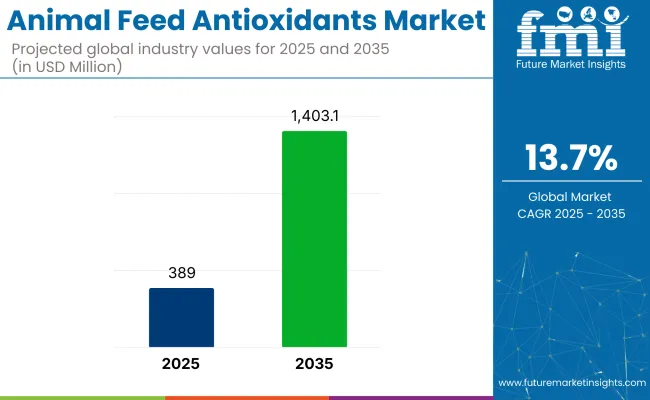

The global animal feed antioxidants market is projected to reach USD 389 million in 2025 and is expected to grow significantly, reaching a market value of USD 1,403.1 million by 2035. The market is forecasted to expand at a CAGR of 13.7% from 2025 to 2035.

The demand for animal feed antioxidants is being fueled by several key factors, including the rising need for high-quality animal products like meat, milk, and eggs. These products are in growing demand worldwide, particularly as consumers increasingly seek nutrition-rich and health-conscious food options. There is a corresponding increase in the focus on improving the quality of animal feed and animal welfare to meet the global food security challenges.

The animal feed antioxidant market represents a crucial but niche segment within its parent markets. Within the animal feed market, antioxidants account for approximately 4-6% of the market share, as they play an essential role in preserving feed quality and maintaining nutritional integrity. In the broader agricultural chemicals market, the share of animal feed antioxidants is estimated to be around 1-2%, as this is just one of many chemical additives used in agriculture.

Within the livestock industry, antioxidants contribute around 5-7%, as their use is widespread to ensure better health and productivity in animals. In the pet care market, antioxidants represent about 3-4% of the market, enhancing the shelf life of pet food. The food & beverage market sees an indirect but significant influence, with antioxidants accounting for 2-3% of the impact, due to their role in the production of animal-based products.

A major driving force behind the growth of the market is the need to improve the health, productivity, and well-being of livestock. Antioxidants in animal feed are crucial for combating oxidative stress and minimizing the risks of disease, which can negatively impact animal productivity. In California alone, the CDFA reported 764 infected dairies by late June 2025, with ongoing monitoring and quarantine protocols.

By stabilizing feed materials during storage, antioxidants play a vital role in enhancing the nutritional value and quality of feed, ensuring that animals receive the necessary nutrients to grow and perform optimally. This is particularly important in the context of modern intensive farming systems, where high production rates and quality standards are essential to meeting market demands.

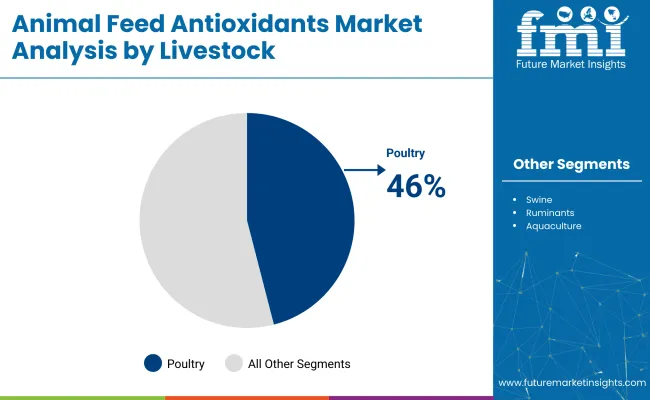

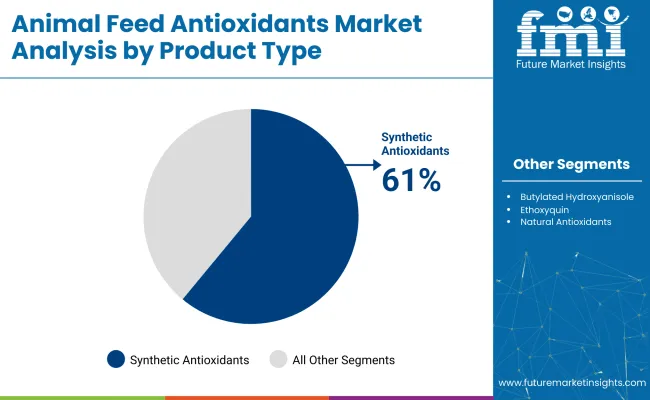

Poultry leads the market due to its efficiency in producing high-protein, cost-effective food, with antioxidants playing a key role in improving feed efficiency and animal health. Dry antioxidants dominate the market due to their versatility, ease of handling, and cost-effectiveness, while synthetic antioxidants account for the largest market share, thanks to their ability to preserve feed quality and enhance livestock productivity.

Poultry are projected to account for nearly 46% industry share by 2025, driven by its efficiency in producing high-protein, cost-effective food.

Dry antioxidants are projected to account for over 52% of the share in 2025, making them the largest form category.

The synthetic antioxidants segment is projected to dominate the animal feed antioxidants market, holding approximately 61% of the market share.

The market is driven by the rising demand for high-quality animal products and improved feed efficiency, with antioxidants playing a crucial role in animal health and productivity. Technological advancements and consumer awareness are fostering the growth of both synthetic and natural antioxidant solutions in the market.

Market Growth Driven by Animal Welfare and Feed Quality

The market is primarily driven by the growing demand for high-quality animal products such as meat, milk, and eggs. As consumers increasingly seek healthy, protein-rich food, the pressure on livestock producers to improve animal welfare and feed quality has intensified.

Antioxidants play a crucial role in maintaining the nutritional integrity of feed by protecting it from oxidative stress, improving feed efficiency, and enhancing thehealth and productivity of animals. These additives contribute significantly to improving feed stability and ensuring better livestock performance, which in turn drives market growth.

Technological Advancements and Rising Consumer Awareness

Advancements in antioxidant technologies have also contributed to the market's expansion. With innovations in both synthetic and natural antioxidants, there is an increasing focus on developing feed additives that are more effective and sustainable. Natural antioxidants, such as tocopherols and rosemary extracts, are gaining traction as more producers seek plant-based alternatives to synthetic options.

Rising consumer awareness about animal health and the nutritional value of food products has accelerated the demand for healthier, more sustainable feed ingredients. This shift towards cleaner and more effective feed solutions is expected to support continued market growth.

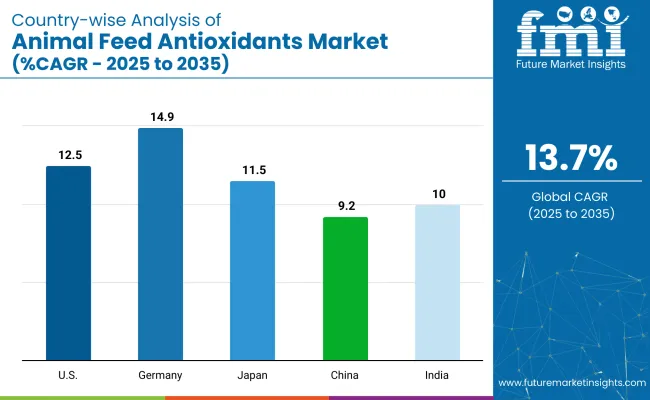

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 12.5% |

| Germany | 14.9% |

| Japan | 11.5% |

| China | 9.2% |

| India | 10.0% |

India’s growth is driven by its expanding poultry sector and a rising focus on enhancing feed quality through antioxidants. Chinais seeing a strong 9.2% CAGR, fueled by the growing need for antioxidants in its rapidly developing livestock industries, supported by government-backed agricultural initiatives. In contrast, developed economies such as Germany (14.9%), the United States(12.5%), and Japan (11.5%) are growing at a more stable pace.

Within the OECD, Germany leads with the highest growth, driven by the increasing demand for antioxidants to support animal health and feed longevity. The United States follows with steady growth in its livestock and poultry industries, where antioxidants are becoming a key focus. As the market adds over USD 400 million by 2035, both emerging economies like Indiaand China, as well as stable markets in the OECD, will significantly shape its development.

The report provides a detailed analysis of 40+ countries, with the top five countries highlighted for reference.

The USA animal feed antioxidants market is estimated to grow at a 12.5% CAGR during the study period. This growth is largely driven by the increasing demand for high-quality animal products, particularly poultry and pork. The USA is a major player in the global livestock market, with large-scale production of meat and dairy.

As consumers increasingly demand healthier and more sustainably produced food, USA producers are focusing on improving feed quality to enhance animal health and productivity. The use of antioxidants in animal feed helps prevent oxidative stress, improve feed efficiency, and support animal immunity.

With a rising emphasis on reducing the environmental impact of farming, antioxidants help ensure that feed maintains its quality during storage and handling, thus promoting sustainability in the agricultural sector. Regulatory pressure for better animal welfare and feed safety standards is also contributing to the increased demand for antioxidants in the USA

The Germany animal feed antioxidants market is estimated to grow at a 14.9% CAGR during the study period. Germany, as one of Europe’s largest agricultural producers, is increasingly focusing on improving animal health and feed quality, driven by consumer demand for premium animal products. The country has a strong emphasis on sustainability and environmental regulations, which has prompted a shift toward more efficient and healthier livestock farming practices.

Antioxidants in animal feed play a critical role in maintaining the nutritional integrity of the feed, preventing oxidative stress, and improving the health of animals. The rising demand for organic and natural food products is another contributing factor, pushing the adoption of natural antioxidants like tocopherols and rosemary extracts. With Germany's strong position in the European Union's agriculture policies, regulations requiring higher feed safety standards further stimulate the demand for antioxidants in animal feed.

The China animal feed antioxidants market is estimated to grow at a 9.2% CAGR during the study period. China’s rapidly expanding livestock sector, driven by increased meat consumption, is a key factor in the growing demand for feed antioxidants. The country is the world’s largest producer and consumer of pork, and the increasing demand for poultry and dairy products is also significant.

As China's middle class grows and consumer preferences shift toward higher-quality meat and dairy products, there is a greater emphasis on improving livestock feed to enhance animal health and productivity. Antioxidants are used in China to ensure feed quality, prevent oxidative stress, and promote animal well-being. China's focus on food safety and traceability has led to stricter regulations for animal feed, encouraging the use of antioxidants to maintain the nutritional value of feed and ensure compliance with national standards.

The Japan animal feed antioxidants market is estimated to grow at an 11.5% CAGR during the study period. Japan’s animal feed market is influenced by the country’s demand for high-quality and safe meat products, particularly in the poultry and aquaculture sectors.

As a nation with a strong focus on food safety and sustainability, Japan has stringent regulations governing animal feed, which encourages the use of antioxidants to improve feed quality and ensure better health outcomes for livestock. Antioxidants help prevent oxidative damage in animal feed, ensuring that animals remain healthy and productive, particularly in the highly controlled environments of poultry and fish farming.

With an increasing trend toward more sustainable farming practices, Japan’s farmers are increasingly adopting natural antioxidants, such as rosemary extracts and tocopherols, to cater to the growing demand for organic and clean-label products in the food market.

The India animal feed antioxidants market is estimated to grow at a 10.0% CAGR during the study period. India, with its rapidly expanding livestock sector and rising demand for animal-based proteins, is witnessing a surge in the adoption of antioxidants in animal feed. The growing population and increasing income levels have led to higher demand for meat, dairy, and eggs, resulting in greater focus on improving animal feed quality to enhance health, growth, and productivity.

The Indian government’s emphasis on food safety and livestock welfare is pushing the adoption of high-quality feed additives. Antioxidants play a crucial role in preventing feed deterioration, reducing oxidative stress, and improving the health of animals.

Key players like BASF SE, DSM Nutritional Products, and Cargill, Incorporated dominate the market due to their advanced technologies and extensive product portfolios. BASF SE is a leading player, offering a range of feed antioxidants that enhance livestock health and feed efficiency.

DSM Nutritional Products provides innovative antioxidant solutions that improve feed quality, particularly for poultry and swine. Cargill, Incorporated, a global leader in animal nutrition, focuses on sustainable feed additives to optimize animal growth and productivity. Other significant players, including Adisseo, Alltech, Inc., and Evonik Industries AG, specialize in the development of natural and synthetic antioxidants that promote better health outcomes for animals.

Emerging players like Kemin Industries, Inc., DuPont de Nemours, Inc., Biorigin, and Nutreco N.V. are focusing on expanding their antioxidant product offerings to cater to the growing demand for high-quality feed additives, particularly in emerging markets.

Recent Animal Feed Antioxidants Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 389 million |

| Projected Market Size (2035) | USD 1,403.1 million |

| CAGR (2025 to 2035) | 13.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in tons |

| Livestock Analyzed (Segment 1) | Poultry, Swine, Ruminants, And Aquaculture. |

| Form Analyzed (Segment 2) | Dry Antioxidants (Powder And Granules), And Liquid Antioxidants. |

| Product Type Analyzed (Segment 3) | Synthetic Antioxidants ( Butylated Hydroxytoluene (BHT), Butylated Hydroxyanisole (BHA), Ethoxyquin, Propyl Gallat ), And Natural Antioxidants (Tocopherols (Vitamin E), Ascorbic Acid (Vitamin C), Carotenoids, Rosemary Extract). |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | BASF SE, DSM Nutritional Products, Cargill, Incorporated, Adisseo, Alltech, Inc., Evonik Industries AG, Kemin Industries, Inc., DuPont de Nemours, Inc., Biorigin, Nutreco N.V. |

| Additional Attributes | Dollar sales, and share of key segments like synthetic and natural antioxidants, growth rates, regional trends, competitive landscape, and regulatory impacts on feed quality and demand. |

The industry is segmented into poultry, swine, ruminants, and aquaculture.

The industry is segmented into dry antioxidants (powder and granules), and liquid antioxidants.

The industry finds synthetic antioxidants (Butylated Hydroxytoluene (BHT), Butylated Hydroxyanisole (BHA), Ethoxyquin, Propyl Gallat), and natural antioxidants (Tocopherols (Vitamin E), Ascorbic Acid (Vitamin C), Carotenoids, Rosemary Extract).

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 389 million in 2025.

It is forecasted to reach USD 1,403.1 million by 2035.

The industry is anticipated to grow at a CAGR of 13.7% during this period.

Synthetic antioxidants are projected to lead the market with a 61% share in 2035.

Europe, particularly Germany, is expected to be the key growth region with a projected growth rate of 14.9%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Growth Promoter Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Digest Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA