The Latin America Frozen Ready Meals sales are estimated USD 3,488.0 million in 2025 to USD 6,083.4 million by 2035, recording a compound annual growth rate (CAGR) of 5.7% during the predicted period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 3,488.0 million |

| Projected Latin America Value (2035F) | USD 6,083.4 million |

| Value-based CAGR (2025 to 2035) | 5.7% |

The business of frozen ready meals in Latin America today has significant health gains and elevated growth, which is driven primarily by the increasing consumer demand for quick-preparation meal alternatives that still keep within the traditional tastes. Within some of the top markets, such as Brazil and Mexico, some of the most consumed categories include frozen lasagna; rice-based meals; empanadas; chicken- and beef-based entrées; and heatables, such as enchiladas and tamales.

Brazil's food offerings are highly flavored from national dishes; pre-cooked feijoada packs, combinations of farofa, and grilled chicken with rice can be easily found in the retail freezer. On the other hand, in Mexico, the big hits include burritos, enchiladas, and taco kits, mostly present in supermarkets and convenience stores aimed at attracting the younger generation and students. Such households are usually very high-demand clientele who want variety in their food but wouldn't want to spend so much time in the kitchen preparing them.

The market keeps transforming by 2025 and into bigger availability of multi-portion packs, diet-specific offerings (low-calorie, high protein), and international cuisines. Retailers and brands adapt quickly localized recipes so that they can reach regional tastes while effective use of packaging innovations that allow a longer shelf life or easy microwave reheating.

Also, private label offers are gaining very fast, especially through large supermarket chains in Brazil and Chile, as because of the cut-price of private labels, the margin between them and premium international brands is getting narrower. Frozen readymade meals are also becoming more common with their slowly but surely increasing penetration, especially in bigger urban centers with growing cold-chain infrastructure, and this segment is expected to gain a lot of momentum throughout 2035 through in-store promotion and the launch of newer products.

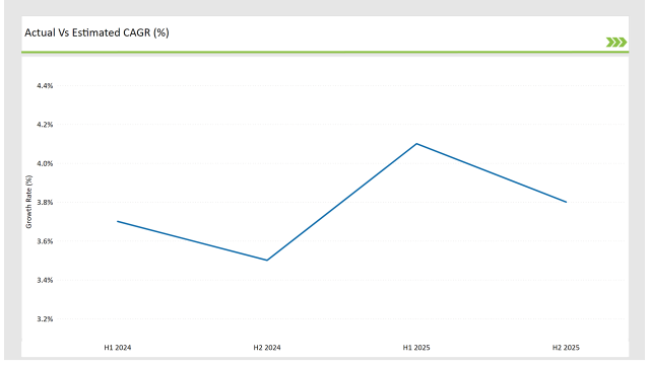

The table below presents a comprehensive comparative analysis of compound annual growth rate (CAGR) changes over a six-month period for the base year (2024) and the current year (2025) in the Latin American Frozen Ready Mealsmarket.

This semi-annual assessment highlights key shifts in market dynamics and outlines patterns in revenue realization, offering stakeholders a clearer understanding of the market’s growth trajectory throughout the year. The first half of the year (H1) covers the period from January to June, whereas the second half (H2) runs from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.7% |

| H2 (2024 to 2034) | 3.5% |

| H1 (2025 to 2035) | 4.1% |

| H2 (2025 to 2035) | 3.8% |

H1 signifies period from January to June, H2 Signifies period from July to December

The data indicates a steady upward shift in the growth momentum of the Latin American frozen ready meals market. In H1 2024, the compound annual growth rate (CAGR) stood at 3.7%, slightly tapering to 3.5% in H2 2024, reflecting mild fluctuations in consumer spending and seasonal demand. However, the market picked up significantly in H1 2025, with a jump to 4.1% CAGR, indicating growing traction for frozen convenience meals across key countries like Brazil, Mexico, and Argentina.

| Date | Development/M&A Activity & Details |

|---|---|

| Sep-24 | Molinos Río de la Plata Acquires Sibarita Frozen Pizza Brand Argentine food company Molinos Río de la Plata acquired the Sibarita frozen pizza brand from Canadian multinational McCain Foods. This acquisition enhances Molinos ' portfolio in the frozen ready meals sector, allowing it to cater more effectively to the growing demand for convenient meal solutions in Argentina. |

| Oct-24 | JBS S.A. and Sigma Alimentos Compete for Kraft Heinz's Oscar Mayer Unit Brazilian meatpacker JBS S.A. and Mexico's Sigma Alimentos entered bids to acquire Kraft Heinz's Oscar Mayer hot dog and cold cuts business, valued at nearly USD 3 billion. This move aligns with their strategies to expand processed meat portfolios and strengthen positions in the USA market. |

| Nov-24 | Paladini Invests in Frozen Food Production Expansion Argentine pork processor Paladini invested USD 10 million to expand its plant in Santa Fe province. This expansion aims to increase the company's capacity in producing frozen ready meals, responding to the rising consumer demand for convenient food options in Argentina. |

Eating Habit Changes and the Convenience Demand Increase

Convenience meal solutions are now considered the need of the hour among Latin American consumers with an evolving lifestyle: young consumers or working professionals. Time has become an obstacle to cooking, and frozen ready meals have taken over with preparation ease, longer storage, and more options.

Furthermore, in doubles like Brazil and Mexico, the increasing dual-income acres create food consumption habits making ready-to-eat food purchases popular. One of the major findings of a consumer survey in the region for the year 2024 showed that over 46% of urban consumers in cities such as São Paulo and Mexico City buy frozen meals at least once weekly. The factors of convenience and the efforts brands are putting into making the products more nutritious and tastier significantly raise the product's appeal within middle-income classes.

Retail Expansion and Enhanced Cold Chain Infrastructure

Frozen ready meal have become a lot more available all throughout Latin America thanks to the modernization and subsequent improvements in cold-chain logistics. Supermarkets, hypermarkets, and discount retail chains are allocating more space to frozen products, with brands offering targeted promotions and localized flavors.

Retailers like GrupoÉxito (Colombia), Cencosud (Chile), and Walmart (Mexico & Brazil) are not only stepping into featuring more private-label frozen meals, but also making the category more affordable. Simultaneously, investments on refrigerated storage and last mile delivery improved product availability for a lot of Tier 2 and Tier 3 cities.

Mexico's frozen food logistics market grew by 6.2% in 2024, further strengthening manufacturers' ability to assure quality and reach. Infrastructure like these maintain the product integrity required gaining consumer access into frozen ready meals dispersed from the large urban areas.

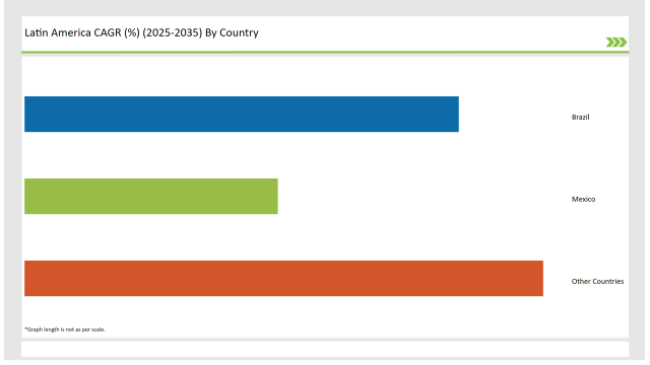

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 36% |

| Mexico | 21% |

| Other Countries | 43% |

The Latin American market for frozen ready meals is majorly dominated by Brazil as it constitutes 36% of the regional share, which can be attributed to the growing population of middle-class Brazilians with an increasing inclination toward practical and timesaving food solutions. Consumers, generally, accept frozen meals as a possible alternative for lunch and dinner, particularly in cities like São Paulo, Rio de Janeiro, and Brasília.

Hence, local players and international brands are scaling their portfolios to include the local flavors of dishes such as feijoada, moqueca, and lasanha à bolonhesa, which means Brazilian-style lasagna, to boost the adoption of the category. According to the 2024 retail insight survey, almost 52% of Brazilian households purchased frozen meals biweekly at the lowest, reflecting a cultural move to convenience without much deviation from the familiar tastes.

Mexico has 21% of the entire market of frozen ready meals in Latin America as a direct consequence of the increased penetration of modern retail chains like Walmart, Soriana, and Bodega Aurrerá. Busy professionals and students in major Mexican cities such as Mexico City, Monterrey, and Guadalajara are showing a growing tendency towards the consumption of ready-to-eat frozen meals due to the fast-paced urban life and the demands it places upon people for easy food choices.

Popular products include burritos, enchiladas, rice bowls, and pasta dishes tailored for the Mexican market. Increased visibility of products in supermarkets, aggressive in-store promotions, and the proliferation of private labels made rapid increases in accessibility and affordability for frozen meals. Within a consumer survey in 2024, it found 41% of Mexico metropolitan consumers buy frozen ready meals at least once a week, proving better acceptance as part of their habitually consumed meals.

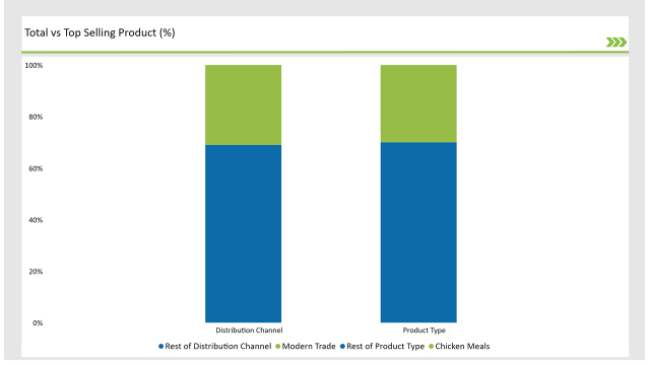

| Main Segment | Market Share (%) |

|---|---|

| Product Type (Chicken Meals) | 30% |

| Remaining segments | 70% |

Product Type Analysis: Chicken Meals Lead with 30% Market Share

Latin America chicken-based frozen ready meals dominate the segment at 30% market share. Some examples are grilled chicken with rice, chicken pasta, breaded fillets, and stir-fry combos; their economy, protein value, and wide appeal across age groups keep them in good stead. The rest is divided among beef meals, vegetarian options, seafood-based meals, and pork dishes.

Beef meals (like carne guisada or beef stews) remain extremely popular in Mexico and Argentina, and vegetarian meals- composed of beans, legumes, vegetables, and plant-based proteins- are enjoying increased prominence among health-conscious and flexitarian consumers. Increasingly stocking of vegetarian-ready meals of rice, pasta, and vegetables without the addition of meat in urban supermarkets seeks to respond to the evolving dietary preference.

| Main Segment | Market Share (%) |

|---|---|

| Distribution Channel (Modern Trade) | 31% |

| Remaining segments | 59% |

Distribution Channel Insights: Modern Trade Holds 31% Share

Modern trade channels-comprising supermarkets, hypermarkets, and large retail chains-account for 31% of frozen ready meals' total sales in Latin America. They thus allow consumers easy access to frozen meals owing to the genuinely sizeable variety displayed, constant availability, better storage infrastructure, and attractive in-store promotions.

Within this, supermarkets in urban centers, such as São Paulo, Mexico City, and Buenos Aires, play an influential role since they usually provide dedicated frozen sections with significant brand visibility. The rest is split among other distribution channels, including the traditional trade (mom-and-pop stores and local grocers), online retail, and convenience stores.

Classical retail is still relevant in semi-urban and rural regions with limited penetration of modern retail. e-Commerce, meanwhile, is an emerging space, especially after the pandemic, as busy consumers proceeded to order frozen meals online via apps and grocery delivery platforms for quick replenishment.

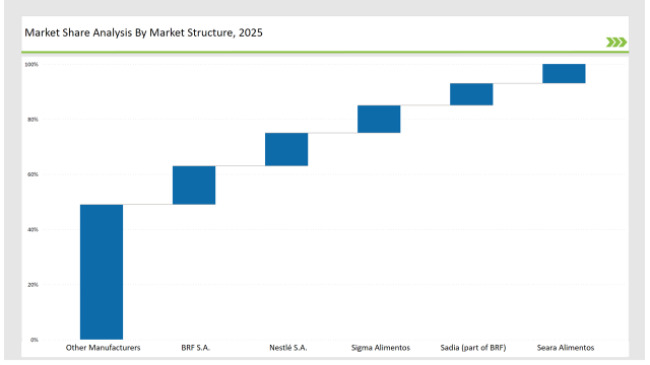

| Manufacturer | Market Share (%) |

|---|---|

| BRF S.A. | 14% |

| Nestlé S.A. | 12% |

| Sigma Alimentos | 10% |

| Sadia (part of BRF) | 8% |

| Seara Alimentos | 7% |

| Other Manufacturers | 49% |

Note: The above chart is indicative in nature

The Latin American frozen-ready-meals market shows a moderate level of fragmentation, as can be seen from distribution of market share. BRF S.A., Nestlé S.A., and Sigma Alimentos have a combined share of 36%, while almost half the share (49%) belongs to smaller local and regional players.

This fragmentation indicates that while dominant brands with good distribution networks and established consumer trust are present, there is still ample space for the success of regional brands, private labels, and new entrants. Companies such as BRF and Sadia have made an appeal in various Latin American countries through vertical integration and strong cold chain logistics.

In contrast, Nestlé has taken an innovation approach in its offering of ready meals focusing on local tastes while being nutritionally enriched and convenient. Sigma Alimentos and Seara Alimentos are now also aggressively pursuing cross-border strategies, expanding their reach through acquisitions and strategic partnerships.

Current market trends indicate that there is high consumer demand for protein-rich frozen meals that are preservative-free and flavored with ethnic spices, a demand that market players are addressing by expanding their portfolios. Sustainability for packaging and shelf-life technologies as well as partnerships with modern trade retailers for shelf visibility is also becoming a strategic priority.

With the expediting of competitive dynamics, larger players are expected to double down on digital engagement, value-based pricing, and local sourcing, maintaining or growing their share in the market, as modern trade evolves and e-commerce adoption intensifies.

As per product type, the industry has been categorized into Vegetarian Meals, Chicken Meals, Beef Meals, and Other Meals.

As per distribution channel, the industry has been categorized into Food Chain Services, Modern Trade, Departmental Stores, Online Stores, and Other Distribution Channel.

This segment is further categorized into Aluminium Can, Plastic, and Glass.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

Brazil leads the market with a 36% share, driven by strong urban consumption and a preference for convenient chicken- and beef-based meals.

Chicken meals dominate the product type segment, accounting for 30% of the total market share in 2025.

Modern trade channels, including supermarkets and hypermarkets, lead distribution with a 31% market share.

Key companies include BRF S.A., Nestlé S.A., Sigma Alimentos, Sadia (part of BRF), and Seara Alimentos.

Demand is being fueled by rising dual-income households, time-constrained lifestyles, and the growing preference for convenient yet nutritious meal options.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA