The Latin America Shrimp Market is set to grow from estimated USD 5,687.1 million in 2025 to USD 13,218.4 million by 2035, with a compound annual growth rate (CAGR) of 8.8% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 5,687.1 million |

| Projected Latin America Value (2035F) | USD 13,218.4 million |

| Value-based CAGR (2025 to 2035) | 8.8% |

Shrimp is among the most widely consumed seafood species in Latin America, eaten throughout households, restaurants, and export markets. The region is a large producer of farmed and wild shrimp, with Ecuador, Mexico, Brazil, and Argentina being the primary production centers.

Shrimp is available in different forms, such as fresh, frozen, cooked, and value-added products like breaded or marinated shrimp. Although fresh shrimp is usually bought in local markets and seafood stalls, frozen shrimp prevails in the retail and foodservice markets because of its longer shelf life and ease of use.

Supermarkets, hypermarkets, wet markets, and direct farm sales are major sales channels for local consumption. At the same time, much of Latin American shrimp production is exported, with the United States, Europe, and China being major international purchasers.

Latin American consumers are fond of shrimp in conventional products such as ceviche, grilled shrimp, and stews with shrimp. Rising urbanization and changing eating habits have also stimulated the demand for pre-cooked and ready-to-eat shrimp products.

In the future, the Latin American shrimp market is likely to grow consistently up to 2035 due to increased seafood consumption, export demand, and improved sustainable aquaculture. But industry challenges like outbreaks of disease in shrimp farms, volatile feed prices, and climatic risks could affect output. Investment in sustainable farming practices and innovation in processing will be key to sustaining long-term industry growth.

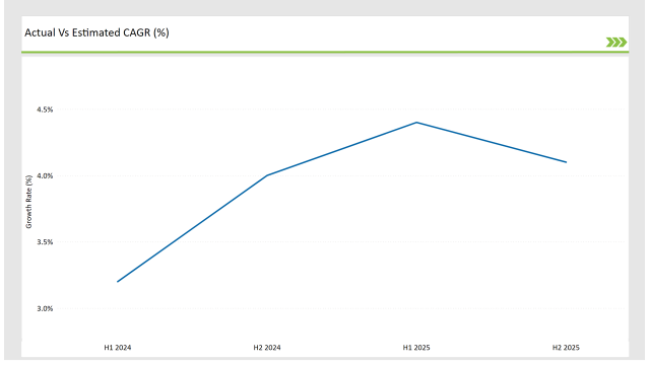

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin American Shrimp market.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 3.2% |

| H2(2024 to 2034) | 4.0% |

| H1(2025 to 2035) | 4.4% |

| H2(2025 to 2035) | 4.1% |

H1 signifies period from January to June, H2 Signifies period from July to December

This gradual upward revision in CAGR suggests positive market dynamics, driven by factors such as rising shrimp consumption, increasing exports, and advancements in aquaculture practices. The improving outlook highlights growing confidence in the industry’s expansion, though external influences like environmental changes, feed prices, and trade regulations may still affect long-term performance.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | After years of robust growth, shrimp production in Latin America decelerated, with growth rates dropping to 2% in 2024 due to persistently low prices. However, projections indicate a rebound to 4% growth in 2025 as the oversupply situation eases. |

| 2024 | Ecuador, a leading shrimp producer, also experienced a slowdown, with production growth estimated at 2% in 2024 and anticipated to rise by 3-4% in 2025, reaching approximately 1.3 million metric ton |

| 2024 | Efforts were made to unite shrimp producers globally to boost demand. Notably, the Global Shrimp Council was established to foster collaboration among producers worldwide. |

Growing Domestic Consumption of Shrimp

Shrimp eating is increasing throughout Latin America, powered by shifting food consumption patterns, urbanization, and growing disposable incomes. As seafood becomes popular as a healthy substitute for protein, more Latin American consumers are adding shrimp to their plate.

Traditional fare like ceviche, moquecas, and shrimp stews continue to propel demand, while ready-to-eat and processed shrimp items are increasingly found in stores. This increasing domestic demand is prompting producers to pay attention not just to exports but also to building their home markets.

Development of Sustainable Aquaculture Practices

Latin America's shrimp farming industry is quickly embracing sustainable aquaculture methods to increase production efficiency with reduced environmental footprint. Recirculating aquaculture systems (RAS) investment, low-impact feed formulations, and disease-resistance shrimp strains are all aiding farms to maximize yields and minimize loss.

Several producers are also pursuing eco-certifications to access environmentally aware consumers as well as ensure long-term sustainability. As governments and industry players advocate for responsible shrimp farming, Latin America is positioning itself as a global leader in sustainable seafood production.

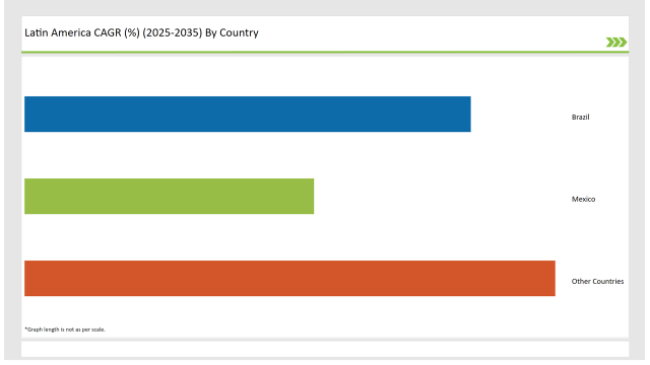

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Brazil | 37% |

| Mexico | 24% |

| Other Countries | 44% |

Brazil controls the largest share of the Latin American shrimp market (37%) due to the fast growth in large-scale aquaculture businesses. Brazil experienced heavy investments in intensive and semi-intensive shrimp aquaculture, especially in northeastern states such as Rio Grande do Norte and Ceará, where there is high-yield production supported by good coastal conditions.

The Brazilian shrimp industry has also gained from the latest technology in the form of automated feeding systems and better disease management practices, thereby improving production efficiency and mortality levels. Brazil's shrimp production crossed 120,000 metric tons in 2024, and with increasing domestic demand and high export potential, the industry is likely to grow even more in 2025.

With a 24% market share, Mexico is Latin America's shrimp industry leader, underpinned by wild catch as well as farmed shrimp production. The country's major shrimp-producing states are the northwestern states of Sinaloa, Sonora, and Nayarit, which enjoy immense coastal resources as well as well-established aquaculture infrastructures.

Mexico's shrimp production in 2024 surpassed 170,000 metric tons due to high demand from domestic markets and foreign countries such as the USA and Europe. Efforts by the government to advance sustainable aquaculture and disease control measures have also bolstered the industry.

Also, the growth of processed and value-added shrimp products (e.g., frozen, cooked, and breaded shrimp) has driven sales in retail and foodservice channels, setting Mexico up for sustained growth in 2025.

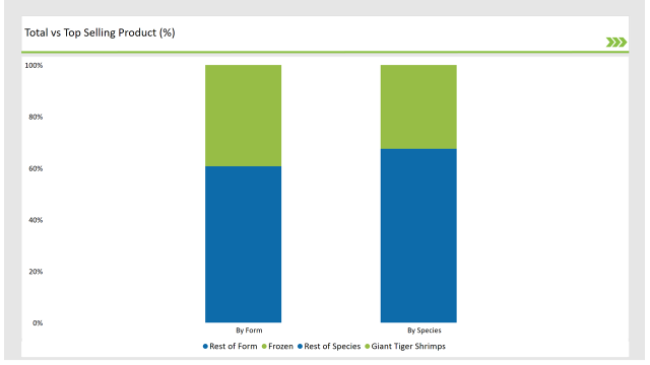

% share of Individual Categories Product Type and Form in 2025

| Main Segment | Market Share (%) |

|---|---|

| Giant Tiger Shrimps (By Species) | 32.5% |

The superiority of edible Shrimp in the Latin American market is mainly propelled by the superior demand for fresh and processed sausages, especially in countries such as Brazil, Mexico, and Argentina.

Edible casings are chosen because they are easy to work with, have a uniform character, and are capable of maximizing production efficiency, thus being perfectly suited for artisanal and industrial sausage manufacturing. Also, the trend of convenience foods and pre-cooked meat products is growing, thus the demand for quality standardized sausage casings which do not need to be peeled before being consumed.

The growth of quick-service restaurants (QSRs), supermarkets, and contemporary retail chains is also driving the demand for pre-packaged sausages, where edible Shrimp contribute a uniform texture and bite.

Additionally, advancements in collagen casing toughness, moisture resistance, and flavor uptake are rendering them an increasingly viable substitute for natural casings, especially for fresh sausages such as chorizo, linguiça, and longaniza. With increasing consumption of meat and technological advancements in food processing, the Edible Shrimp segment is likely to continue its solid market position.

| Main Segment | Market Share (%) |

|---|---|

| Frozen (By Form) | 39.3% |

Frozen shrimp is the most popular shrimp form in Latin America, holding a 39.3% market share in value terms in 2024. This dominance is driven by longer shelf life, convenience, and strong export demand from key markets like the United States, Europe, and Asia.

The frozen shrimp segment benefits from advancements in freezing technology, including IQF (Individually Quick Frozen) and block freezing, which help maintain shrimp quality and freshness. Latin American producers, particularly in Brazil and Mexico, have invested heavily in processing facilities and cold storage infrastructure, allowing them to supply bulk frozen shrimp to both foodservice and retail sectors.

In domestic markets, frozen shrimp is gaining popularity due to the rise of supermarkets, hypermarkets, and e-commerce platforms, where consumers prefer pre-packaged, ready-to-cook seafood options. Additionally, with the growing demand for processed and value-added shrimp products (such as breaded and marinated shrimp), the frozen segment is expected to continue expanding in 2025 and beyond.

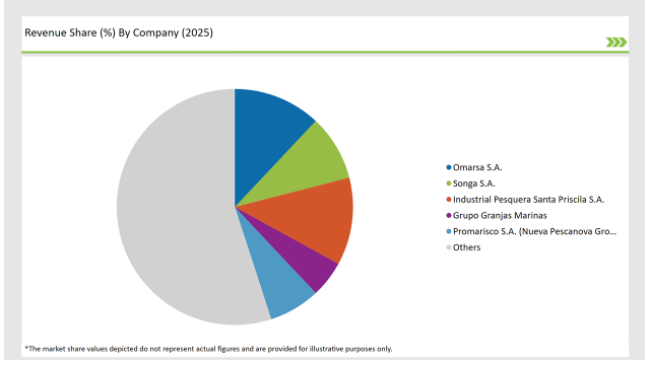

2025 Market share of Latin America Shrimp manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Omarsa S.A. | 12% |

| Songa S.A. | 9% |

| Industrial Pesquera Santa Priscila S.A. | 12% |

| Grupo Granjas Marinas | 5% |

| Promarisco S.A. (Nueva Pescanova Group) | 7% |

| Others | 55% |

The Latin American shrimp industry is organized into large integrated firms, medium-sized regional producers, and small independent producers, each serving different market segments. Large firms like Omarsa S.A., Santa Priscila, Promarisco, and Songa S.A. are the major exporters and hold the entire value chain from hatcheries and farms to processing factories and international distribution.

They maintain close collaboration with foreign customers, especially China, the United States, and the European countries, and keep strengthening investment in green aquaculture and high-value-added products like shrimp.

Mid-sized regional producers such as Honduras' GrupoGranjas Marinas and some Brazilian and Mexican shrimp farms target export as well as domestic markets. They are enhancing their presence in frozen and processed segments of shrimp by upgrading their aquaculture technology, disease resistance practices, and processing facilities.

Smaller independent farmers and cooperatives serve mainly local consumption and small-scale exports. Although they are deprived of modern technology and heavy infrastructures, they have a key function of delivering fresh shrimp to domestic consumers and conventional seafood networks.

Today, Ecuador is still the top shrimp exporter in Latin America, with major producers increasingly challenged by India and Vietnam in international markets. Brazil and Mexico, on the other hand, are experiencing growing domestic consumption, fueled by the growing availability of shrimp in supermarkets and foodservice channels.

Brazilian companies are developing semi-intensive shrimp farming operations, while Mexican producers are concentrating on high-value processed shrimp for export. Producers in Honduras and other small Central American nations are targeting specialized markets and obtaining sustainability certifications to help them compete.

The sector is moving towards value-added shrimp products, including IQF frozen shrimp, marinated shrimp, and ready-to-cook forms, as consumer tastes change. Firms are also spending on automated feeders, AI-based monitoring, and disease-free shrimp varieties to enhance productivity and minimize losses.

Sustainability practices like low-impact feed and recirculating aquaculture systems (RAS) are becoming differentiators in international trade. In order to minimize reliance on conventional buyers, Latin American shrimp producers are venturing into new markets in the Middle East and Asia, broadening their export base.

In the future, technological innovation, sustainability initiatives, and value-added processing will define the future of the Latin American shrimp industry, enabling major players to consolidate their positions in a more competitive global market.

As per species, the industry has been categorized into Gulf Shrimps, Farmed White leg Shrimps, Banded Coral Shrimps, Royal Red Shrimp, Giant Tiger Shrimps, Blue Shrimps, and Ocean Shrimps.

As per form, the industry has been categorized into Canned, Breaded, Peeled, Cooked & Peeled, Shell-On, and Frozen.

This segment is further categorized into Organic, and Conventional.

This segment is further categorized into Direct, and Indirect (Modern Trade, Convenience Stores, Specialty Food Stores, Wholesale Stores, Discount Stores, Online Retail, and Other Retail Formats).

As per application, the industry has been categorized into Food, Pharmaceutical, Cosmetics, Industrial, and Biotechnology.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America Shrimp market is projected to grow at a CAGR of 8.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 13,218.4 million.

Key factors driving the Shrimp market include the increasing demand for processed and convenience foods, particularly in the meat industry, as well as the growing preference for natural and high-quality casings that enhance product safety and shelf life. Additionally, advancements in food technology and the rising trend of clean-label products further contribute to market growth.

Germany, and Italy are the key countries with high consumption rates in the Latin American Shrimp market.

Leading manufacturers include Omarsa S.A., Songa S.A., Industrial Pesquera Santa Priscila S.A., Grupo Granjas Marinas, Promarisco S.A. (Nueva Pescanova Group) Other Regional & Smaller Producers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA