From an estimated USD 119.6 million in 2025, Latin America Hydrolyzed Vegetable Protein Market sales are expected to reach USD 256.2 million by 2035, achieving a CAGR of 7.9% during the predicted growth period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 119.6 million |

| Projected Latin America Value (2035F) | USD 256.2 million |

| Value-based CAGR (2025 to 2035) | 7.9% |

The hydrolyzed vegetable protein (HVP) market in Latin America is set to enjoy steady growth between 2025 and 2035, driven by the combination of increasing demand from the food processing industry for plant-based, cleaner-label flavor enhancers.

HVP is primarily used as a natural flavoring agent in soups, sauces, seasonings, and ready-to-eat meals, as well as in meat alternatives, both of which are exceptional areas of consumer attention across Latin American markets.

The current trend of plant-based and protein-rich diets, alongside growing health consciousness and a desire for umami-rich products, has been a major motivator for local and international manufacturers to expand their HVP availability in this region. Brazil, Mexico, and Argentina are emerging as key markets, characterized by a burgeoning middle class, evolving food preferences, and a vibrant food manufacturing ecosystem.

From here on, the next decade would see innovations in raw material sourcing, such as soy, maize, and wheat, as well as in enzymatic hydrolysis processes. These innovations would together drive improvements in taste profiles while reducing side products like MSG. Regulatory changes would further drive a clean-label shift in claims and transparency in ingredient labeling, thereby shaping market dynamics.

Additionally, most local and foreign companies will increasingly target sustainability efforts in conjunction with operational efficiency and R&D to enhance their productivity and product differentiation. Since the natural and economical flavoring agents have been pursued increasingly by food manufacturers, HVP will soon find itself in overabundance in both traditional and new foods' applications across Latin America.

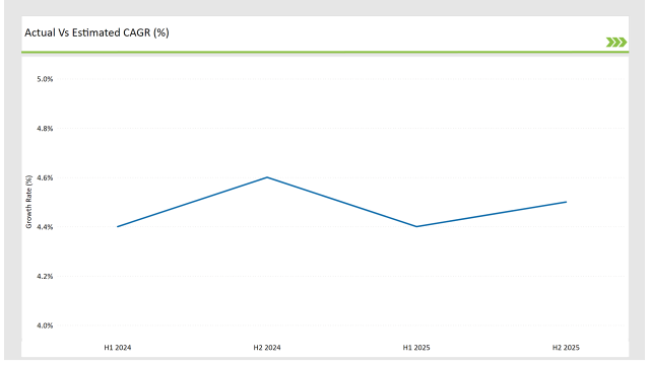

The CAGR data for the Latin American hydrolyzed vegetable protein (HVP) industry between 2024 and 2025 depicts a relatively stable yet slightly optimistic long-term growth scenario. In the first half of 2024, the projected value CAGR for the 2024 to 2034 period reached 4.4%, which then saw a modest increase to 4.6% in the second half of the same year, indicating greater market confidence likely to have been inspired by higher demand from the processed food and plant-based protein sectors.

In 2025, projections are to stay consistent, with a climbing CAGR of 4.4% in the first half and a marginal increase to 4.45% in second half. This adjustment reflects the industry's continued trajectory of steady growth, with moderate gains expected due to ongoing innovations in formulation, improved supply chains, and a rising preference for clean-label flavoring ingredients. Overall, the data reflect a market that is typically stable in long-term potential with gradual gains.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.4% |

| H2(2024 to 2034) | 4.6% |

| H1(2025 to 2035) | 4.4% |

| H2(2025 to 2035) | 4.5% |

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| 2023 | Surthrival launched a new plant-based protein product derived from wild-foraged sources, aligning with demand for natural, sustainable alternatives . |

| Aug-24 | Rising collaboration between Latin American flavor houses and global protein ingredient suppliers to co-develop clean-label HVP solutions |

| May-24 | Anticipated acquisitions of regional protein processors by global firms seeking deeper penetration into Latin America’s processed foods sector. |

Advocacy of Clean-Labelling and Vegetarianism- Bring in Demand of HVP

In recent years, the clean label movement has become increasingly influential across Latin America, influencing consumers' choices of food products. The ingredients then have a true identity, and consumers seek products with few additives and no artificial enhancers in their formulation, as they prefer natural alternatives, such as hydrolyzed vegetable protein (HVP).

HVP serves as a natural flavor enhancer, offering a rich umami profile that helps replace synthetic chemical flavoring agents, such as monosodium glutamate (MSG), which some consumers now prefer to avoid. As such, HVP has made its name as an option preferred in the formulation of clean-label savory products, such as soups, ready meals, seasonings, and meat alternatives.

Besides, the upsurge of plant-based diets in cities like São Paulo, Buenos Aires and Mexico City is also spearheading the demands for not-from-animal sources of protein and flavor. HVP exactly covers this by providing ethnic depth and savory complexity to vegetarian and vegan offerings.

Major food processors and private-label brands reformulate their product lines to omit the use of controversial additives and substitute them with other natural alternatives, such as HVP. Additionally, much of this was revised in response to the increasing regional regulatory emphasis on food labeling transparency, which has accelerated the industry's movement toward natural ingredients that consumers trust. In addition to influencing purchasing decisions by whitewashing the product labels, the developments surrounding HVP as a strategic tactic ingredient for flavor and label-friendly functionality continue.

Growth in Local Food Processing and Seasoning Industries Supporting HVP Demand

This is yet another driving factor in the ever-increasing food processing industry in Latin America. Increased per capita income and lifestyle changes have led to an influx of local products pertaining to core applications of HVP, such as soups, instant noodles, bouillon cubes, processed meat, and snack foods. As regional players strive to enhance flavor profiles while being cost-efficient, HVP has become the most indispensable ingredient in delivering umami taste to consumers.

In addition, local players in seasoning and spice blend markets are quite instrumental in further expanding HVP usage. These companies are incorporating HVP into savory formulations specifically designed for regional palates which include spicy, smoky, and grilled flavor varieties that would appear to pamper Latin American taste buds.

The growing footprint of mid-sized and domestic flavor houses has also led to increased collaboration with international ingredient suppliers, facilitating the transfer of technology and knowledge in enzymatic hydrolysis and plant-based protein processing. Government-backed food innovation programs, as well as technical training initiatives, have bolstered local capabilities, and hence, fast-tracking of HVP production and application is possible now. This ecosystem of food processors, seasoning manufacturers, and ingredient innovators is reinforcing demand for HVP as a versatile, affordable, and scalable flavor solution in region.

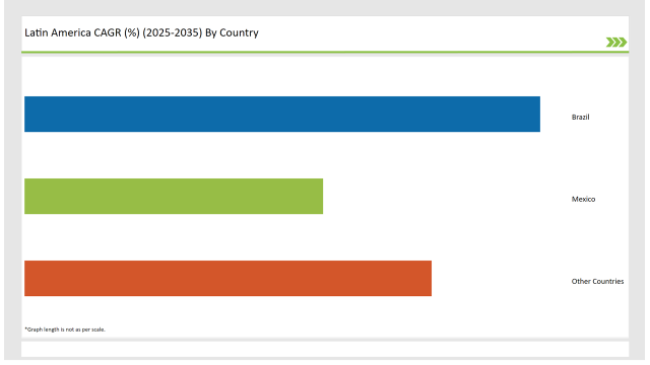

The following table shows the estimated growth rates of the top four markets. These countries are expected to exhibit high consumption, with high CAGRs projected through 2035.

| Country | Market Share (%) |

|---|---|

| Brazil | 34% |

| Mexico | 21% |

| Other Countries | 45% |

Brazil accounts for the largest share of the hydrolyzed vegetable protein (HVP) market in Latin America, constituting approximately 34% of regional consumption. This dominance in the market can be attributed to the vigorous and fast-growing processed food industry in Brazil, exploiting the maximum range of savory products such as frozen meals, instant noodles, meat products, bouillons, and seasonings.

With the increasing trend of Brazilian consumers toward more time-saving convenience foods, HVP has found a huge demand for cheap flavoring options. Local manufacturers extensively use HVP to enhance the umami flavor, improve the texture, and enhance the overall taste of their product formulations.

Furthermore, the Brazilian market is booming in other segments of plant-based foods, thereby increasing the usage of HVP as a natural, clean-label flavor enhancer. Regulatory emphasis on clean labels and transparency is driving reformulation among major brands. All this is complemented by local production capabilities and technical expertise, coupled with the presence of global ingredient firms such as Kerry and Ajinomoto, which ensure a consistent supply base and innovation. Thus, all these factors collectively drive Brazil's dominance in the regional HVP scenario.

The epicenter for growth is the country's food manufacturing ecosystem, which includes snack foods, sauces, spice blends, and ready meals product categories that tend to call for strong, savory flavors. HVP finds its application here as an ideal formulation ingredient, bringing out deep umami notes, masking bitterness, and supporting overall flavor balance without the use of synthetic additives.

Clean-label expectations and MSG-free considerations have propelled Mexican food brands to reformulate some ingredients toward naturally derived HVP. Furthermore, proximity to North American markets and high levels of foreign direct investment in food processing have facilitated timely entry into Mexico for highly advanced HVP solutions and manufacturing technologies. It is clearly in the process of moving from being a consumption hub to becoming a strategic location for the production and innovation of hydrolyzed vegetable proteins in the region.

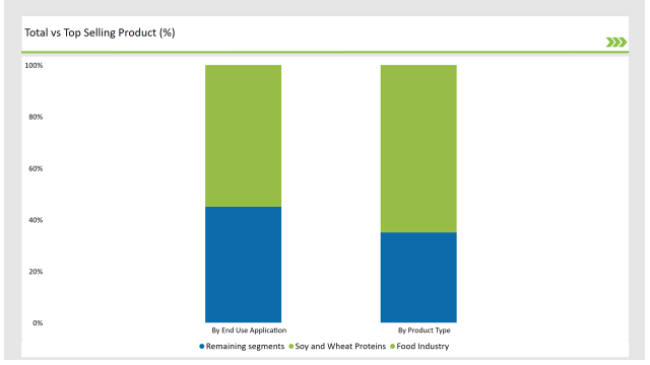

% share of Individual Product Type and Application in 2025

| Main Segment | Ma rket Share (%) |

|---|---|

| Product Type (Soy and Wheat Proteins) | 65% |

| Remaining segments | 35% |

Soy and wheat proteins are very dominant in the hydrolyzed vegetable protein market. Except for a few small markets, the soy and wheat protein segment in the HVP market in Latin America leads with 65% of the total market share. This introduction of dominance mainly depends on the easy availability, cost-effectiveness, and versatility of these proteins.

The proteins from both sources are good sources of all essential amino acids, capable of imparting great taste and are widely accepted and incorporated in assorted food applications such as soups, sauces, snacks, and meat alternatives. Besides their functions in exhibiting textural and flavor-enhancing properties with processing applicability, soy and wheat proteins are preferred in food formulation.

Soy protein is particularly valued for its high nutritional value in many forms; being present in almost all vegan and vegetarian products. In other systems, wheat protein is valued for solubility and is included in foods with a neutral taste. These attributes lend strength to the market; consequently, many manufacturers utilize these ingredients to meet the growing demand for plant-based, protein-rich products.

| Main Segment | Market Share (%) |

|---|---|

| End Use Application (Food Industry) | 55% |

| Remaining segments | 45% |

Food Industry Domination in Hydrolyzed Vegetable Protein (HVP) Market The food industry is other sector that still uses hydrolyzed vegetable protein (HVP) as an approach for end use in Latin America, with 55% market share. The reason is its application in various food products, including soups, sauces, ready-to-eat products, seasonings, snacks, and processed meats.

HVP carries a major push toward enhancing the flavor and taste profiles of these products, imparting a rich umami taste, as well as their overall texture, which makes HVP one of the important ingredients for food manufacture. Demand for quick foods and processed snack items is increasing in most parts of the region, especially with large urban centers growing in population, and thus the position of HVP in the food industry is destined to become stronger.

HVP is plant protein-based and would be in accord with the consumer demand of natural and clean label ingredients as well. With an ever-increasing demand for enhancing taste and nutritional value sustainably and affordably, the prospects of HVP in the food industry remain highly positive.

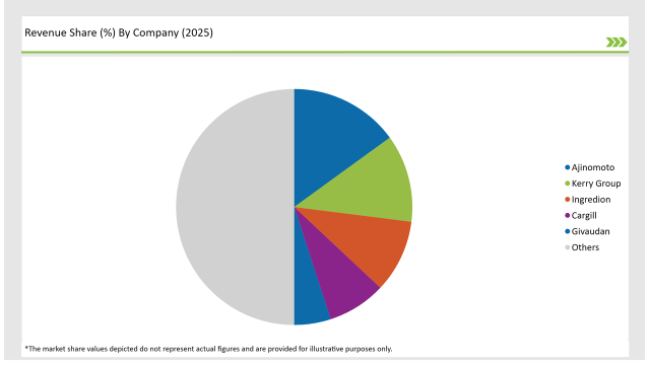

2025 Market share of Latin Hydrolysed Vegetable Protein manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Ajinomoto | 15% |

| Kerry Group | 12% |

| Ingredion | 10% |

| Cargill | 8% |

| Givaudan | 5% |

| Others | 50% |

The hydrolyzed vegetable protein market demonstrates moderate to high concentration in Latin America with only a few global manufacturers, like Ajinomoto, Kerry Group, Ingredion, Cargill, and Givaudan, holding a significant share of the market. These players capitalize on extensive distribution networks, R&D capabilities, and brand reputation to sustain their inclination.

A concerted effort among major companies captures an enormous share of the HVP market, accounting for roughly 50-60% of the total market share. Regional companies contribute a significant portion to the HVP market, with the "Others" category accounting for about 45%. So one can say there exists this parallel where large corporations monopolize the broad picture of the HVP market while providing niche manufacturers to meet the specific requirements of the market alongside.

Global enterprises now sharpen their competitive edge by investing heavily in R&D so as to develop newer and improved HVP versions that respond to the dynamic needs of consumers such as plant-based and clean-label. Considerable prevalence has recently been seen in the development of soy-free and gluten-free HVP counterparts that would find support in an increasing demand for allergen-centric ingredients. The big players, Kerry Group and Ingredion, are involved in building strategic alliances and acquisitions to expand product portfolios and their Latin American market presence.

Such alliances assure that local ingredients get sourced and penetrated faster into the market. These manufacturers have chosen to optimize their supply chains and reduce production costs to remain competitive. This includes opening local manufacturing units, working closely with regional suppliers, and ensuring a steady, reasonably priced supply of raw materials.

Due to the growing awareness of sustainability and environmental concerns, leading manufacturers are now focusing on sustainable sourcing and environmentally friendly production. In this way, the industry aims to meet the growing demand for plant proteins while minimizing its negative environmental impacts.

While regional players offer local flavor alternatives, larger upstream corporations are establishing the Latin America HVP market, particularly with local flavor preferences, smaller-scale product offerings, and specialized applications. These regional manufacturers leverage their in-depth understanding of local market dynamics to deliver customized products that cater to the specific needs of consumers and businesses in the region.

As per Form, the industry has been categorized into Chunks, Slice, Flakes, and Granules.

As per Product Type, the industry has been categorized into Soy Protein, Wheat Protein, Pea Protein, Rice Protein, Chia Protein, Flax Protein, and Corn protein.

As per End Use, the industry has been categorized into Household, Commercial, Food Industry, and Animal Feed.

As per Distribution Channel, the industry has been categorized into Direct, and Indirect.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

In Latin America, several prominent manufacturers lead the HVP market. These include global players like Ajinomoto, Kerry Group, Ingredion, Cargill, and Givaudan. These companies dominate the market due to their extensive distribution networks, strong brand recognition, and substantial investments in research and development.

Hydrolyzed Vegetable Protein is predominantly used in the food industry, where it accounts for around 55% of the market share. It is a key ingredient in soups, sauces, snacks, seasonings, and ready-to-eat meals, providing flavor enhancement. Additionally, HVP finds applications in animal feed, pharmaceuticals, and cosmetics. In animal feed, it serves as a protein source for livestock, while in cosmetics, it is used for its moisturizing and conditioning properties in skincare and haircare products.

The increasing demand for plant-based and allergen-free food products is one of the key reasons behind the growing popularity of Hydrolyzed Vegetable Protein in Latin American food products. With consumers becoming more health-conscious and opting for cleaner labels, HVP offers an ideal solution as it is a plant-derived ingredient with excellent flavor enhancement properties.

The Latin American Hydrolyzed Vegetable Protein market is driven by several factors. Firstly, there is a growing demand for plant-based proteins, especially as vegan and vegetarian diets gain popularity. Secondly, consumers are becoming more health-conscious, seeking natural, non-GMO ingredients.

The Latin American Hydrolyzed Vegetable Protein market is moderately concentrated, with a few large global manufacturers like Ajinomoto, Kerry Group, and Cargill holding a significant share of the market. However, smaller regional manufacturers also play a critical role in serving niche markets and meeting specific local consumer preferences.

The competition in the Latin American Hydrolyzed Vegetable Protein market is intense, with large global players competing based on innovation, cost efficiency, and distribution networks. At the same time, smaller regional manufacturers differentiate themselves by offering customized products that cater to local tastes, preferences, and market segments. While large companies target mass-market consumers, regional players focus on specialized products, which results in a diverse and dynamic competitive landscape.

In the cosmetics industry, Hydrolyzed Vegetable Protein is prized for its conditioning and moisturizing properties. It is commonly used in skincare and haircare products to enhance texture and functionality. In haircare products, for example, HVP can strengthen hair and improve its elasticity, while in skincare, it helps retain moisture and improve skin hydration, making it a valuable ingredient in a range of cosmetic formulations.

Despite its growth, the Hydrolyzed Vegetable Protein market in Latin America faces several challenges. Price volatility of raw materials can impact production costs, making it difficult for manufacturers to maintain stable pricing. Additionally, consumer perceptions of plant-based proteins can be a barrier, especially in markets where animal-based proteins are traditionally preferred.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Chickpea Protein Market Analysis – Demand, Share & Forecast 2025–2035

Hydrolyzed Vegetable Proteins Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Vegetable Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

UK Hydrolyzed Vegetable Protein Market Trends – Demand, Innovations & Forecast 2025-2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

USA Hydrolyzed Vegetable Protein Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Hydrolyzed Vegetable Protein Market Report – Demand, Growth & Industry Outlook 2025-2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Australia Hydrolyzed Vegetable Protein Market Growth – Innovations, Trends & Forecast 2025-2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand of Protein Beverage Hybrids for Value Channels in Latin America Analysis - Size and Share Forecast Outlook 2025 to 2035

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA