The Latin America bakery mixes market is set to grow from an estimated USD 731.0 million in 2025 to USD 1,156.8 million by 2035, with a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 731.0 million |

| Projected Latin America Value (2035F) | USD 1,156.8 million |

| Value-based CAGR (2025 to 2035) | 4.7% |

The QSR sector and snack culture in Latin America are now expanding rapidly, which is leading to a higher demand for ready-to-use bakery mixes. As fast-food chains, cafes, and bakeries diversify their offerings of cakes, bread, cookies, and pastries, bakery mixes provide an efficient solution for mass production.

Commercial bakeries use these mixes simultaneously for standardized outputs together with faster manufacturing time as well as important cost reduction benefits. The demand for fresh baked goods allows commercial establishments to uphold their quality standards.

Popular interest in bakery mixes among home bakers keeps increasing owing to their easy preparation and user-friendly nature. Users can make their own bread, cakes, and cookies easily and quickly with these products that require very little preparation. The trend of being able to bake artisan breads and cakes aside from cookies and that too with relatively less preparation has sparked the demand for bakery mixes in the region.

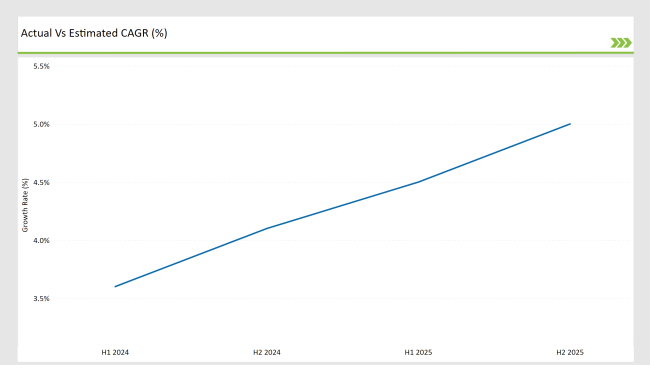

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin Americabakery mixes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin Americabakery mixes market, the is predicted to grow at a CAGR of 3.6% during the first half of 2024, with an increase to 4.1% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 4.5% in H1 and is expected to rise to 5.0% in H2.

This pattern reveals a decrease of 19 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 28 basis points in the second half of 2025 compared to the second half of 2024.

Innovations in Functional Ingredients in Bakery Mixes

In the Latin American region, the bakery mixes market is increasingly using ingredients that are healthy as well as functional like probiotic, fiber, and plant-based ingredients. These new ingredients are used in the bakery mixes as a healthier alternative to the existing ingredients which is the main reason these products are getting so popular with the consumers who are looking for functional foods.

For example, mixes that are enriched with fiber for making products such as cookies, bread: and cakes have increased due to their positive effect on digestion. Probiotics, on the other hand, are beneficial by supporting the gut and immune system along with the additional benefits that they provide, hence are being included more in common household products that the consumers are interested in.

The plant-based ingredients, for instance, almond flour or chia seeds, are also becoming increasingly popular with the growing number of those who want to eat plant-based diets and want their baked products to be nutri-enhanced.

Customization and Premiumization of Bakery Products

A shift towards an increasing focus on premium and artisan baked products in Latin America has resulted in a bakery mix manufacturing ecosystem that is oriented towards specialty mixes that address regional preferences. The longing for authentic flavors and high-quality ingredients in baked goods by consumers increases all the time. In response to this need, the producers make flavored mixes for pizza dough, brownies, and cookies especially designed with traditional local flavors in mind.

The premiumization shift is the main driver for the high-grade mixes sector, as the clientele is prepared to spend extra for better quality and unique varieties. The progress made in the direction of customized baked goods has led to increased imagination in the area of home baking thus producing a market for specialist and premium bakery mixes that are consistent with their preferences for premium, tasty, and authentic foods.

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Many Brazilians adopted bakery mixes as a simple imaginative method to create homemade artisan bread and cakes at home due to the home baking surge during the COVID-19 pandemic. Baking mixes serve as an easy method to obtain outstanding baking results while bypassing the requirement for extended baking experience thus transforming DIY baking into an enjoyable family achievement backdrop.

This trend particularly attracts the interest of middle-class buyers, who look for not expensive but high-quality products to make wonderful, homemade treat, and thus, it is supported by an increased demand for bakery mixes.

Mexican culinary traditions, such as pan dulce, empanadas, and conchas, continue to significantly influence the demand for bakery mixes in Mexico. These traditional baked products, famous for their specific regional tastes, are valuable now with the bakery mixes that let them be duplicated.

Now that people are looking for traditional Mexican desserts with less work, bakery mixes according to their preferences become more and more available. Manufacturers utilize ingredient-specific mix products that duplicate regional baked food recipes to serve increasing demands for authentic local baked goods which drives upward growth in the Mexican bakery mix market.

Several Latin American countries have initiated strict sugar regulation policies because obesity and diabetes along with other non-communicable diseases continue to increase. Regulations aimed at healthy eating usually contain three elements such as mandatory food labels and public health messages combined with sugar price taxation.

Consequently, manufacturers of bakery mixes have begun to include low-calorie sweeteners like stevia, erythritol, and sugar alcohols into their products more and more often to adhere with regulatory directives as well as to meet the demand for health-conscious options.

These sugar substitutes empower manufacturers to roll out products such as sugar-free or low-sugar bakery mixes, thus they become more attractive for consumers worried about the health impacts of too much sugar intake. These measures are fostering the conception of functional products in the bakery section and bringing the market for sweeteners to a positive state in Latin America.

The growing trend of seeking ease in baking is mainly the reason chocolate brownie mixes gaining popularity in Latin America. These mixes are the most convenient option, as they cut the consumer's time spent in preparing the ingredient list, and still they can enjoy brownies that there are no additional chemicals.

This feature resonates mostly with the busy families and working people, who would love to have some delectable desserts, but there is no time or know-how to make them from scratch. Brownie mixes provide consistency and quality, allowing anyone to build a little dessert with no trouble. With the consumer's lifestyles resulting in more busy schedules the need for quick products to prepare along with bakery mixes is on the rise.

2025 Market share of Latin America Bakery Mixes Manufacturers

Note: above chart is indicative in nature

The Latin American Bakery Mixes Market is characterized by a moderate degree of consolidation, with the strongest competitors being Grupo Bimbo, Mondelez International, and General Mills playing the lead role. The companies benefit from their broad distribution networks, a robust research and development setup, and the well-known brands that help them to keep the leader position.

These firms are seriously striving to take their market share further by coming up with new varieties of high-quality, convenient, and premium bakery mixes. Not only that, but there are also regional players such as the Archer Daniels Midland (ADM) and Kerry Group that are aligned with local demands, thus they provide mixes that are particular to regions of interest and therefore increase their shareholder in the fast-growing Latin American market.

As per Product Type, the industry has been categorized into Flours, Sweeteners, Edible Oils, Coca and Chocolate, and Other.

As per Source, the industry has been categorized into Natural, Organic, and Artificial.

As per Application, the industry has been categorized into Bread, Cakes & Pies, Cookies & Biscuits, Pizza Dough, Brownies, Pancakes & Waffle, and Others (Crackers etc.).

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America bakery mixes market is projected to grow at a CAGR of 4.7% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,156.8 million.

In Latin America, there is a growing consumer preference for premium and artisanal baked goods, prompting bakery mix manufacturers to innovate and offer specialty mixes that cater to regional tastes.

Leading manufacturers include Grupo Bimbo, Mondelez International, General Mills, Tate & Lyle, and Lallemand.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA