The Latin America food emulsifier market is set to grow from an estimated USD 315.9 million in 2025 to USD 562.6 million by 2035, with a compound annual growth rate (CAGR) of 5.9% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025 E) | USD 315.9 million |

| Projected Latin America Value (2035 F) | USD 562.6 million |

| Value-based CAGR (2025 to 2035) | 5.9% |

Latin America is witnessing a rapid growth in bakery and confectionery businesses, especially in Brazil and Mexico, which is contributing to the demand for emulsifiers such as lecithin and mono- and diglycerides. These are used to add strength, texture, and product consistency to dough.

It is expected that the food emulsifier sector will be valued at around USD 315.9 million by 2025, with a projected annual growth rate of 5.9% for the next 10 years. The rise of cold chain infrastructure in Latin America has resulted in emulsified products like frozen desserts and dairy products being shipped and stored without any quality issues, thereby, retaining their freshness throughout transportation and storage facilities.

Emulsifiers are the essential ingredients that not only keep these products stable but also avoid separation or texture loss, and preserve their attractive appearance, thus, meeting consumer expectations for consistent and high-quality packaged goods.

Manufacturers in Latin America are trying their best to develop emulsifiers that are specifically adapted for traditional products such as dulce de leche, cheese spreads, and regional sauces. These innovations improve the stability, texture, and shelf life of such products, allowing them to meet the demands of modern food processing while preserving the authentic flavors and textures cherished in the region's culinary traditions.

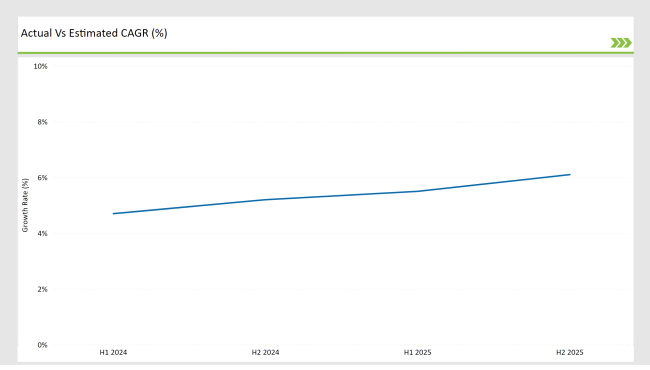

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America food emulsifier market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin Americafood emulsifier market, the sector is predicted to grow at a CAGR of 4.7% during the first half of 2024, with an increase to 5.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 5.5% in H1 and is expected to rise to 6.1% in H2.

This pattern reveals a decrease of 18 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 24 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| July 2024 | Tate & Lyle's Acquisition of CP Kelco (July 2024): In July 2024, Tate & Lyle acquired CP Kelco, a USA-based ingredients supplier known for pectin and specialty gums, for USD 1.8 billion. This acquisition enhances Tate & Lyle's portfolio of natural ingredients, including emulsifiers, to meet the growing demand for healthier food options in markets such as Latin America. |

Clean-Label Movement Fuels Growth of Plant-Based Food Emulsifiers

The trend of plant-origin emulsifiers, particularly soy lecithin and sunflower, is gaining momentum in Latin America as the consumers are now factual to prefer natural and clean-label dishes. Plant-based emulsifiers are being preferred more for their health advantages, sustainable resources, and multipurpose food applications.

Many bakeries depend on lecithin particularly to enhance the consistency of the dough, provide longer shelf life, and produce soft textures in bread and pastries, thus, thanks to more profit high-quality products are readily available. The movement is also being seen among functional food manufacturers who have started using plant-derived emulsifiers for fulfilling needs of health-conscious consumers who are on the look for fortified and low-fat products.

This is not just a solitary instance but it represents the gradual transition of Latin America from synthetic to natural and minimally processed foods, as people prioritize environmental transparency in the ingredients they use in their dishes.

Boosting Solubility and Consistency in Infant Formula with Emulsifiers

There is an increase in the usage of emulsifiers in infant formula and nutritional products across the Latin America region due to better understanding of infant health and the acceptance of fortified nutrition. Lecithin and mono-diglycerides are good examples of emulsifiers that work on making powdered infant formulae mix well in water and a consistent liquid texture.

These are added to the product to make it more stable, to avoid separation, and hence improve the overall quality. The emphasis on proper nutrition has made infant formula with additional nutrients the first priority instead of the fast food trend. Emulsifiers are also utilized in the case of various forms of nutritional supplements, thus they are the ones that people depend on, in the completion of health-focused global trend.

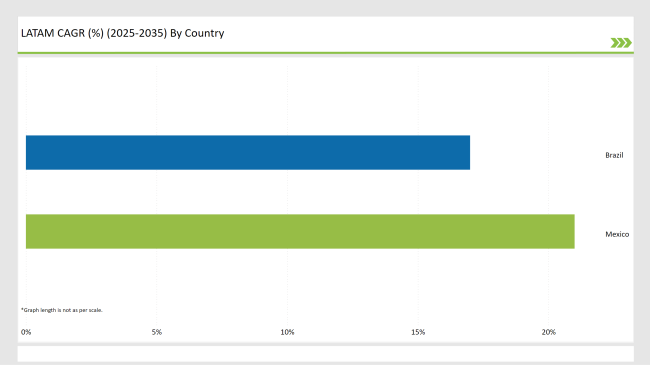

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The dairy-based beverages and desserts gaining more and more attraction are unveilers of sorbitan esters which are the emulsifiers needed. This is particularly visible in the case of Brazilian sweets like creamy flans and flavored dairy drinks. These emulsifiers are very important due to the fact that they hold the smooth texture and dilution of the product together, as well as prevent ingredient separation during storage and transport.

The Brazilian consumers are always after indulgent, high-quality dairy products thus the manufactures must keep the product stable and consistent, which ensures a good experience with the product. The necessity of mixing dairy with eatables that are ready to eat or drink is on the rise and this is why the emulsifiers have turned out to be the main additives for extending durability and preserving the premium top-notch quality.

The movement toward plant-based and functional foods in Mexico markedly has benefited emulsifiers like polyglycerol esters. As consumers embraced a more nutritious course of life, their options such as almond milk, soy beverages, and vegan cakes reached new heights of popularity.

The role of these emulsifiers in plant-based formulations is to stay solubilized, that is to say, they prevent the separation of ingredients while maintaining smooth textures so as to provide the consumer with a high-quality product.

Furthermore, foods that are enriched with protein such as dairy-free yogurt and the like require high-quality emulsifiers that along with their other benefits add stability and consistency. The trend of the consumers with clean-label products and sustainability is increasing, so that the plant-based food manufacturers' depend on emulsifiers heavily to fulfill market needs.

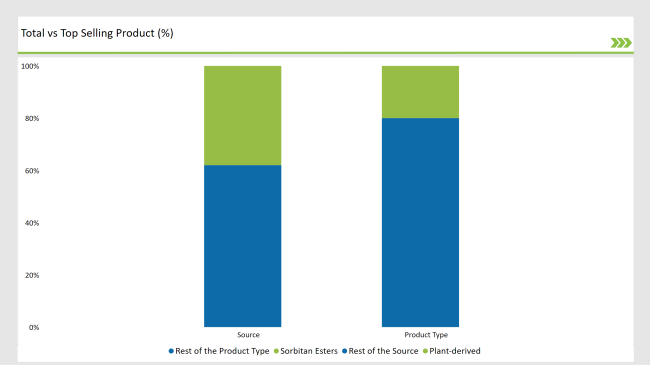

% share of Individual categories by Source and Product Type in 2025

The increase in people choosing plant-based diets has been a big factor to push the demand for emulsifiers that are in line with vegan standards. Emulsifiers from plant sources, such as soy and sunflower lecithin, are essential to gather the stability of the texture of the product required for plant-based dairy and meat alternatives.

These emulsifiers additionally boost the quality of the product without changing the label or vegan claims, these are the products which health-conscious and environmentally aware people increasingly look for. Besides, the plant-based sources of emulsifiers bring along extra functional variability in the food applications.

They gain texture of products in bakeries by bettering the dough, use in stabilizing non-dairy beverages and in fortifying confectionery products, all of these emulsifiers result in a wider variety of foods with better texture, longer shelf life, and higher consistency in production. The flexibility of these emulsifiers has made them an invaluable addition in food industry operations.

With the help of the crosstalk of the multichannel applications and the sorbitan esters that are versatile and needed in many food applications, it can be said that they have a forever soaring need. The unique heat stability they provide, enable using them in the processes of high-temperature meals such as in bakery, fry oils and ready meals.

In making bread, they provide dough stability and texture improvements so that when subjected to high-heat conditions, they will be the same every time. When they are used for frying, they act as an anti-crasher by separating oil better, thus they take care of the fried product’s crispiness. To some extent, this warmth also causes emulsions to destabilize which is crucial for the production of high-temperature stable foods.

Simultaneously, the processed food sector, which encompasses items such as microwavable meals, sauces, and dressings, greatly benefits from sorbitan esters. These emulsifiers make it possible for uniform mixing, ingredient separation, and prolonged product life which in turn allows the processed foods to keep their quality, consistency, and market readiness through all phases of production and storage.

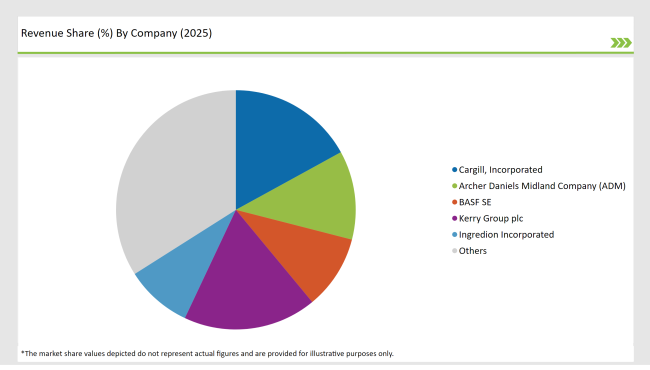

2025 Market share of Latin America Food Emulsifier Manufacturers

Note: above chart is indicative in nature

The Latin American food emulsifier market is moderately concentrated, with big players like Cargill, ADM, and Kerry Group dominating it with vast production capacities, efficient distribution, and a spirit of innovation. These companies make use of their R&D power to implement the solution of the public interest.

They introduce sustainable and plant-based emulsifiers that conform to the trends of the time towards clean-label products. Regional players meanwhile, like Corbion and Palsgaard, have the localized strategy of creating emulsifiers that are meant for traditional Latin American foods such as sauces and dairy-based desserts.

The market is also changing through the introduction of cost-efficient production techniques, which on one side enables the companies to match demand while keeping their prices competitive.

As per Source, the industry has been categorized into Plant-derived and Animal-derived.

As per Product Type, the industry has been categorized into Lecithin, Derivatives of Mono, Di-glycerides, Sorbitan Esters, Polyglycerol Esters, StearoylLactylates, and Others.

As per Application, the industry has been categorized into Bakeries, Confectionaries, Dairy Products, Functional Foods, Salads and Sauces, Infant Formula, and Others

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America food emulsifier market is projected to grow at a CAGR of 5.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 562.6 million.

The market is driven by the rising demand for plant-derived emulsifiers, particularly lecithin from soybeans and sunflower, is rising in Latin America as consumers increasingly prefer natural and clean-label ingredients.

Leading manufacturers include Cargill, Incorporated, Archer Daniels Midland Company (ADM), BASF SE, Kerry Group plc, Ingredion Incorporated.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA