The Latin America non-alcoholic malt beverages market is set to grow from an estimated USD 2,612.2 million in 2025 to USD 5,319.1 million by 2035, with a compound annual growth rate (CAGR) of 7.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 2,612.2 million |

| Projected Latin America Value (2035F) | USD 5,319.1 million |

| Value-based CAGR (2025 to 2035) | 7.4% |

In Latin America, younger people are drinking less alcohol. This change in the younger generation is due to a greater awareness of health and wellness issues. This group of people sees health as an essential factor and strives to find alternatives that match their chosen lifestyle.

Social events are changing, the norm of non-alcoholic beverages coming being more accepted and preferred so that the people could participate in a gathering without having a drink. This is a change of culture that also affects global life to balance consumer experience with physical well-being.

Marketing strategies are being used to target and attract a diversified crowd by associating non-alcoholic malt beverages as trendy drinks. Out-of-the-box campaigns convey the benefits and the unusual flavors of these drinks thus making them desirable for buyers.

Moreover, the introduction of new products, like new flavors and cool packages, is a vital factor in arousing consumers' interest. Such emphasis on marketing and newness aids companies to soar high on the level of non-alcoholic malt beverages in the competitive market of refreshment.

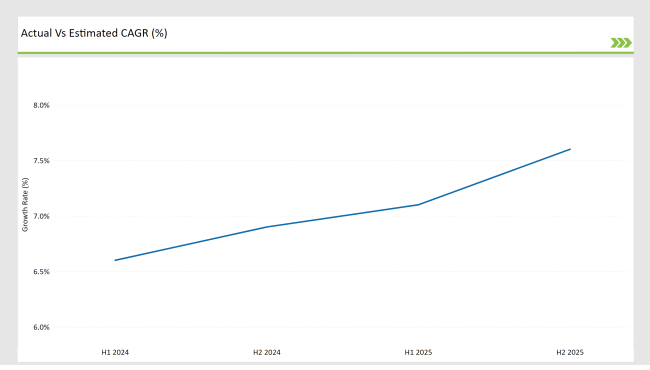

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America non-alcoholic malt beverages market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December.

For the Latin America non-alcoholic malt beverages market, the is predicted to grow at a CAGR of 6.6% during the first half of 2024, with an increase to 6.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 7.1% in H1 and is expected to rise to 7.6% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

Building Community and Brand Loyalty Through Social Media Engagement

Social media channels have turned into indispensable media as they have prompted the change in consumer preference of alcoholic malt beverages to non-alcoholic products in addition to the influence of younger demographics. The companies are using Instagram, Facebook, and TikTok together to make funny and interesting content that exhibits their products, talks about special tastes, and gives messages in a lifestyle format.

Collaborations with promoters make the brand more popular since the brand's relation with them is like an adjectival phrase, e.g. non-alcoholic beverages in a social situation. Interactive competitions like contests and user-generated content are such that they can get the community involved and at the same time will brand loyalty.

Social media also allows imputes for information and the clientele to communicate directly, therefore the companies may react pretty soon to the new trends and customer wishes. The dynamic way of marketing not only fosters visibility but also brings about entirely higher sales and market share.

Quick and Easy: The Popularity of Ready-to-Drink Non-Alcoholic Options

The rising need for convenient items is a key reason for the fast spread of individually packable non-alcoholic malt beverages. Since the consumer living has become rapidly hectic, finding products that are fast, and simple to get, along with quality plus taste, is a consumers foremost priority.

Aseptic single-serve packaging is the top choice that has been ruling, which means that consumers can carry their drinks without a worry for time and convenience such on buses, workplaces, or activities outdoors. Another is that resealable bottles and cans are very portable and practical besides being easy to consume which promotes user experiences.

This shift is most attractive to the younger ones because they are convenience seekers and tend to pick drinks that fit well into their such age groups. Hence the brands are in the process of developing new ones which justifies the sale volume and the line's growth.

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

In Brazil the non-alcoholic malt beverage market has grown remarkably due to both local and international brands. The result of the increase is not only the addition of new products but also the innovative flavors and formulations that are designed to meet the different preferences of the consumers.

The brands are now presenting to the consumers drinks made from traditional Brazilian ingredients, thus, connecting to local tastes and at the same time, giving a chance to drink healthier. The consumers are the first ones to be affected by this new collection, as they discover that they also can choose drinks that suit their tastes and lifestyles. Hence, this phenomenon encourages many to go out and try the drinks, and this directly affects the market's growth and acceptance in a positive way.

Mexico brands are heavily focusing on targeted marketing campaigns to connect with consumers, particularly the younger generation, by stressing the fun and social components of non-alcoholic malt beverages. By such campaigns these types of drinks are presented as modern and possibly for different occasions, thereby efficiently making them desirable alternatives for alcoholic ones.

Accordingly, government projects are implemented that encourage responsible drinking and create public health awareness which are both necessary for consumers' behavior. Through the public health campaigns the people are incited to choose the healthier way while the advantages of the non-alcoholic drinks are brought up.

Together with strategic marketing and supportive regulatory factors this positive imagery of non-alcoholic malt drinks will bring their popularity up in Mexico where social occasions are held.

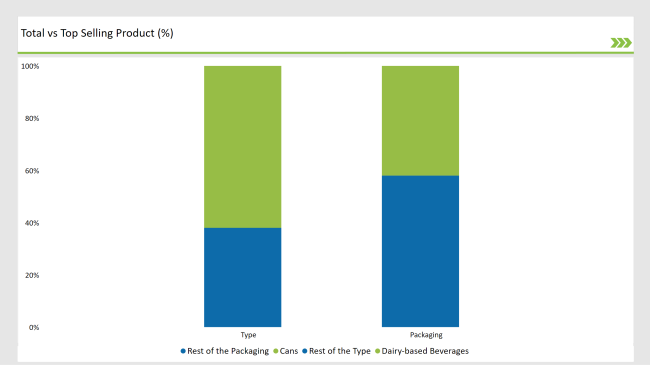

% share of Individual categories by Type and Packaging in 2025

The burgeoning popularity of functional beverages indirectly accelerates the demand for dairy-based drinks in Latin America. Consumers now are keener on purchasing products that promos health benefits other than just surviving, besides the manufacturers fortifying their drinks with probiotics, prebiotics, and extra vitamins.

Their relation with health trends make these products attractive to consumers looking for functional solutions to their health problems. Besides that, dairy drinks are viewed as products with the best nutritional components that supply our body with calcium, protein, and vitamins.

The problems consumers' consciousness was playing along with ones now become engineering the better health and dairy drink repercussions. The promise of functional benefits and nutrient density is underpinning growth in the market.

The growing interest in can packaging among the Latin American non-alcoholic malt beverages market due to the convenience and portability is the main area driving it. The fact that cans are light and can be easily transported makes them the ideal solution for people with a busy lifestyle looking for instant and ready-to-drink products.

Moreover, cans come with an airtight seal that not only prevents the outside air and moisture from getting in but also protects the beverage from spoilage and thus, the customer, who expects a consistent taste, is satisfied. This property of preservation is especially important for cocktails that do not contain alcohol, where the flavor is a major factor in customer satisfaction.

Together, these two reasons present cans as a popular selection for both customers and manufacturers, thus, improving the market for non-alcoholic malt beverages.

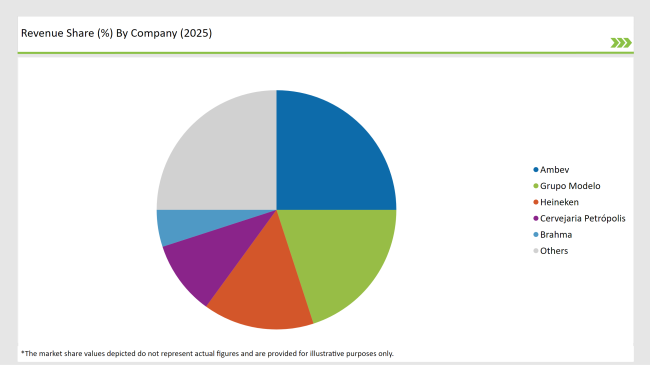

2025 Market share of Latin America Non-Alcoholic Malt Beverages Manufacturers

The Latin America non-alcoholic malt beverages market is at a middle level in terms of consolidation, with significant players such as Ambev, Grupo Modelo, and Heineken pushing the industry with their supply chain and wide portfolio of brands. The companies use the brand power, innovation in the products, and the right marketing strategy to rise their market share.

In addition, some new major labels like Cerveza Polar and other local craft brewers focus on special flavors and health-oriented products which are their approaches on the niche markets. With this competitive environment, the problem of consumer demands in the non-alcoholic malt beverages business is addressed by offering diversified choices.

As per Type, the industry has been categorized into Dairy-based Beverages and Carbonated and Soda Drinks.

As per Flavor, the industry has been categorized into Citrus, Berry, Pomegranate, Classic/ Natural, Apple, Peach, Mixed Fruit, Coffee/Cocoa, and Others (vanilla, tea, etc.).

As per Packaging, the industry has been categorized into Bottles, Cans, and Liquid Cartons.

As per Application, the industry has been categorized into Direct and Indirect (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Discount Stores, Independent Retailers and Online Retailers)

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America non-alcoholic malt beverages market is projected to grow at a CAGR of 7.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 5,319.1 million.

Companies are actively investing in marketing strategies that position non-alcoholic malt beverages as trendy and appealing to a diverse audience.

Mexico and Brazil are key regions with high consumption rates in the Latin America non-alcoholic malt beverages market.

Leading manufacturers include Ambev, Grupo Modelo, Heineken, Cervejaria Petrópolis and Brahma.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA