The Latin America Chickpea Protein sales is projected to increase from an estimated USD 14.7 million in 2025 to USD 26.3 million by 2035, recording a compound annual growth rate (CAGR) of 5.9% during the predicted period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 14.7 million |

| Projected Latin America Value (2035F) | USD 26.3 million |

| Value-based CAGR (2025 to 2035) | 5.9% |

From 2025 to 2035, the industry is expected to see strong compound annual growth rate (CAGR) which will account for increasing investments in value-added processing infrastructure, research and development and chickpea protein isolates-based end products. Together with their foreign food-tech partners, local start-ups are innovating high protein snacks from chickpeas, creating vegan cheese products, and fortifying drinks with these ingredients.

It is consumer behavioral changes-the hunt for healthier, ethical, and eco-friendly products that speed up the momentum of chickpea protein in the region. In Latin America, the rapidly growing chickpea protein industry is mainly fuelled by the increasing consumer demands for plant-based items, clean label products, and sustainable food solutions.

Due to its superior digestibility, balanced amino acid profile, and non-allergic nature, chickpea proteins have significant applications in meat alternatives, dairy-free beverages, nutritional supplements, baking products, and sports nutrition. Brazil, Argentina, and Mexico emerge as the new leading producers and consumers in line with their favorable agro-climatic conditions and growing processing capacity. Its mother Market pulses have got enormous potentials though this chickpea protein is highly introductory still in Latin countries.

Below is a detailed comparative analysis on the changes in compound annual growth rate (CAGR) for six months between the base year (2024) and current year (2025): The analysis focuses on the major transformations as far as chickpea protein market in Latin America is concerned.

This is one among most-significant reporting periods where the sum amount of key changes is integrated, regarding the industry sources of review revenues, towards improved understanding by stakeholders regarding trends of revenue realization by the market over the curly event the year in consideration. The first half of a year (H1) runs from January to June while the other from July to December is referred to as H2.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.5% |

| H2 (2024 to 2034) | 4.0% |

| H1 (2025 to 2035) | 3.9% |

| H2 (2025 to 2035) | 34.2% |

H1 signifies period from January to June, H2 Signifies period from July to December

The semiannual CAGR analysis for Latin America Chickpea Protein Market presents an upward trend across the growth expectations. CAGR increased in 2024 from 3.5% in H1 to 4.0% in H2, which indicates further rising demands as well as investment pull. This same momentum carries into 2025, changing the CAGR slightly to 3.9% for H1 and topping out at 4.2% for H2, indicating strong confidence in market expansion.

| Date | Development/M&A Activity & Details |

|---|---|

| March 2024 | EMBRAPA (Brazil) developed chickpea and lentil protein concentrates with protein levels of 73% and 80%, respectively. These are intended for use in plant-based foods such as burgers and beverages, with production based on circular economy principles and minimal waste. |

| April 2024 | Tomorrow Foods (Argentina) expanded its plant-based protein offerings, including Latin Chickpea, through partnerships with regional food manufacturers in Brazil and Chile. The company focuses on supplying clean-label, allergen-free ingredients for the development of plant-based products. |

| May 2024 | Regional Investment Initiatives in Brazil and Argentina have announced funding for plant-based protein processing, including chickpea protein, under national innovation grants aimed at reducing dependence on imported proteins and scaling local production for domestic and export markets. |

Increased Popularity of Plant-Based Eating Patterns

A principal driver of the chickpea protein market in Latin America is the trend towards plant-based alternatives for food. Health-conscious consumers actively seek plant proteins that offer wholesome nutrients, free from allergens, with lesser ecological impacts. Health surveys conducted in the region indicated that about 35% of urban people in Brazil and Mexico were actively minimizing their intake of meat, creating increased demand for chickpea-based meat alternatives and nutritional powders.

The very mild flavor of chickpea protein along with its technological properties makes it ideal for use in vegan burgers, protein bars, and lactose-free beverages. This complies with the foremost international sustainability goals, which are being impeded with awareness focusing on carbon footprint increase attributed to animal agriculture; thus, adding a long-term future for chickpea protein to be placed as a very capable alternative in the food industry.

Expansion of Functional and Clean Label Product Segments

Another major driving force is the rapidly expanding clean-label functional food segments in Latin America. Chickpea protein is widely acknowledged for satisfying a multitude of clean-label requirements: it is non-GMO, gluten-free, hypoallergenic, and has been minimally processed. Food and beverage brands are cashing in on those properties to develop high-performing products free of synthetic additives or artificial preservatives.

Functional foods that use chickpea protein have also caught the eye of millennial sports nutritionists concerned with wellness and the aging population looking for benefits such as immunity boosting and muscle retention. With several government-endorsed initiatives promoting indigenous crops such as chickpeas, together with an international partnership of sustainable agriculture programs, further innovation in this space is being fostered.

Ingredient transparency and health-oriented branding add the potential for chickpea protein to escape bacterial fast lane notoriety within the mainstream food economy.

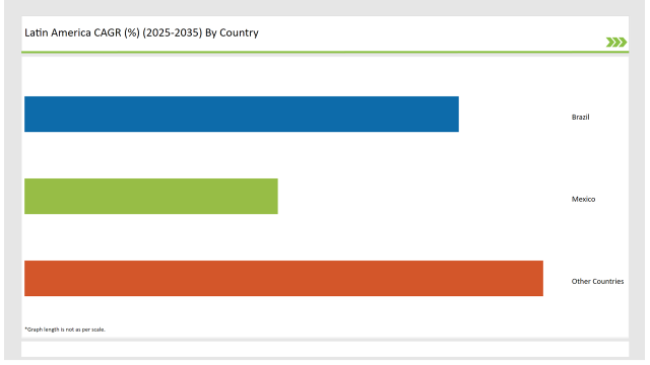

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Brazil | 36% |

| Mexico | 21% |

| Other Countries | 43% |

Brazil holds 36% value share in chickpea protein and is largest market in Latin America, hosting several converging trends. The rise in consumer interest movements toward plant-based and allergen-free protein sources accelerates the demand in functional food categories like meat alternatives, nutritional intake supplements, and dairy-free beverages.

The healthy urban crowd throughout the country, especially in São Paulo and Rio de Janeiro, is now consuming chickpea protein due to its excellent nutritional profile, clean-label properties, and good digestion. To add, federal innovation funding and agricultural R&D programs such as EMBRAPA have produced chickpea protein concentrates and isolates domestically to reduce imports and increase competitiveness in the domestic and export markets

exico is the second-largest market for chickpea protein in the region. Demand is driven by the usual consumption of chickpeas in traditional food and recently widening the scope of applications of chickpea ingredients into new food products, such as protein-enriched snacks, and dairy alternatives, in countries where it is mostly used.

Small and mid-sized food companies in Mexico are launching more and more chickpea flour and chickpea-based concentrates products in the market targeting health and flexitarian consumers. Mexico is also not left behind because it shares a border with the USA, many doing these trade agreements on producing chickpea ingredients for local and export use will be at the forefront of the plant-forward trends in North America.

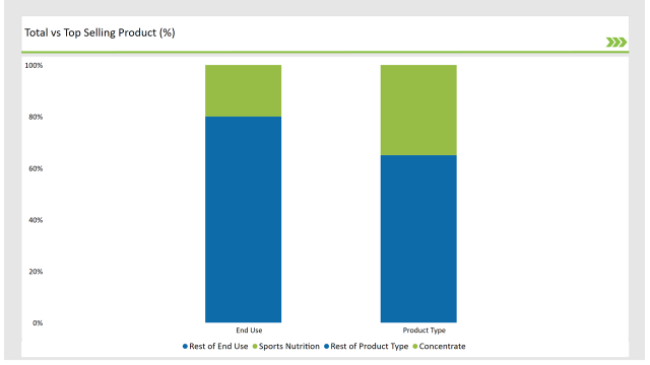

% share of Individual Product Type and End use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Concentrate) | 35% |

| Remaining segments | 65% |

In the Latin American chickpea protein market, concentrates account for 35% of the total market share, reflecting their growing preference in specialized nutrition and clean-label formulations. Chickpea protein concentrates typically contain 60-70% protein content, making them ideal for functional foods, fortified bakery items, snack bars, and plant-based meat products.

Their popularity stems from a balanced nutritional profile, neutral taste, and cost-effectiveness compared to isolates. Manufacturers in Brazil, Argentina, and Mexico are increasingly using concentrates for localized formulations that align with regional taste preferences while still offering digestive benefits, allergen-free positioning (non-soy, non-dairy), and fiber content.

Although isolates and flours remain significant segments, the versatility of chickpea protein concentrates in both dry and wet applications has made them a strategic choice for brands targeting mainstream health-conscious consumers and functional food innovation in Latin America.

| Main Segment | Market Share (%) |

|---|---|

| End Use (Sports Nutrition) | 20% |

| Remaining segments | 80% |

The sports nutrition segment holds a 20% market share in the Latin American chickpea protein market, signaling a strong and growing interest among fitness-focused consumers and athletes in plant-based alternatives to traditional animal or soy-based proteins.

Chickpea protein is gaining traction in protein powders, recovery shakes, energy bars, and performance snacks, thanks to its rich amino acid profile, digestibility, and non-GMO, gluten-free attributes. With increasing awareness around gut health, clean eating, and sustainable sourcing, health enthusiasts are seeking out chickpea protein for its natural fiber content and lower allergenic potential.

Brands in Brazil and Mexico are particularly leveraging chickpea protein in sports supplement innovation, often combining it with rice or pea proteins to achieve complete amino acid profiles. While other end-use categories like bakery, dairy alternatives, and infant nutrition dominate the broader market, sports nutrition is a high-potential growth driver, especially among millennials and Gen Z consumers pursuing holistic wellness and active lifestyles.

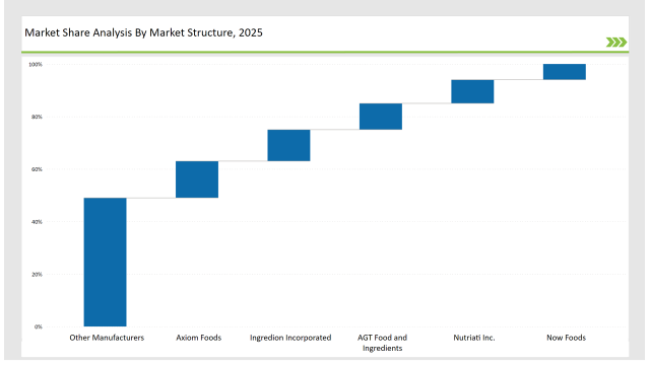

2025 Market share of Latin America Chickpea Protein manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Axiom Foods | 14% |

| Ingredion Incorporated | 12% |

| AGT Food and Ingredients | 10% |

| Nutriati Inc. | 9% |

| Now Foods | 6% |

| Other Manufacturers | 49% |

Note: The above chart is indicative in nature

Now the chickpea protein market in Latin America is moderately consolidated, and whatever some international suppliers may have, they are now joined by emerging regional players. Market development is still pretty young-bad most of it-still far short of the majority-as some companies like Axiom Foods, Ingredion, and AGT Food and Ingredients try to carve out their own niches through exports and collaboration, quite a bit of it still relatively early stage, leaving plenty of opportunities for new entrants and strategic development here.

Most of the market participants have designed enter-and-consolidate strategies targeted at developing chickpea protein as an emergent category in the overall plant-based protein market in Latin America. Partnerships with local food manufacturers for contract manufacturing, pilot-type production facilities established in Brazil, Mexico, and Argentina. With the trigger of increased global interest in clean-label and allergen-free proteins, the naturally fragmented market is slowly beginning to see momentum for product innovations and growth in private labels.

As markets otherwise side-ambitious demands-exclusively sports nutrition, dairy alternatives, and some discipline in functional food demand-increases, this industry is nearing the point where only a few select players would leverage technological advancement, vertical integration, and regional processing hubs to ensure stronger hold on the market.

As per Product Type, the industry has been categorized into Isolate, Concentrate, Textured and Hydrolyzed.

As per Nature, the industry has been categorized into Organic and Conventional.

As per End Use, the industry has been categorized into Food & Beverage Processing, Sports Nutrition, Infant Nutrition, Pharmaceutical Products, Personal Care Products and Animal Nutrition.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America Chickpea Protein market is projected to grow at a CAGR of 5.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 26.3 million.

Chickpea protein is primarily used in sports nutrition, dairy alternatives, meat substitutes, and baked goods, owing to its high protein content and clean-label appeal.

Brazil and Mexico are the leading countries due to growing demand for plant-based nutrition and the presence of both consumers and manufacturers focused on sustainable proteins.

Protein concentrates dominate the market with a 35% share, valued for their balance of functionality and affordability in food and beverage formulations.

Yes, the market is growing steadily, with an increasing CAGR from 2024 to 2025, indicating rising consumer awareness and industry investment in plant-based nutrition.

Sports nutrition is an emerging high-growth segment, accounting for 20% of the market, especially among fitness-oriented consumers and clean-label product seekers

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Latin America Pulses Market Outlook – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA