The Latin America probiotic supplements market is set to grow from an estimated USD 646.8 million in 2025 to USD 2,087.2 million by 2035, with a compound annual growth rate (CAGR) of 12.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 646.8 million |

| Projected Latin America Value (2035F) | USD 2,087.2 million |

| Value-based CAGR (2025 to 2035) | 12.4% |

Driving demand for probiotic supplements with the priority being gut health and immunity among the Latin American consumers post-pandemic period. The increase of health consciousness, together with the frequent cases of digestive disorders, stress-related gut problems, and antibiotic treatments have made people look for natural ways to handle these issues.

Probiotics are a great choice as they help rebalance gut flora, improve nutrient absorption, and boost the immune system. Social media, medical professionals, and functional food trends enrich consumers' understanding of their advantages. Thus, the terms of health-aware people, fitness maniacs, and the elderly have grown dramatically in the number of probiotics they incorporate into their daily lifestyles.

Global players such as Yakult, Danone, Nestlé, and Nature’s Bounty have bolstered their market share in Latin America through integrative distribution networks and launching localized probiotic formulas. These enterprises outweigh the competition using strong marketing strategies, clinical trials, and retail mergers to up the level of consumer confidence.

On the other side, local companies are coming up with novelties such as vegan probiotics, organic strains, and specific formulations for digestive problems, immunity, and women health. The boom of e-commerce, pharmacy networks, and health stores has made it accessible for most people, thus spreading the probiotic supplements throughout the region in terms of demographics and income levels.

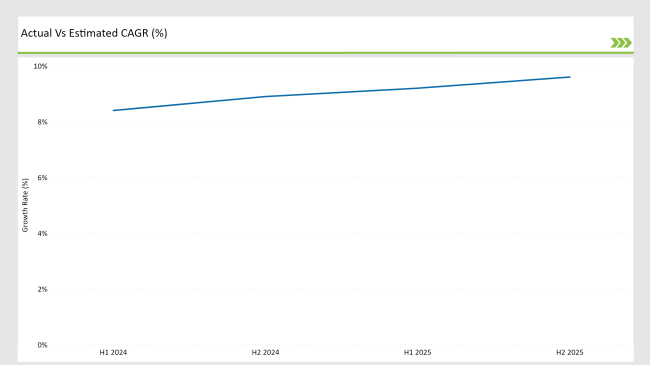

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America probiotic supplements market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America probiotic supplements market, the is predicted to grow at a CAGR of 8.4% during the first half of 2024, with an increase to 8.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 9.2% in H1 and is expected to rise to 9.6% in H2.

This pattern reveals a decrease of 12 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 15 basis points in the second half of 2025 compared to the second half of 2024.

Women’s Probiotics: A Key to Hormonal and Digestive Balance

The probiotic supplements for babies in Latin America are facilitated with the help of parents only. This is due to their determination to help babies support their digestion, immunity, and overall gut health. The soaring popularity of Lactobacillus and Bifidobacterium-based probiotics among colicky, diarrhea, and insect-justified antibiotic gut issues has lead to probiotic alternatives such as liquid forms, powder, and gummies.

To top it off, pediatricians and other professional health practitioners are actively supporting Lactobacillus and Bifidobacterium probiotics for the problem of gut microbiota in the infant age after the full and clear disclosure to patients' parents. On the other hand, women's health probiotics have gained more recognition and are said to be associated with hormonal balance, metabolic health, and gut-brain axis support.

The promotion of Lactococcus lactis and Streptococcus strains women-specific formulations to cut down on bloating, improve digestion, and support vaginal health is also there. The outlets for these products are various since they can be found in all types of convened stores like pharmacies, and across various e-commerce portals.

The Rise of High-Potency Probiotics: 10 Billion+ CFU for Maximum Benefits

The high-CFU probiotic supplements beyond 10 billion CFU are the ones that the consumers in Latin America are looking for more and more these days. The association between the high level of colony-forming units and the benefits like a balanced gut flora, proper digestion, and a stronger immune system as well as the fact that they are particularly useful for the people with digestive disorders or those with an impaired immune system are the major reasons for such decision.

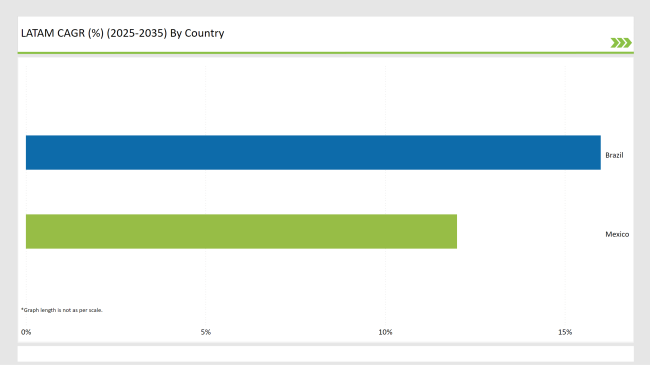

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Brazil is facing a very huge economic problem due to increasing rate of various digestive disorders among irritable bowel syndrome (IBS), gastritis, acid reflux and lactose intolerance. Probiotic supplements have acquired a significant place in these households.

The Brazilian diet, mainly derived from fried foods, red meat, and spicy dishes, has become a major contributor to gut inflammation and bloating, causing a change in consumer behavior towards gut-friendly solutions like probiotics. Furthermore, the increasing intake of processed food accompanied by a high-sugar diet has aggravated the digestive discomfort, thus, the first choice has become high-CFU probiotics and multi-strain formulations.

On the flip side, ANVISA (Agência Nacional de Vigilância Sanitária) has done a good job by shortening probiotic supplement rules, which then leads to quicker product approvals and gives a chance for clinically-backed formulations to enter the market.

With the help of proper health claim guidelines and ingredient safety measures, consumer trust in the probiotic has also risen. This regulatory support has encouraged the further growth of both local as well as international brands which are consequently raising their number of probiotic products.

Mexico stands out as the second home to the highest number of gastrointestinal diseases in the whole Latin America region. This is reflected in the high number of reported cases for ulcer, gastric infections, and IBS, associated with H.pylori, which actively drives the market for probiotic supplements.

The primary cause lies in inadequate sanitation, where the communities often have nonexistent or unprotected drinking water sources, leading to frequent digestive infections, diarrhea, and dysbiosis. Such cases make probiotics a valuable supplement for people.

Introduction of gut bacteria balancing and immune system support probiotics has been possible due to the negative correlation between obesity and diabetes which is currently prevailing in Mexico. Alongside this, pharmacy chains such as Farmacias del Ahorro, Farmacias Guadalajara, and Benavides have also enlarged their probiotic product platforms, so more consumers trust and buy.

Local supplement producers, as well as international manufacturers, are currently working together to invent Mexican-specific probiotic strains that meet regional gut health problems such as gas and diarrhea, etc. Thus, this activity not only facilitates the growth of the market but also the medical acceptance.

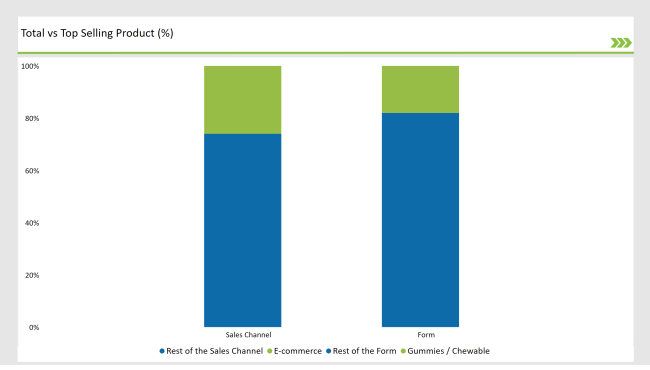

% share of Individual categories by Sales Channel and Form in 2025

Downtown pharmacy chains such as Drogasil (Brazil), Farmacias del Ahorro (Mexico), and Cruz Verde (Chile) have added vitamin-subscription models to their e-commerce platforms making probiotics more accessible to the buyers.

Items on these platforms include probiotic drinks, food, and dietary supplements in many varieties while the customers can also view the prices, the promotional discounts, read valuable reviews, and select the compound or formulation that best fits the customer.

Besides, wellness-focused stores like Natue (Brazil) and Farmalisto (Mexico) set home delivery and auto-refill which is very convenient and thus ensure consistent probiotic intake to the consumers.

On the other hand, cross-border shopping is on the rise, as Latin American consumers tend to buy clinically tested and high-CFU probiotic supplements online from the USA and Europe. Global brands have started to gain popularity through the offering of personalized and scientifically backed probiotic formulations even the health-conscious consumers are very much interested.

Along with the gain of popularity on baby- and kid-friendly probiotic supplements that Latin American parents are after to enhance gut, digestion, and immunity, the developing companies behind this are also galloping into the mass market.

Probiotic pills and powders are traditional forms and are often hard for children to take, resulting in a high surge in gummy and chewable formulations for infants and toddlers designed specifically. Instead of refrigerated liquid probiotics, chewable and gummy probiotics are shelf-stable and do not need water, thus they are a good option for on-the-go supplementation.

Meanwhile, the children-friendly options that have been surfacing are the gummies and chewables made via molecular probiotics instead of liquid through the fermentation process. The streaming demand is supported by innovation and by the increased availability on both retail and e-commerce platforms.

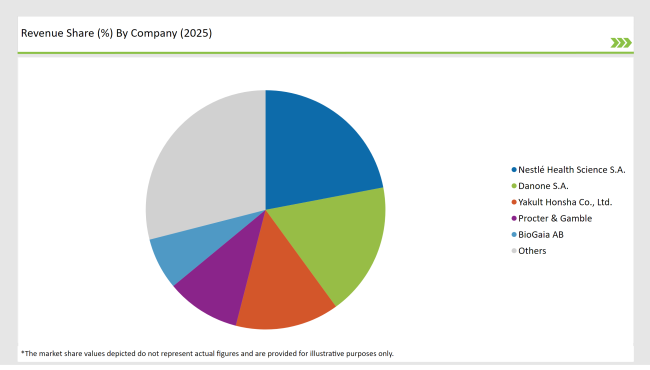

2025 Market share of Latin America Probiotic Supplements Manufacturers

Note: above chart is indicative in nature

The Latin America probiotic supplements market has a moderate to high level of consolidation due to the presence of the global leaders like Nestlé Health Science, Danone, and Yakult, who have assured their status by the use of the strong distribution channels, highly advanced R&D, and brand trust.

The firms utilize clinical-backed formulas and cooperation with others to widen their probiotic product lines. At the same time, the regional market players, such as Farmoquímica, Omnilife, and Medcell are serving the local preferences with specialized formulations.

Chr. Hansen and BioGaia, which are international biotech companies, supply probiotic strains along with patented solutions to supplement manufacturers in Latin America, thus, they enhance the industry’s competitiveness. The industry is in a process of evolution through the sales and market development of pharmacies by the use of electronic platforms and the requirement of multi-strain, high-CFU probiotics.

As per Customer Orientation w.r.t. Functionality, the industry has been categorized into Baby / Infant, Women, Men, and Unisex.

As per Bacteria Type, the industry has been categorized into Lactobacillus, Streptococcus, Bifidobacterium, Bacillus coagulants, Saccharomyces, and Lactococcus lactis.

As per Sales Channel, the industry has been categorized into Hypermarkets / Supermarkets, Specialty Stores, E-commerce, Drug Stores & Pharmacies, Health & Wellness Stores, Convenience Stores, Departmental Stores, and Others.

As per CFU Count, the industry has been categorized into Less than 1 Billion, 1 Billion to 5 Billion, 5 Billion to 10 Billion, 10 Billion to 20 Billion, 20 Billion to 30 Billion, 30 Billion to 50 Billion, and More than 50 Billion

As per Form, the industry has been categorized Tablets / Pills, Capsules, Liquid, Powder, Gummies / Chewable, Lozenges, and Others (Gels, Soft Gels)

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America probiotic supplements market is projected to grow at a CAGR of 12.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 2,087.2 million.

Increased health consciousness, coupled with higher incidences of digestive disorders, stress-related gut issues, and antibiotic use, has led people to seek natural solutions.

Mexico and Brazil are key regions with high consumption rates in the Latin America probiotic supplements market.

Leading manufacturers include Nestlé Health Science S.A., Danone S.A., Yakult Honsha Co., Ltd., Procter & Gamble, and BioGaia AB.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA