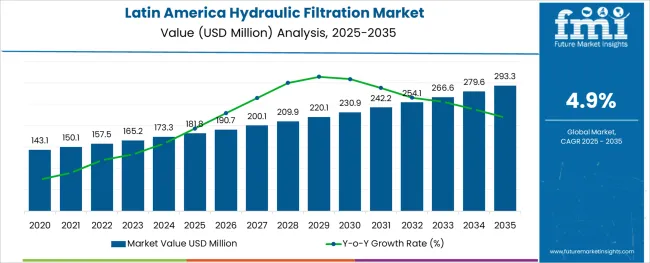

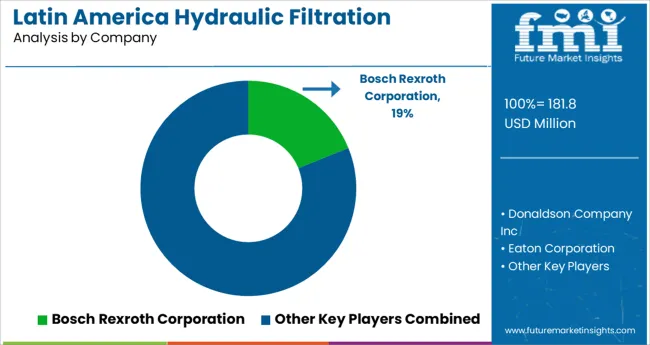

The Latin America Hydraulic Filtration Market is estimated to be valued at USD 181.8 million in 2025 and is projected to reach USD 293.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The Latin America hydraulic filtration market is progressing steadily due to the expansion of industrial automation, rising investments in heavy machinery, and growing awareness of equipment maintenance practices. Sectors such as construction, mining, and agriculture are increasingly prioritizing hydraulic system efficiency, as unfiltered fluid contaminants can lead to operational failures and increased downtime.

As regional industries focus on improving machinery longevity and reducing lifecycle costs, demand for high performance hydraulic filters is growing. Government initiatives supporting infrastructure development and domestic manufacturing are further stimulating equipment sales, driving the need for robust filtration systems.

Advancements in filtration media, real time monitoring, and sensor integration are also enhancing filtration precision and preventive maintenance strategies. The market outlook remains positive as stakeholders increasingly adopt smart filtration solutions to ensure uninterrupted industrial operations, reduce environmental impact, and comply with evolving maintenance standards.

The market is segmented by Product Type, Technology Type, Sales Channel, and End Use and region. By Product Type, the market is divided into Suction Filter, Pressure Filter, Return Line Filter, Off-Line Filter, Breather Filter, and Others. In terms of Technology Type, the market is classified into With Sensor and Without Sensor. Based on Sales Channel, the market is segmented into OEM and Aftermarket. By End Use, the market is divided into Industry and Mobile Equipment. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

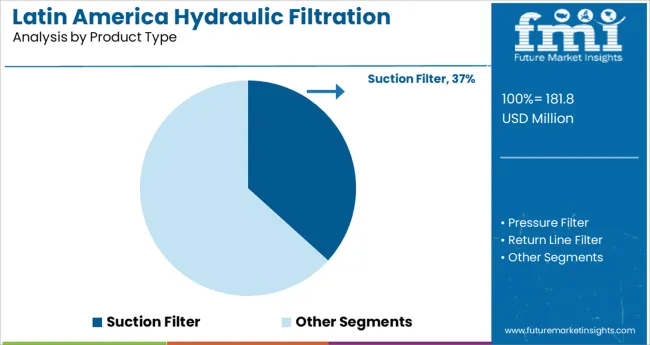

The suction filter segment is expected to contribute 36.70% of the total revenue by 2025 within the product type category, establishing itself as the leading segment. This preference is supported by its critical role in protecting the hydraulic pump from large particle contamination during fluid intake.

These filters are typically positioned at the reservoir outlet, providing the first line of defense against system wear. Their widespread use across mobile and stationary equipment highlights their cost efficiency, ease of installation, and compatibility with a variety of hydraulic systems.

The growing need to prevent cavitation and pump damage in rugged operational environments is further reinforcing demand. As industries emphasize preventive maintenance and contamination control, suction filters remain indispensable for maintaining hydraulic system integrity and performance.

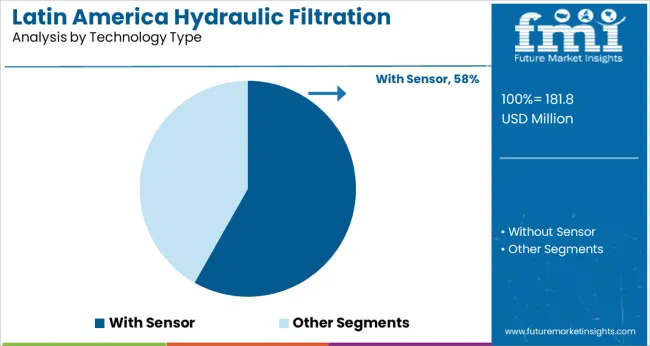

The with sensor segment is projected to account for 58.20% of the total market revenue by 2025 under the technology type category, positioning it as the dominant segment. This is driven by the increasing emphasis on predictive maintenance, real time monitoring, and operational transparency in hydraulic systems.

Filtration units equipped with sensors enable continuous tracking of pressure drop, fluid cleanliness, and element status, allowing timely replacements and system adjustments. These smart capabilities help avoid unplanned downtime and enhance asset utilization.

As Latin American industries integrate digital maintenance systems, the adoption of sensor enabled filtration solutions is rising, delivering operational intelligence and cost effectiveness. The trend toward smart industrial solutions continues to support the prominence of this technology segment.

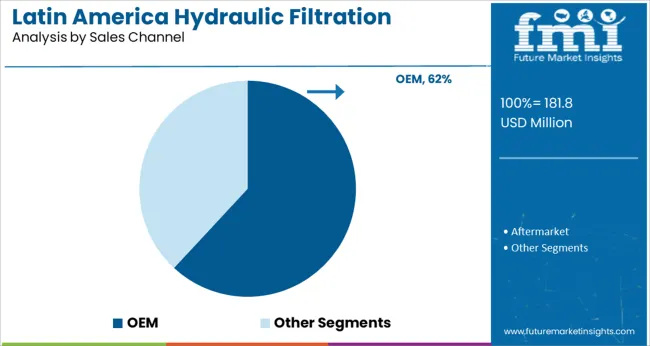

The OEM segment is expected to represent 61.90% of total market revenue by 2025 within the sales channel category, marking it as the leading distribution route. This dominance is attributed to manufacturers incorporating hydraulic filters as integral components in original equipment to ensure system reliability from the point of deployment.

OEM channels provide access to specialized, high quality filtration solutions tailored to specific machinery requirements. The rise in regional equipment manufacturing and demand for performance optimized components has encouraged OEMs to partner with filtration suppliers for customized integration.

Additionally, warranty assurance and standardization offered through OEM distribution support buyer confidence and long term serviceability. As machinery demand grows across construction, energy, and agriculture, OEM channels continue to lead hydraulic filtration supply strategies in Latin America.

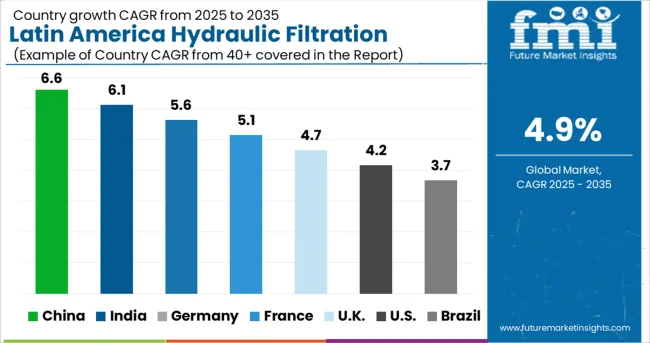

According to FMI, the hydraulic filtration market in Latin America grew at 2.3% CAGR during the historical period from 2020 to 2024. However, with the rapid growth of industrial sectors across countries like Brazil and Chile, the overall sales of hydraulic filtration are projected to increase at 4.9% CAGR between 2025 and 2035.

The rapid growth of industries such as food & beverage, industrial machine, oil & gas, plastic & polymer, and energy & power, increasing production and sales of mobile equipment, and the growing need for protecting hydraulic systems from pollutants are some of the key factors providing impetus to the growth of the Latin America hydraulic filtration market.

In recent years, there has been a robust growth of industrial and commercial construction sectors across Latin America as a result of rising investments in the infrastructure sector. This has generated a huge demand for industrial machinery and mobile equipment which uses hydraulic systems for various applications. This has boosted the sales of hydraulic filters and the trend is expected to continue during the forecast period.

Apart from that prominent manufacturers present in the market are focusing on quality materials and research and development (R&D) for hydraulic filtration production to overcome the rising customer demand. This will further boost the market across Latin America during the next ten years.

Majority of the industries today use hydraulic systems as compared to mechanical, electrical, or pneumatic systems, as they can move heavier loads and exert more force. Without the use of gears, pulleys, or heavy leavers, the fluid power system allows it to easily handle a wide range of weights due to which the installation rate of the hydraulic system has increased in recent years and to enhance the operability for a long period the demand for hydraulic filters has also increased.

It is expected that with the rising installation of hydraulic systems in the end-use sectors, the demand for hydraulic filters in Latin America is expected to have a higher growth rate over the next ten years.

Advancements in Technology and Cost Effectiveness of Hydraulic Filters to Propel Demand.

Through the creation and adoption of new technologies, the hydraulic equipment sector is experiencing a technological revolution. Many hydraulic filters based on breakthroughs and technologies are utilized in planning and management for more effective equipment operations.

The introduction of new raw materials, including micro glass, indicates the stakeholders' increased efforts to promote innovations in the layout and characteristics of new models of hydraulic filters. Prominent manufacturers are launching hydraulic filters to meet the unique needs of end-use applications from various industries. This is expected to boost the Latin America hydraulic filtration market during the forecast period.

Increasing Adoption of Hydraulic Filters in Thriving Plastic & Polymer Processing/Manufacturing Sector to Boost Market

Opportunities for plastic processing continue to grow across a range of industries. Automotive, construction, medicine, and many other industries are all eager to take advantage of the latest innovations in plastic processing. With the emergence of Industry 4.0 and the smart factory, processors need to look at every opportunity to reduce their outlays and increase the overall efficiency of their operations. High-performance hydraulic fluid filters represent an easy opportunity to improve efficiency in a range of areas.

All hydraulic plastic injection mold systems are subject to fluid leakage and contamination. Experts from the industry say that contamination of the hydraulic fluid is the prime reason for nearly 80% of all injection molding machine (IMM) issues. Thus, the role of hydraulic filters becomes more important in the plastic and polymer industry.

The global injection-molded plastics market reached a valuation of USD 173.3 billion in 2024 and it is expected to grow at a strong pace during the forecast period. This in turn will generate a plethora of opportunities for hydraulic filtration manufacturers across Lain America.

Lack of Quality Control Across the Developing Countries in the Region to Limit Market Expansion

Quality control at various stages of manufacturing is very important for hydraulic filters. However, the growing negligence and low-quality raw material procurement to earn large profit margins lead to the manufacturing of low-quality hydraulic filters. The large-scale production of such low-quality hydraulic filters across developing nations is expected to hamper the overall industry as well as the mobile sector, and thus, in response, it is expected to weaken the demand for hydraulic filters across all major application sectors.

Moreover, various types of hydraulic equipment are required for carrying out different types of operations. Hydraulic equipment is placed in critical work conditions and is required to work in accordance with the regulations, directives, and standards applicable to end-use operations and industry. This will result in costly operations for small and medium-sized industries and will generate pressure on the manufacturing industries to reduce the cost. This is expected to act as a key restraint for the market during the forecast period.

Brazil Remains at the Epicenter of Latin America Filtration Market

As per FMI, Brazil remains the most dominant market for hydraulic filtration systems across Latin America and it is expected to hold more than 1/3rd of the market share during the forecast period. This can be attributed to the robust development of end-use sectors in the country.

Brazil has the largest mining and construction market in Latin America, which includes expanding projects in infrastructure development and mining projects. Similarly, there has been a rapid growth of industries like aerospace, cement, iron and steel production, petroleum processing, automotive, and cement across the country during the last few years.

In addition to this, the food and beverage sector plays a very important role in the manufacturing sub-sector. Brazil's industrial growth has been aided by the accessibility of an inexpensive workforce, an increase in the import of manufacturing machinery, and an abundance of raw materials.

With the rising industrial sector, the installation of hydraulic systems has also increased in the country, resulting in higher demand for hydraulic filters. This will continue to boost the hydraulic filtration market in Brazil during the projected period.

Rising Number of Construction & Mining Equipment Making Chile an Attractive Market

According to Future Market Insights, demand for hydraulic filtration across Chile is projected to rise at 6.0% CAGR during the forecast period from 2025 to 2035. This can be attributed to the rapid growth of industrial and infrastructural sectors across the country.

Chile has been one of Latin America’s fastest-growing economies in recent decades which enables the country to significantly reduce poverty rates and enhance job opportunities by investing significant capital in industrial & Infrastructural sectors. This has created a conducive environment for the growth of the hydraulic filtration market.

Apart from that increasing fleet of construction & mining equipment is playing a key role in elevating the demand for hydraulic systems and hydraulic filtration in the country.

With Sensor, Hydraulic Filtration is Becoming a Highly Popular Technology Type

As per FMI, the with-sensor hydraulic filter segment is expected to hold more than 2/3rd of the value share in the Latin American hydraulic filtration market during the forecast period. This can be attributed to the increasing inclination of end users towards the monitored hydraulic systems.

With rising industrial automation and increasing technological development, the popularity of digitally connected hydraulic systems is increasing which is expected to drive the demand for sensor hydraulic filters in industrial as well as mobility equipment sectors.

Aftermarket Segment to Generate Lucrative Revenues Throughout the Forecast Period

By sales channel, the aftermarket segment holds the highest share of the Latin America hydraulic filtration market and it is expected to create an absolute $ opportunity of USD 73.7 millionduring the forecast period (2025 to 2035). Increased rate of replacement of these filters in end-use sectors is a key factor behind such excessive sales from the aftermarket sales channel.

Similarly, the availability of hydraulic filtration products at cheaper prices through aftermarket sales channels will further aid in the growth of the target segment over the next ten years.

Leading market players operating in the Latin America hydraulic filtration market include Parker Hannifin Corporation, Donaldson Company Inc, Pall Corporation, Eaton Corporation, Filtration Group Industrial, MANN+HUMMEL Group, Moog, Yamashin Filter Corp, MP Filtri S.P.A., HYDAC, Bosch Rexroth Corporation, Norman and others.

Manufacturing businesses want to increase the availability of their hydraulic filtration on the market through the introduction of safe and developed service offers and collaboration with domestic players. They are continuously introducing new hydraulic filters in the Latin American market to increase their sales and solidify their presence in this region. For instance,

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 181.8 million |

| Projected Market value (2035) | USD 293.3 million |

| Anticipated Growth Rate (2025 to 2035) | 4.9% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | Latin America |

| Key Countries Covered | Brazil, Mexico, Argentina, Chile, Peru, and the rest of the Latin American Countries |

| Key Market Segments Covered | Product Type, Technology Type, Sales Channel, & End Use |

| Key Companies Profiled | Parker Hannifin Corporation; Donaldson Company Inc; Pall Corporation; Eaton Corporation; Filtration Group Industrial; MANN+HUMMEL Group; Moog; Yamashin Filter Corp; MP Filtri S.P.A.; HYDAC; Bosch Rexroth Corporation; Norman and others |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global latin america hydraulic filtration market is estimated to be valued at USD 181.8 million in 2025.

It is projected to reach USD 293.3 million by 2035.

The market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types are suction filter, pressure filter, return line filter, off-line filter, breather filter and others.

with sensor segment is expected to dominate with a 58.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA