demand for high-quality animal protein, driving innovation in feed additive development. The country’s vibrant retail sector and emerging health-focused startups facilitate the distribution of advanced animal nutrition products. Italy’s animal nutrition chemicals market reflects a balanced approach that integrates traditional food values with modern wellness trends.

South Korea’s animal nutrition chemicals marketis set to grow at a CAGR of 5.1%, propelled by the country’s dynamic functional foods sector and innovation ecosystem. The market focuses on incorporating bioactive compounds such as probiotics, enzymes, and plant extracts into animal feed to improve livestock growth performance, immune function, and disease resistance. Government policies and dietary guidelines encourage the use of advanced feed additives in poultry, swine, and ruminant production to meet consumer demand for sustainable and health-oriented animal products.

South Korea’s highly urbanized retail environment and health-conscious population drive market adoption of natural and multifunctional feed chemicals. Leading industry players invest heavily in research and development to optimize formulations for nutrient utilization and animal welfare. The integration of traditional botanical ingredients with modern biotechnology distinguishes South Korea’s animal nutrition chemicals market.

The animal nutrition chemicals market in Japan is forecast to expand at a CAGR of 4.5% by 2035, supported by strong research and development in precision livestock nutrition. The market emphasizes functional feed additives that improve nutrient absorption, support aging livestock, and address chronic disease management. Japan’s demographic trends, including an aging population and increasing demand for health-conscious food products, influence the development of advanced feed chemicals.

Government-led nutrition campaigns and public-private partnerships promote innovation in feed additive formulations. The Japanese market prioritizes sustainability and environmental stewardship, integrating additives that reduce nutrient waste and emissions. Collaboration among academia, industry, and regulators accelerates the development of high-purity enzymes, probiotics, and bioactive compounds tailored to poultry, swine, and ruminants. Japan’s focus on quality control and scientific innovation secures its competitive position in the global animal nutrition chemicals industry.

Animal nutrition chemicals market in China is projected to register a CAGR of 6% from 2025 to 2035, driven by government initiatives aimed at modernizing livestock production and reducing environmental impact. The country’s large-scale poultry, swine, and ruminant operations increasingly adopt feed additives that improve growth performance, feed conversion ratio, and disease resistance. China’s integrated supply chain and advancements in feed additive manufacturing enable cost-effective production and broad market penetration.

Policy frameworks such as Healthy China 2030 incentivize sustainable feeding practices and the use of natural feed chemicals. Leading Chinese feed additive manufacturers focus on research in cultivation, extraction, and formulation technologies to maintain competitive advantage domestically and globally. Urbanization and rising disposable incomes fuel demand for higher-quality animal protein, further accelerating market expansion. China’s role as a major exporter and consumer positions it at the forefront of the global animal nutrition chemicals market.

The animal nutrition chemicals market in Australia and New Zealand is expected to grow at a CAGR of 4.2% through 2035. Growth is driven by increasing consumer awareness of animal welfare, environmental sustainability, and clean-label food products. Regulatory authorities in both countries encourage feed reformulation to reduce antibiotic use and enhance natural growth promoters in poultry, swine, and ruminant diets. The market benefits from well-developed agricultural export industries demanding premium animal protein products with traceable, sustainable origins.

Collaborative research and industry partnerships accelerate development of feed additives that improve nutrient efficiency and animal resilience to environmental stress. Consumer preferences for ethically produced animal protein support the adoption of innovative feed chemicals that align with wellness and ecological priorities. The Australia-New Zealand market’s focus on transparency and quality elevates its position within the Asia-Pacific animal nutrition chemicals landscape.

Demand for animal nutrition chemicals in India is growing globally, with a projected CAGR of 6.5% between 2025 and 2035. The market expansion is driven by a rapidly increasing livestock population, rising demand for protein-rich animal products, and growing awareness of animal health and nutrition. Government initiatives such as the Food Safety and Standards Authority of India’s (FSSAI) Eat Right movement and favorable tax policies encourage adoption of advanced feed additives that enhance productivity, disease resistance, and feed efficiency in poultry, swine, and ruminants.

India’s market benefits from the unique integration of traditional animal husbandry practices with modern nutrition science. Domestic feed additive manufacturers focus on affordability, accessibility, and education campaigns to increase penetration. The fusion of Ayurvedic principles with contemporary feed formulations provides India with a distinctive competitive advantage. Rapid urbanization and rising income levels further contribute to expanding consumption of high-quality animal protein, fueling market growth.

The animal nutrition chemicals market is highly competitive, dominated by global industry leaders including BASF SE, Cargill, Inc., Evonik Industries AG, and Royal DSM. These companies strategically leverage innovation, sustainable practices, and advanced technologies to expand their market share worldwide.

For example, Cargill, Inc. has invested significantly in fermentation-based production of high-purity amino acids and enzymes, enhancing its footprint in key regions such as North America and Asia-Pacific. Evonik Industries AG specializes in producing specialty amino acids like methionine, integrating sustainability initiatives that reduce environmental impact while improving product efficacy.

BASF SE offers a broad portfolio of feed additives designed to promote animal gut health, supported by robust research and development efforts. Royal DSM has recently introduced precision nutrition solutions through digital platforms, emphasizing customized animal health management and feed optimization. Strategic collaborations remain crucial, exemplified by DuPont’s partnerships with global feed manufacturers to develop tailored probiotic blends that enhance feed conversion ratios.

Recent consolidation trends include Evonik’s acquisition of specialty feed additive companies, aimed at expanding regional market presence. Emerging players focus on niche segments such as natural feed additives and organic livestock nutrition, intensifying competition. Regulatory compliance and sustainability continue to be central pillars of growth strategies, with leading suppliers aligning product innovation to evolving global standards, thereby securing competitive advantages in the dynamic animal nutrition chemicals market.

EvonikVland Biotech Joint Venture Launch (2024)

Evonik Industries AG partnered with Shandong Vland Biotech Co., Ltd. to establish EvonikVland Biotech in China, focusing on animal probiotics and gut health solutions for livestock. This joint venture aims to strengthen Evonik’s market share in the rapidly growing Greater China animal nutrition sector, combining Evonik’s R&D expertise with Vland’s local production capabilities.

Royal DSM’s up4® Precision Nutrition Solutions (2024)

Royal DSM launched its up4® sports nutrition product line, developed in collaboration with Team dsm-firmenichPostNL. While primarily focused on human nutrition, the underlying precision nutrition technologies reflect DSM’s broader strategy to leverage digital and biotech innovations in animal health and nutrition, improving feed efficiency and animal performance.

Cargill’s Expanded Partnership with ENOUGH for Sustainable Animal Protein (2024)

Cargill expanded its partnership with ENOUGH, a sustainable fermentation protein producer, investing in new production technologies. Although ENOUGH’s ABUNDA® mycoprotein targets alternative proteins for human consumption, the fermentation innovations and sustainability models are increasingly influencing Cargill’s animal nutrition chemical offerings by promoting eco-friendly, high-quality protein ingredients for animal feed.

Dynamics profoundly impact the growth and demand of the animal nutrition chemicals market by analyzing growth drivers, challenges, opportunities, and risks. This insight helps manufacturers, suppliers, and stakeholders optimize their strategies for their next winning business move.

In 2024, the global animal nutrition chemicals market was valued around USD 16.25 billion, driven by increased consumption of animal protein and demand for improved livestock health. Essential feed additives such as amino acids, enzymes, vitamins, and minerals contribute to better feed conversion ratios and enhanced animal immunity. Companies like Evonik Industries AG and Royal DSM expanded their production capacities of amino acid-based feed supplements in 2024 to meet rising demand.

Advances in precision animal nutrition and digital feed formulation technologies launched by players such as Royal DSM and Alltech in 2024 to 2025 enable tailored nutrition strategies for poultry, swine, and ruminants. These innovations improve nutrient absorption efficiency while reducing feed wastage and environmental impact, aligning with sustainable livestock farming trends.

The animal feed additives industry faced evolving regulatory frameworks in 2024 and 2025. The USA FDA and European Food Safety Authority (EFSA) increased scrutiny on feed additive safety, especially regarding antibiotic alternatives and probiotic supplements. These regulations affect product approvals and market access timelines globally.

Supply chain volatility for critical raw materials like methionine and lysine-sourced primarily from China and Southeast Asia-persisted into 2025. Geopolitical tensions and environmental factors, including droughts in key agricultural regions during 2024, disrupted supply chains and contributed to price fluctuations, challenging manufacturers’ production planning.In emerging markets such as India and Brazil, infrastructural gaps and fragmented regulatory standards slowed widespread adoption of advanced animal nutrition chemicals despite strong growth potential in these regions.

The Asia Pacific region maintained significant growth in 2024 and 2025 due to expanding meat consumption and urbanization driving demand for efficient animal nutrition solutions. Brazil also recorded steady growth, supported by government programs promoting environmentally friendly feed additives and sustainable animal husbandry practices.

Increasing restrictions on antibiotic growth promoters accelerated adoption of natural feed additives such as enzymes, probiotics, and phytogenics. Novozymes launched innovative enzyme-based solutions in early 2025 designed to improve gut health and feed efficiency while lowering nitrogen and methane emissions in livestock farming.Digital transformation in animal nutrition progressed with AI-enabled precision feeding platforms released by Alltech and other market leaders in 2025, facilitating real-time monitoring and optimized feed formulations to maximize livestock productivity.

Climate change posed risks to the animal nutrition chemicals supply chain in 2024 and 2025, with droughts and extreme weather affecting raw material availability in Southeast Asia and China, major producers of feed additives. This volatility led to raw material price surges that influenced feed additive manufacturing costs.Consumer awareness around feed additive safety also increased, prompting companies like Cargill to launch transparency and education campaigns in 2025, emphasizing the efficacy and safety of enzyme and amino acid-based feed additives.

The global animal nutrition chemicals market is valued at approximately USD 16.3 billion in 2025, with steady growth expected through 2035.

Animal food manufacturers are projected to hold around 42% of the market share in 2025, driven by increasing demand for high-quality meat and dairy.

The poultry segment leads the market by species, accounting for about 35% share in 2025 due to high global consumption of poultry meat and eggs.

Additives such as amino acids, vitamins, minerals, enzymes, probiotics, and natural functional ingredients are widely used to improve feed efficiency and animal health.

Precision nutrition helps tailor feed to specific species and growth stages, optimizing nutrient use, reducing waste, and enhancing animal performance.

The poultry industry is adopting natural feed additives and functional ingredients to reduce antibiotics, meeting consumer demand for antibiotic-free products and promoting sustainable farming.

List of Tables

Table 1: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2015-2019

Table 2: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2020-2030

Table 3: Global Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2015-2019

Table 4: Global Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2020-2030

Table 5: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2015-2019

Table 6: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2020-2030

Table 7: Global Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2015-2019

Table 8: Global Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2020-2030

Table 9: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2015-2019

Table 10: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2020-2030

Table 11: Global Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2015-2019

Table 12: Global Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2020-2030

Table 13: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2015-2019

Table 14: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2020-2030

Table 15: Global Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2015-2019

Table 16: Global Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2020-2030

Table 17: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2015-2019

Table 18: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2020-2030

Table 19: North America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2015-2019

Table 20: North America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2020-2030

Table 21: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2015-2019

Table 22: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2020-2030

Table 23: North America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2015-2019

Table 24: North America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2020-2030

Table 25: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2015-2019

Table 26: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2020-2030

Table 27: North America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2015-2019

Table 28: North America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2020-2030

Table 29: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2015-2019

Table 30: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2020-2030

Table 31: North America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2015-2019

Table 32: North America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2020-2030

Table 33: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2015-2019

Table 34: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2020-2030

Table 35: Latin America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2015-2019

Table 36: Latin America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2020-2030

Table 37: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2015-2019

Table 38: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2020-2030

Table 39: Latin America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2015-2019

Table 40: Latin America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2020-2030

Table 41: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2015-2019

Table 42: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2020-2030

Table 43: Latin America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2015-2019

Table 44: Latin America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2020-2030

Table 45: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2015-2019

Table 46: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2020-2030

Table 47: Latin America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2015-2019

Table 48: Latin America Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2020-2030

Table 49: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2015-2019

Table 50: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2020-2030

Table 51: Europe Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2015-2019

Table 52: Europe Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2020-2030

Table 53: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2015-2019

Table 54: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2020-2030

Table 55: Europe Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2015-2019

Table 56: Europe Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2020-2030

Table 57: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2015-2019

Table 58: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2020-2030

Table 59: Europe Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2015-2019

Table 60: Europe Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2020-2030

Table 61: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2015-2019

Table 62: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2020-2030

Table 63: Europe Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2015-2019

Table 64: Europe Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2020-2030

Table 65: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2015-2019

Table 66: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2020-2030

Table 67: East Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2015-2019

Table 68: East Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2020-2030

Table 69: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2015-2019

Table 70: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2020-2030

Table 71: East Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2015-2019

Table 72: East Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2020-2030

Table 73: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2015-2019

Table 74: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2020-2030

Table 75: East Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2015-2019

Table 76: East Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2020-2030

Table 77: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2015-2019

Table 78: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2020-2030

Table 79: East Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2015-2019

Table 80: East Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2020-2030

Table 81: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2015-2019

Table 82: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2020-2030

Table 83: South Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2015-2019

Table 84: South Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2020-2030

Table 85: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2015-2019

Table 86: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2020-2030

Table 87: South Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2015-2019

Table 88: South Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2020-2030

Table 89: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2015-2019

Table 90: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2020-2030

Table 91: South Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2015-2019

Table 92: South Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2020-2030

Table 93: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2015-2019

Table 94: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2020-2030

Table 95: South Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2015-2019

Table 96: South Asia Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2020-2030

Table 97: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2015-2019

Table 98: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2020-2030

Table 99: Oceania Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2015-2019

Table 100: Oceania Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2020-2030

Table 101: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2015-2019

Table 102: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2020-2030

Table 103: Oceania Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2015-2019

Table 104: Oceania Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2020-2030

Table 105: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2015-2019

Table 106: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2020-2030

Table 107: Oceania Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2015-2019

Table 108: Oceania Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2020-2030

Table 109: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2015-2019

Table 110: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2020-2030

Table 111: Oceania Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2015-2019

Table 112: Oceania Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2020-2030

Table 113: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2015-2019

Table 114: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Region, 2020-2030

Table 115: Middle East & Africa Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2015-2019

Table 116: Middle East & Africa Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Region, 2020-2030

Table 117: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2015-2019

Table 118: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Product Type, 2020-2030

Table 119: Middle East & Africa Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2015-2019

Table 120: Middle East & Africa Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Product Type, 2020-2030

Table 121: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2015-2019

Table 122: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Application, 2020-2030

Table 123: Middle East & Africa Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2015-2019

Table 124: Middle East & Africa Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Application, 2020-2030

Table 125: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2015-2019

Table 126: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Forecast by Species, 2020-2030

Table 127: Middle East & Africa Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2015-2019

Table 128: Middle East & Africa Animal Nutrition Chemicals Market Volume (Metric Tons) and Forecast by Species, 2020-2030

List of Figures

Figure 1: Global Animal Nutrition Chemicals Market Value (US$ Mn) and Volume (MT) Forecast, 2020-2030

Figure 2: Global Animal Nutrition Chemicals Market Absolute $ Opportunity (US$ Mn), 2020-2030

Figure 3: Global Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Region, 2020 & 2030

Figure 4: Global Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Region, 2020 - 2030

Figure 5: Global Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Product Type, 2020 & 2030

Figure 6: Global Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Product Type, 2020 - 2030

Figure 7: Global Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Application, 2020 & 2030

Figure 8: Global Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Application, 2020 - 2030

Figure 9: Global Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Species, 2020 & 2030

Figure 10: Global Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Species, 2020 - 2030

Figure 11: Global Animal Nutrition Chemicals Market Attractiveness Analysis by Region, 2020 - 2030

Figure 12: Global Animal Nutrition Chemicals Market Attractiveness Analysis by Product Type, 2020 - 2030

Figure 13: Global Animal Nutrition Chemicals Market Attractiveness Analysis by Application,, 2020 - 2030

Figure 14: Global Animal Nutrition Chemicals Market Attractiveness Analysis by Species, 2020 - 2030

Figure 15: North America Animal Nutrition Chemicals Market Value (US$ Mn) and Volume (MT) Forecast, 2020-2030

Figure 16: North America Animal Nutrition Chemicals Market Absolute $ Opportunity (US$ Mn), 2020?2030

Figure 17: North America Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Region, 2020 & 2030

Figure 18: North America Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Region, 2020 - 2030

Figure 19: North America Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Product Type, 2020 & 2030

Figure 20: North America Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Product Type, 2020 - 2030

Figure 21: North America Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Application, 2020 & 2030

Figure 22: North America Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Application, 2020 - 2030

Figure 23: North America Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Species, 2020 & 2030

Figure 24: North America Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Species, 2020 - 2030

Figure 25: North America Animal Nutrition Chemicals Market Attractiveness Analysis by Region, 2020 - 2030

Figure 26: North America Animal Nutrition Chemicals Market Attractiveness Analysis by Product Type, 2020 - 2030

Figure 27: North America Animal Nutrition Chemicals Market Attractiveness Analysis by Application, 2020 - 2030

Figure 28: North America Animal Nutrition Chemicals Market Attractiveness Analysis by Species, 2020 - 2030

Figure 29: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and Volume (MT) Forecast, 2020-2030

Figure 30: Latin America Animal Nutrition Chemicals Market Absolute $ Opportunity (US$ Mn), 2020?2030

Figure 31: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Region, 2020 & 2030

Figure 32: Latin America Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Region, 2020 - 2030

Figure 33: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Product Type, 2020 & 2030

Figure 34: Latin America Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Product Type, 2020 - 2030

Figure 35: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Application, 2020 & 2030

Figure 36: Latin America Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Application, 2020 - 2030

Figure 37: Latin America Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Species, 2020 & 2030

Figure 38: Latin America Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Species, 2020 - 2030

Figure 39: Latin America Animal Nutrition Chemicals Market Attractiveness Analysis by Region, 2020 - 2030

Figure 40: Latin America Animal Nutrition Chemicals Market Attractiveness Analysis by Product Type, 2020 - 2030

Figure 41: Latin America Animal Nutrition Chemicals Market Attractiveness Analysis by Application, 2020 - 2030

Figure 42: Latin America Animal Nutrition Chemicals Market Attractiveness Analysis by Species, 2020 - 2030

Figure 43: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and Volume (MT) Forecast, 2020-2030

Figure 44: Europe Animal Nutrition Chemicals Market Absolute $ Opportunity (US$ Mn), 2020?2030

Figure 45: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Region, 2020 & 2030

Figure 46: Europe Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Region, 2020 - 2030

Figure 47: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Product Type, 2020 & 2030

Figure 48: Europe Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Product Type, 2020 - 2030

Figure 49: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Application, 2020 & 2030

Figure 50: Europe Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Application, 2020 - 2030

Figure 51: Europe Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Species, 2020 & 2030

Figure 52: Europe Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Species, 2020 - 2030

Figure 53: Europe Animal Nutrition Chemicals Market Attractiveness Analysis by Region, 2020 - 2030

Figure 54: Europe Animal Nutrition Chemicals Market Attractiveness Analysis by Product Type, 2020 - 2030

Figure 55: Europe Animal Nutrition Chemicals Market Attractiveness Analysis by Application, 2020 - 2030

Figure 56: Europe Animal Nutrition Chemicals Market Attractiveness Analysis by Species, 2020 - 2030

Figure 57: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Volume (MT) Forecast, 2020-2030

Figure 58: East Asia Animal Nutrition Chemicals Market Absolute $ Opportunity (US$ Mn), 2020?2030

Figure 59: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Region, 2020 & 2030

Figure 60: East Asia Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Region, 2020 - 2030

Figure 61: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Product Type, 2020 & 2030

Figure 62: East Asia Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Product Type, 2020 - 2030

Figure 63: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Application, 2020 & 2030

Figure 64: East Asia Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Application, 2020 - 2030

Figure 65: East Asia Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Species, 2020 & 2030

Figure 66: East Asia Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Species, 2020 - 2030

Figure 67: East Asia Animal Nutrition Chemicals Market Attractiveness Analysis by Region, 2020 - 2030

Figure 68: East Asia Animal Nutrition Chemicals Market Attractiveness Analysis by Product Type, 2020 - 2030

Figure 69: East Asia Animal Nutrition Chemicals Market Attractiveness Analysis by Application, 2020 - 2030

Figure 70: East Asia Animal Nutrition Chemicals Market Attractiveness Analysis by Species, 2020 - 2030

Figure 71: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and Volume (MT) Forecast, 2020-2030

Figure 72: South Asia Animal Nutrition Chemicals Market Absolute $ Opportunity (US$ Mn), 2020?2030

Figure 73: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Region, 2020 & 2030

Figure 74: South Asia Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Region, 2020 - 2030

Figure 75: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Product Type, 2020 & 2030

Figure 76: South Asia Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Product Type, 2020 - 2030

Figure 77: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Application, 2020 & 2030

Figure 78: South Asia Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Application, 2020 - 2030

Figure 79: South Asia Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Species, 2020 & 2030

Figure 80: South Asia Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Species, 2020 - 2030

Figure 81: South Asia Animal Nutrition Chemicals Market Attractiveness Analysis by Region, 2020 - 2030

Figure 82: South Asia Animal Nutrition Chemicals Market Attractiveness Analysis by Product Type, 2020 - 2030

Figure 83: South Asia Animal Nutrition Chemicals Market Attractiveness Analysis by Application, 2020 - 2030

Figure 84: South Asia Animal Nutrition Chemicals Market Attractiveness Analysis by Species, 2020 - 2030

Figure 85: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and Volume (MT) Forecast, 2020-2030

Figure 86: Oceania Animal Nutrition Chemicals Market Absolute $ Opportunity (US$ Mn), 2020?2030

Figure 87: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Region, 2020 & 2030

Figure 88: Oceania Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Region, 2020 - 2030

Figure 89: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Product Type, 2020 & 2030

Figure 90: Oceania Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Product Type, 2020 - 2030

Figure 91: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Application, 2020 & 2030

Figure 92: Oceania Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Application, 2020 - 2030

Figure 93: Oceania Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Species, 2020 & 2030

Figure 94: Oceania Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Species, 2020 - 2030

Figure 95: Oceania Animal Nutrition Chemicals Market Attractiveness Analysis by Region, 2020 - 2030

Figure 96: Oceania Animal Nutrition Chemicals Market Attractiveness Analysis by Product Type, 2020 - 2030

Figure 97: Oceania Animal Nutrition Chemicals Market Attractiveness Analysis by Application, 2020 - 2030

Figure 98: Oceania Animal Nutrition Chemicals Market Attractiveness Analysis by Species, 2020 - 2030

Figure 99: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and Volume (MT) Forecast, 2020-2030

Figure 100: Middle East & Africa Animal Nutrition Chemicals Market Absolute $ Opportunity (US$ Mn), 2020?2030

Figure 101: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Region, 2020 & 2030

Figure 102: Middle East & Africa Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Region, 2020 - 2030

Figure 103: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Product Type, 2020 & 2030

Figure 104: Middle East & Africa Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Product Type, 2020 - 2030

Figure 105: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Application, 2020 & 2030

Figure 106: Middle East & Africa Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Application, 2020 - 2030

Figure 107: Middle East & Africa Animal Nutrition Chemicals Market Value (US$ Mn) and % Growth by Species, 2020 & 2030

Figure 108: Middle East & Africa Animal Nutrition Chemicals Market Y-o-Y Growth Rate by Species, 2020 - 2030

Figure 109: Middle East & Africa Animal Nutrition Chemicals Market Attractiveness Analysis by Region, 2020 - 2030

Figure 110: Middle East & Africa Animal Nutrition Chemicals Market Attractiveness Analysis by Product Type, 2020 - 2030

Figure 111: Middle East & Africa Animal Nutrition Chemicals Market Attractiveness Analysis by Application, 2020 - 2030

Figure 112: Middle East & Africa Animal Nutrition Chemicals Market Attractiveness Analysis by Species, 2020 - 2030

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutritional Ingredients in Animal Feed Market Trends - Growth & Industry Forecast 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA