The Latin America probiotic strains market is set to grow from an estimated USD 591.2 million in 2025 to USD 1,162.9 million by 2035, with a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 591.2 million |

| Projected Latin America Value (2035F) | USD 1,162.9 million |

| Value-based CAGR (2025 to 2035) | 7.0% |

In Latin America, a major factor that drives the demand for probiotics consists of gastrointestinal disorders, such as irritable bowel syndrome (IBS) and the like, which are becoming increasingly common. In their pursuit of symptom relief, people are resorting to the use of natural compounds rather than pharmaceuticals more often.

Probiotics are actually the most well-known option for recovering balance of normal gut flora, improving digestion, and benefiting overall gut health. The higher rate of consumers' acceptance and the consequent product sales growth encourage such people to look at probiotics more and more as a natural way of addressing digestive troubles.

Healthy foods and beverages market in Latin America is having an impressive and steady growth, driven by consumer demand for products that deliver health benefits beyond basic nutrition. Probiotics are one of the important elements of this trend, as they are mostly incorporated into yogurts, smoothies, and dietary supplements.

With the increase of health awareness among consumers, they are gradually switching to lifestyle products that help wellness, immunity, and digestive health. This change has initiated the innovation and expansion of probiotics, the section of the market.

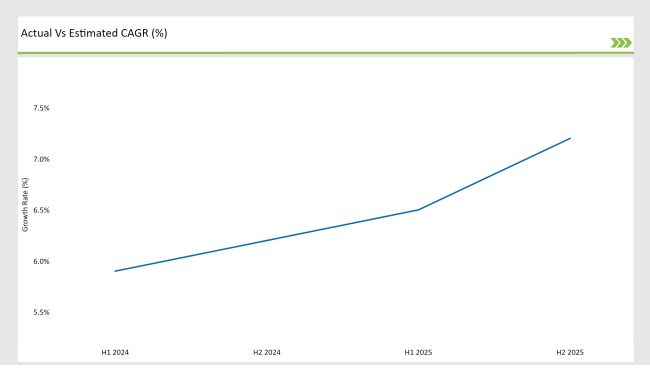

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America probiotic strains market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America probiotic strains market, the is predicted to grow at a CAGR of 5.9% during the first half of 2024, with an increase to 6.2% in the second half of the same year.

In 2025, the growth rate is anticipated to slightly increase to 6.5% in H1 and is expected to rise to 7.2% in H2. This pattern reveals a decrease of 14 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 22 basis points in the second half of 2025 compared to the second half of 2024.

Probiotics in Focus: The Surge in Demand Driven by Awareness

Better education of the public about gut health is a major influence for people's conduct in Latin America, which occurs along with information campaigns and the role of social media in society.

As practitioners of health, wellness, nutritionists, and diet advocates put emphasis on the gut's role in overall health, they help people to get more familiar with the merits of probiotics. The realization of this fact has led consumers to look for probiotic foods enriched with probiotics, like yogurts, supplements, and functional beverages, to improve their digestive system and the immunity.

Likewise, the media channels contribute to the dissemination of information and personal experiences about health issues, thus being the reason for the use of probiotics as a natural resource for dealing with different health metabolic diseases. One result of this is the increase in sales and the rise of probiotic strains market in the region.

Revolutionizing Probiotics: New Formats and Flavors for Consumers

Advancement of product lines is the main source for the growing probiotic market in Latin America since the companies have been increasingly directing resources towards R&D. Apparatuses that optimize the probiotics for local tastes, manufacturers now introduce a range of flavors and formats including ready-to-drink probiotic beverages that cherry pick the stakeholders of the fast-paced consumers.

Moreover, the brands are mixing probiotics with other vitamins, minerals, and superfoods that attract people, with the intention of not only increasing the product's nutritional value but addressing certain health issues. This plan is aimed not only at the potential target audience of probiotic products but also at those looking for health solutions.

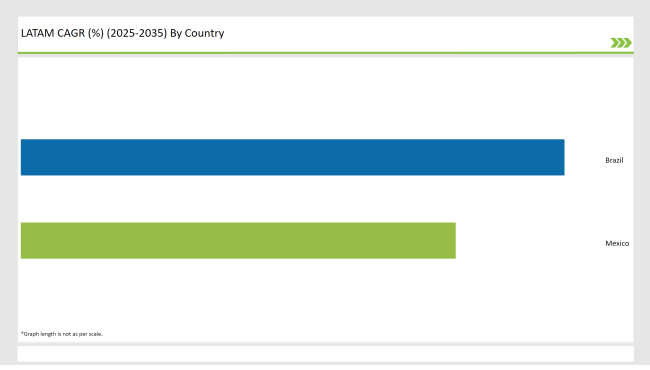

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Brazilian government has created a regulatory framework that sustains the development and commercialization of functional foods, probiotics, and other related products. This is the regulatory environment which is supportive of such activities and this is the mandatory provision of explicit regulations on the health claims and safety assurance of products which thus allows companies to find out the involved intricacies in the introduction of new probiotic formulations.

Furthermore, the company establishments which are associated with the promotion of health and nutrition continue to encourage manufacturers to invest in research and development.

Consequently, this backing of the regulatory framework not only increases the competition for probiotic products but it also boosts the trust of the consumers which is the final effect for the growth of the probiotic market all over Brazil.

The consumers in Mexico are being more influenced by the increasing prevalence of digestive disorders, like irritable bowel syndrome (IBS) and others gastrointestinal tract-related issues.

That is to say, people are increasing their packs of all those who are feeling some kind of uncomfortable digestive problems such as bloating, constipation, and so forth, and so on, are tending to use more natural resources through the application of probiotic microorganisms which are living cells believed to help in the restoration of the balance of flora in the gut, the better assimilation of food, and the disappearance of relevant.

This perception emphasizes probiotics as the best possible solution for not only immediately finding - quite healthy - natural products but also significantly improving digestive health which in turn is affecting the market consumer for probiotics with -as one of the ideas- the more inclusion of these products in their wellness routines. Bifidobacterium bifidum in the Latin America probiotic market due to its health benefits and scientific evidence.

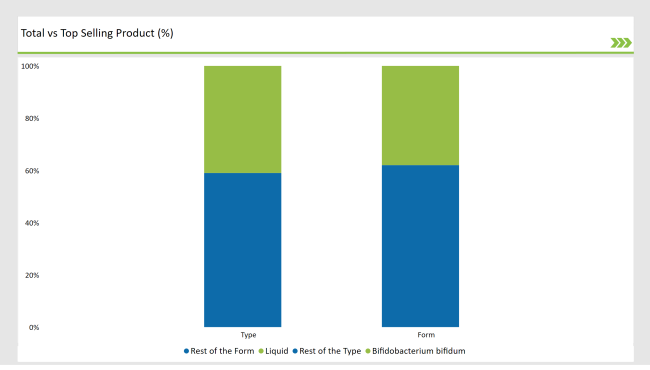

% share of Individual categories by Type and Form in 2025

Bifidobacterium bifidum is gaining more and more followers in the probiotics market of Latin America because of its targeted solutions for health and the solid technical support. This culture is sometimes included in the list of health benefits including the use of probiotics for irritable bowel syndrome (IBS) and enhancing the total gut health; this is very attractive for people who want to feel better and for them to have it available.

The health-focused individuals who are on the targeted path are the ones who treat the special matter. The efficacy of Bifidobacterium bifidum is also further established by the studies. More evidence regarding the health advantages offered by the strain is leading the users to select the products with this particular culture more, and to drive even more demand in the market.

The growing use of liquid forms of probiotics in Latin America is strongly steered by the belief in fast absorption and cultural habits or preferences. Traders mostly think of liquids as the most efficient way of delivering probiotics into the body instead of solid forms like capsules or tablets, thus they nominate them as the most effective. This idea sets the stage for a real preference for liquid, as people are in search of easy and fast access to the gut health improvement system.

Simultaneously with the cultural temptation toward soft drinks in several Latin American states, drinking liquid probiotics; one, of such reasons. Functional drinks are the daily drink in the region and probiotic beverages fit well into the daily habits of consumers thus along with the clothing of interest and increased practical availability for probiotic liquid products.

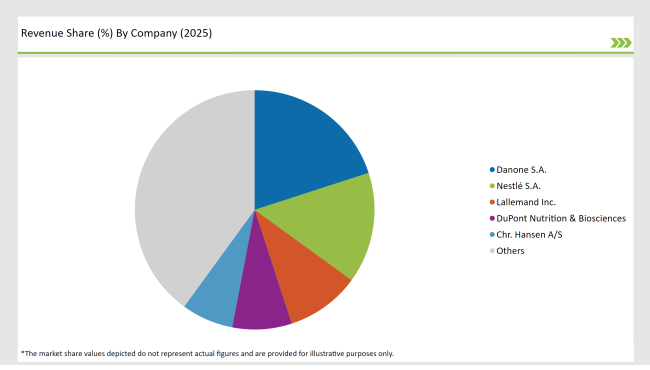

2025 Market share of Latin America Probiotic Strains Manufacturers

Note: above chart is indicative in nature

The Latin America probiotic strains market is a little consolidated, the main players like Danone, Nestlé, and Yakult lead the industry with their wide product portfolio and strong distribution network. These companies through their strong research and development teams innovating and enhancing probiotic lines target customer health trends.

Furthermore, the companies like ProbioFerm and BioCare Copenhagen are because of their product development will kind of satisfy the tastes and health needs of the Latin American customers that they do. This is the marriage of global and local companies that builds a competitive arena that enhances the probiotic strains market.

As per Type, the industry has been categorized into Lactobacillus acidophilus, Lactobacillus rhamnoses GG, Bifidobacterium bifidum, and Other.

As per Form, the industry has been categorized into Dry and Liquid.

As per End-use Application, the industry has been categorized into Food and Beverages, Yogurt Drink and Fermented Milk, Fruit Juice, Bakery, Meat Products, Pharmaceuticals, Functional Food, Animal Feed, and Dietary Supplement.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America probiotic strains market is projected to grow at a CAGR of 7.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,162.9 million.

Increased awareness of gut health is significantly influencing consumer behavior in Latin America, driven by educational campaigns and the pervasive impact of social media.

Mexico and Brazil are key regions with high consumption rates in the Latin America probiotic strains market.

Leading manufacturers include Danone S.A., Nestlé S.A., Lallemand Inc., DuPont Nutrition & Biosciences, and Chr. Hansen A/S.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA