The Latin America Calf Milk Replacer Market sales is estimated at USD 275.3 million in 2025 to USD 646.3 million by 2035, recording a compound annual growth rate (CAGR) of 8.9% during the predicted period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 275.3 million |

| Projected Latin America Value (2035F) | USD 646.3 million |

| Value-based CAGR (2025 to 2035) | 8.9% |

Latin American calf milk replacer market is expected to grow steadily from 2025 to 2035 due to increasing emphasis on early nutrition, meeting livestock productivity goals, and the growth of intensive and increasingly professional farming practices. Brazil, Argentina, and Mexico are among the first to adopt this trend as dairy and beef producers there seek inexpensive and nutritionally balanced alternatives to whole milk feeding.

Calf milk replacers are being accepted more and more by producers who support concepts like uniform growth, gut health, and lessening susceptibility to diseases in young calves. The growth of commercial dairy operations and increasing awareness of animal welfare and feed efficiency support the greater adoption of scientifically formulated milk replacers containing probiotics, proteins, vitamins, and minerals.

At the same time, local and international manufacturers are innovating with plant-based formulations, medicated variants, and digestive-enhancing additives to meet ever-changing needs within the Latin American market sphere.

This is also sustained by localized distribution networks being formed and partnerships with veterinary service providers being initiated as investments in animal nutrition and farm productivity increase. This shows the market is changing, with elements such as sustainability in the forefront, price competitive conditions, and formulations specific to regional cattle breeds being expected to open up new opportunities to various players across the value chain.

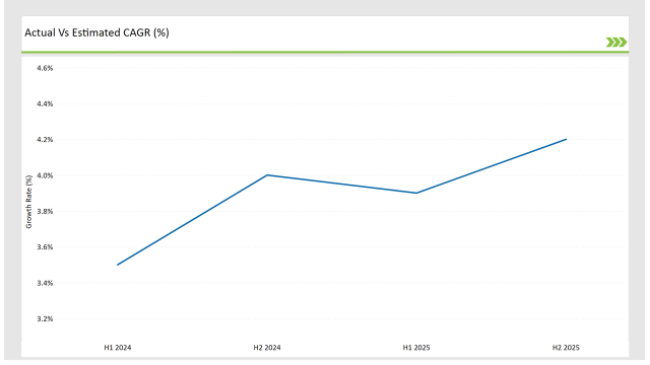

The comprehensive comparative assessment table on the impact of changes of the compound annual growth rate (CAGR) within a six-month interval for the base year (2024) versus current year (2025) in the Latin American Calf Milk Replacer will be corroborated further. This biannual study updates changes in market dynamics and revenue realization patterns. The first half-year is from January to June, while the second half-year is from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.5% |

| H2 (2024 to 2034) | 4.0% |

| H1 (2025 to 2035) | 3.9% |

| H2 (2025 to 2035) | 34.2% |

H1 signifies period from January to June, H2 Signifies period from July to December

The semi-annual CAGR analysis for the Latin America Calf Milk Replacer Market reflects a gradual upward trend in growth expectations. In 2024, the CAGR increased from 3.5% in H1 to 4.0% in H2, signaling rising demand and investment traction. For 2025, this momentum is sustained, with CAGR slightly adjusting to 3.9% in H1 and peaking at 4.2% in H2, indicating strong confidence in market expansion driven by growing applications, health trends, and plant-based product innovation across the region.

| Date | Development/M&A Activity & Details |

|---|---|

| Feb 2024 | In February 2024, Cargill expanded its animal nutrition operations in Brazil, the company's third-largest market for this division. This expansion includes partnerships for cattle supplement production and the acquisition of Anhambi, a move aimed at strengthening Cargill's presence in the Brazilian marke |

| April 2024 | I n 2024, Mars' Pet Nutrition business invested €600,000, building on an €80,000 investment from IDH, to support the Sustainable Production of Calves Program. This initiative aims to improve the sustainability, resilience, and incomes of small-scale cattle ranchers in Brazil, with plans to expand support to an additional 120 ranchers by the end of 2026. |

Sustainable Animal Nutrition: Demand Increases

Farmers, especially dairy and beef farmers, are getting aware of the advantages of high-quality nutrition for calves in the entire continent. Thearg increasing emphasis on animal health and production of farm creates a high demand for calf milk replacers, which are gradually penetrating the countries like Brazil and Argentina.

This product enhances calf growth rates, reduces weaning time, and lowers mortality rates, thereby contributing towards long-term sustainability goals. Increasing pressure to optimize livestock systems is creating avenues for sustainable and easier feeding solutions.

Innovations in Products and Improvements Towards Technology

The changing face of the industry is the formulation of milk replacers that have higher protein contents, fortified with vitamins, probiotics, and added immune development enhancers. Investment in R&D is now the way for most companies to differentiate their offerings, develop regionally relevant products, and extend shelf life.

Emerging innovations such as lung-support additives and gut-health blends transform basic nutritionals into functional products to develop cost-effective interventions for disease resistance and improved performance in calves.

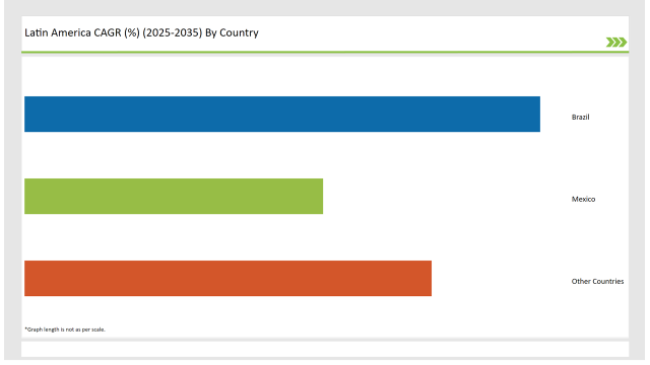

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Country | Market Share (%) |

|---|---|

| Brazil | 36% |

| Mexico | 21% |

| Other Countries | 43% |

With a significant 36% chunk, Brazil has become an important cattle milker market in Latin America and is strongly growing since livestock farming professionals are adhering to recombinant methods of calf management to increase feed efficiency and foster rapid growth rates. Calf replacers are further demanded by Brazil's primary focus on export-centered animal husbandry, which seeks to maintain herd health, although the nation is also subject to high calf mortality to yield maximum output.

The broader adoption of milk replacers across the whole spectrum of large farming zones by mainly local-made formulations and the increasing involvement of private parties, such as agricultural producers and veterinary doctors over time, have increased demand for replacers.

In Mexico, where local consumption alone mounts up to a substantial 21% of the regional market, the milk replacer calf industry is gathering momentum as a result of heat and highly oscillating feed prices. Smallholder and middlemen breeders suffer from the shortage of fresh milk and thus resorting to the commercialization of calf milker replacer.

Through reduced variation in milk used, replacers provide a uniform young calf living environment. Rural-area dairy modernization efforts-embedded with subsidized government skill development initiatives and international assistance-support the continuation of the practice by creating awareness concerning the beneficence of using calf milk replacers. This move has set Mexican manufacturers closer to providing such goods and thus directly benefitting those remote and marginalized farms.

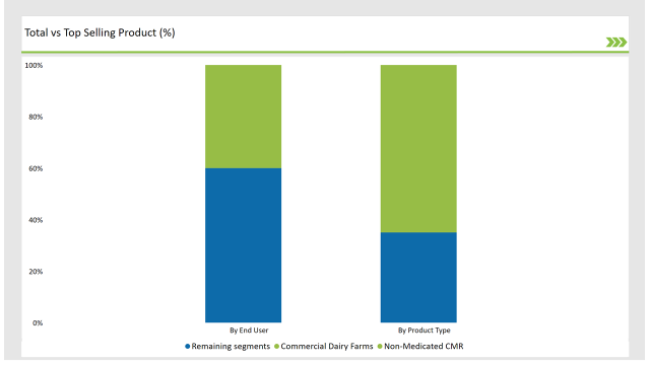

% share of Individual Product Type and End use Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Non-Medicated CMR (Product Type) | 65% |

| Remaining segments | 35% |

Non-medicated calf milk replacements (CMRs) emerged at the forefront of the Latin American market, valuating about 65% of all product demand in 2024. In Latin America, farmers are leaning toward non-medicated formulations to streamline their feeding programs according to consumer demand for antibiotic-free animal products.

These substitutes provide necessary nutrients required for healthy calf growth without added pharmaceuticals and, thus, are consistent with the changes in animal welfare standards and sustainability in livestock production. Further justifying the segment's dominance is the fact that the demand is further strengthened by the growing interest in preventive nutrition and natural immune building in both commercial and small-scale producers.

| Main Segment | Market Share (%) |

|---|---|

| Commercial Dairy Farms (End User) | 40% |

| Remaining segments | 60% |

In Latin America, commercial dairy farms had an approximate share of 40% of total demand for calf milk replacers by the year 2024. These are the farms implementing some structured herd management systems and concentrating on good early calf health to ensure high yields in milk production over time. Integration of milk replacers in feeding programs leads to reduced dependency on maternal milk, easier weaning strategies, and uniformity in calf development.

Nutritive balance with replacement milk promotes weight gain and better immunity, which lowers disease risk. While dairy farms expand into other markets such as Brazil and Mexico, so does the role of milk replacers in their operations.

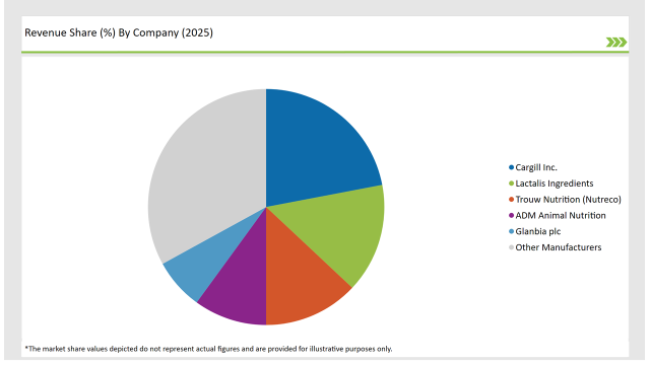

2025 Market share of Latin AmericaCalf Milk Replacermanufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Cargill Inc. | 22% |

| Lactalis Ingredients | 15% |

| Trouw Nutrition ( Nutreco) | 13% |

| ADM Animal Nutrition | 10% |

| Glanbia plc | 7% |

| Other Manufacturers | 33% |

Note: The above chart is indicative in nature

This market is centered on calf milk replacers in Latin America. The market is typically not very vast and has some multinational manufacturers such as Cargill, Trouw Nutrition (Nutreco), and Lactalis Ingredients as the key players with a considerable chunk of the overall market share. They use this strategy of concentration by acquiring or partnering with local counterparts or investing directly into regional production plants.

The objective of such an operational strategy will secure long-term contracts with commercial dairy farms and larger livestock farms through stable demand sources. These strategies would include the non-medicated formulations, which instead of antibiotics are able to strengthen calf health, and thus align with consumer preferences on all-natural items.

Besides this, manufacturers are spending on their R&D efforts in order to improve the efficiency of modern interventions such as probiotics enriched replacers and precision nutrition. Through effective technical know-how, specific formulations, as well as a strong distribution network, these players effectively limit the market share available to smaller or regional firms.

Meanwhile, regional players often compete in terms of affordability, tailoring their products to local feeding practices, and providing some flexibility in logistics in remote areas. These prime players will be gearing up for more innovations in their products and even marketing strategies as demand for these high-quality replacers increases, especially with Brazil and Mexico.

Medicated CMR, Non-Medicated CMR

Powder CMR, Liquid CMR

Direct Sales/B2B, Retail/B2C

Commercial Dairy Farms, Individual Farmers, Research & Academic Institutions

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America Calf Milk Replacer market is projected to grow at a CAGR of 8.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 646.3 million.

Key drivers include the expansion of commercial dairy farms, rising focus on early-stage calf health, and growing preference for antibiotic-free feeding practices. Countries like Brazil and Mexico are investing in structured nutrition for better herd productivity.

Non-medicated calf milk replacers dominate the market with a 65% share, reflecting a shift toward natural, preventive nutrition approaches in animal rearing.

Major companies include Cargill Inc., Lactalis Ingredients, Trouw Nutrition, ADM Animal Nutrition, and Glanbia plc, collectively holding over 60% of the market.

Powdered form is the most widely used due to ease of storage, transport, and longer shelf life-ideal for both small farms and commercial operations.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA