The Latin America Yerba Mate Market is projected to increase from an estimated USD 174.3 million in 2025 to USD 333.7 million by 2035, recording a compound annual growth rate (CAGR) of 6.7% during the predicted period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 174.3 million |

| Projected Latin America Value (2035F) | USD 333.7 million |

| Value-based CAGR (2025 to 2035) | 6.7% |

The period from 2025 to 2035 is expected to see a radical shift in the representative sector thus creating a great deal of prospective investment in the Yerba Mate industry in Latin America.

With consumers looking for more health-oriented drinks particularly in the wellness/functional drinks sector, the Yerba Mate has gone through a tremendous rise in demand in different places. Yerba Mate, a traditional herbal tea from the South American regions, is recognized globally for its promoting energy, cognitive wellbeing, and offering vital nutrients.

Furthermore, the shift in consumer preferences toward natural organic products has further compounded the benefits of the Yerba Mate, which now gets to be associated with proper health and bodily well-being. The increasing people consciousness regarding the environment has pushed the people towards fair trade and environmentally responsible products which is a primary reason for the growth in sales of the Yerba Mate beverage.

The Yerba Mate industry in Latin America will flourish, thanks to its ingrained culture associating the product with it, especially in countries like Argentina, Brazil, Paraguay, and Uruguay. These nations are currently the top producers and exporters of Yerba Mate; however, demand is shifting towards countries like North America, Europe, and Asia, as a result of the rising peoples interest in functional and plant-based drinks.

The health-boosting, energy-enhancing arranger of Yerba Mate is being promoted as a functional beverage. Thus, with the base of products made up of both traditional forms (like loose leaves and tea bags) as well as ready-to-drink (RTD) beverages, the market is flourishing. The hip increase of e-commerce channels and addressing green issue further on provide support to the market in developmental terms.

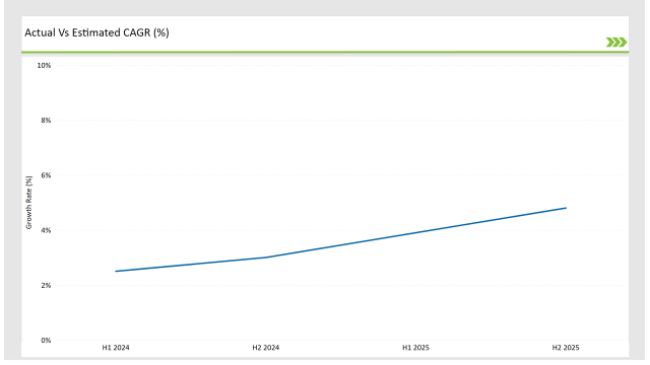

The table below presents a comprehensive comparative analysis of the compound annual growth rate (CAGR) changes over a six-month period for the base year (2024) and the current year (2025) in the Latin America Yerba Mate market.

This semi-annual assessment highlights key shifts in market dynamics and outlines patterns in revenue realization, offering stakeholders a clearer understanding of the market’s growth trajectory throughout the year. The first half of the year (H1) covers the period from January to June, whereas the second half (H2) runs from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.5% |

| H2 (2024 to 2034) | 3.0% |

| H1 (2025 to 2035) | 3.9% |

| H2 (2025 to 2035) | 4.8% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin American Yerba Mate market, the sector was predicted to grow at a CAGR of 2.5% during the first half of 2024, with an increase to 3.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 3.9% in H1 but is expected to rise to 4.8% in H2.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Sustainability Initiatives- Mate Revolution launched a fair-trade-certified Argentinian yerba mate line, emphasizing eco-friendly packaging. |

| March 2024 | Product Launches- Guayakí introduced an organic ready-to-drink yerba mate beverage line in Latin America, featuring innovative flavors like hibiscus and elderberry. |

| February 2024 | Expansion of Retail Distribution- CBSe expanded its presence in Latin America by collaborating with health food stores and e-commerce platforms, focusing on flavored yerba mate blends. |

| January 2024 | Strategic Partnerships - A major Latin American beverage brand partnered with a Paraguayan yerba mate producer to develop premium loose-leaf and RTD products. |

Health-Conscious Consumer Trends

The increasing preference for health-conscious, functional beverages is one of the key elements regarding the growth of the Yerba Mate market. Consumers are now more prone to the kind of drinks that can help them with added benefits like energy boosts, antioxidants, and vitamins.

Except for other drinks, totally non-caffeine additives for Yerba Mate are being eroded into the jitters that results from drinking coffee. This tendency is particularly strong with the younger, wellness-oriented generations who look for drinks which are not only functional but also sustainable.

Sustainability and Ethical Sourcing

Along with the growing trend of consumers being more environmental-friendly, the need for products that are ethically and sustainably sourced is on the rise. Responding to these needs, producers of Yerba Mate are turning to organic agriculture and fair trade certifications.

The momentum for eco-friendly packaging and the objective of the reduction of environmental impacts are tending supportive market growth where many brands are opting for biodegradable or recyclable materials. These efforts, in turn, are part of a broad global trend towards sustainability, to which Yerba Mate becomes a more attractive choice for environmentally concerned individuals.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Brazil | 35% |

| Mexico | 20% |

| Other Countries | 50% |

Brazil is in charge of the Yerba Mate market, especially with its high domestic consumption and demand for the product in the export sector. Brazil, which is one of the largest Mate producers in the region, is still profiting from the fact that it has developed a culture of using Mate particularly in the southern states.

The growing realization of the health benefits of Yerba Mate such as increasing the body's energy level and aiding digestion has led to the increasing demand for this drink among the consumers who are picky about what they drink. The overall expansion of Brazil's export strategies has played a role in the country becoming a general player on the global scene, thus, Yerba Mate is building a reputation in places like North America and Europe.

Mexican Yerba Mate has reached a market growth breakthroughs due to residential consumers' shift towards healthier drink options. People are now almost entirely seeking replacements for sodas and energy drinks that are wheelhouse asymptotic.

The approach of plant-based and functional drinks in the development along with the newer range of products like the prefix - Yerba Mate which is rich in antioxidants and is thus gaining popularity also help the case of the drink. The e-commerce boom by the irrigation of additional platforms has also been a major contributor to the improvement of the market in Mexico.

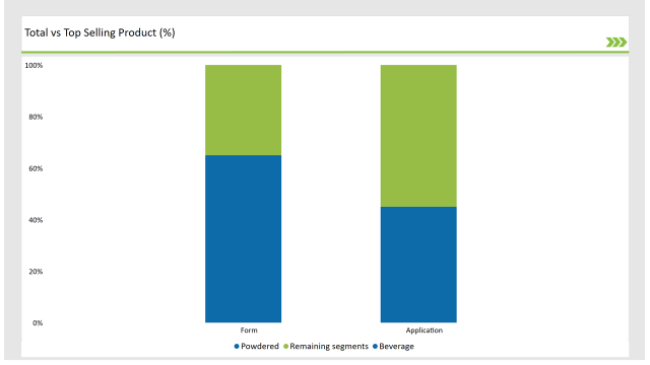

% share of Individual Categories Form and Application in 2025

| Main Segment | Market Share (%) |

|---|---|

| Form (Powdered) | 65% |

| Remaining segments | 35% |

The strength of powdered Yerba Mate in the Latin American market is mainly rooted in the convenience, the traditional use in the region, and the fact that this product is more versatile. Powdered Yerba Mate is a very consumer-friendly alternative, available on-demand and allowing for very free personal serving setups and preparation methods.

This format of using powdered yerba mate is quite far from traditional drinking both in a mate gourd and in smoothies, among other drinks. Also, lower production costs relative to tea bags or RTD options substantially increase the accessibility of powdered Yerba Mate to a larger consignment of consumers.

In many countries, especially in Argentina and Brazil, powdered Yerba Mate is deeply embedded in local culture as consumers prefer it for being authentic and the taste is all-natural without any other ingredients. Additionally, its long shelf life and ease of storage make it popular for example, in the rural areas where access to ready-to-drink options may be limited.

The rise of health-focused, functional drinks among the population has also led to the demand for powdered Yerba Mate, since it is frequently proposed as a natural energy stimulant and a good source of antioxidants.

| Main Segment | Market Share (%) |

|---|---|

| Application (Beverages) | 45% |

| Remaining segments | 55% |

Yerba Mate's strong beverage sector is driven by its increasingly healthy image as a functional drink as well as a substitute for traditional sweetened beverages like coffee and soda. More and more people are adding Yerba Mate drinks to their diets as a result of the fact that it has a unique view of a natural caffeine source that comes with a non-jumpy, smooth energy increase, which is not like coffee.

The issue of people trying to live healthier by drinking plant-based functional drinks is increasing as are the reasons with which these are beverages are made with antioxidants, vitamins, and detoxifying properties - factors that Yerba Mate has acquired a reputation for.

Then not only a-while pack of ready-to-drink (RTD) with Yerba Mate beverages, but also Yerba Mate drinks including tea lists as well as energy drinks, this cluttered origin of such drinks has helped with their growth. These goods target busy customers who are on the go, seeking easy and healthy alternatives.

The arena of iced drinks has been well-addressed by the introduction of cold-brew Yerba Mate and iced teas, which have helped to expand the segment, particularly among younger, wellness-oriented consumers. The versatility of Yerba Mate, being enjoyed hot or cold, also plays a huge role in its acceptance across the globe as a drink.

2025 Market share of Latin America Yerba Mate manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Cruz de Malta | 21% |

| Guayaki | 9% |

| Playadito | 15% |

| Amanda | 11% |

| Yerba Mate La Merced | 7% |

| Others | 37% |

The Yerba Mate market in Latin America has a medium to high concentration level, dominated by a small number of leading companies in the manufacturing and distribution sector. Companies like Cruz de Malta, La Merced, and Aguaí are among the markers with significant market shares, owing to their established presence both in the local market and through international sales.

These firms offer an extensive portfolio that includes everything from traditional loose-leaf Yerba Mate to RTD beverages, thereby catering to a wide consumer base.

Dominated by the big players, the market still provides space for small producers, particularly those who are focusing on the organic and premium products to establish their niche. The added international appetite for Yerba Mate, specifically in North America and Europe, has not only improved the business but also has incited both the large and small brands to invest in export sections and promote their brands.

However, the entry barriers remain strong as the new ventures have to secure stability in supply chains, install facilities for production and successfully maneuver distribution channels. Market share continues to be heavily weighted in the hands of top brands, while a transition toward a broader palette of products and competition both grow with demand for innovating and sustainable Yerba Mate create.

As per Form Type, the industry has been categorized into Powder, Liquid, and Others.

As per Application, the industry has been categorized into Beverages, Dietary Supplements, Personal Care, and Others.

As per Type, the industry has been categorized into Argentinian Yerba Mate, Brazilian Yerba Mate, Paraguayan Yerba Mate, and Others.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America Yerba Mate market is projected to grow at a CAGR of 6.7% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 333.7 million.

The largest producers of Yerba Mate in Latin America are Argentina, Brazil, Paraguay, and Uruguay. Argentina and Brazil are the primary exporters.

Yerba Mate is available in several forms, including powdered, tea bags, and ready-to-drink (RTD) beverages. The powdered form holds the largest market share due to its versatility.

Yerba Mate is known for boosting energy, enhancing mental clarity, improving digestion, and providing a rich source of vitamins and antioxidants.

Key trends include the rise of ready-to-drink Yerba Mate beverages, the expansion of organic and sustainable offerings, and increased availability through e-commerce channels.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA