The Latin America animal feed alternative protein market reflects a moderate but steady growth trajectory, with a CAGR assessment of 5.0% during the 2025 to 2035, period. The market is estimated to be worth around USD 767.4 million USD in 2025 and is projected to reach USD 1244 million USD by the year 2035, attributed to the increasing demand for sustainable protein sources in the dairy and livestock sectors and changing livestock nutrition regulations across the region.

| Attributes | Description |

|---|---|

| Estimated Latin America Alternative Protein Feed Market Size (2025E) | USD 767.4 million |

| Projected Latin America Alternative Protein Feed Market Size (2035F) | USD 1244 million |

| Value-based CAGR (2025 to 2035) | 5.0% |

Concerns around the environmental impact of traditional animal feed ingredients like soymeal and fishmeal have driven investment and appetite for alternative protein solutions. These include insect-based protein (e.g., black soldier fly larvae), algae protein, single-cell proteins (SCPs), fermented proteins, and pulses such as fava beans and peas.

Brazil, Mexico, and Argentina have been at the forefront of this shift, driven by the increasing needs of the poultry, swine, aquaculture, and dairy industries. These sectors are increasingly looking for cost effective and sustainable alternatives that will reduce dependency on imports, and buffer against price volatility of commodities.

At the same time, carbon-reduction targets and feed efficiency mandates are driving the use of new trends in large scale feed processors and integrators to try novel proteins in order to meet ESG targets.

Startups and multinational corporations have struck pacts to establish commercial-scale insect farms, microbial fermentation centers and plant protein processing facilities across the region. A lot of feed laws in the world are being changed slowly, regulators do hear innovation voices too.

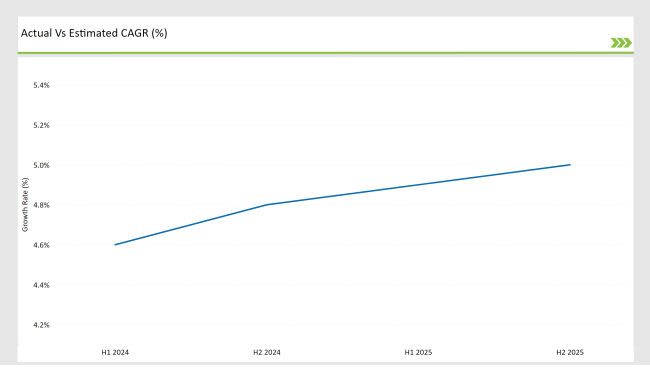

The table below presents the half-yearly performance comparison for the alternative protein feed market in Latin America, highlighting changes in value CAGR across periods:

Each successive half-year period reflects a slight improvement in CAGR, consistent with rising awareness and the gradual commercialization of novel protein technologies. The second half of the year typically performs better due to agricultural cycle completions, new livestock stocking, and regional feed procurement strategies.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Ynsect Begins Operations in Brazil : Ynsect launched its first insect protein production facility in Brazil, focusing on sustainable feed protein solutions for aquaculture and poultry. |

| Oct-24 | Cargill Expands Algae Protein Partnerships : Cargill partnered with a Brazilian biotechnology startup to expand production of algae-based feed proteins for sustainable livestock nutrition. |

| Aug-24 | Nutreco Invests in Insect Protein Startup : Nutreco (Trouw Nutrition) invested in a Colombian insect farming startup to accelerate commercialization of black soldier fly meal across Latin America. |

| Jun-24 | Evonik Enhances Amino Acid Profiles in Alt Proteins : Evonik introduced new fermentation-based protein feed ingredients with optimized amino acid profiles for poultry and aquaculture in Latin America. |

| Apr-24 | Corbion Launches Algae Protein Line in Chile : Corbion expanded its algae-based feed ingredient portfolio in Chile, promoting omega-3-rich and sustainable alternatives to fishmeal. |

Sustainability is Driving Feed Innovation

With the growth of demand for sustainable livestock production in Latin America, alternative protein sources have emerged as critical alternatives to traditional feed proteins, such as soy, fishmeal and meat. Environmental and deforestation challenges presented by conventional feed are driving industry players to insect, microbial, and algae-based proteins.

Protein from Insects Carves Out Healthy Segment

Black soldier fly larvae (BSFL), in particular, have been sweeping through Latin America’s aquaculture and poultry feed sectors, and insect-based protein is rapidly gaining popularity. The use of insect meal is gaining traction in sustainable applications especially by the likes of Ynsect and Entobel and Nutreco targeting high protein and low carbon foot print solutions. Local governments are very much addicted and are creating an ideal environment for insect protein production.

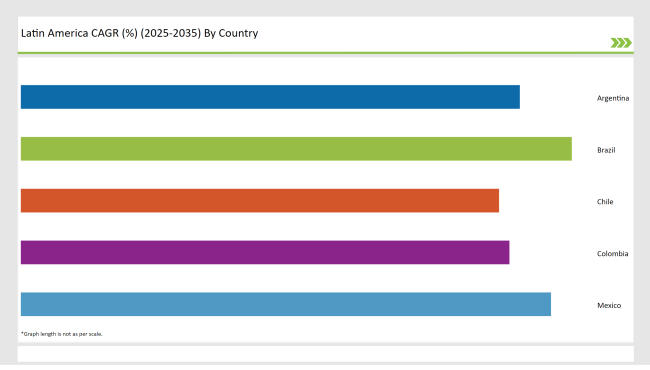

The following table outlines the estimated compound annual growth rates (CAGR) for the top-performing countries in Latin America expected to lead demand for animal feed alternative proteins:

With the being the largest livestock and aquaculture-producing country in Latin America, Brazil holds the lead in the region for animal feed alternative protein market. Increasing concerns over the environmental impact of traditional soy and fishmeal protein sources are driving a gradual transition to sustainable alternatives, including insect-based protein, algae-derived feed and fermented microbial protein.

Adoption is also being driven by government-backed agricultural innovation programs and partnerships with global agri-tech companies. Alternative protein feed has high digestibility, improved nutrition, lower methane emissions, making it quite appealing to the poultry and swine sectors, as it supports Brazil's long-term sustainability goals.

The expanding livestock farming and booming aquaculture in Mexico is driving strong demand for alternative feed protein. Due to the increasing urbanization in recent years, more animal-proteins are being consumed, which challenges feed manufacturers to seek low-cost and efficient substitutes.

High protein density, reduced environmental footprint as well as improved feed conversion ratios have made feed ingredients like insect meal, algae-based proteins and single-cell proteins become more established alternatives. Furthermore, legislation and government support for the concept of a circular economy, especially in the field of waste-to-feed, are boosting local insect protein production.

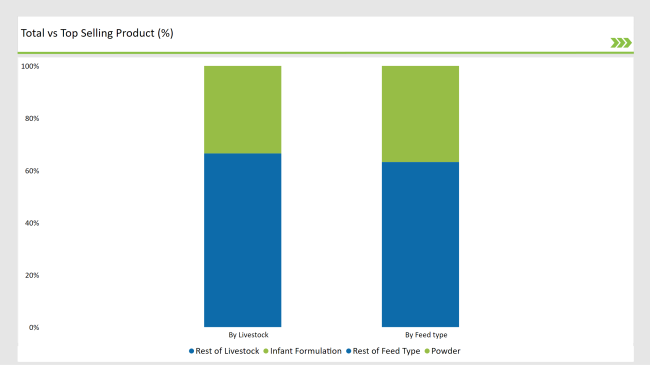

% share of Individual categories by Feed Type and Livestock in 2025

Insect-Based Protein Emerging as a Sustainable Powerhouse in Animal Feed. This is What ESG Auditing, With Deep Traceability to The Source, Looks Like. This group of protein ingredients, sourced from materials such as black soldier fly larvae and mealworms, is gaining ground in poultry, aquaculture and pet food uses.

They’re prized among producers for their high digestibility and abundance of amino acids, and embraced by regulators and environmentalists for their low greenhouse gas emissions and waste-reducing potential. With both startups and established firms investing in insect farming infrastructure, this segment will likely stabilize over time as the business case for crushing soy and fish meal shifts towards negligible growth.

Aquaculture Leads Livestock Segment with a Push for Sustainable Marine FeedGrowing demand for sustainable fish meal alternatives, aquaculture is the largest end-use segment for alternative proteins in Latin America region. There is a trend towards formulating feeds that contain more plant based proteins, algae based proteins, and single cell proteins in the aquaculture industry as traditional marine resources become more limited and unsustainable by October 2023.

Countries like Chile and Brazil, leaders in the regional aquaculture sector, are adopting these innovations to comply with international sustainability norms. Alternative proteins are nutritionally adequate and versatile, which enhances feed conversion ratios and promotes overall fish health, thereby propelling growth in this segment.

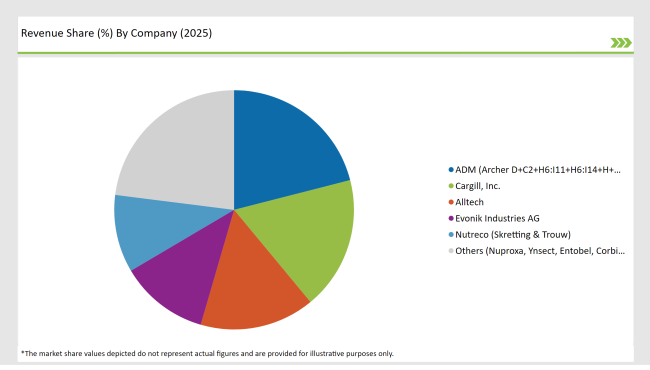

2025 Market share of Latin America Animal Feed Alternative Protein suppliers

Note: above chart is indicative in nature

Sete's entry into this new territory marks a significant addition to the rapidly insourcing Latin American market for sustainable alternatives proteins for animal feeding. The market is characterized by moderate consolidation in which global agribusiness giants such as ADM, Cargill, and Alltech dominate with their vertically-integrated supply chains, strong R&D capabilities, and existing linkages with regional feed producers.

Two of the main companies involved in the development of amino acid-enhanced and microalgae-based protein feeds are Evonik Industries AG and Nutreco (through Skretting and Trouw Nutrition). Allfresh Group specializes in natural and non-GMO feed alternatives for health in the performance-oriented Latin American market.

Upstart protein solutions from players like InnovaFeed, Entobel, and Ynsect are based on insects and Corbion is also expanding into algae-derived feed ingredients to improve omega-3 availability and reduce dependence on classic fishmeal.

Insect-Based Protein, Plant-Based Protein, Fish Meal Alternative, Single-Cell Proteins, Others

Poultry, Swine, Cattle, Equine, Aquaculture

Meal, Pellets, Liquid, Freeze-Dried

The Latin America animal feed plant-based protein isolates market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.0% from 2025 to 2035.

By 2035, the market is expected to reach approximately USD 1244 million, up from an estimated USD 767.4 million in 2025.

Key drivers include rising demand for sustainable and plant-based protein sources in animal nutrition, increasing awareness of the environmental impact of traditional animal feed proteins, and the growing livestock industry in the region.

Brazil leads the Latin American market in terms of revenue and is expected to register the highest CAGR from 2025 to 2035, driven by its significant livestock production and adoption of plant-based feed alternatives.

Prominent manufacturers in the Latin American animal feed alternative protein market include Cargill, Incorporated, Archer Daniels Midland Company (ADM), BASF SE, Alltech Inc., and Nutreco, known for their extensive product portfolios and strong market presence.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Latin America Pulses Market Outlook – Size, Demand & Forecast 2025–2035

Latin America Food Emulsifier Market Outlook – Share, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA