The Latin America fructo-oligosaccharides (FOS) market is expected to grow at a steady rate, with a compound annual growth rate (CAGR) of 7.4% during the period from 2025 to 2035. The market was valued at about USD 2443.0 million in 2025 and is expected to reach USD 4974.6 million by 2035. The demand for FOS in food, beverage and nutraceutical applications is being driven by growing consumer attention towards gut health, digestive wellness and natural sugar alternatives.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 2443.0 million |

| Projected Size (2035F) | USD 4974.6 million |

| Value-based CAGR (2025 to 2035) | 7.4% |

Fructo-oligosaccharides, known as prebiotics are being used more and more in Latin America, where they are considered a functional fiber which benefits intestinal microbiota and improves digestion. Increased awareness for healthy food consumption has led to increased adoption of FOS in dairy, infant nutrition, bakery, functional beverages and supplements sectors. Food producers currently are incorporating FOS to include health positioning, but also to improve texture and mouthfeel and sweetness without contributing calories.

A growing number of urban middle-class consumers in need, which have been prioritizing preventive health and wellness, are nurturing growth in the market across countries like Brazil, Mexico, Colombia, and Argentina. Regional governments and regulators have also started advocacy for healthier eating, including the reduction of added sugars -creating a positive environment for use of FOS in reduced- or no-sugar formulations.

On the supply side as well, local manufacturers are increasingly investing in the production of inulin & FOS that is sourced from agave, chicory roots as well as sugar beet, therefore creating the supply-side momentum. In addition, international players are expanding their presence throughout Latin America through distribution ventures, product launches, and branding backed by health claims concerning digestive support, weight management, and immunity.

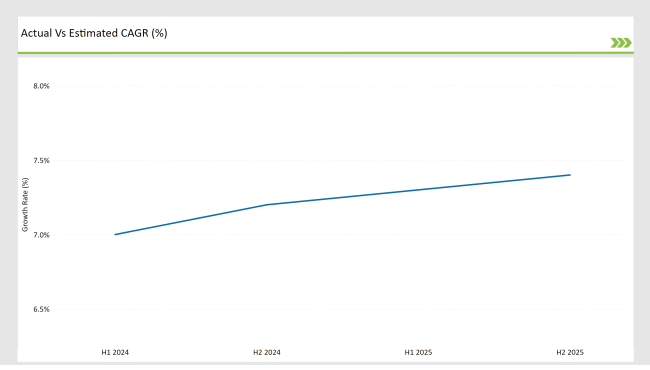

The following table provides a semi-annual breakdown of value-based CAGR to illustrate market momentum across both halves of the year for base and forecast years. This view highlights seasonal demand patterns and the introduction of fiber-rich functional foods during key consumption windows.

Generally, the second half of each cycle (H2) shows a larger CAGR, largely because the market is more active around new product launches supporting wellness campaigns in both back-to-school and end of year health resets. H2 from 2024 to 2034 grew 30 bps over H1 and H2 from 2025 to 2035 reached7.4%, as demand for fiber-fortified and sugar- reduced products is likely to remain strong.

| Date | Development/M&A Activity & Details |

|---|---|

| Feb-25 | BENEO Expands Prebiotic Production in South America : BENEO announced the expansion of its FOS and inulin production capacity in Chile to support the growing demand for natural prebiotics in Latin America. |

| Nov-24 | Ingredion Launches Prebiotic Fiber Ingredient in Brazil : Ingredion introduced a new FOS ingredient targeting functional beverage and dairy sectors, focusing on digestive wellness and clean-label claims. |

| Aug-24 | Tate & Lyle and Cosucra Partner for Plant-Based Nutrition : Tate & Lyle and Cosucra Groupe Warcoing SA initiated a strategic collaboration to promote FOS from chicory root in plant-based and sports nutrition segments. |

| May-24 | Tereos Strengthens R&D in Dietary Fibers : Tereos established a fiber innovation hub in São Paulo to develop new applications of FOS in bakery and dairy alternatives. |

| Mar-24 | Nutriagaves de México Expands Agave-Derived FOS Line : Mexican-based Nutriagaves launched new organic-certified agave FOS products, aiming to tap into regional demand for low-glycemic sweeteners and prebiotics. |

Digestive Health and Prebiotic Demand Fuel Growth

Strong growth in the Latin American FOS market is driven by growing consumer interest in gut health, digestive health, and immune health. Functional food and beverages firms are also actively integrating FOS, which has demonstrated probiotic function, in order to encourage the development and propagation of helpful gut microbiota, assisting in digestive health.

FOS From Agave Becomes Popular in Mexico

One more regional trend which is a unique feature of this region is the agave-derived FOS category overtly in Mexico, where firms like Nutriagaves de México are capitalizing on native crops to create clean-label, low-glycemic and organic FOS. These are becoming popular choices for plant-based beverages, health bars and infant nutrition products.

Setbacks of Functional Beverages and Dairy Alternatives

FOS is gaining popularity in diverse options, including functional beverages, non-dairy yogurts, and sports nutrition, owing to its mild sweetness, fiber content, and digestive benefits. FOS formulations by multinational companies like Ingredion, BENEO, and Meiji Co., Ltd are made to address flavor, texture, and stability in these expanding categories.

The following table displays the estimated growth rates of the top five countries in Latin America expected to experience high fructo-oligosaccharide (FOS) consumption through 2035.

Brazil leads the FOS market in Latin America, driven by strong end-users demand for functional food products and drinks. As digestive health emerges as a high priority in wellness, FOS, which is a prebiotic that supports good gut flora, is being used more in dairy foods, baked goods, and nutritional supplements. Brazilian food industries have been seizing this opportunity and adapting traditional products to use FOS and cater to the growing health-conscious consumer base.

Moreover, the rising awareness regarding lifestyle disorders among the expanding middle-class population of Brazil is further driving the market for dietary fibers such as FOS. FOS is included in local products launched like fortified yogurt, juices, and snacks, to meet clean-label and sugar-reduction trends. Regulatory backing for the incorporation of prebiotics into food and beverage formulations is another factor multiplying the scope of application for FOS across product categories.

FOS growth is also threatened with positivity in the Mexican market, especially functional beverages and dietary supplement market. The increasing consumer awareness regarding gut health, immunity, and general well-being, is expected to boost the demand for prebiotic fibers. Brands promote digestive balance from FOS in nutritional drinks, powders and dairy-based drinks.

Additionally, urbanization and the growing numbers of freshly diagnosed gut disease in the population have sparked interest in gut-friendly options. Cross-border trends and imports of other products from North America have accelerated the dissemination of FOS-enriched health products to the Mexican market as well. Urban Health-sensitive Millennials and Gen Z Consumers Looking for Naturally Derived Ingredients Favor FOS as a Functional Additive

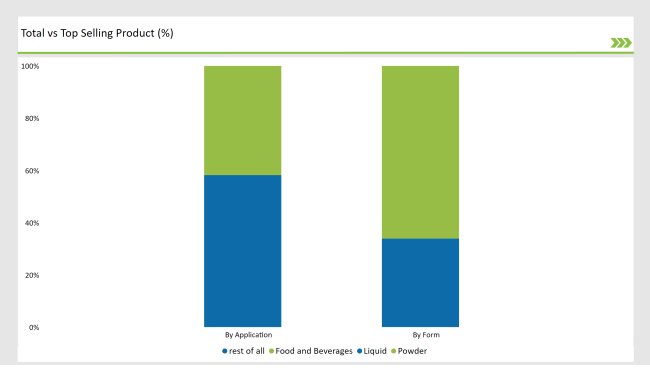

The powdered fructo-oligosaccharides form has seen considerable popularity in the Latin America market due to its stability and ease of blending along with increased shelf life. This is the most preferred form among the manufacturers as it is highly utilized in functional food, infant formulas, and nutritional supplements.

The powdered solution provides improved formulation flexibility and is suitable for dry mix applications, as in bakery goods, cereals, and powdered drinks. Plus, the bulk packaging and distribution of it makes it more cost-effective, making it an ideal fit for mass-production, solidifying its edge in the market. So easy to add to existing production lines with no change to product flavour or texture is another reason manufacturers love powdered FOS.

FOS in infant formulation is burgeoning across Latin America with people becoming aware about infant gut health and it is one of the prebiotics. For example, Fructo-oligosaccharides added to infant formulas may help mimic human milk oligosaccharide content and enhance beneficial bacteria like Bifidobacteria and immune support.

The rise in birth rates in key markets such as Brazil and Mexico and increased consumer preference for premium infant nutrition are augmenting the demand for FOS in this segment. The regulatory endorsements and clinical evidence supporting FOS advantages are also fuelling manufacturers towards infant formula fortification with these prebiotic fibres thereby, release significant demand in the foreseeable future.

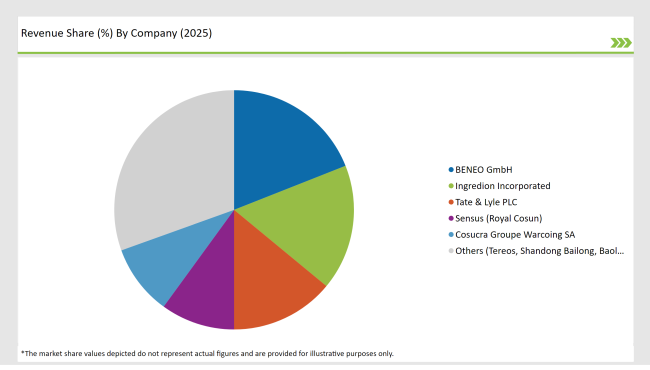

2025 Market share of Latin American FOS suppliers

Note: above chart is indicative in nature

The Latin American FOS market is moderately consolidated; a variety of global ingredient suppliers and local players are responding to the growing demand for prebiotic fibers and functional food ingredients. The market in Latin America is also concentrated with major players, such as, BENEO GmbH, Ingredion Incorporated, and Tate & Lyle PLC with global manufacturing ability, application expertise, and strong distribution partnerships.

These players continue to thrive with the ability to supply international safety and functional quality standards meeting their high-purity FOS ingredients as well as the growing focus on digestive health, low-calorie sweeteners, and clean-label demand. Cosucra GroupeWarcoing SA and Tereos Group also serve important roles with their tailored food & beverage and nutraceutical offerings. Regional and emerging suppliers including CorporativoNutriagaves de México, Sensus and Shandong BailongChuangyuan Bio-Tech Co. Ltd. are penetrating the market by providing price competitiveness, leveraging local geographic production advantages.

As per form the industry has been categorized into Powder and Liquid

The segment is further categorized into Infant Formulation, Food and Beverages, Animal Feed, Dietary Supplements and Pharmaceuticals

Source in further categorized into Sucrose and Inulin

The Latin American FOS market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.4% from 2025 to 2035, driven by increasing demand for prebiotics and functional foods.

By 2035, the Latin American prebiotics market, which includes FOS, is expected to reach approximately USD 2443.0 million, up from an estimated USD 4974.6 million in 2025.

Key drivers include rising health consciousness among consumers, increasing demand for functional foods and beverages, and growing awareness of the benefits of prebiotics in promoting gut health.

Brazil leads the Latin American FOS market in terms of revenue, while Argentina is the fastest-growing market in the region.

Prominent manufacturers in the Latin American FOS market include BENEO, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, and Nutriagaves.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA