The Latin America Starch Derivatives market is expected to reach USD 2.52 billion in 2025 and is projected to experience a steady year-over-year growth, reaching a total value of USD 3.67 billion by 2035. This represents a compound annual growth rate (CAGR) of 6.4% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size in 2025 | USD 2.52 billion |

| Projected Value in 2035 | USD 3.67 billion |

| Value-based CAGR from 2025 to 2035 | 6.4% |

Latin America starch derivatives market, estimated at USD 2.52 billion in 2025 and poised to reach USD 3.67 billion in 2035, is witnessing growth at a CAGR of 3.8%. The market is moderately concentrated with major ingredient producers widening their domestic production and distribution networks to meet mounting demand for food, beverage, pharmaceutical, and industrial use. Expansion plans target localized processing plants and supply chain integration to reduce dependence on imports and enhance responsiveness to customer requirements.

As customers increasingly seek clean-label, low-calorie, and plant-based products, manufacturers reformulate starch derivatives such as maltodextrin, glucose syrup, and modified starches to meet functionality requirements while being sensitive to health and transparency trends. This shift is compelling businesses to invest in enzyme-based and non-chemical modification processes to produce more natural and sustainable options.

The growth in Latin American processed food, particularly convenience meals, dairy, and snacks, is a key driver of demand for shelf-stabilizing and texture-altering starch derivatives. Companies are meeting this demand by modifying ingredient functionality to suit applications, e.g., improved freeze-thaw stability and controlled viscosity, to suit the different needs of regional food companies.

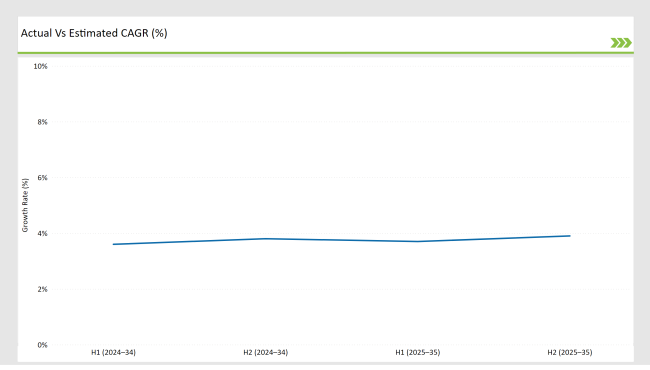

The below table provides a comprehensive comparative half-yearly change in compound annual growth rate (CAGR) for the base year (2024) and current year (2025) individually for the Latin America Starch Derivatives market. Half-yearly depiction provides extreme fluctuations in market trends and mirrors trends in revenue realization, providing the stakeholders with a better idea of the trend in growth for the year. H1 is the first half of the year, i.e., January to June, and H2 is the second half from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Comparative analysis of the growth trend of the Latin America starch derivatives market in 2024 and 2025 shows wide performance difference in demand and supply. The sector will grow by a compound annual rate of growth (CAGR) of 3.6% in the first half of the year 2024 (H1) and later at a slightly higher rate of growth of 3.8% in the second half of 2024 (H2).

Growth rates are expected to be 3.7% in H1 and 3.9% in H2 in 2025. It is a slow growth in growth rates, showing rising demand for starch derivatives. These spikes are seasonal based on demand fluctuations seasonally and raw material price volatilities exerting a temporary effect on the market.

| Date | Development/M&A Activity & Details |

|---|---|

| Apr-24 | Regional beverage companies began reformulating products using modified starches to enhance texture and stability, aligning with health-conscious trends. |

| Jul-24 | A leading multinational entered into a joint venture with a local starch producer in Argentina to expand production capacity and distribution networks. |

| Sep-24 | Regulatory bodies in Latin America updated guidelines on starch derivative Latin America ge in food products, prompting industry-wide adjustments in formulations. |

| Dec-24 | Increased research and development efforts focused on sustainable sourcing of starch derivatives, aiming to reduce environmental impact and improve supply chain resilience. |

| Mar-25 | A significant merger between two regional starch derivative companies aimed to consolidate market presence and streamline operations across Latin America. |

Pharmaceutical and Personal Care Applications

The pharmaceutical industry in Latin America employs starch derivatives as excipients to drugs in the aid of controlled release of active ingredients. Derivatives also find application in the personal care industry in creams and lotions because they possess stabilizing and moisturizing properties. Health and hygiene consciousness have encouraged demand for such applications.

Industrial and Textile Uses

Apart from consumables, starch derivatives are used in the textile industry as sizing agents to boost the strength and smoothness of yarns during weaving. In paper production, they are used as coatings for printability improvement and surface quality improvement. Latin America's fast industrialization increases consistent demand for the functional ingredients.

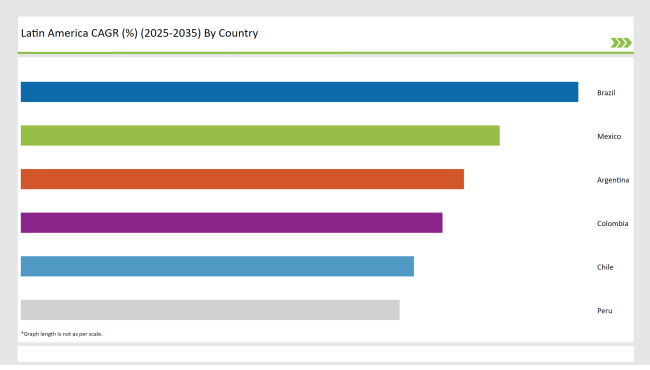

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Latin American starch derivatives market is increasing moderately with increased use of processed food and convenience food in Brazil, Mexico, and Argentina. Along with the development of urbanization and improvements in work-life balance, packaged foods based on starch derivatives as a stabilizing, thickening, and sweetener agent are chosen by consumers in these nations to a larger degree.

This heightened dependence on convenience foods, snacks, and beverages has spurred demand for such ingredients as maltodextrin, glucose syrup, and modified starch, mainly among middle-income families. Furthermore, the consumption practice of milk-based drinks and functional beverages has moved starch derivatives to other food and beverage innovations.

The industrial sector is also contributing a gigantic share to this market growth with starch derivatives use in pharmaceuticals, paper production, and textile treatment. Government support towards industry development and infrastructure development in large economies like Brazil has accelerated the commercial use of starch derivatives.

Also, greater investment in the region by multinational food processing and ingredient companies has contributed to an integrated supply chain, which is increasingly available locally. These, combined with population expansion and growing consumer awareness of functional ingredients, are all feeding favorable conditions for growth in the starch derivative market across Latin America.

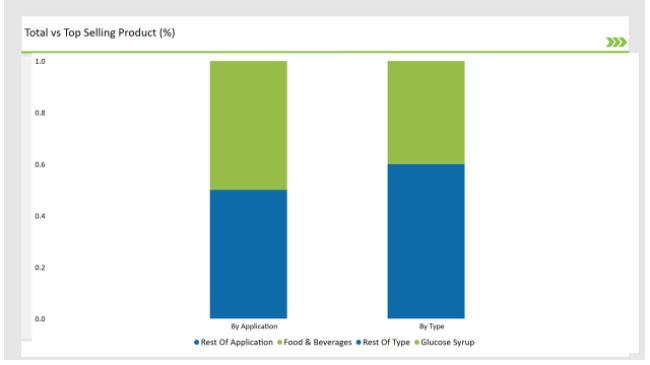

% share of Individual categories by Type and Applications in 2025

This growth is triggered by the increasing need for processed foods and beverages where starch derivatives are utilized to thicken, stabilize, and sweeten. Glucose syrup and maltodextrin will be the most dominant types since they will find widespread application in foods. The foods and drinks industry will drive the market, as it reflects the regional trend of consuming convenience foods.

Pharmaceuticals and cosmetic & personal care segments are expected to witness high growth due to expanding uses of starch derivatives in pharmaceutical products and cosmetic products. The industrial segment would also benefit from increasing demands for biodegradable and environment-friendly materials with the starch derivatives offering environment-friendly solutions.

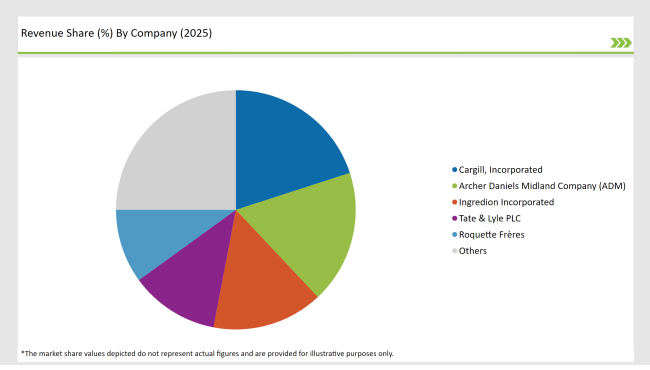

Market leaders like Cargill, ADM, and Ingredion dominate the Latin American starch derivatives market with technologically superior processing units and extensive distribution networks. Their focus is on product innovation and strategic partnerships to establish strong footing in the market, particularly in food & beverages, pharmaceuticals, and paper industries.

2025 Market share of Latin America Starch Derivatives suppliers

Note: above chart is indicative in nature

The market environment also includes local and specialty players with starch derivatives available to address special consumer requirements, such as clean-label and non-GMO starch derivatives. Increasing demand for processed food, health awareness among consumers, and increased emphasis on sustainability and plant-based ingredients also spur market growth.

The industry is segmented into bread, pizza, buns, cakes, cookies, waffles & pancakes, and others, with bread holding the largest share due to its widespread consumption globally.

The industry includes Type I, Type II, and Type III starter cultures, with Type I being the most used due to its effectiveness in traditional and commercial baking.

Latin America

By 2025, the Latin America starch derivatives market is expected to grow at a CAGR of 3.8%.

By 2035, the sales value of the Latin America starch derivatives market is expected to reach USD 3.67 billion.

Key factors propelling the Latin America starch derivatives market include the expanding processed food industry, increasing demand for sweeteners and thickeners in beverages and dairy, and growing use of starch derivatives in pharmaceutical and paper applications.

Brazil is expected to lead in starch derivatives consumption due to its large-scale food processing industry, rising middle-class population, and growing demand for convenience food products.

Prominent players in the Latin America starch derivatives manufacturing include Cargill, Ingredion, Archer Daniels Midland Company, Tate & Lyle, and Tereos. These companies are noted for their extensive manufacturing capacities, diversified product offerings, and strong distribution networks across the region.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA