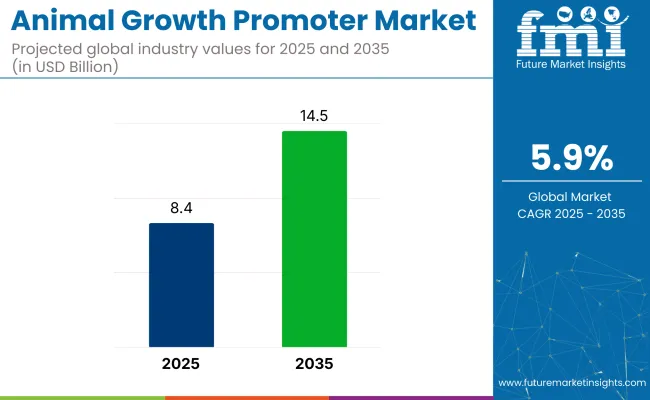

The global animal growth promoter market is anticipated to grow from USD 8.4 billion in 2025 and is poised to reach USD 14.5 billion by 2035, which shows a CAGR of 5.9%. The increasing demand for animal protein drives the growth of the animal growth promoter market. Farmers and producers are adopting natural growth promoters due to strict restrictions on antibiotic use. Companies are also advancing feed additive formulations to improve livestock productivity and health.

| Metric | Value |

|---|---|

| 2025 Market Value | USD 8.4 billion |

| 2035 Market Value | USD 14.5 billion |

| CAGR (2025 to 2035) | 5.9% |

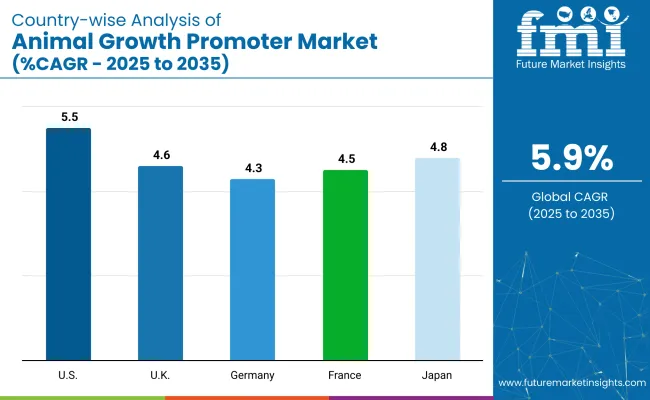

The market is set to grow steadily, with the USA recording a CAGR of 5.5% from 2025 to 2035 due to strong demand for antibiotic-free meat and advanced feed technologies. Japan will grow at a CAGR of 4.8%, driven by strict food safety standards and higher adoption of probiotics and enzymes.

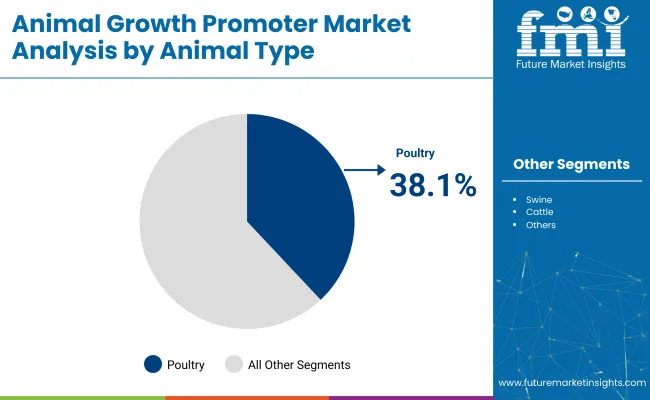

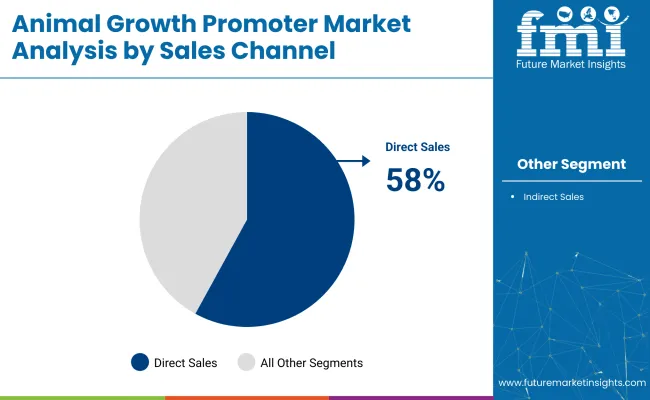

Germany will see a CAGR of 4.3%, supported by consumer preference for organic meat and sustainable practices. Direct sales will dominate the sales channel segment with a 58% share, while poultry will lead the animal type segment with a 38.1% market share in 2025.

Governments have banned or restricted the use of antibiotic growth promoters in animal feed in many regions. In the European Union, antibiotics have been completely banned for growth promotion since 2006. North America and Asia are also strengthening similar restrictions.

Companies are developing natural alternatives such as probiotics, phytogenic additives, and organic acids to support sustainable livestock production. They are also using encapsulation technologies to ensure targeted nutrient release in animals. Additionally, precision feeding solutions with digital farming systems are being introduced to improve feed efficiency, increase productivity, and meet food safety standards.

The market constitutes a small yet vital share within the broader animal feed additives and animal nutrition markets. Globally, growth promoters account for approximately 10-12% of the overall animal feed additives market value, driven by their use in enhancing feed efficiency, nutrient absorption, and livestock productivity. Within the larger animal nutrition industry, which includes feed, vitamins, minerals, and enzymes, growth promoters represent nearly 4-5% of total market revenues.

The animal growth promoter market is segmented by animal type, product type, functionality, sales channel, and region. By animal type, the market is categorized into poultry, swine, cattle, aquaculture, and others such as Goats, Sheep, And Horses. By product type, it is segmented into antibiotic-based promoters, hormonal promoters, enzyme-based promoters, probiotics and prebiotics, organic acids, phytogenic (plant-based) additives, and others (Mineral-Based Growth Promoters, Amino Acid Supplements, and Peptide-Based Additives).

By functionality, it is classified into growth enhancement, feed efficiency improvement, disease prevention and immunity boost, nutrient absorption optimization, and digestive health support. Based on sales channel, the market is divided into direct sales and indirect sales (veterinary clinics, pharmacies, online retailers, and specialty stores). Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The poultry segment is the most lucrative within the animal growth promoter market, accounting for a significant 38.1% market share in 2025.

Probiotics and prebiotics are the most lucrative segment, accounting for an expected market share of 28% in 2025.

Growth enhancement is identified as the most lucrative segment, holding an estimated market share of 38% in 2025.

Direct sales are considered the most lucrative segment, accounting for an expected market share of around 58% in 2025.

The market is growing steadily with rising demand for efficient livestock production. Probiotics and organic acids are increasingly adopted as natural alternatives to antibiotics. Advancements in encapsulation technologies and precision feeding are enhancing feed efficiency and sustainability.

Recent Trends in the Animal Growth Promoter Market

Challenges in the Animal Growth Promoter Market

The USA is expected to achieve the highest growth among these countries with a CAGR of 5.5% between 2025 and 2035, driven by strong demand for antibiotic-free meat and advancements in feed innovations. Japan is projected to witness a CAGR of 4.8% due to strict feed safety regulations and rising seafood consumption.

France is expected to expand at 4.5%, driven by its strong poultry sector and adoption of phytogenic additives. The UK is anticipated to grow at 4.6%, supported by sustainability trends and the use of natural additives. Germany is likely to grow the slowest at 4.3%, despite high demand for organic meat and advanced feed technologies.

This report covers an in-depth analysis of 40+ countries; the five top-performing OECD Countries are highlighted below.

The animal growth promoter sales in the USA are projected to grow at a CAGR of 5.5% from 2025 to 2035.

The UK animal growth promoter revenue is anticipated to grow at a CAGR of 4.6% from 2025 to 2035.

Germany’s animal growth promoter revenue is expected to grow at a CAGR of 4.3% from 2025 to 2035.

Sales of animal growth promoters in France are expected to grow at a CAGR of 4.5% from 2025 to 2035.

Japan’s animal growth promoter market is forecasted to grow at a CAGR of 4.8% from 2025 to 2035.

The market is relatively fragmented, with numerous global and regional players competing across product segments. Leading companies such as Zoetis Inc., Elanco Animal Health, Cargill, Royal DSM, and Bayer Animal Health dominate through strong distribution networks, innovation, and strategic partnerships.

Top companies compete by focusing on product innovation, sustainability, and targeted acquisitions to expand their portfolios. For instance, Cargill invests heavily in developing specialized probiotics and enzyme blends for species-specific applications, while DSM focuses on sustainable and natural feed additives to align with regulatory standards. Pricing strategies are competitive, particularly for probiotics and organic acids, as companies seek to maintain market share against regional players.

Recent Animal Growth Promoter Industry News

| Report Attributes | Details |

| Current Total Market Size (2025) | USD 8.4 billion |

| Projected Market Size (2035) | USD 14.5 billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume (Metric Tons) |

| By Animal Type | Poultry, Swine, Cattle, Aquaculture, Others (Goats, Sheep, Horses) |

| By Product Type | Antibiotic-Based Promoters, Hormonal Promoters, Enzyme-Based Promoters, Probiotics and Prebiotics, Organic Acids, Phytogenic (Plant-Based) Additives, Others (Mineral- b ased Growth Promoters, Amino Acid Supplements, Peptide- based Additives, and Betaine Compounds). |

| By Functionality | Growth Enhancement, Feed Efficiency Improvement, Disease Prevention and Immunity Boost, Nutrient Absorption Optimization, Digestive Health Support |

| By Sales Channel | Direct Sales, Indirect Sales (Veterinary Clinics, Pharmacies, Online Retailers, Specialty Stores) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Zoetis Inc., Elanco Animal Health, Cargill Inc., Royal DSM N.V., Bayer Animal Health GmbH, Nutreco N.V., Alltech Inc., ADM Animal Nutrition, Evonik Industries AG, Kemin Industries, BASF SE, Phibro Animal Health, Land O'Lakes Inc., BIOMIN GmbH, DuPont ( Danisco Animal Nutrition), Zoopan S.A., Azelis Holding S.A., and Novozymes A/S. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per product type, the market has been categorized into Antibiotic-Based Promoters, Hormonal Promoters, Enzyme-Based Promoters, Probiotics and Prebiotics, Organic Acids, Phytogenic (Plant-Based) Additives, and Others.

As per animal type, the industry has been categorized into Poultry, Swine, Cattle, Aquaculture, and Others (Sheep, Goats, and Horses).

This segment is further categorized into Growth Enhancement, Feed Efficiency Improvement, Disease Prevention and Immunity Boost, Nutrient Absorption Optimization, and Digestive Health Support.

As per form, the industry has been categorized into Direct Sales, Indirect Sales (Veterinary Clinics, Pharmacies, Online Retailers, and Specialty Stores).

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltics, and the Middle East & Africa.

The market is valued at USD 8.4 billion in 2025.

The market is projected to reach USD 14.5 billion by 2035.

Poultry leads the market, holding a 38.1% share in 2025.

The market is growing at a CAGR of 5.9% from 2025 to 2035.

Growth enhancement accounts for a 40% market share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA