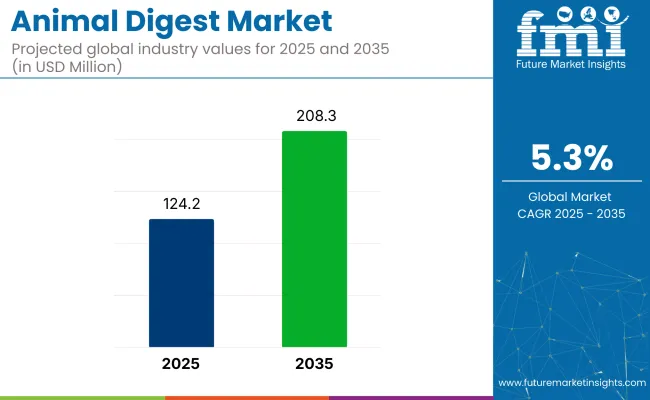

The animal digest market is projected to grow from USD 124.2 million in 2025 to USD 208.3 million by 2035, reflecting a CAGR of 5.3% over the forecast period. Demand is anticipated to remain consistent as animal digest continues to serve as a palatability enhancer and nutritional supplement in pet food and livestock feed. While North America remains the core manufacturing and consumption hub, expansion into Latin America and Southeast Asia is expected to gain pace.

Technological improvements in rendering processes and ingredient traceability are helping address historical concerns around transparency and safety. As consumers scrutinize labels more closely, producers are highlighting the nutritional relevance of digest through better documentation and certification. Enhanced processing control and cleaner supply chains are likely to elevate its status across both mainstream and specialty feed applications.

As of 2025, the animal digest market holds a specialized but vital share across its broader parent markets. Within the global animal feed additives market, it accounts for approximately 2-3%, primarily due to its role in enhancing feed palatability. In the pet food ingredients market, holds a more substantial share of about 5-7%, driven by its widespread use in dry kibble and treats for flavor enhancement.

Within the global animal nutrition market, its contribution is estimated at 1-2%, as it serves a specific functional role. In the rendered products market, it represents around 3-5%, since it is a value-added by-product. In the global livestock feed market, animal digest comprises roughly 1-2%, especially in formulations targeting improved feed intake.

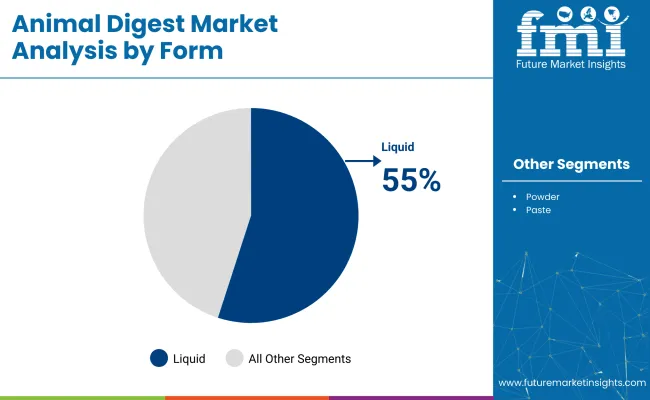

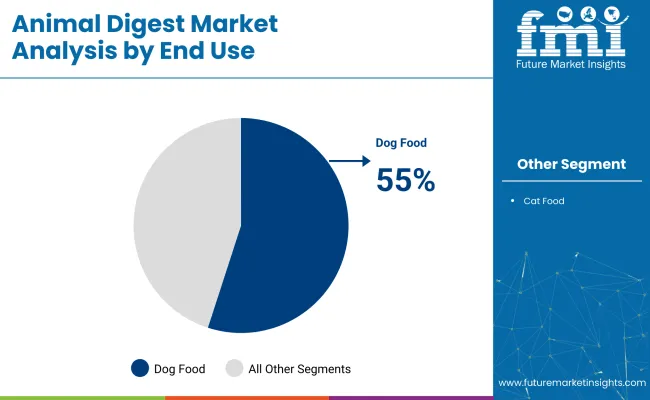

Liquid form is projected to dominate the form segment with 55% market share by 2025, while pork remains the leading source with a 40% share. Dog food is expected to account for 55% of the end-use segment, driven by increasing demand for palatable and protein-rich pet diets.

Liquid animal digest is forecasted to lead the form segment, holding 55% of the market share by 2025, due to superior flavor dispersion and high absorption efficiency.

Pork is expected to secure 40% of the source segment in the market by 2025, supported by widespread availability and cost-effectiveness.

Dog food is anticipated to dominate the end-use segment, capturing 55% of the market share by 2025, due to growing pet ownership and demand for enhanced palatability.

The market is experiencing growth driven by increasing use in pet nutrition and livestock performance. Manufacturers are focusing on enhancing palatability, improving nutritional uptake, and meeting rising demand for functional and high-quality feed ingredients.

Growing Use in Pet Food and Companion Animal Nutrition

Animal digests are key flavor enhancers in both wet and dry pet food, increasing feed acceptance among pets. Producers are developing species-specific formulas, such as poultry, beef, or fish-based digests, tailored to animal preferences. Premium pet food brands rely on high-quality digests to improve product appeal, particularly in treats and specialty diets for older or sensitive pets. Demand is also supported by growing pet adoption and humanization trends.

Enhanced Role in Livestock Feed Efficiency and Nutrient Utilization

In commercial livestock, animal digests are utilized to improve feed intake and digestion. Their inclusion helps optimize growth rates and feed conversion ratios in poultry, swine, and aquaculture. Feed producers are integrating digests into starter feeds and performance diets to promote early growth and improve health outcomes. This has led to increased purchasing by feed mills and integrated farms aiming for consistent productivity gains.

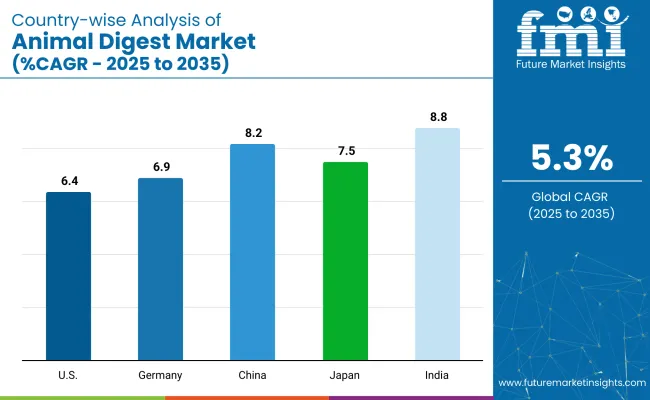

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

| Germany | 6.9% |

| China | 8.2% |

| Japan | 7.5% |

| India | 8.8% |

The global market is forecast to grow at a CAGR of 5.3% from 2025 to 2035, with varied growth patterns across key regions. India, a member of the BRICS group, is leading the market with an 8.8% CAGR, supported by rapid expansion in livestock and aquaculture feed demand. China, also a BRICS nation, follows with a CAGR of 8.2%, driven by large-scale pet food and fish farming sectors.

Japan, an OECD member, is advancing steadily at 7.5% CAGR, focused on premium pet nutrition and marine aquaculture. In Europe, Germany is growing at 6.9% CAGR, fueled by sustainability policies and advanced feed processing. The USA, another OECD country, maintains strong growth at 6.4%, supported by premiumization in companion animal nutrition and regulatory compliance.

While BRICS nations are scaling rapidly through volume and affordability, OECD countries are shaping the market through innovation, quality standards, and regulatory rigor.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Demand in India is forecast to grow at 8.8% CAGR through 2035, the fastest among major markets. This growth is underpinned by rising demand for high-efficiency feed in poultry, aquaculture, and dairy sectors. Increasing focus on protein-enriched diets and the need to boost palatability in compound feeds are pushing digest usage across rural and industrial regions.

As a BRICS and Emerging Market nation, India is investing in local rendering infrastructure to reduce import dependence and enable scalable digest production. Growth is also supported by expanding pet food retail and rising awareness of functional animal nutrition, particularly in urban hubs.

The market in China is projected to grow at a CAGR of 8.2%, driven by its dominant role in aquafeed and growing urban pet food demand. Digest ingredients are widely adopted in feed for carp, tilapia, and shrimp, enhancing palatability and nutrient uptake. Pet food manufacturers are incorporating poultry- and fish-based digest into high-value dry and wet formulations.

As a BRICS and Protein-Transition Market, China is pushing for feed conversion efficiency in both commercial livestock and pet care. Domestic suppliers are expanding rapidly to meet government goals of sustainable feed practices and reduced food waste through byproduct valorization.

Japan is experiencing steady growth in the market with a CAGR of 7.5%, led by demand for precision-formulated pet food and high-value aquafeed. As an OECD member with stringent safety standards, Japan emphasizes digest ingredients that are traceable, refined, and suitable for senior and specialty pet diets.

Marine-based digest, particularly from sardines and tuna, is gaining ground in fish farming regions. The domestic market favors functionality, palatability, and low-allergen potential. Local producers are innovating in processing techniques that preserve bioavailability, meeting demand in a mature but highly selective feed and pet food ecosystem.

Germany’s industry is forecast to grow at 6.9% CAGR, driven by regulatory alignment, clean-label trends, and performance-focused feed solutions. As part of the EU27 and Sustainability-Focused Nations, Germany places high importance on responsible sourcing and traceable byproducts. Pet food brands are increasingly incorporating hydrolyzed digest for flavor enhancement without artificial additives.

In livestock feed, digest use supports reduced antibiotic reliance and improved animal intake. Germany’s advanced rendering facilities and compliance-driven production processes are setting benchmarks in the EU market, particularly in poultry, swine, and premium pet nutrition sectors.

The USA market is expanding at a 6.4% CAGR, supported by growth in premium pet nutrition and the modernization of aquafeed practices. As an OECD economy, the USA enforces strict AAFCO and FDA standards that are shaping digest production and labeling practices.

Digest is widely used in pet food for palatability and nutrient density, especially in products targeting older pets or those with sensitive digestion. In aquaculture, digest contributes to protein efficiency and reduced feed waste. USA manufacturers are investing in advanced hydrolysis technologies, long-term shelf stability, and clean-label formulations to meet evolving consumer expectations.

The market is moderately fragmented, featuring a mix of global players and emerging suppliers that cater to growing demands in pet nutrition and animal feed industries. Established companies like Kemin Industries, ADM Animal Nutrition, Cargill, and BASF SE lead the market with robust R&D capabilities and advanced manufacturing processes, ensuring consistent quality and palatability in feed-grade digest products. Darling Ingredients and Omega Protein Corporation play key roles in providing sustainable raw materials derived from animal by-products.

Nestlé and B&G Foods, Inc. integrate animal digest components into their pet food portfolios, enhancing flavor and nutritional value. Companies such as John Pointon and Sons Ltd, BRF Ingredients, and Novozymes contribute through specialized enzyme solutions and feed additives. Emerging firms like Foodchem and New Alliance Fine Chem Pvt. Ltd. are expanding their footprint in regional markets with customized solutions.

| Report Attribute | Details |

|---|---|

| Market Size (2025) | USD 124.2 million |

| Projected Market Size (2035) | USD 208.3 million |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Forms Analyzed (Segment 1) | Paste, Powder, Liquid |

| Sources Analyzed (Segment 2) | Poultry, Pork, Turkey, Duck, Salmon, Lamb |

| End Uses Analyzed (Segment 3) | Dog Food, Cat Food |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Key Players | Kemin Industries, B&G Foods, Inc., ADM Animal Nutrition, BASF SE, Cargill, Darling Ingredients, John Pointon and Sons Ltd, Nestlé, Omega Protein Corporation, DowDuPont Inc., Novozymes, Foodchem, BRF Ingredients, New Alliance Fine Chem Pvt. Ltd., and other emerging competitors |

| Additional Attributes | Dollar sales by form and source, rising preference for poultry and salmon digest, expanding pet ownership, and premium pet food demand are shaping market growth across emerging and developed economies. |

The industry is segmented based on form into paste, powder, and liquid animal digest formulations.

Animal digest is derived from multiple sources, including pork, poultry, turkey, duck, salmon, and lamb.

The key end-use applications are in pet nutrition, specifically in dog food and cat food products.

The market spans across various regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, and the Middle East & Africa.

The global animal digest market is anticipated to reach USD 208.3 million by 2035.

The market is forecast to be valued at USD 124.2 million in 2025.

The market is expected to grow at a compound annual growth rate of 5.3% during the forecast period.

Liquid animal digest is expected to dominate the form segment with a 55% market share in 2025.

Dog food applications are projected to lead end use, capturing a 55% share of the market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA