The Latin America sports drink market is estimated to register USD 2.6 billion in 2025 and is projected to reach USD 4.9 billion in 2035, recording a compounded annual growth rate (CAGR) of 6.4% over the forecast period 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 2.6 billion |

| Projected Latin America Value (2035F) | USD 4.9 billion |

| Value-based CAGR (2025 to 2035) | 6.4% |

The Latin America sports drink market is expected to grow rapidly in the forecast period of 2025 to 2035. Sports drinks demand is being driven by growing health awareness, frequent participation in fitness activities, and a relatively young population across countries like Brazil, Mexico, Argentina, and Colombia.

The market is anticipated to achieve a valuation of USD 2.6 billion in 2025 and grow uniformly at USD 4.9 billion by 2035, representing a CAGR of 6.4%. As well as the above, increased marketing by international players, growing interest in hydration-driven beverages, and a move away from sugary carbonated beverages is helping sustain such growth.

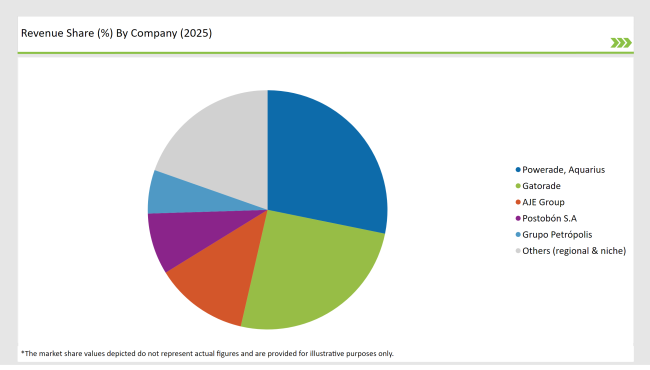

Key players like Gatorade (PepsiCo), Powerade (The Coca-Cola Company), Sporade (AJE Group) and BodyArmor are rapidly establishing their foothold in the region. Furthermore, local new entrants are gaining niche segments with competitive prices and local tastes.

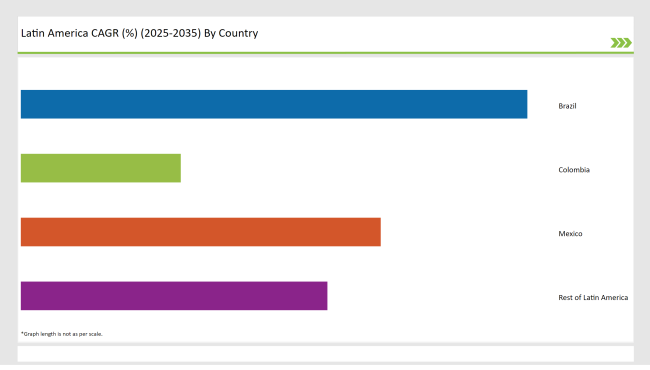

The comparison in compound annual growth rate (CAGR) over the period of 1st year from July 2023 to December 2023 and 2nd year from July 2024 to December 2024 of geographic extent and individual countries for the Latin America sports drink market is represented in the table below.

This semi-annual analytical research encapsulates significant changes in market share and revenue realization patterns, providing stakeholders a concrete view of intra-annual growth trends.

| Period | CAGR |

|---|---|

| H1(2024 to 2034) | 6.2% |

| H2(2024 to 2034) | 6.5% |

| H1(2025 to 2035) | 6.4% |

| H2(2025 to 2035) | 6.7% |

H1 signifies period from January to June; H2 signifies period from July to December

Latin America (sports drink: +6.2% H1/ 6.5% H2) In 2025, the H1 CAGR is expected to show a slight improvement at 6.4%, reaching 6.7% in H2. This is indicative, 20bp rise from H1 2024 to H1 2025, then again 20bp rise from H2 2024 to H2 2025. This sustained upward trajectory is driven by growing consumer demand, rising product diversification, and consistent investments in branding and distribution in key Latin American markets.

| Date | Development / M&A Activity & Details |

|---|---|

| 25-Jan | Expansion in Distribution Channels: Powerade (Coca-Cola) announced an aggressive expansion across Brazil and Mexico, targeting over 5,000 new retail points in Q1 2025. |

| 24-Oct | Product Launch: Gatorade introduced a new zero-sugar, electrolyte-enhanced sports drink tailored for the Latin American tropical climate, beginning distribution in Chile. |

| 2024 | Strategic Partnership: Sporade (AJE Group) partnered with local fitness chains to promote on-site branded hydration stations in Colombia and Peru. |

| 24-Mar | Regulatory Approval: ANVISA (Brazil’s health authority) approved a new natural flavoring for sports drinks, enabling cleaner-label formulations across the region. |

| 24-Sep | Research Collaboration: A new partnership between Universidad de Buenos Aires and a multinational beverage company was launched to study hydration science in athletes. |

On-Demand Functional Hydration in Fitness and Sports

There is an increasing amount of health consciousness and the growing fitness-centric populace across Latin America is significantly increasing the demand for health and fitness-oriented functional hydration beverages like the sports drinks. Urban consumers, particularly in Brazil and Mexico, want products that offer more than gall, content, an above-average level of hydration they want electrolytes, vitamins and performance-enhancing ingredients.

Brands such as Gatorade and Powerade are also introducing region-specific variants catering to consumers’ pre- and post-workout needs. That rise has also been bolstered by sports endorsements, local fitness events and influencer-led marketing campaigns focused on performance and recovery.

Trend Shift Toward Low-Sugar and Natural Ingredient Formulations

With Latin American consumers becoming increasingly conscious of their health, a clear preference shift toward low-sugar, natural ingredient profiles of sports drinks can be observed. Faced with mounting scrutiny of sugar-sweetened drinks over the years, key players have launched low-calorie and no-sugar versions, frequently using natural sweeteners such as stevia.

Clean-label trends are also driving brands to remove artificial colors and flavors, as a way of aligning with broad-based wellness movements worldwide. This shift is particularly significant in countries such as Chile and Argentina, where new labeling laws and public health campaigns are influencing consumer behavior.

The Brazilian sports drink market is more than 57% of the Latin American sports drink market, which should not come as a surprise since Brazil has a growing middle class, a developing sports culture and a growing number of people who are conscious about their health.

Proven functional beverage market players such as São Paulo and Rio de Janeiro grow in the demand for these products, increasingly aimed at gym-goers and amateur sports practitioners. With Gatorade and Powerade, the general players, making extensive investments through localized marketing campaigns and athletes to cement their market positions.

Mexico accounts for the second biggest share of the Latin American sports drink market. This is due to growing fitness consciousness, the popularity of running and cycling events, and drive against obesity in the country. Mexican consumers are converging around low-sugar, electrolyte-rich drinks and companies are honing their formulations with clean-label, natural ingredients. Convenience stores and pharmacies are also key in terms of sports drink distribution.

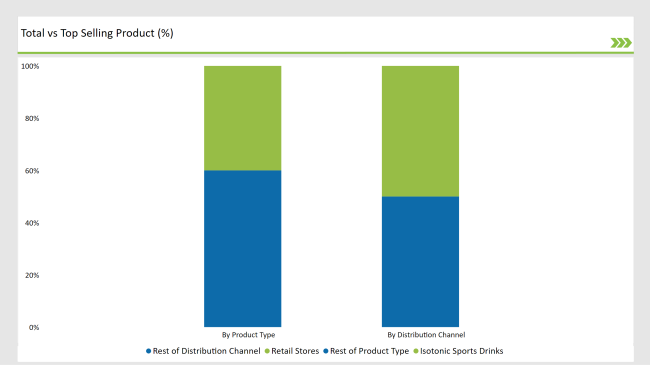

% Share of Individual Categories by Product Type and Distribution Channel in 2025

The two Latin American calf milk replacers segments that are gaining traction are stick packs and powdered formulations, owing to their extended shelf life, the ease of transportation and the flexibility that on-farm solutions offer. Liquid milk replacers are typically refrigerated or stored on ice according to the manufacturers’ recommendations and therefore can spoil; as such, powdered forms are better suited for rural and distant areas with less infrastructure.

Farmers only need to reconstitute the powder as needed, optimizing feed usage and minimizing waste.This format is especially prevalent in countries like Brazil and Colombia where cattle ranching typically covers extensive and not very urbanized rural areas.

Powdered replacers are commonly used because of their cost-effectiveness and the ability to feed a wider variety of liquid fat sources, making them attractive to small- to mid-scale dairy operations wanting to maximize feed efficiency and avoid excesses that might put calf nutrition at risk. Moreover, due to enhancements in their solubility and the stability of nutrients, powdered formulations become much more competitive with liquid forms.

The Latin America sports drinks market is moderately consolidated, with a few international brands holding a significant share of the market. Big players such as The Coca-Cola Company, PepsiCo (Gatorade) and AJE Group shape the landscape with extensive distribution networks, strong marketing tactics and strong brand awareness.

These players use their breadth of recovery retail partners, product innovation (e.g., sugar-free or electrolyte-enhanced) and sponsorships across sports to remain dominant in the major Latin American markets such as Brazil, Mexico and Colombia.

At the same time, regional and new brands are making inroads thanks to their responses to niche demand areas including natural ingredients, organic formulations and affordably priced offerings aimed at the mass market. Startups are particularly vibrant in the area of fitness and wellness, taking advantage of local tastes and trends.

Sports drink industry is segmented as hypotonic drinks, hypertonic drinks, isotonic drinks, electrolyte drinks and energy drinks.

As per form, the industry has been categorized into ready-to-drink, drink mixes and tablets.

Sales channel further includes modern trade, convenience store, specialty store, pharmacy store, online retail, sports retail stores, grocery store, online retail and other sales channels.

The Latin America Sports Drink market is projected to grow at a CAGR of 6.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 4.9 billion.

The market is driven by the Rising Health and Fitness Awareness, Expanding Urban Middle Class, and Product Innovation & Diversification.

Brazil, Mexico and Colombia are key regions with high consumption rates.

Leading manufacturers include Gatorade, Sporade, AJE Group, Postobón S.A., and Grupo Petrópolis, known for their innovative and sustainable production techniques.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA