The Latin America fish protein market is projected to surge from an estimated USD 83.4 million in 2025 to USD 178.8 million by 2035, growing at a compound annual growth rate (CAGR) of 7.9% throughout the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Market Size (2025E) | USD 83.4 million |

| Projected Latin America Value (2035F) | USD 178.8 million |

| Value-based CAGR (2025 to 2035) | 7.9% |

Latin America fish protein market is expected to witness significant growth in the forecast period 2025 to 2035. This growth has been largely supported by the rising awareness towards health concerns and rising demand for functional food ingredients along with the growing aquaculture industry.

FYI Our enhanced fish protein hydrolysate and fish protein concentrate products offers the best solution for optimizing high-protein, low-fat nutritional products in food, pharmaceutical and animal nutrition sectors.Shaping this growth is a renewed attention on sustainability in the efficient use of marine resources. The fish protein industry meets these demands by reducing waste in the fishing industry (through by-product upcycling) and by providing clean-label and traceable food ingredients.

Major players within the Latin American market are investing in technological developments and increasing production capacity to supply increasing domestic and export demand. Brazil, Peru, and Chile are becoming the heavyweight nations, with healthy fisheries and favorable government policy toward marine-based exports.

According to the table below, the structural changes in the compound annual growth rate (CAGR) of the base year (2023) and the present day (2024) for the Latin America fish protein market have been compared over a duplicate of half year. This half-yearly assessment helps identify key market changes and summarizes revenue realization patterns, enabling stakeholders to better understand which direction the growth is currently heading within the year.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 7.8% |

| H2 2024 | 8.0% |

| H1 2025 | 7.9% |

| H2 2025 | 8.2% |

H1 signifies period from January to June, H2 signifies period from July to December

The Quantity of Fish Protein Market Latin America is forecasting to rise at a CAGR of 7.8% in the initial half of 2024, however, is likely to witness a slight rise to 8.0% in the second half of the year 2024. By 2025, we expect growth to tick up engaging additional slack, coming in at 7.9% in H1 and 8.2% in H2. Specifically, this pattern shows a 10-basis-point rise between the first half of 2024 and the first half of 2025, and a 20-basis-point increase between the second half of 2025 and the second half of 2024.

| Date | Development / M&A Activity & Details |

|---|---|

| 22-Feb | Expansion in Production Capacity : TASA (Tecnológica de Alimentos S.A.) announced the expansion of its fishmeal and fish protein concentrate production facilities in Peru, aiming to cater to rising demand from nutraceutical and pet food sectors across Latin America. |

| 15-May | Strategic Partnership : Brazilian seafood processor Seara Alimentos partnered with Chilean biotech firm AquaNutra to develop sustainable fish protein hydrolysates for use in clinical nutrition and sports supplements. |

| 2024 | Vertical Integration Acquisition : Austral Group S.A.A. acquired a regional fish oil processing facility in northern Chile to integrate upstream raw material supply and optimize production of high-grade fish protein concentrates. |

| 11-Aug | Product Launch : Colpex Internacional S.A.C. introduced a new high-solubility fish protein powder aimed at infant nutrition and elderly care products in Brazil and Argentina. |

| 29-Nov | Regulatory Approval : The Brazilian Health Regulatory Agency (ANVISA) approved a new enzymatic hydrolysis-based fish protein isolate developed by Apelsa Guadalajara S.A. , citing enhanced digestibility and amino acid profile. |

Latin America: Growing Demand for Sustainability and Usability in Animal Protein

Given the rising attention to health-oriented diets and responsibly sourced foods, fish protein is a premium, sustainable choice to traditional animal protein in Latin America. Because fish is one of the richest sources of protein, consumers are becoming increasingly aware of the nutritional properties it offers, particularly in functional food applications including meal replacements, sports nutrition and elderly care products.

Countries like Brazil, Chile, and Peru are experiencing an increased demand for protein ingredients aiding muscle recovery, cardiovascular health, and weight management. Aquaculture and the fish processing industry growth are also fostering increased availability of raw materials used for fish protein manufacturing, thus propelling the industry expansion.

Novel Enzymatic Hydrolysis and Fish Protein Products with High Purity

Manufacturers in Latin America are utilizing processing technologies such as enzymatic hydrolysis to produce fish protein concentrates and hydrolysates with an increased level of digestibility, solubility and bioavailability. These developments are particularly beneficial for creating protein supplements for medical nutrition and specific diet populations.

Companies like TASA and Apelsa are investing more into advanced extraction and refinement methods to deliver fish protein ingredients with standardized amino acid profiles, minimized odor, and improved taste. As highlighted in a recent article, this technological shift is placing Latin America in a competitive position in the global protein ingredient market, particularly in nutraceuticals and infant nutrition segments.

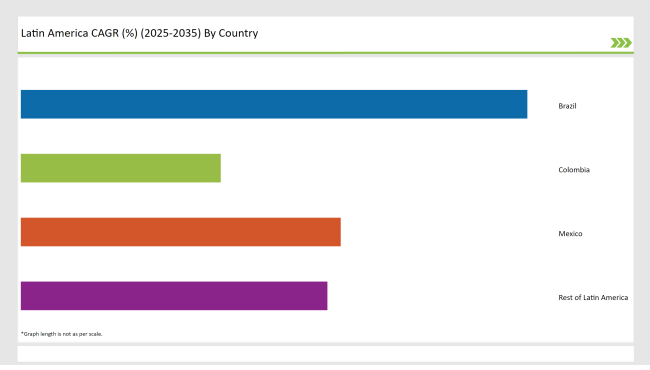

The following table shows the market share of the top four markets in the Latin America fish protein sector.

Brazil continues to be the largest fish protein market in Latin America, spurred by increasing demand for high-quality animal proteins in human and animal nutrition. The establishment of an aquaculture industry in the country and increasing demand for functional food ingredients further underpins the background for fish protein consumption.

Seara Alimentos and foreign investors are increasing local production capacity. Brazil's pet food industry-among the largest in the region-is using fish protein hydrolysates, from FIP, as a high-value ingredient that combines digestibility and nutritional advantages.

The nutraceutical, sports nutrition, and clinical nutrition industries are all driving Mexico to become a high-growth market in the region. An increasing middle class and a growing health-focused consumer trend have driven demand for fish protein concentrates in protein bars, supplements and medical nutrition products.

Moreover, government initiatives promoting food fortification and child nutrition are also strengthening the market. Also the local companies and regional brands are improving the extraction and refinement processes which creates more value-added fish protein varieties for local and export markets.

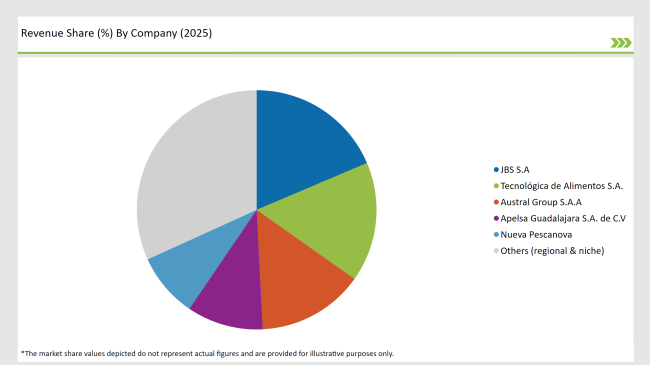

Latin America fish protein market is moderately consolidated, with a few major regional and international players holding significant market shares. Leading firms such as JBS S.A., TASA and Austral Group currently enjoy the advantages of vast fishing operations, in-house processing service centers, and established exporting channels to retain market shares in countries such as Brazil, Peru, and Mexico.

At the same time, Apelsa Guadalajara, Nueva Pescanova, and Colpex Internacional - all of which are targeting smaller niche segments with fish protein concentrate and meal that can be used in food, feed, and pharmaceutical applications. Localized strategies and flexible production allow them to compete effectively for domestic demand and regional exports.

Dietary Supplements Drive the Demand for Fish Protein in Latin America

There was also a combined growth factor for fish protein as an ingredient in the dietary supplements market across Latin America due to its bioavailability, complete amino acid composition, and digestibility. With the rising awareness on muscle recovery, weight management, gut health, and immune function, consumers are opting for fish protein-based supplements.

As noted for the increase in liquid algae omega in Europe, both liquid and powdered fish protein supplements are on the rise for similar reasons in Latin America: to put more convenient nutrition in the hands of on-the-go consumers. These formats mix easily into smoothies, juices, or protein shakes, offering a pill-free option for those who dislike tablets or capsules.

For example, Mexico and Brazil are two of many countries experiencing boom in diatery supplement market due to younger populations headling towards fitness and wellbeing as well as older populations seeking nutritional support. Both local and international brands are taking advantage of this by introducing innovative, clean-label, sustainably sourced fish protein supplements.

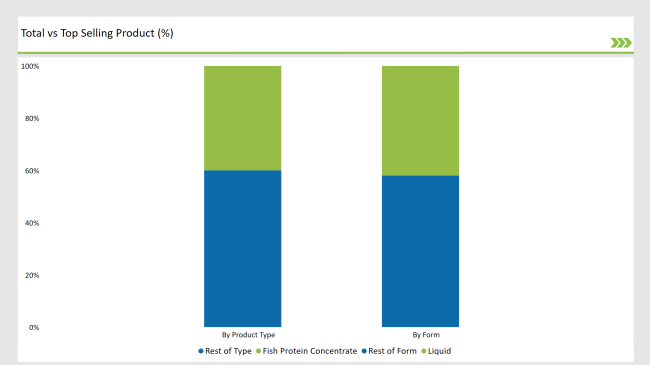

As per Product Type, the industry has been categorized into Fish Protein Concentrate, Fish Protein Isolate and Fish Protein Hydrolysate.

As per Form, the industry has been categorized into Liquid and Powder.

As per Application, the industry has been categorized into Food & Beverages, Cosmetics & Personal Care, Dietary Supplements, Pharmaceuticals and Others.

The Latin America Fish Protein market is projected to grow at a CAGR of 7.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD .78.8 million.

The market is driven by the Rising Demand for High-Quality Animal Feed, Increasing Focus on Functional Foods & Nutraceuticals, and Expansion of Fish Processing Industry.

Brazil, Mexico and Colombia are key regions with high consumption rates.

Leading manufacturers include JBS S.A., Tecnológica de Alimentos S.A., Austral Group S.A.A., Apelsa Guadalajara S.A. de C.V., known for their innovative and sustainable production techniques.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Latin America Pulses Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA