The Latin America bubble tea market is likely to grow significantly from an estimated USD 304 million in 2025 to about USD 821.4 million in 2035 with a compound annual growth rate (CAGR) of 10.5% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 304 million |

| Projected Latin America Value (2035F) | USD 821.4 million |

| Value-based CAGR (2025 to 2035) | 10.5% |

Latin America is experiencing an emerging Asian-style drinks trend, and bubble tea is at the forefront among Gen Z and millennials consumers. With the convergence of social media fads, flavor creativity, and customization, bubble tea is fast becoming popular in urban markets like São Paulo, Buenos Aires, and Mexico City.

Consumer trial and penetration are also being facilitated by the high-energy café culture and increasing chain presence of Asian fusion restaurants. Consumers in Latin America are increasingly embracing lower-sugar, fruit-flavored, and herbal products that enable wellness-driven choices, leading to tapioca pearl innovation and plant-based alternatives to milk.

This, retail expansion in the form of specialty kiosks, mall stores, and delivery platforms is changing the business model of bubble tea in the region. Increasing formal tea cafés and in-market foreign franchise penetration is favoring standardized menu options and brand consideration.

Companies are also making investments in pre-mixed kits and RTD (ready-to-drink) packaging formats for home consumption among young consumers on convenience-based packaging grounds. With higher disposable incomes and high visual appeal, bubble tea will be a non-alcoholic beverage mainstreamer in Latin America's changing marketplace.

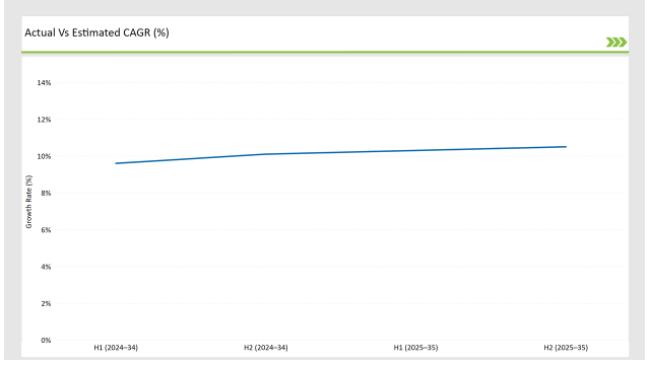

The half-yearly update mirrors the shifting dynamics in the Latin American bubble tea market by contrast of CAGR percentages between H1 and H2 of 2024 and 2025. This mirrors short-term changes in consumption, pricing, and innovation cycles.

H1 represents the January to June period, H2 represents the July to December period.

In 2024, the market started on a positive note with 9.6% CAGR in H1, increasing to 10.1% in H2, showing initial signs of organized retail growth and flavor innovation. In 2025, H1 will be succeeded by 10.3% CAGR, increasing further to 10.5% in H2, driven by influencer marketing, premiumization of ingredients, and café-level beverage personalization. This is a 70 basis point increase year-over-year, showing more intense market consolidation and consumer adoption of bubble tea variants.

Fusion of Cultures in a Cup: Developing Flavor for Bubble Tea in Latin America

The bubble tea industry throughout Latin America is experiencing a colorful transformation as local people more and more move towards global beverage culture infused with native flavors. While bubble tea from Asia became popular, Latin American entrepreneurs now combine traditional milk tea bases with indigenous fruits like mango, guava, passionfruit, and tamarind.

These changes are not only flavor-based but also to be localized into local culture and identity. Thus, bubble tea cafes throughout the region are revolutionizing the beverage industry with creative and culturally relevant beverage options that appeal to a wider demographic of consumers.

Health in a Cup: Functional Ingredients Revolutionize Bubble Tea Formulas

The health revolution sweeping Latin America is encouraging bubble tea brands to come up with functional ingredients that will attract consumers' focus on physical health. Bases of tea - such as green tea or matcha, and hibiscus are now being merged with chai seeds, collagen, probiotics and plant-based options for milk to make the dessert more health-conscious.

These health-focused blends are leveraging the rise in demand for sugar-free content and artificial-free ingredients, so it's no wonder they are in particularly high demand among Gen Z and millennials. The trend positions bubble tea as so much more than a liquid dessert but also as a means of functional everyday nutrition.

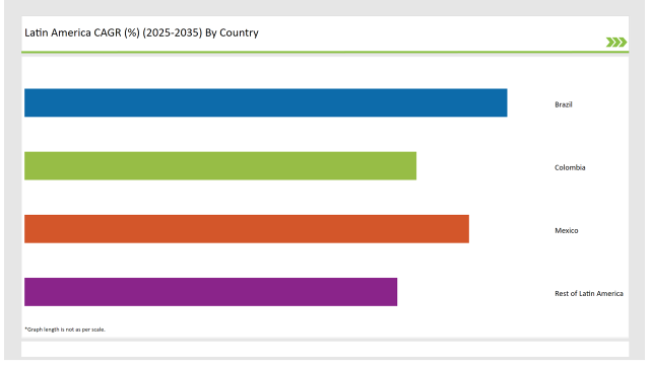

The following table shows the projected growth rates of the top two markets. They will have high consumption and high CAGRs through 2035.

There is growing popularity of bubble tea in Brazil as the drink gains popularity among teenagers and promoted to customers as a social drink. Cities of São Paulo and Rio de Janeiro in Brazil are witnessing a bubble tea chain store epidemic in shopping malls, food mobiles, and common work spaces to cater to fashion-conscious audiences.

Shops combine Brazilian flavors such as coconut milk and açaí into an Asian foundation, and thus give it a Brazilian twist. Rise in influencer marketing and visual coolness of bubble tea has also rendered it distinctive in the Brazilian café culture. While bubble tea has become city nightlife party joints' signature, visibility and mainstream adoption should drive long-term expansion in Brazil.

Mexico's bubble tea sector is enjoying solid momentum from the convergence of e-commerce and on-demand delivery platforms. Young Mexican consumers in Mexico City, Guadalajara, and Monterrey increasingly order bespoke bubble tea flavors through mobile apps, and volumes are rising for boutiques as well as mass chains.

Demand for home delivery is also fueling packaging and product innovation initiatives. Brands are launching RTD (ready-to-drink) bubble tea packaging and subscription programs to increase convenience and interaction. Such online push is essential in turning bubble tea into a habitual treat for Mexico's tech-oriented and adventurous consumers.

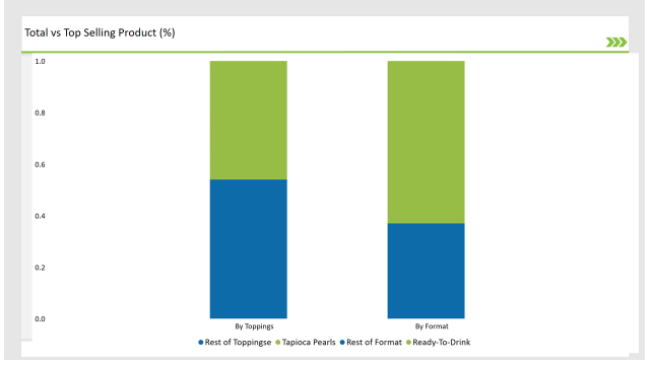

Ready-To-Drink (RTD) bubble tea dominates the market in 2025 with 62.5% of market share in Latin America because of strong consumer adoption among urban Brazilian and Mexican consumers. RTD formats are convenient to consume and readily available from cafes, vending machines, and supermarket chiller cabinets.

This can be attributed to lifestyles of the consumers, rising demand for functional drinks, and youth targeting. Brands are introducing new products in green-colored bottles with appeal to Gen Z consumers and health-conscious consumers. RTD also rides on the wave of impulse buying behavior and wide availability in foodservice and convenience channels.

Tapioca pearls rule the market for bubble tea toppings in Latin America at 45.8% in 2025. Hugely favored due to their chewy nature and sheer popularity, these pearls are the foundation of traditional bubble tea menus. Brazilians, Mexicans, and Chileans all connect the bubble tea experience with tapioca and hence consider it a staple menu option. Foodservice operators are interested in procuring good-quality tapioca and are also testing honey-coated or flavored versions.

In spite of increasing competition from newer-aged toppings, tapioca pearls still maintain leadership position on the grounds of nostalgic value, mass familiarity, and high repeat purchase behavior.

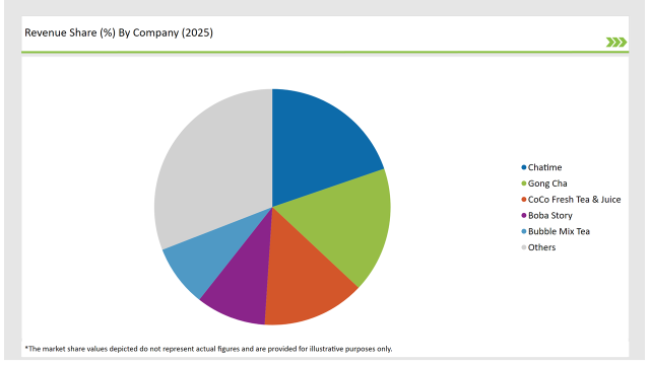

2025 Latin America Bubble Tea Market Players' Market Share

Note: above chart is indicative in nature

Bubble tea market in Latin America is relatively consolidated as top international brands occupy more than 50% of the regional market share. The leaders are the big three, Chatime, Gong Cha and CoCo Fresh Tea & Juice, whose rare and consistent quality has meant only 5% of sales are repeat customers as they dominate the market with established franchise networks and premium positioning. The incumbents reign in Mexico and Brazil, where cafe culture is also coming strong.

Local players like Boba Story, Tplus and Bubble Mix Tea emphasize affordability and local flavors to appeal to price-sensitive millennials and post-millennials. Chains seeking a share at their newly entering markets are doing so through localized promotion and focused toppings. When looked at overall, independent cafes are distributed, reflect market diversity and push the envelope with regional flavor and format experimentation.

As per Format type, the industry has been categorized into Ready-To-Drink, and Ready-To-Mix.

As per the Toppings, the industry is sub-segmented into Tapioca Pearls, Popping Bob Bursting Bubbles, Taro Balls, Coconut Jelly, Red Bean, Grass Jelly, and Fruit Bites.

Unflavored, Flavored, Nut Flavored, Honey, Mocha, Caramel, Vanilla, Taro, and others are key Flavors covered in report.

The distribution channel segment includes Food Service Industry, and Direct Sales the direct sales is further categorized into Hypermarket Supermarket, Convenience store, Grocery Retailers, Specialty Retailers, Wholesale Stores.

The Latin America bubble tea market is projected to grow at a CAGR of 10.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 821.4 million.

The market's growth is driven by increasing urbanization, the influence of Asian cultures, and a rising demand for novel beverages among younger demographics.

Brazil is expected to register the highest CAGR from 2025 to 2035, making it a key region in the Latin America bubble tea market.

Leading manufacturers include Lollicup USA, Inc., Gong Cha, Bubble Tea House Company, Ten Ren's Tea Time, and Fokus Inc.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA