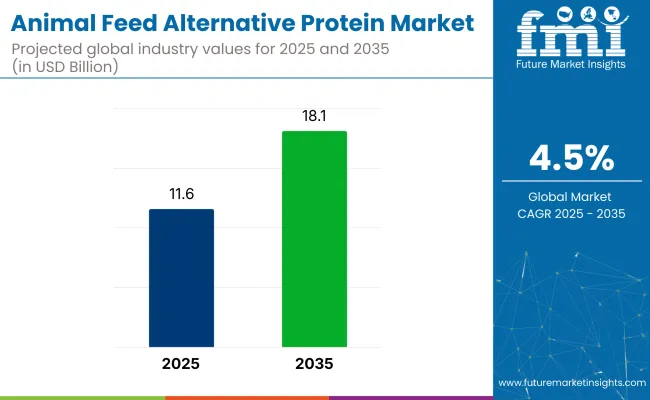

The global animal feed alternative protein market is projected to reach a value of USD 11.6 billion in 2025, with expectations of significant growth, culminating in a market size of USD 18.1 billion by 2035. This increase reflects a CAGR of 4.5% over the forecast period.

As the demand for animal feed continues to rise globally, the focus on alternative protein sources has been intensifying, driven by the need to find more sustainable and cost-effective solutions. In particular, the rise in feed prices has compelled the industry to explore alternative sources that are not only cost-efficient but also offer enhanced nutritional value.

The animal feed alternatives protein market is gaining traction, though it remains a niche segment within its parent markets. Within the animal feed market, alternative proteins currently account for approximately 5-7% of the market share, driven by the rising demand for more sustainable and plant-based protein sources.

In the broader agricultural protein market, the share is estimated to be around 3-5%, as alternative proteins are gaining attention but still represent a small portion of agricultural protein production. Within the plant-based protein market, alternative proteins for animal feed hold about 10-12% of the share, as plant-based proteins such as soy and pea are increasingly used in feed formulations.

The sustainable agriculture market sees alternative proteins making up approximately 6-8%, as part of the broader trend toward environmentally-friendly solutions. In the food and beverage industry, the indirect impact of feed alternatives is modest, contributing roughly 1-2% due to their role in the production of animal-based food products.

One of the primary factors influencing this market's growth is the need for more sustainable livestock nutrition. In 2025, the USDA committed USD 14.4 million to support urban agriculture and innovative production methods. Traditional protein sources like soymeal and fishmeal are becoming more expensive, while concerns regarding their environmental impact are leading to a shift in the industry.

Alternative protein sources, such as plant-based proteins, insect meal, and fermented proteins, have become key players in addressing these challenges. These proteins are not only more sustainable but also promise to deliver higher digestibility, better absorption of nutrients, and improved feed conversion rates (FCR), which are critical to optimizing livestock production. The growing emphasis on reducing carbon footprints and minimizing environmental harm is driving the demand for these alternative protein sources.

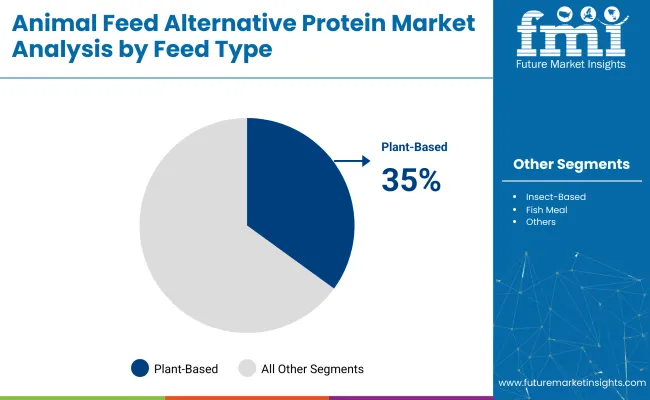

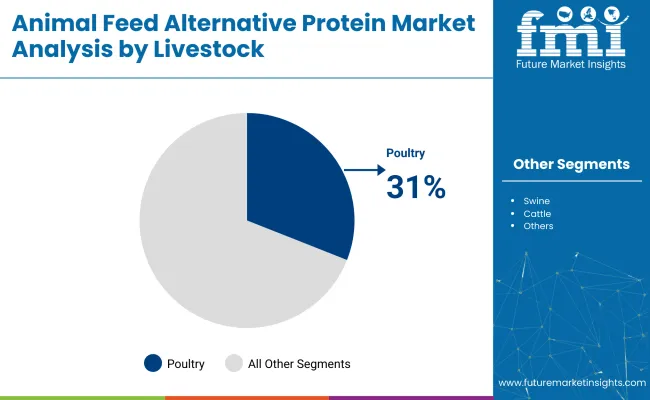

Plant-based proteins are expected to dominate the animal feed market due to their cost-effectiveness and scalability, with soy, pea, and fava bean proteins being the most commonly used. Poultry is the fastest-growing segment, driven by high feed conversion efficiency and the adoption of alternative proteins like insect meal. The pellet form is set to lead the market, offering benefits such as ease of handling, uniform mixing, and improved feed efficiency, making it the preferred choice for large-scale livestock and aquaculture operations.

Plant-based proteins are projected to lead the feed type segment, accounting for 35% of the global market share by 2025.

Poultry are projected to lead the livestock segment, accounting for 31% of the global market share by 2025.

The pellet form is expected to hold a significant market share of 30% of the global animal feed alternative protein market. This dominance is due to the advantages it offers, such as ease of handling, storage, and transportation.

The rising need for affordable feed options is accelerating the use of alternative proteins like plant-based and insect meals. Innovations in technologies such as single-cell protein fermentation are enhancing the cost-effectiveness and performance of these protein alternatives.

Growing Demand for Sustainable and Cost-effective

The growing demand for cost-effective animal feed solutions is one of the key drivers for the rise of alternative proteins. Traditional protein sources, such as soymeal and fishmeal, have faced rising prices, making them less economically viable for large-scale livestock operations.

This shift has accelerated the adoption of alternative proteins like plant-based and insect meal, which offer more affordable and environmentally friendly options. The increasing pressure on the agricultural sector to reduce its carbon footprint further supports the move toward more sustainable feed alternatives.

Technological Advancements in Protein Production

Technological innovations play a pivotal role in the growth of the animal feed alternative protein market. The development of new protein extraction and fermentation techniques, such as single-cell protein fermentation and algae-based feed solutions, has improved the availability and affordability of alternative proteins.

These advancements enable better digestibility and nutrient absorption, leading to improved feed conversion rates and livestock performance. With continued investment in R&D, these technologies are expected to drive the commercialization of even more efficient and sustainable protein sources for animal feed.

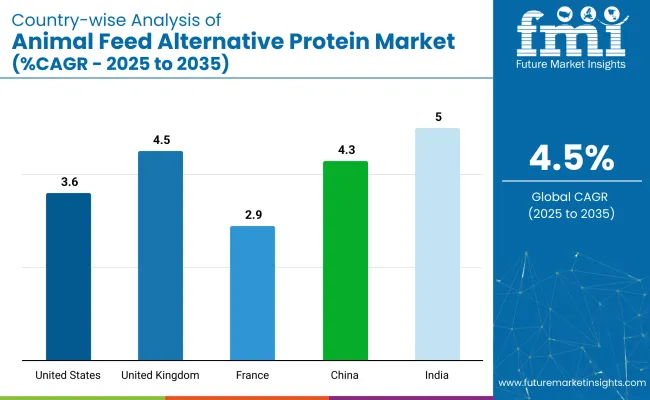

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.6% |

| UK | 4.5% |

| France | 2.9% |

| China | 4.3% |

| India | 5.0% |

The global animal feed alternative protein market is experiencing significant growth, particularly in emerging markets. India is leading the charge, driven by its expanding poultry and livestock industries and a strong push for sustainable and plant-based protein sources in animal feed.

China follows closely, with a projected 4.3% CAGR, as government initiatives in sustainable agriculture and growing demand for alternative feed proteins boost its livestock sector. Developed economies such as France (2.9%), the United States (3.6%), and the United Kingdom (4.5%) are experiencing steady growth at a more gradual pace.

Among these, the United Kingdom leads the OECD countries with a demand for innovative and sustainable protein alternatives in its poultry and aquaculture sectors. The United States follows with steady growth, focusing on increasing plant-based protein adoption in livestock feed. As the market grows and adds over USD 200 million by 2035, both high-growth regions like India and China, along with the stable demand from OECD nations, will influence the future of the global alternative protein market.

The report includes a detailed analysis of over 40 countries, with the top five countries highlighted for reference.

The USA animal feed alternative protein market is projected to grow at a CAGR of 3.6% during the forecast period. This growth is largely driven by the increasing need for sustainable and economically viable feed options amid rising environmental concerns and escalating feed prices.

The USA agricultural industry, being one of the largest globally, faces growing pressure to adopt more sustainable practices, fueling interest in alternative protein sources such as plant-based proteins, insect meal, and microbial proteins. The market is benefitting from advancements in protein extraction technologies and regulatory approvals that support the integration of alternative proteins into livestock feed.

As farmers and feed manufacturers focus on reducing their environmental impact while optimizing feed efficiency, the demand for alternative proteins is expected to continue growing, further contributing to the market's expansion.

The animal feed alternative protein market in China is expected to grow at a CAGR of 4.3% during the forecast period. With its vast agricultural landscape, China is increasingly focused on improving the sustainability and efficiency of its livestock sector. The combination of rising feed prices, environmental concerns, and growing demand for animal products has made alternative proteins, such as plant-based and insect meal, a more attractive solution.

China is also investing significantly in research and development to enhance feed efficiency and reduce reliance on traditional feed ingredients, like fishmeal and soymeal. These factors have positioned China as a key player in the global market, with the country’s growing adoption of alternative proteins playing a vital role in shaping the future of animal feed.

The France animal feed alternative protein market is anticipated to grow at a CAGR of 2.9% over the forecast period. France's strong commitment to sustainability and environmental responsibility has been a major factor driving the use of alternative proteins in its livestock industry. With stringent environmental regulations aimed at reducing carbon emissions, coupled with policies promoting animal welfare, there has been a significant increase in the demand for alternative feed options.

The French government has incentivized the use of plant-based and insect-based proteins, providing an alternative to traditional animal feeds. France, as a leader in the EU’s Green Deal, is accelerating the transition to eco-friendly farming practices. The increasing adoption of insect meal in poultry and swine feed reflects the country’s growing focus on sustainable agricultural solutions.

The UK animal feed alternative protein market is forecast to grow at a CAGR of 4.5%, aligning with global market trends. The increasing focus on sustainability and the need to reduce the carbon footprint of agriculture are key factors driving interest in alternative proteins. The UK government’s commitment to achieving net-zero emissions by 2050 has spurred policies that encourage the use of sustainable feed alternatives.

As part of these sustainability efforts, the UK is incorporating plant-based proteins and insect meal into livestock feed. Consumer demand for ethically produced and environmentally friendly animal products has driven increased investments in alternative protein technologies. With ongoing support from both the government and the agricultural sector, the UK market is poised to continue expanding as more producers shift toward these sustainable alternatives.

The India animal feed alternative protein market is expected to grow at a CAGR of 5.0% from 2025 to 2035. India’s rapidly growing agricultural sector, along with increasing livestock production, creates a substantial demand for cost-effective and sustainable feed alternatives. The market is being propelled by the rising prices of traditional feed ingredients and the need for more environmentally friendly solutions.

With technological advancements and growing investments in alternative protein sources like plant-based and insect meal, India is well-positioned to lead in the adoption of these alternatives. Government support and initiatives aimed at sustainable agriculture further boost market expansion.

The animal feed alternative protein market is moderately consolidated, with leading players such as Archer Daniels Midland Company (ADM), Cargill, Inc., DuPont de Nemours, Inc., Nestlé Purina PetCare, Alltech, Inc., and Calysta, Inc. These companies dominate by offering a wide range of sustainable and cost-effective protein solutions tailored for the livestock and aquaculture sectors.

For instance, Archer Daniels Midland Company (ADM) provides plant-based protein solutions widely used in animal feed formulations, while Cargill, Inc. is known for its vast network and innovative approaches to sourcing plant and insect proteins. DuPont de Nemours, Inc. excels in developing advanced microbial proteins for more efficient feed solutions, and Nestlé Purina PetCare leads with high-quality insect-based protein products. Alltech, Inc. focuses on delivering nutrient-rich, sustainable proteins for animal nutrition, while Calysta, Inc. is driving growth with its fermentation technology for single-cell proteins in aquaculture feeds.

Recent Animal Feed Alternative Protein Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 11.6 billion |

| Projected Market Size (2035) | USD 18.1 billion |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in tons |

| Feed Type Analyzed (Segment 1) | Insect-Based Protein, Plant-Based Protein, Fish Meal Alternative, Single-Cell Proteins, Others . |

| Livestock Analyzed (Segment 2) | Poultry, Swine, Cattle, Equine, Aquaculture. |

| Form Type Analyzed (Segment 3) | Meal, Pellets, Liquid, Freeze-Dried. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Archer Daniels Midland Company (ADM), Cargill, Inc., DuPont de Nemours, Inc., Nestlé Purina PetCare, Alltech, Inc., Calysta, Inc., Ÿnsect, Innovafeed, Protix, Unibio International, Novonesis Group (formerly Novozymes & Chr. Hansen merger), Skretting (Nutreco), and Corbion N.V. |

| Additional Attributes | Dollar sales projections, market share by protein type (plant-based, insect, microbial), growth rates and CAGR for key markets (USA, China, Europe), competitive landscape, leading players’ strategies, regulatory impacts, and consumer trends toward sustainable feed alternatives. |

The industry is segmented intoinsect-based protein, plant-based protein, fish meal alternative, single-cell proteins, others.

The industry findslivestock inpoultry, swine, cattle, equine, aquaculture.

The segment is divided intomeal, pellets, liquid, freeze-dried.

TheIndustry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania.

The industry is valued at USD 11.6 billion in 2025.

It is forecasted to reach USD 18.1 billion by 2035.

The industry is anticipated to grow at a CAGR of 4.5% during this period.

Plant-based proteins are projected to lead the market with a 35% share in 2035.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 5.0%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Animal Feed Alternative Protein Market Insights – Demand, Trends & Forecast 2025–2035

Australia Animal Feed Alternative Protein Market Report – Size, Share & Innovations 2025-2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA