Sales of Latin America Fungal Protein is projected to rise from an estimated USD 352.2 million by 2025 to USD 674.3 million by 2035, with a CAGR of 6.7% during the forecasted period of 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 352.2 million |

| Projected Latin America Value (2035F) | USD 674.3 million |

| Value-based CAGR (2025 to 2035) | 6.7% |

Latin American fungal protein industry is expected to have considerable growth driven by a shift towards environmentally friendly and plant-based dietary solutions. As environmental impacts and nutritional benefits become known, fungal proteins, especially derived from mycoprotein and yeast strains, are slowly picking up in demand for human food and animal feed.

Brazil, Mexico, and Colombia are at high potential for markets with the increasing urban health consciousness, food-tech investments, and increasing vegetarian and flexitarian diets. Advances in precision fermentation and biomass cultivation have also made the processes more scalable and cost-effective.

As the regulations will favor the interests of these industries and food innovation hubs will spread their wings, the fungal protein industry will continuously grow in Latin America and contribute significantly toward the alternative protein ecosystem in the region.

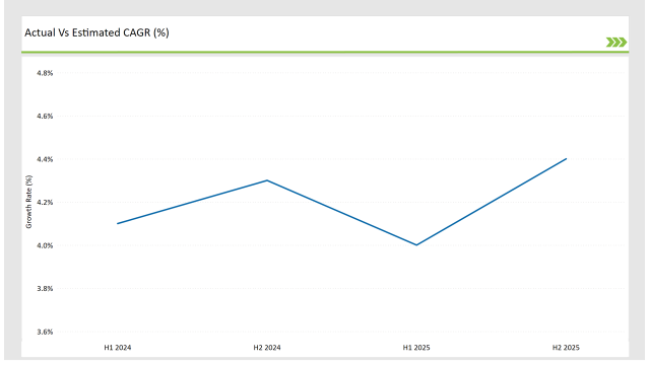

This analysis highlights the most important transformations as far as the Latin American market for Fungal Protein is concerned. H1 denotes January through June, the first six months of a given year, while H2 refers to the six-month period from July to December.

The semiannual analysis of CAGR in the Latin American Fungal Protein market points in an upward direction with regular trends. In year of 2024 and 2025, growth accelerated a bit from H1 to H2, with a 0.2% increase from 4.1% to 4.3% in 2024 and a similar increase from 4.0% to 4.4% in 2025. This is showing increasing consumer confidence, product availability, and rising demand for targeted health supplements across region.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.1% |

| H2(2024 to 2034) | 4.3% |

| H1(2025 to 2035) | 4.0% |

| H2(2025 to 2035) | 4.4% |

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| August 2024 | Naplasol Acquires Mycorena: Naplasol, a Belgium-based plant-based meat alternative company, acquired Mycorena, a Sweden-based biotechnology firm specializing in fungi-based protein ingredients. This acquisition aims to enhance Naplasol's mycoprotein product portfolio and expand sustainable solutions for the food, pet food, and feed industries. The deal enables the production of Mycorena's Promyc at Naplasol's facility in Bree, Belgium, contributing to the growing demand for alternative protein sources |

| September 2022 | Lesaffre Acquires Recombia Biosciences: Lesaffre, a global key player in fermentation, acquired Recombia Biosciences to advance its capabilities in genome editing and synthetic biology. This acquisition aims to innovate yeast products for sustainable production, potentially impacting the fungal protein market through enhanced fermentation technologies. |

The Increasing Demands for Sustainable Proteins.

A growing awareness among consumers regarding environmental degradation and the harmful aspects of traditional livestock farming has led to quite an increase in demand for fungal proteins across different countries of Latin America.

Brazil, Mexico, and Colombia have become metropolises increasing the curiosity and attention for alternative proteins such as mycoprotein which acquires fewer resources, namely, land, water, and energy as compared to protein-rich animals. The trend has been bolstered significantly by the young, health-conscious population of the region looking for eco-friendly and plant-based nutrition alternatives.

Advances in Fermentation Technology.

Emerging fermentation and biomass cultivation technologies have done much toward the increasing protein production from fungi in Latin America. Startups and food tech firms are trying to engineer the "precision fermentation" concept for lower-cost production of large quantities of very protein-rich fungal ingredients.

It is also a tremendous improvement in efficiency but also the texture and flavor of the fungal protein product to increase acceptance into mainstream food and beverage applications.

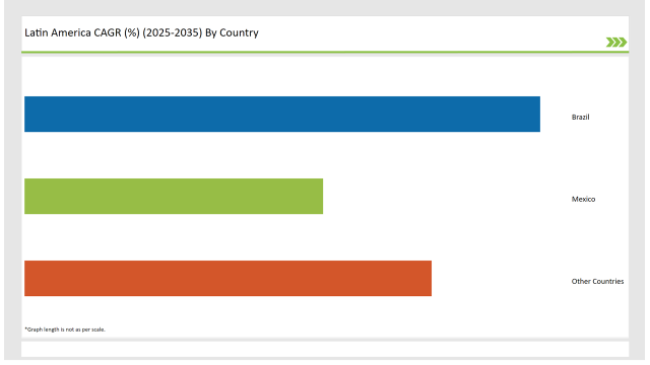

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Brazil | 38% |

| Mexico | 22% |

| Other Countries | 30% |

Brazil is rapidly progressing on the way to realizing sustainability since consumers now have some knowledge of the environmental impacts associated with traditional animal-based proteins. In this regard, alternative proteins like fungal proteins are increasingly sought after by Brazilian consumers.

The Brazuca's knack towards supporting eco-agricultural practices and the generation of robust plant-based diets, especially by keeping a younger population in tow, is driving an ever greater push to sustainable food sources, including mycoprotein-low carbon footprints.Since Brazil's well-established food processing sector plays a key role in alternative protein, many companies are investing their research and development efforts into fungal protein food product applications.

Local startups as well as multinational companies are ramping into altar production of fungal proteins to match the ever-increasing demand in food and animal nutrition. In this way, but for fermentation technologies, it creates the way for making fungal protein really cost-effective and very widely available to Brazilians.

Plant-based diet-health awareness is an impetus for alternative protein sources such as fungal proteins. Actually, this trend is more pronounced among the urban population of major cities, Mexico City in particular, when flexitarians and vegetarians are concerned.

This is actively being looked at by local food makers with fungal proteins as ingredient in their snacks, meat substitutes, and nutritional supplements. Mexico is making headway in sustainable agriculture, such initiative being that of more efficient, less resource-intensive protein sources.

Both the government and the private sector are also contributing to developing green technologies in the fermentation-based production of fungal proteins. This will, with the present demand from consumers for greener solutions, empower the Mexican fungal protein industry, especially as demand from consumers for products is expected to grow.

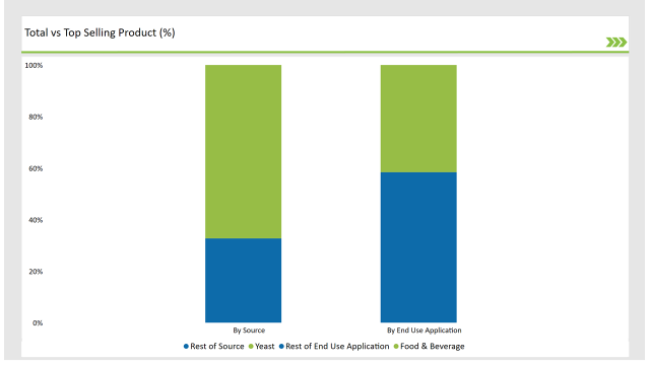

% share of Individual Product Type and Application in 2025

| Main Segment | Value Share (2025) |

|---|---|

| End Use Application (By Food and Beverage) | 41.6% |

The mushroom protein is in the limelight in the food and beverage market for its meaty texture and umami taste and with a rich amino acid profile. These features found in meat substitutes, snack foods, and functional drinks.

Fungal proteins are considered an everyday food for consumers looking for high protein, low fat, and sustainable products, especially in the frozen food and ready-to-eat food sectors. Food and beverage industry is one key applications of the fungal protein with its great array of nutritional-, functional-, and sustainability-related advantages, all of which resonate well with current consumer and industry trends.

Fungal proteins are rich in high-quality fiber, micronutrients, and amino acids, making them most suitable for diverse formulations for nutritious food products like meat alternatives, ready-to-eat meals, and dairy substitutes. Fungal proteins are a very important ingredient in vegan meat product preparation like nuggets, sausages, burgers, and other alternative protein products because of their meat-like texture as well as neutral taste.

Demand from marketplace is very high for these products due to the growing popularity of flexitarian and vegetarian diets. These could also be applied in beverage products, snacks, soups, and bakery products with fungal protein as an enhancer for their nutritional value and texture.

| Main Segment | Value Share (2025) |

|---|---|

| Yeast (By Source) | 67.3% |

Yeast-derived fungal proteins are estimated to grab a significant 67.3% of Latin America's fungal protein market. This dominance is due to versatility, nutritional richness, and established safety profile. Yeast proteins, rich in essential amino acids, B-vitamins, and minerals like selenium, are most suitable for a wide range of applications.

In the Latin American region, they have found use in food and beverages, animal nutrition, and pharmaceuticals. In the food industry, yeast extracts are used to boost flavor profile in soups, sauces, and ready-to-eat meals, increasingly demanded by the consumer for clean-label and plant-based products.

Yeast proteins play a role in gut health and immunity when applied in animal nutrition-natural feed additives. Pharmaceutical applications benefit from yeast through fermentation processes in the manufacture of vaccines and therapeutic proteins. The versatility of yeast-derived proteins to many kinds of formulations makes them relevant along health and sustainability trends, thereby enhancing their leading position in the market.

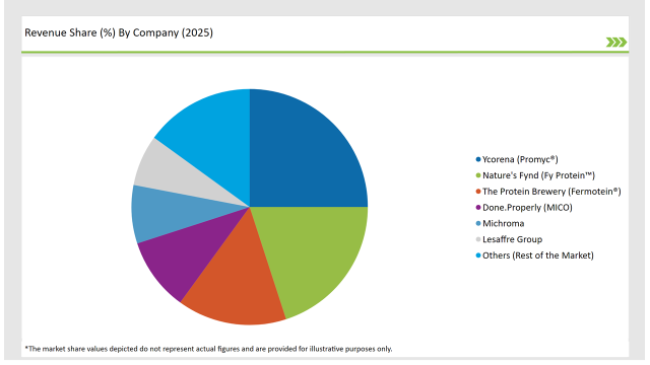

The leading players in the market invest heavily in research and development to create unique and sustainable fungal protein products. Innovations extend to new forms, flavors, and applications of product to differentiate their offerings from their competitors.

Also imperative in a market where plant-based proteins are still coming into their own will be building brand recognition and educating consumers on the benefits of fungal protein. Companies like Ycorena and Nature's Fynd have been using marketing campaigns that promote their products in terms of both nutritional values and environmental sustainability, targeting health-conscious and eco-aware consumers.

As demand for sustainability among food ingredient bodies becomes stronger, fungal protein manufacturers emphasize environmentally friendly production methods. These include waste minimization, water use reduction, and optimization of energy consumption during dry processing.

This sustainability profile will not only attract an increasing number of consumers who favor environmentally conscious practices but will also place the sponsoring brands at the forefront of the green protein movement.Key players have expanded their reach beyond established markets to new areas within Latin America and worldwide.

With such strategic expansion, they will gain market share in emerging economies where the demand for plant-based proteins continues to rise. Localized production and distribution networks are vital in capturing competitiveness in diverse regional markets.

Broader consumer trends influencing the fungal protein market include clean-label, plant-based diets, and functional foods; leading brands adjust forever to these changes with their offer of consumer-preferred products like gluten-free, non-GMO, or high-protein options.

As per product type, the industry has been categorized into Yeast and Fusarium Venenatum. Yeast Segment is further categorized into Baker’s Yeast and Brewer’s Yeast.

By End Use Application, the fungal protein market is segmented into Food and Beverage, Animal Nutrition, Pharmaceutical and Biotechnology. The Food and Beverage segment is further classified into processed food, beverages, bakery, and dairy. The Animal nutrition segment is again segmented into Aquaculture, Pet Food, Ruminant, and Others (Poultry & Swine).

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America Fungal Protein market is expected to experience steady growth in the coming years valuation of USD 352.2 Million in 2025.

Fungal protein is primarily used in food and beverage products as an alternative to animal-based proteins. It is commonly incorporated into plant-based meat substitutes, dairy-free products, snacks, beverages, and functional foods. Its versatility makes it an appealing ingredient for various product categories, from vegan protein shakes to protein-rich snacks.

The fungal protein market in Latin America is moderately concentrated, with the top six key players accounting for approximately 75% of the market share. The remaining 25% is held by smaller or emerging players, suggesting that while a few brands dominate the market, there is still room for niche players to capture a portion of the market through innovation and specialized products.

The fungal protein market in Latin America is expected to experience steady growth due to increasing consumer interest in plant-based foods, sustainability, and alternative protein sources. As consumer preferences shift toward healthier and more environmentally conscious choices, demand for fungal protein is anticipated to rise, driving further innovation and market expansion.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Latin America Pulses Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA