The Latin America cultured wheat market is projected to rise from an estimated USD 60.9 million in 2025 to USD 116.7 million by 2035, recording a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 60.9 million |

| Projected Latin America Value (2035F) | USD 116.7 million |

| Value-based CAGR (2025 to 2035) | 6.7% |

With the increased focus on clean-label ingredients, natural preservatives, and functional food applications, the Latin American cultured wheat market is on a strong growth trajectory between the years 2025 and 2035. Around the bakery, snacks, and processed food sectors, cultured wheat, a naturally fermented ingredient used as a natural mold inhibitor and shelf-life extender is most definitely on the rise.

With consumers becoming more conscious about the ingredients they consume, cultured wheat represents a non-GMO and label-friendly way to replace synthetic additives. The growing health consciousness, particularly regarding gut health and microbiome equilibrium, is propelling the advent of fermented and bioactive food materials.

The following table illustrates the comparative analysis of the compounded annual growth rate (CAGR) over six months between base year 2023 and the current year 2024 for the Latin America cultured wheat market.

This half yearly examination draw attention to five critical transformations in market components and underlines income recognition patterns, allowing partners to get a better estimate of development in within the 12 months.

| Particular | CAGR |

|---|---|

| H1 2024 | 6.5% |

| H2 2024 | 6.6% |

| H1 2025 | 6.4% |

| H2 2025 | 6.7% |

H1 signifies period from January to June, H2 signifies period from July to December

This is also true for the Latin America cultured wheat market, where the segment is set to expand at 6.5% CAGR over the first half of 2024 before again crossing the 6.5% threshold to grow at 6.6% from mid 2024 to end 2024. The growth rate is expected to fall to 6.4% in H1 2025, before a recovery to 6.7% in H2 2025.

This pattern corresponds to a decline of 10 basis points 5 but an increase of 10 basis points 6 between H1 2024 to H1 2025, and 7 between H2 2025 relative to H2 2024. The small year-over-year dips suggest seasonal demand dynamics, possibly related to product launches or agricultural cycles, or regulatory changes in the preservation of clean-label food.

| Date | Development / M&A Activity & Details |

|---|---|

| 25-Jan | Expansion in Cultured Wheat Production : Bimbo Group announced the expansion of its fermented wheat ingredient facility in Mexico to meet the rising demand for clean-label preservatives across Latin America. |

| 12-Mar | New Product Launch : Selmi Foods introduced a line of bakery products using cultured wheat as a natural preservative under its premium “Renata Naturals” label in Brazil. |

| 2024 | Strategic Acquisition : Kerry Group acquired a regional fermentation startup in Argentina specializing in cultured wheat solutions, enhancing its presence in South American markets. |

| 08-Jun | Regulatory Approval : Brazil's ANVISA granted approval for the use of cultured wheat as a natural mold inhibitor in packaged bakery products, signaling regulatory support for clean-label innovations. |

| 24-Aug | Research Collaboration : DSM N.V. initiated a joint R&D program with Universidad de Chile to develop next-gen fermented wheat strains optimized for tropical climate conditions and longer shelf life. |

Increased Demand for Clean-Label and Natural Preservatives in Food Products Throughout Latin America

With consumers in Latin America becoming more health conscious, there is a rising shift towards clean label food products that do not contain synthetic additives and preservatives. Enter cultured wheat, a naturally fermented ingredient that is being touted as a more natural option as a natural mold inhibitor and shelf-life extender. To meet consumer expectations for transparency, simplicity and minimal processing, leading industry manufacturers, such as M. Dias Branco and Grupo Bimbo, are adding cultured wheat to bakery and snack products.

The trend also fits into larger movements gliding across the world toward fermented ingredients and natural antimicrobials (meaning substances that kill microbes). Complying with regulatory bodies has already opened doors to clean-label claims for the cultured wheat that will see faster adoption in Latin America’s processed food sector.

Functional Fermented Ingredients: Innovations for Gut Health and Food Safety

In the cultured wheat space, innovation is being dictated by the intersection of two large consumer trends: the drive for gut-friendly ingredients, and food safety. Fermented cultivation of wheat creates bioactive compounds and organic acids which maintain a healthy microbiome.

With initiatives from companies like DSM and Lesaffre, as well as regional fermentation start-ups, R&D is aimed at optimising strain potency and fermentation efficiency and developing custom solutions tailored to the climate conditions and consumer preferences of the Latin America region. With both health benefits and an ability to extend shelf life, these innovations are driving up use of cultured wheat in baked goods as well as ready meals, meat alternatives and functional snacks.

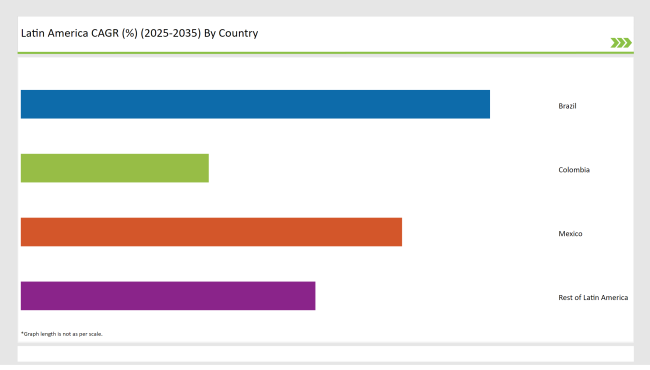

Brazil accounts for 35.2% of the the Latin American market for cultured wheat in 2025. In the current environment of strong consumer interest in healthier foods and widespread adoption of natural preservatives in the bakery industry, companies like M. Dias Branco and Selmi are harnessing cultured wheat in unique ways. Further government support for food safety measures and natural components drives growth, with more people in cities and those looking to eat healthy also contributing.

Mexico is a central actor in cultured wheat adoption, with a 28.6% share-of-market in 2025. With Grupo Bimbo and various other major bakery players already in play, it creates a strong infrastructure for scaling up fermented ingredients.

consumers become increasingly label-conscious, cultured wheat’s function as a natural mold blocker in breads, tortillas and snacks is expanding. The strategic location also encourages regional exports, particularly clean-label bakery products to the USA.

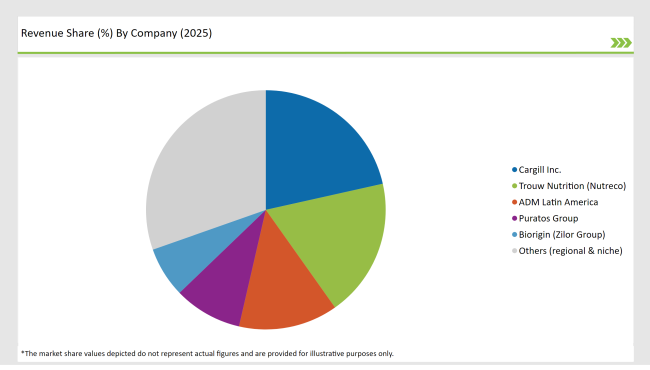

There are a moderate to high level of consolidation in the Latin America cultured wheat market, with a handful of influential players making their presence felt across the market owing to R&D strength, ingredient innovation coupled with distribution network system.

Primary multinationals and regional ingredient specialists are looking into clean-label solutions, and are introducing cultured wheat as a natural replacement for chemical preservatives, especially in baked goods, meat alternatives, and dairy substitutes.

Global heavyweights like Cargill and Trouw Nutrition (Nutreco) have been at the forefront of this effort, leveraging their scale, integrated supply chains and partnerships with Latin America’s food manufacturers to bolster market presence. At the same time, regional players and smaller brands are addressing unique formulation needs in markets such as Brazil, Mexico and Colombia with customized fermented wheat blends for a niche food application

Cheese Alternatives: Clean-Label Innovation with Cultured Wheat

As a natural preservative, lab-cultured wheat is gaining traction in Latin America’s cheese sector alongside a growing synergy with plant-based formulations. Though similar in how an algae omega alternative in a liquid format is attractive, with application possibilities across brands and products, cultured wheat in cheese means versatility and clean-label functionality, and is particularly useful in both dairy cheese and non-dairy cheese alternatives.

Hypothetical form vs. getting real Cultured wheat melds nicely into the production of molodershchego (fresh cheeses) and soft spreads to even shredded cheese blends which just means shelf life without sacrificing taste or texture. Its fermented beginnings and plant based profile resonate with industrial and health-conscious consumers throughout Brazil, Mexico and Colombia who are demanding natural ingredients in everyday food products.

This is an increasingly important application with manufacturers reformulating their cheese lines to accommodate both clean-label expectations and regulatory scrutiny. This makes it particularly appealing to vegan cheese manufacturers, who need the microbial stability as well as improved product appeal among flexitarian and plant-based consumers. As the Latin American dairy sector transforms, the simple incorporation and stable performance of cultured wheat has positioned the ingredient as one of the leading choices.

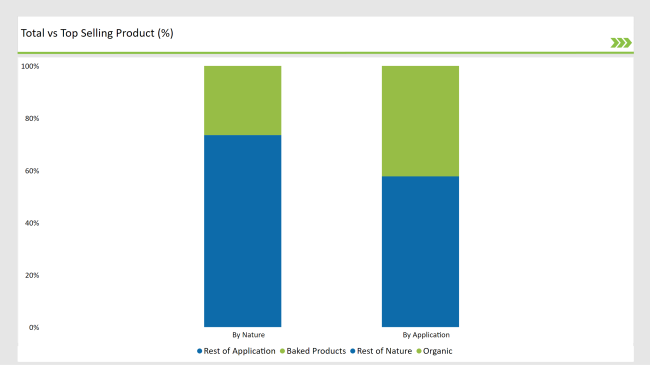

In this segment, Organic and Conventional are included in the report

Various applications like Baked Products, Cheeses, Meats, Salad Dressings, Condiments, Dips and Spreads are considered in the report.

The Latin America Cultured Wheat market is projected to grow at a CAGR of 6.7% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 116.7 million.

The market is driven by the Rising Demand for Clean-Label Ingredients, Expansion of the Bakery and Processed Food Sectors, and Consumer Shift Toward Natural & Plant-Based Alternatives.

Brazil, Mexico and Colombia are key regions with high consumption rates.

Leading manufacturers include Cargill Inc., Trouw Nutrition (Nutreco), ADM Latin America, Puratos Group, and Biorigin (Zilor Group) , known for their innovative and sustainable production techniques.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA