The aqua feed additives market in Latin America is forecasted to increase from USD 0.1 billion in 2025 to USD 0.3 billion by 2035 with a CAGR of 6.1% from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated LATAM Market Size (2025E) | USD 0.1 billion |

| Projected LATAM Value (2035F) | USD 0.3 billion |

| Value-based CAGR (2025 to 2035) | 6.1% |

Latin America Aqua Feed Additives Market, 2025 to 2035, set the Aquaculture based Industries on fire in Brazil, Chile, Mexico and Ecuador. Essentially, the increasing worldwide demand for fish protein and transitioning to sustainable aquaculture practices is leading to the adoption of high-quality feed additives, such as enzymes, probiotics, amino acids, phytogenics, and vitamins. The increasing use of feed additives such as probiotics, phytogenics, and organic acids is also driven by their positive effects on feed conversion ratios and fish immunity and their low environmental waste.

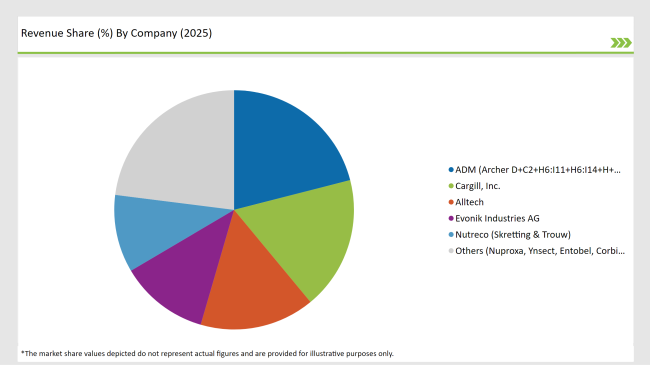

Key contributors to the growing industry include like Alltech, Cargill, DSM, Kemin Industries, Evonik, Nutreco, and ADM, who are all investing in local operations and R&D in order to customize products to the needs of Latin American aquaculture.

The table below details the comparison of CAGR changes in six-month intervals between the base year (2023) and the current year (2024) for the Latin America aqua feed additives market. This semi-annual analysis identifies substantive changes in market dynamics and delineates revenue realization trends, showcasing a granular view of intra-year growth momentum to stakeholders.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.9% |

| H2 2024 | 6.2% |

| H1 2025 | 6.1% |

| H2 2025 | 6.4% |

H1 signifies the period from January to June, H2 signifies the period from July to December.

In fact, the Latin America aqua feed additives market is expected to grow at a CAGR of 5.9% in H1 2024 and 6.2% in H2 2024 due to the aforementioned factors. The growth rate is forecasted to increase to 6.1% in H1 2025 and to 6.4% in H2 2025.

| Date | Development/M&A Activity & Details |

|---|---|

| 15-Jan | Production Expansion in Brazil: Cargill announced the expansion of its aqua feed additives production plant in São Paulo, Brazil, to cater to growing regional demand. |

| 10-Mar | Launch of Sustainable Feed Solutions: Alltech introduced a new line of phytogenic additives for shrimp farming, tailored to the Latin American climate and species. |

| 2024 | Strategic Acquisition: Nutreco acquired a controlling stake in a Chilean aquafeed company to strengthen its market presence and R&D capabilities in South America. |

| 05-May | Regulatory Approval: Kemin Industries received approval from Brazil’s Ministry of Agriculture for a new probiotic blend designed to reduce disease in tilapia. |

| 30-Sep | Research Collaboration: Evonik and the University of São Paulo launched a joint research initiative focused on amino acid optimization in feed for Amazonian fish. |

Growing Interest in Functional Feed Solutions Across Latin American Aquacultures

As aquaculture scales across Latin America, demand for functional feed additives that serve purposes beyond basic nutrition is seeing a marked increase. Producers of fish and shrimp in countries including Brazil, Chile, and Ecuador are using additives like probiotics, phytogenics, enzymes and organic acids to boost feed efficiency, immunity, and outbreaks of diseases.

The trend comes as export demand for antibiotic-free and sustainably farmed seafood continues to increase, in North American and European markets in particular. Pioneering this shift, companies like Alltech, Kemin, and Nutreco are rolling out species-specific additive blends designed for tropical aquaculture systems.

Eco-Conscious Innovation of Additive Ingredients

In Latin America, environmental sustainability is quickly becoming a pillar of aquafeed strategies. Producers are making investments in sustainable additive technologies that minimize the waste footprint, improve water quality, and drive improved feed conversion ratios.

Developers such as Cargill and Evonik are working to fill the void with algae- and plant-based additives that can serve as sustainable replacements for traditional marine-sourced products. These innovations support regional government initiatives to decarbonise aquaculture and to comply with tightening environmental regulations. This focus on greener inputs is also driving buyer preference, with large seafood retailers and importers asking for more transparency and traceability regarding the make-up of feed.

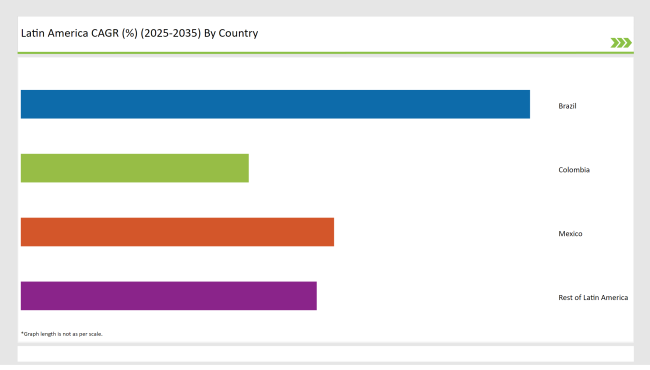

Brazil is also by far the biggest and most powerful force in the Latin American aqua feed additives market. A booming tilapia farming industry in the country, supported by strong government subsidies and private aquaculture investment, has led to growing demand for functional feed additives.

Major players, such as Cargill and Nutreco, have notably increased their production in the country and been localizing their offerings, such as enzymes, organic acids and probiotics, for native fish species. Moreover, the shift by Brazil towards antibiotic-free production systems is driving the transition towards natural additives, thereby driving the market growth.

The consumption of aqua feed additives in Mexico is increasing rapidly, primarily owing to the development of the shrimp aquaculture industry in Pacific coastal areas. Phytogenics and immunostimulants are being utilized more and more by poultry producers to help avoid disease outbreaks and satisfy international quality standards.

Additive adoption is now viewed as crucial in terms of productivity and biosecurity due to increasing seafood exports to the USA and Asia. The global leaders are partnering with local feed mills to offer tailored blends of additives for shrimp and tilapia.

Latin America aqua feed additives market is characterized by moderate consolidations, with both international and regional brands leading the market. Global giants such as Evonik Industries, Alltech, and BioMar Group are using their R&D strengths, technical support services, and regional manufacturing hubs to cement a foothold in the region.

Their portfolios emphasize nutritional supplements, functional health products, and performance boosters for primary species such as tilapia, shrimp, and catfish. On the other hand, regional experts like Yes Sinergy (Brazil), Inve Aquaculture (with solid relations in Central and South America) and Grupo Diana (Colombia) are winning demand with localized formulation expertise, price-competitive solutions, anddeep distribution networks. These brands are key to addressing the varied regulatory and nutritional needs of aquaculture players throughout Latin America.

Fish Oil: A Key Component for Improved Growth and Immunity in Aquaculture

In Latin America, fish oil is still one of the drivers of aqua feed additives market preferene in tilapia and crustacean aquafarming as fish oil is an optimal source of omega-3 fatty acids which consists of EPA and DHA thereby plays a considerable role in growth, disease resistance and reproduction in aquatic species.

In some countries, such as Brazil and Ecuador, fish oil is increasingly included in functional feed formulations, particularly for high-value export species, where nutritional quality directly correlates to market price and acceptance in international markets.

Although sustainability issues with marine-sourced ingredients are on the rise, for many parts of the world fish oil is irreplaceable because of its high bioavailability and clinically proven benefits. Additionally, emulsified fish oil formulations in a liquid format are becoming increasingly popular throughout feed mills for their better digestibility and homogeneity in pelleted feeds, minimizing nutrient loss during the extrusion process. This adaptability leads to its use in both intensive and semi-intensive aquaculture systems throughout Latin America.

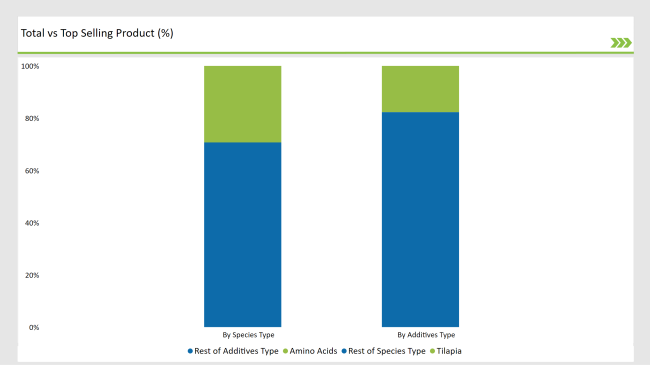

In this segment, the industry has been categorized into Amino Acids, Vitamins, Minerals, Antibiotics, Acidifiers, Binders, Antioxidants, Prebiotics, Patents, Others

By species type industry has been categorized into Crustaceans, Catfish, Salmonids, Carp, Tilapia, Mollusks, Mullet

Ingredient types such as Corn, Soybean, Fish Oil, Peas, Sunflower Seed, and Others are included in the report.

The Latin America Aqua Feed Additives market is projected to grow at a CAGR of 6.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 0.3 billion.

The market is driven by the Expanding Aquaculture Production, Focus on Animal Health & Disease Prevention, and Push for Antibiotic-Free & Sustainable Aquaculture.

Brazil, Mexico and Colombia are key regions with high consumption rates.

Leading manufacturers include Evonik Industries, Alltech, BioMar Group, Yes Sinergy, known for their innovative and sustainable production techniques.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA