Latin America Collagen Peptide Market Overview: The Latin America collagen peptide market was valued around USD 53.2 million in 2025, and will projected to reach USD 1357.8 million by 2035, at a CAGR of 6.3% from 2025 to 2035

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 53.2 million |

| Projected Latin America Value (2035F) | USD 1357.8 million |

| Value-based CAGR (2025 to 2035) | 6.3% |

From 2025 to 2035, the Latin America collagen peptide market is slated to grow at an impressive rate. Bolstered by the rising need of health benefiting supplements and expanding wellness-aware population, collagen peptides are evolving as a key ingredient in functional food and beverages, nutraceuticals and beauty-from-within products across this region.

The market was valued at USD 53.2 million in 2025, and is projected to reach USD 1357.8 million by 2035. The 6.3% annual growth rate is fueled primarily by a maturing population and active younger people wanting to preventatively maintain musculoskeletal health, increasing consumer interest in joint, skin and bone health.

The following table gives a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six-month periods for base year (2023) and current year (2024) specifically for Latin America collagen peptide market.

This semi-annual analysis, through highlighting key fluctuations at the behavior of the market as well as outlining both growth momentum, supplies stakeholders with clearer visibility into intra-year behavior of the market.

| Particular | CAGR |

|---|---|

| H1 2024 | 6.2% |

| H2 2024 | 6.4% |

| H1 2025 | 6.3% |

| H2 2025 | 6.6% |

H1 signifies the period from January to June, while H2 spans July to December.

The growth rate for the Latin America collagen peptide market is expected to be 6.2% in H1 2024, followed by 6.4% in H2 2024. In H1 2025 it is projected to drop slightly to 6.3% before rising to 6.6%. That reflects a 10-basis-adjustment lower-than-forward in the first half of 2024 vs the first half of 2025, and a 20-basis-adjustment higher-than-forward in the second half of 2025 vs the second half of 2024. This is a common mid-year phenomenon fueled by higher consumer spending on health and wellness products during the second half of the year.

| Date | Development / M&A Activity & Details |

|---|---|

| 25-Jan | Expansion in Manufacturing Capacity: Gelnex announced the expansion of its collagen peptide production facility in Brazil to accommodate rising regional and export demands. The expansion is expected to boost output by 40% by the end of 2025. |

| 12-Mar | New Product Launch: Novaprom, a JBS subsidiary, launched a premium line of hydrolyzed collagen supplements targeting the beauty and sports nutrition segments across Latin America. |

| 2024 | Strategic Acquisition: Gelita AG acquired a minority stake in a Colombian biotech firm specializing in marine collagen, aiming to diversify its raw material base and expand in the Andean market. |

| 18-Jul | Regulatory Approval: ANVISA (Brazil’s National Health Surveillance Agency) approved new labeling standards for collagen peptides in dietary supplements, promoting transparency and consumer trust. |

| 24-Sep | Research Collaboration: Rousselot partnered with the University of São Paulo to study bioavailability enhancements in collagen peptides, focusing on optimized delivery for joint health applications. |

Latin America Sees Thriving Collagen Demand As Consumers Grow Accustomed To Wellness Routines

With consumers throughout Latin America taking more responsibility for their health, a clear trend towards functional ingredients like collagen peptides is emerging. Demand is mainly fueled by increasing interest around anti-aging, joint health, sports recovery, and beauty-from-within benefits.

But countries such as Brazil, Mexico, and Argentina are experiencing growth in the nutraceuticals and dietary supplement sectors where collagen-based formulas are becoming staples. This trend is being exploited by major regional players such as Novaprom and Gelnex, which are releasing clean-label, bovine- and marine-based peptide products for specific health outcomes. Coupled with the rising ease of access to collagen supplements through e-commerce sites and traditional retail health chains, this consumer category is on an upward curve.

New formats of collagen delivery and improved bioavailability

Companies in Latin America are investing in next-gen collagen formats (powders, ready-to-drink, gummies and capsules) to gain competitive advantage. There is also a rise in clinical-grade collagen peptides targeting mobility issues, skin elasticity and post-operative recovery.

Research and development (R&D) collaborations, such as the one between Rousselot and the University of São Paulo, are driving innovation in bioavailability optimization-guaranteeing collagen is effectively absorbed by the body. By prioritizing enzymatic hydrolysis and peptide profiling in their innovations, the industry is quickly progressing to be more focused and effective in its formulations.

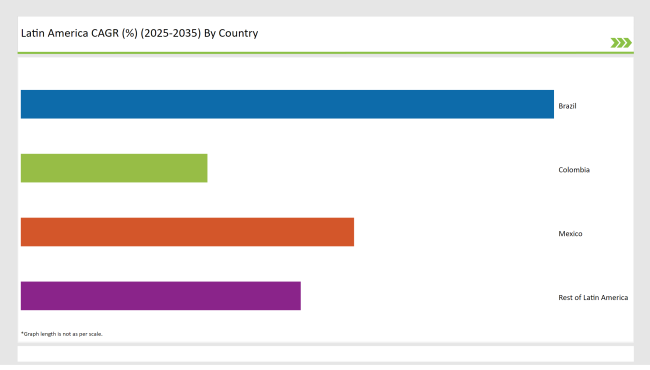

The following table presents the estimated market share projections of the top four Latin American countries expected to drive the demand for collagen peptides through 2035

Brazil's strong presence in the Latin American collagen peptide market will not be dented and the country will account for 40% of the region's market share by the year 2035. Collagen-based preparations for skin health, joint maintenance and sports recovery have gained acceptance in India, thanks to the Indian nutraceutical and cosmeceutical industries that are booming in the country.

Brazil is a prominent consumer and world exporter of collagen peptides, on the back of strong local players such as Novaprom and Gelnex. Beauty-minded consumers, new functional food development, and growing supplement penetration at drugstores and e-commerce channels are also driving the market.

Mexico is becoming a hub for collagen consumption, with a projected 25% share - A growing middle-class population, the rapid growth of health supplement retail, and increased awareness of anti-aging and wellness benefits are driving growth. Urban consumers are incorporating collagen peptides into their everyday health routines - in powdered beverages, capsules, or fortified snacks. Through strategic partnerships and localized marketing, leading international brands are bolstering their presence in-country.

Nutritional Products Lead Collagen Adoption with Strong Functional Health Positioning

Rising concern among consumers about optimal joint health, muscle recovery, gut function, and overall vitality is accelerating the adoption of collagen peptides in the nutritional products category, which is the key segment in Latin America.

Collagen supplements - as powders in sachets, capsules, and RTD blends - are hitting the mass market, particularly with fitness consumers, ageing populations and women-focused wellness brands. Brazil and Mexico have been added to the list with the explosive rise of e-commerce channels and direct-to-consumer nutraceuticals brands that have made collagen easier to access.

Just as liquid algae omega first found traction in Europe due to its ubiquity and bioavailability as a topical, collagen peptides are now being marketed as an industry 'must-have' in nutritional formats and sitiing on tables where we consume shakes, breakfast bowls, health supplements, etc., as daily essentials.” This blendability and functional flexibility has propelled collagen out of the traditional supplement aisles, and into lifestyle-focused consumption.

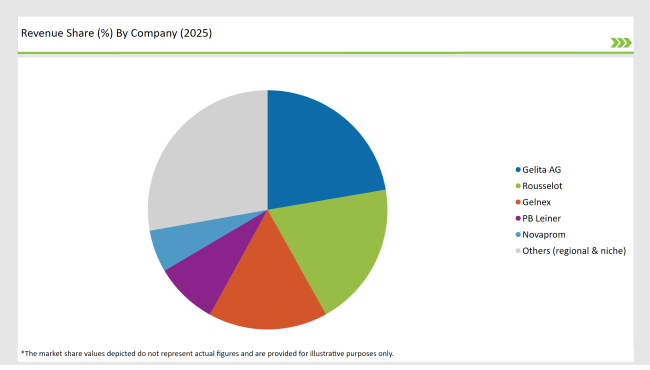

The Latin America Collagen Peptide Market is quite consolidated, with only a limited number of regional and multinational players existing in a somewhat oligopolistic market, which enjoy a greater control over sourcing, processing technologies and final product distribution.

The advanced hydrolysis processes, strong supply chain, and scientific support of global players like Gelita AG, Rousselot (Darling Ingredients), and Gelnex give them a competitive edge in regional markets.

These businesses have a high appeal to health-minded consumers and manufacturers of clean-label products because they remain committed to investing in both volume expansion and ingredient traceability. At the same time, new regional players are creating space by developing marine-derived and bespoke formulations in the beauty, wellness and sports nutrition categories.

As per Application Type, the industry has been categorized into Nutritional Products, Cosmetics & Personal Care Products, Food & Beverages, and Pharmaceuticals.

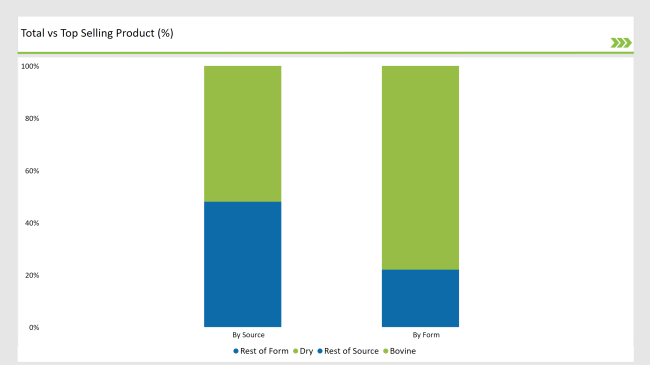

As per Source, the industry has been categorized into Marine & Poultry, Bovine, and Porcine.

As per Form, the industry has been categorized into Dry and Liquid.

The Latin America Collagen Peptide market is projected to grow at a CAGR of 6.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1357.8 million.

The market is driven by the Rising Demand for Functional and Nutritional Products, Booming Beauty-from-Within Trend, and Expanding Sports Nutrition Segment.

Brazil, Mexico and Colombia are key regions with high consumption rates..

Leading manufacturers include Gelita AG, Rousselot, Gelnex, PB Leiner, and Novaprom, known for their innovative and sustainable production techniques.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA