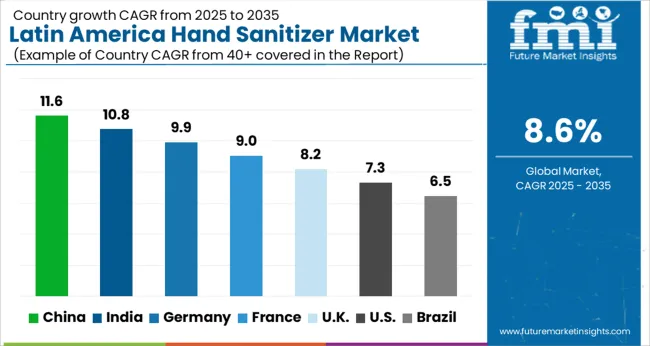

The Latin America Hand Sanitizer Market is estimated to be valued at USD 908.7 million in 2025 and is projected to reach USD 2073.7 million by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

| Metric | Value |

|---|---|

| Latin America Hand Sanitizer Market Estimated Value in (2025 E) | USD 908.7 million |

| Latin America Hand Sanitizer Market Forecast Value in (2035 F) | USD 2073.7 million |

| Forecast CAGR (2025 to 2035) | 8.6% |

The Latin America hand sanitizer market is undergoing continued expansion, supported by elevated hygiene consciousness, institutional demand, and sustained product integration across public, commercial, and personal use environments. The region’s regulatory reinforcement of hand hygiene in healthcare, hospitality, and transport sectors has encouraged consistent consumption patterns.

Key manufacturers are localizing production and expanding retail reach through omnichannel strategies, ensuring accessibility even in semi-urban and rural zones. Improvements in formulation transparency, skin-friendly ingredients, and cost-effective packaging have enhanced consumer retention.

The market is also being influenced by heightened awareness during and post-pandemic, with health authorities maintaining public messaging around infection prevention. Looking forward, growth is expected to be driven by demand for dermatologically safe sanitizing solutions, brand diversification, and increased institutional contracts from education and industrial facilities.

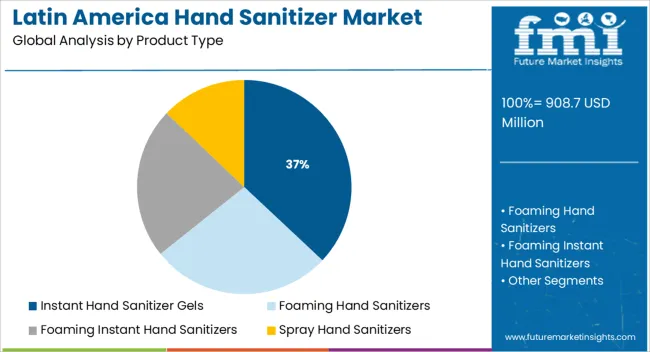

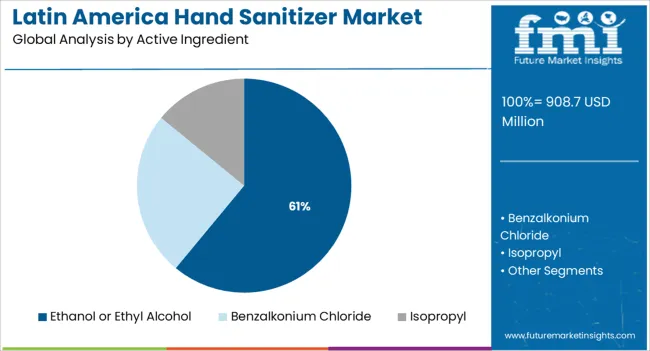

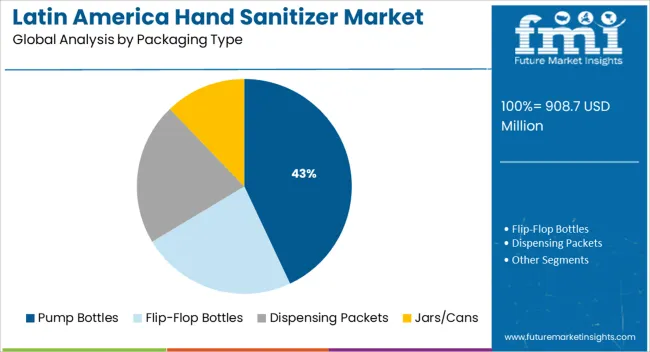

The market is segmented by Product Type, Active Ingredient, Packaging Type, End Use, Pack Size, and Sales Channel and region. By Product Type, the market is divided into Instant Hand Sanitizer Gels, Foaming Hand Sanitizers, Foaming Instant Hand Sanitizers, and Spray Hand Sanitizers. In terms of Active Ingredient, the market is classified into Ethanol or Ethyl Alcohol, Benzalkonium Chloride, and Isopropyl. Based on Packaging Type, the market is segmented into Pump Bottles, Flip-Flop Bottles, Dispensing Packets, and Jars/Cans. By End Use, the market is divided into Institutional and Household. By Pack Size, the market is segmented into 101 ml - 300 ml, Below 100 ml, 301 ml - 500 ml, and 501 ml & Above. By Sales Channel, the market is segmented into Hypermarkets/Supermarkets, Specialty Stores, Multi-Brand Stores, Online Retailers, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Instant hand sanitizer gels are expected to account for 37.00% of total revenue in 2025, making them the leading product type in the Latin America hand sanitizer market. This segment’s growth is attributed to the balance it offers between effective microbial action and ease of application.

Gels are perceived as more convenient for personal and on-the-go use, with improved skin tolerance due to added moisturizers. The quick-dry, non-sticky formulation has made it popular in high-traffic retail, corporate, and healthcare environments.

Manufacturers have optimized viscosity and active ingredient dispersion to maintain performance while enhancing user comfort. Branding strategies around instant sanitization and travel-safe packaging formats have further propelled demand, particularly in urban retail chains and pharmacy outlets.

Ethanol or ethyl alcohol-based hand sanitizers are projected to hold 61.00% of the overall market share in 2025, reinforcing their dominance among active ingredients. This is driven by ethanol’s recognized efficacy against a wide range of pathogens and approval by health regulatory bodies.

The compound’s faster evaporation rate, broad antimicrobial spectrum, and minimal residue properties have made it a preferred choice in both consumer and clinical settings. Regional production capabilities and ethanol availability in Latin America have also ensured supply chain stability and pricing advantages.

Additionally, ethanol formulations have gained favor due to lower skin irritation risk compared to alternative actives when paired with humectants and emollients, further cementing their leadership in multi-use settings.

Pump bottles are projected to contribute 43.00% of total market revenue in 2025, making them the most preferred packaging type in the Latin America hand sanitizer market. Their popularity is driven by convenience in dispensing controlled doses, reduced spillage, and suitability for shared or institutional environments.

Pump formats align well with both household and professional usage, particularly in healthcare, education, and office setups. The packaging’s compatibility with refill initiatives and its alignment with hygiene protocols requiring non-contact operation have further enhanced adoption.

Brands are leveraging pump bottles to support bulk-use economics while offering ergonomic, tamper-evident designs that meet regulatory packaging requirements. This has solidified their presence as the standard for fixed-location sanitizing stations across Latin America.

In the past few years, people have become more health conscious due to rising cases of infections and increasing health issues. Hence, the demand and awareness of public hygiene are surging at a rapid pace globally.

Hygiene is critical since it can help prevent the transmission of germ-borne disorders. Adoption of basic hand hygiene practices can reduce the risk of food poisoning, flu, and other diseases. Germ transmission is most often caused due to poor hand hygiene, according to the World Health Organization (WHO). It is also claimed that illnesses kill hundreds of people every day all across the world, including in Latin America.

As a result, hand cleanliness has become critical in public health interventions. Well-known companies in the Latin America hand sanitizer market such as Dettol, Lifebuoy, and others, are creating awareness about hand hygiene through several hygiene campaigns. Meanwhile, the public's fast-expanding knowledge of hand hygiene is projected to increase the demand for hand sanitizers in the next ten years in Latin America.

Unique Advertising Methods via Social Media to Propel Sales of Hand Disinfectants

The fast-paced advertising and technological landscape has become an essential part of the personal hygiene industry, as customers seek the best features and ingredients in a shorter duration when it comes to searching for one. Awareness of hand sanitizers among customers is increasing due to various social media and digital platforms.

Technological advancements that are enhancing digital platforms such as e-commerce, artificial intelligence, the internet of things (IoT), and big data are further boosting sales of hand sanitizer through the online sales channel. Online platforms are set to be responsible for the fast-paced advertising in this industry. These rapid changes in technology and advertising tactics have increased competition between various companies. Offering innovative services and focusing on advertisement strategies would help key players to flourish in the Latin America hand sanitizer market.

Government Bodies to Encourage the Use of Hygiene Products for Maintaining a Clean Environment

Brazil is one of the fastest-growing markets for hand sanitizers and holds a share of 37.7% of the Latin America hand sanitizer market. The hand sanitizers market in Brazil is anticipated to exhibit growth at a CAGR of 6.0% during the estimated tenure.

Due to its high & efficacy and inexpensive nature, ethyl alcohol was initially suggested for use in hospital practice in Brazil for sanitary hand washing. Hand sanitizer includes emollients that reduce skin dryness, and this was the primary reason for its widespread use among Brazilians, particularly in hospitals. Furthermore, the government's attempts to maintain a hygienic environment in the country are expected to aid growth. For instance, in compliance with stringent norms implemented by the World Health Organization (WHO), the global problems associated with hygiene were evaluated and applied in Brazil by the National Health Surveillance Agency (ANVISA).

Availability of Premium Scented Hand Sanitizers in Mexico to Aid Growth by 2035

Mexico is one of the most lucrative markets for hand sanitizers and holds a share of 21.5% of the Latin America hand sanitizer market. The Mexico hand sanitizer market is anticipated to showcase growth at a CAGR of 8.4% during the evaluation period.

With the growing adoption of hand sanitizers among the masses, manufacturers are nowadays focusing on selling premium hand sanitizers. Premium hand sanitizers with unique ingredients and add-on functionalities such as moisturizing effects and soothing fragrances are taking up significant retail space across Mexico.

Moreover, people are nowadays ready to spend more on premium products due to their concerns about health and hygiene. The above-mentioned factors are anticipated to boost sales of hand sanitizers in Mexico.

High Standard of Living & Disposable Income to Drive Sales of Pocket Hand Sanitizers in Columbia

Colombia is one of the emerging countries in the Latin America hand sanitizer market and it holds a share of 7.2% at present. The hand sanitizer market in Colombia is anticipated to rise at a CAGR of 10.5% during the assessment period.

With rising disposable income in Colombia, there is a considerable upsurge in the use of personal hygiene goods. The standard of living, disposable income, urbanization, and economic significance of the personal care business have all dramatically changed in lower and medium-income communities. Over the past few years, the consumption of hygiene products has significantly grown in the country, and the trend is anticipated to continue in the next ten years.

Demand for Instant Moisturizing Hand Sanitizer Gels to Surge in the Next Decade

Based on product type, instant hand sanitizer gels hold a high share of 75.5% in the overall Latin America hand sanitizer market. Sales of instant hand sanitizer gels are anticipated to grow at a CAGR of 7.5% during the forecast period.

One of the main factors fueling the demand for instant hand sanitizer gels is the emergence of quick hand sanitizer gels made with ethanol or ethyl alcohol components that eliminate 99.9% of bacteria in seconds and also feature moisturizer to alleviate skin dryness. It is also anticipated that the demand for foaming instant hand sanitizers will grow rapidly in the next decade at a CAGR of 13.3%.

Hand Sanitizer Wipes to Gain Impetus in the Institutional Sector by 2035

In terms of end use, the institutional segment holds a significant share of 80.4% of the Latin America hand sanitizer market. As per FMI, the institutional segment is anticipated to grow at a CAGR of 7.3% during the forecast tenure.

There is zero tolerance for viruses and bacteria in the commercial sector such as in hotels and food service restaurants. The commercial sector is abiding by stringent rules and regulations on food safety and hygiene. Consequently, the commercial sector is increasing its adoption of hand sanitizers and encouraging employees such as chefs, waiters, barbers, food industry workers, and others to use hand sanitizers frequently. These factors are anticipated to drive the institutional segment in the Latin America hand sanitizer market.

Below 100 ml Packs of Natural Hand Sanitizers to Witness High Sales in Latin America

In terms of pack size, the below 100 ml bottle segment holds a major share of around 51.2% in the Latin America hand sanitizer market. FMI predicts that the segment is anticipated to grow steadily at a CAGR of 9.0% during the forecast period.

Demand for less than 100 ml bottles is set to grow significantly due to their compact size. Hence, manufacturers are developing mini packs that are easy to use and store. Moreover, small-sized bottles provide easy mobility, are lightweight, and are pocket-friendly. Thus, smaller package sizes are gaining high popularity among buyers.

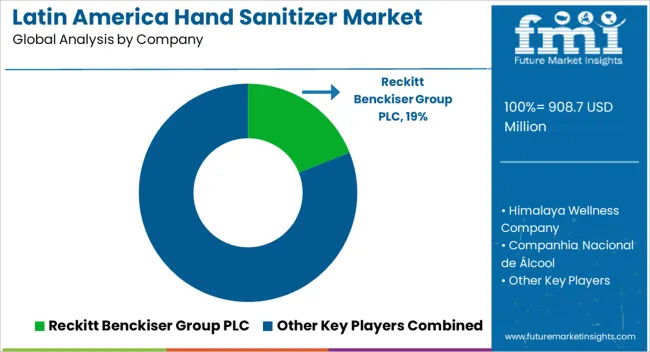

Leading players present in the Latin America hand sanitizer market are focusing on new product launches and mergers & acquisitions to increase their global presence and capture a high revenue share. To cater to the increasing demand for hand sanitizers in the region, manufacturers are focusing on expanding their existing product lines or are including newer products in their respective offerings.

For instance,

Procter & Gamble Company, Reckitt Benckiser Group, and Unilever plc Are on a Spree to Introduce Long-lasting Hand Sanitizers

The Procter & Gamble Company (P&G) is an American global consumer products conglomerate headquartered in Cincinnati, Ohio. William Procter and James Gamble formed the company in 1837. It specializes in a wide range of personal health/consumer health, personal care, and hygiene products, which are divided into numerous categories such as beauty, grooming, health care, fabric & home care, and infant, feminine, and family care.

The efficacy of hand sanitization is wholly dependent on the application of efficient hand disinfecting agents, which come in a wide variety of types and forms such as antimicrobial soaps, as well as water-based or alcohol-based hand sanitizer, the latter of which is extensively employed in hospital settings. In January 2024, Procter & Gamble extended its production capabilities by making Surface Sanitizer in 55-gallon utility barrels for distributing and offering Safeguard Hand Sanitizer to hospitals, health authorities, and other organizations.

Similarly, the company introduced its legal flagship brands, namely, Olay and Head & Shoulders in Brazil to expand its presence in the country. Procter & Gamble wants to enter the untapped markets of both Olay skincare products and the Head & Shoulder anti-dandruff shampoo & conditioner range in Brazil.

In addition to that, the company is constantly focusing on upgrading its product portfolios and strengthening its presence across Latin America by engaging in social media marketing. To do so, it has been appointing celebrity sports persons as brand ambassadors. P&G Brazil, for instance, declared that it has chosen footballer Pelé as its new brand ambassador. This collaboration would enable the footballer to initiate various positive activities and develop the sports sector in the country.

Reckitt Benckiser Group plc, on the other hand, is a multinational consumer products corporation based in Slough, England. It manufactures health, hygiene, and nutrition products. Reckitt's brands include Dettol antiseptic, Disprin analgesic, Strepsils sore throat treatment, Veet hair removal, and Airborne immune support supplement.

In February 2025, Reckitt Benckiser Group plc, the manufacturer of Lysol and Dettol, and Diversey Holdings, Ltd., a leader in the development & delivery of hygiene, infection prevention, and cleaning solutions, announced a distribution partnership that will increase their access to trusted hygiene solutions to help protect staff, clients, and customers from the spread of illness-causing germs.

Apart from these two firms, Unilever plc is another multinational British consumer products corporation headquartered in London, England. Food, condiments, ice creams, cleaning agents, cosmetic goods, and personal care products are manufactured by Unilever. Lifebuoy, Dove, Sunsilk, Knorr, Lux, Sunlight, Rexona/Degree, Axe/Lynx, Ben & Jerry's, Omo/Persil, Heartbrand (Wall's), Hellmann's, and Magnum are some of Unilever's most well-known brands.

Unilever is divided into three segments, namely, foods and refreshments, home care, and beauty & personal care. It has research & development (R&D) centers in China, India, the Netherlands, the United Kingdom, and the USA. In April 2024, Unilever announced that it has adopted one of its deodorant manufacturing lines to develop much-needed supplies of hand sanitizer.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 908.7 million |

| Projected Market Valuation (2035) | USD 2073.7 million |

| Value-based CAGR (2025 to 2035) | 8.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD Million) and Volume (Liters) |

| Key Regions Covered | Latin America |

| Key Countries Covered | Brazil, Mexico, Costa Rica, Chile, Colombia, Guatemala, Panama, Peru, and the Rest of Latin America |

| Key Segments Covered | Product Type, Active Ingredient, Packaging Type, End Use, Pack Size, Sales Channel, and Country |

| Key Companies Profiled | Himalaya Wellness Company; Reckitt Benckiser Group PLC; Companhia Nacional de Álcool; Procter & Gamble Company.; Unilever PLC; The 3M Company; Essity AB; The Clorox Company; Sanofi S.A.; Gojo Industries Inc.; Other (as per request) |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global latin america hand sanitizer market is estimated to be valued at USD 908.7 million in 2025.

The market size for the latin america hand sanitizer market is projected to reach USD 2,073.7 million by 2035.

The latin america hand sanitizer market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in latin america hand sanitizer market are instant hand sanitizer gels, foaming hand sanitizers, foaming instant hand sanitizers and spray hand sanitizers.

In terms of active ingredient, ethanol or ethyl alcohol segment to command 61.0% share in the latin america hand sanitizer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA