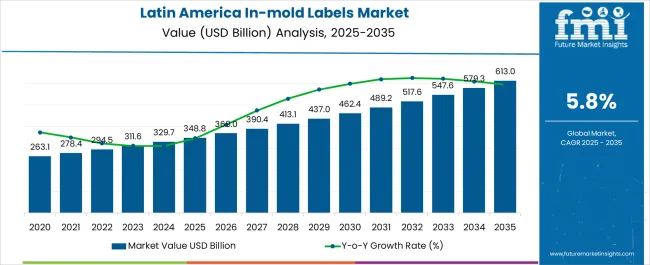

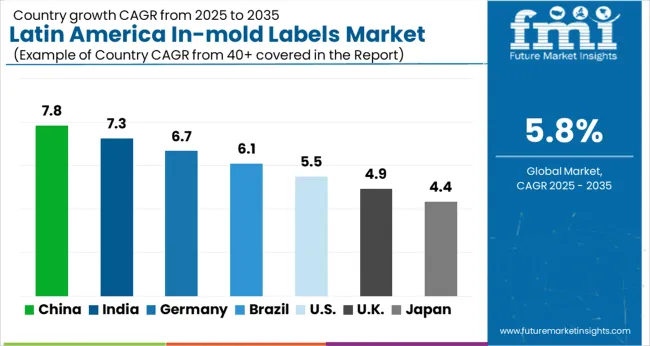

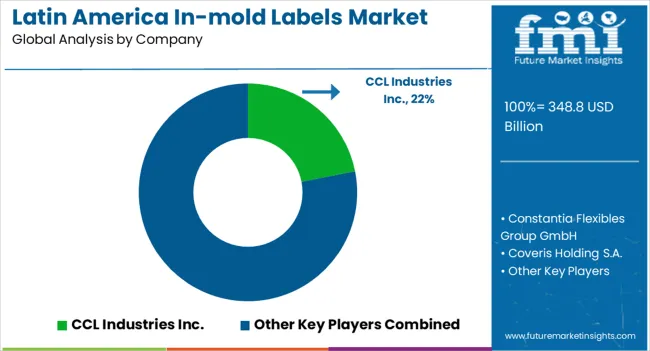

The Latin America In-mold Labels Market is estimated to be valued at USD 348.8 billion in 2025 and is projected to reach USD 613.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Latin America In-mold Labels Market Estimated Value in (2025 E) | USD 348.8 billion |

| Latin America In-mold Labels Market Forecast Value in (2035 F) | USD 613.0 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Latin America in-mold labels market is experiencing sustained growth driven by the increasing shift toward premium packaging solutions, rising adoption of lightweight containers, and the growing importance of product differentiation in competitive retail environments. The demand for in-mold labels is being propelled by their ability to deliver high quality graphics, durability, and resistance to moisture and wear, which are essential for both food and non food packaging.

Manufacturers are increasingly investing in advanced molding technologies, recyclable label materials, and eco friendly inks to align with sustainability commitments and regional regulatory directives. The strong presence of consumer goods, beverage, and household product industries in Latin America has further strengthened the need for durable labeling that enhances brand visibility and product appeal.

The market outlook remains positive as packaging producers continue to integrate innovative design, automation in molding processes, and sustainable materials to meet evolving consumer and regulatory expectations.

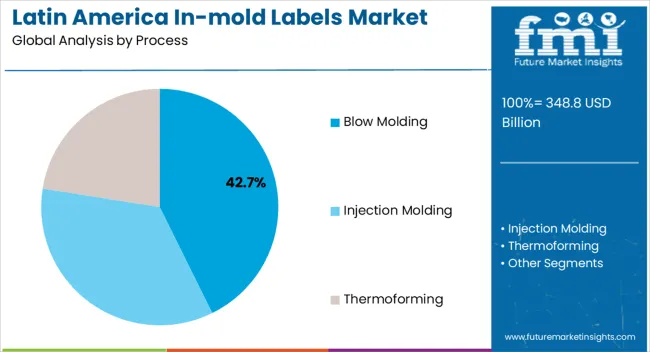

The blow molding process segment is expected to account for 42.70% of total revenue by 2025 within the process category, making it the dominant segment. This growth is being supported by its ability to provide seamless label integration during container production, resulting in a durable finish that resists peeling and abrasion.

Blow molding has gained preference due to its compatibility with high volume production of bottles and containers widely used in beverages, household products, and personal care items.

The efficiency of the process and reduced post production labeling costs have further contributed to its leadership, reinforcing blow molding as the most widely adopted process in the in-mold labels market.

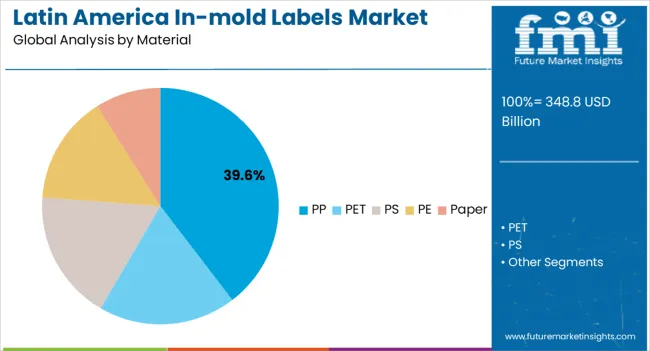

The polypropylene material segment is projected to hold 39.60% of total revenue by 2025 within the material category, making it the leading choice. Polypropylene is valued for its flexibility, durability, and recyclability, all of which align with industry trends toward sustainable and lightweight packaging.

Its compatibility with a wide range of molding processes and printing methods has facilitated broad usage across various packaging formats. Resistance to moisture and chemicals enhances its suitability for food, beverage, and household product labeling.

These attributes have established polypropylene as the material of choice, underpinning its strong revenue share in the regional market.

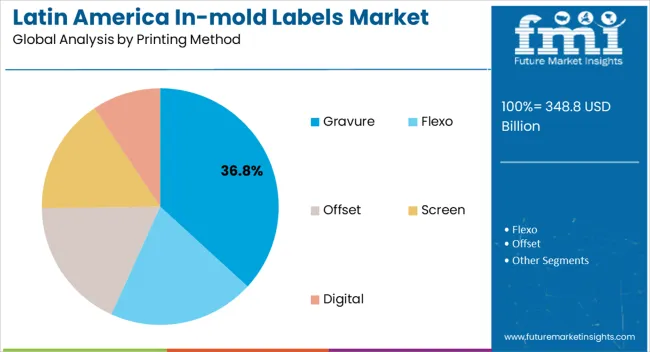

The gravure printing method is expected to represent 36.80% of total revenue by 2025 within the printing category, positioning it as the leading printing technology. Gravure has been preferred for its ability to produce consistent, high resolution images with excellent color reproduction, which is vital for premium product presentation.

Its suitability for long production runs, coupled with durability of the printed design, has made it a cost effective and reliable choice for large scale packaging applications.

The ability of gravure to support complex designs and vibrant graphics has strengthened brand differentiation efforts, solidifying its leadership in the printing method category.

Growing demand from sectors such as chemicals, pharmaceuticals, and food & beverages is a leading driver of the Latin America in-mold labels industry. These sectors are looking for high-quality, cost-effective, and sustainable labeling solutions that can help them to improve their branding and product differentiation. In-mold labels offer several advantages over traditional labels, including:

In-mold labels are becoming increasingly popular in a variety of sectors. Demand for in-mold labels is expected to continue to surge in the next ten years, as more businesses look for sustainable and cost-effective labeling solutions.

| Attributes | Key Insights |

|---|---|

| Latin America In-mold Labels Market Estimated Size (2025E) | USD 311.6 million |

| Projected Market Valuation (2035F) | USD 547.9 million |

| Value-based CAGR (2025 to 2035) | 5.8% |

| Collective Value Share: Top 5 Companies (2025A) | 30% to 35% |

Latin America in-mold labels industry showcased a CAGR of 2.6% during the historical period. It reached a market value of USD 348.8 million in 2025 from USD 263.1 million in 2020.

In-mold labels are applied in the process of manufacturing plastic containers. These labels are made up of the same material as that of the container.

The label acts as part of the container wall and hence provides higher strength to the container with lesser weight of the unit. These are made for the permanent or long shelf life of the label on containers.

Increasing use of in-mold labels for labeling where longer shelf life, amazing aesthetics, higher strength, and other such qualities are required would propel demand. Sectors incorporating in-mold labels in their packaging are food, beverage, pharmaceutical, domestic care, cosmetics, and others.

There has been an increasing focus on product differentiation and branding across various sectors in Latin America. In-mold labels offer unique and eye-catching designs that help products stand out on the shelves, attracting consumer attention and driving demand.

Advancements in printing and labeling technologies have made in-mold labels more accessible and cost-effective. Ability to produce high-quality and intricate designs on in-mold labels has expanded. It might lead to greater demand from companies looking to enhance visual appeal of their products.

Growing focus on sustainability has played a significant role in the rise of in-mold label demand. These labels can be made using recyclable materials, aligning with the increasing preference for eco-friendly and sustainable packaging solutions.

Durability and resistance of in-mold labels to various environmental factors such as moisture, chemicals, and UV exposure, have contributed to their popularity. Companies value longevity and integrity of these labels throughout the product's lifecycle. They would help in ensuring that the branding and product information remain intact.

In-mold labels (IML) can help to save electricity in several ways. They can eliminate the need for separate labeling machines, which can use a significant amount of electricity.

In-mold labels can be molded directly onto the product, which reduces the need for energy-intensive processes such as printing and applying adhesives. These labels can also help to save labor cost in multiple ways.

In-mold labels eliminate the need for manual labeling, which can be a time-consuming and labor-intensive process. These labels can also be applied more quickly and easily than traditional labels, which can save time and labor costs.

| Country | Brazil |

|---|---|

| Market Share (2025) | 23.3% |

| Market Share (2035) | 19.8% |

| BPS Analysis | -340 |

| Country | Mexico |

|---|---|

| Market Share (2025) | 18.4% |

| Market Share (2035) | 16.9% |

| BPS Analysis | -150 |

| Country | Argentina |

|---|---|

| Market Share (2025) | 613.4% |

| Market Share (2035) | 613.0% |

| BPS Analysis | -40 |

| Country | Chile |

|---|---|

| Market Share (2025) | 11.3% |

| Market Share (2035) | 11.3% |

| BPS Analysis | 0 |

| Country | Colombia |

|---|---|

| Market Share (2025) | 9.6% |

| Market Share (2035) | 10.1% |

| BPS Analysis | 60 |

| Country | Peru |

|---|---|

| Market Share (2025) | 7.2% |

| Market Share (2035) | 7.9% |

| BPS Analysis | 70 |

| Country | Puerto Rico |

|---|---|

| Market Share (2025) | 5.9% |

| Market Share (2035) | 7.2% |

| BPS Analysis | 6130 |

| Country | Ecuador |

|---|---|

| Market Share (2025) | 4.0% |

| Market Share (2035) | 5.3% |

| BPS Analysis | 6130 |

| Country | Rest of Latin America |

|---|---|

| Market Share (2025) | 7.0% |

| Market Share (2035) | 8.3% |

| BPS Analysis | 6130 |

Food Companies in Brazil to Look for Advanced In-mold Labeling Systems

Brazil food manufacturing sector might present a lot of opportunities for Latin America in-mold labels market. According to the Food Export Association, the food processing sector of Brazil was estimated to be USD 329.7 billion in 2024. It had registered y-o-y growth of 16.9% from 2024.

Food manufacturers and ingredients suppliers are constantly looking for new suppliers & innovative products. Brazil continues to follow international food trends. Key players in the country are always looking to launch innovative products with high-added value.

There is also an increasing demand for new ingredients, further allowing manufacturers to make products with clean and clear labels. As a result, Brazil is anticipated to offer an incremental opportunity of USD 38.9 million over the projected period.

Pharmaceutical Companies in Mexico to Demand In-mold Labeling Equipment

The pharmaceutical sector of Mexico is the second-largest market in Latin America. It ranks at number 15 globally.

Mexico is known for producing medicines such as anti-inflammatory drugs, cancer treatments, and antibiotics. According to Wisconsin Economic Development Corporation, pharmaceutical sales in Mexico are projected to be USD 613 billion in 2035.

As per Organization for Economic Co-operation and Development (OECD) data, health-related spending in Mexico increased from 5.4% in 2020 to 6.2% in 2024. Mexico is set to hold a share of around 18.4% in 2025 and expand at a CAGR of 4.9% from 2025 to 2035.

In-mold Labeled Containers Made from Polypropylene to Gain Traction by 2035

Polypropylene (PP) is a thermoplastic material mainly used for in-mold labeling as it can be easily molded into any shape and size. PP is suitable to withstand high moisture and temperature. Hence, it can be applied to long lasting consumer goods.

Its high chemical resistance makes it an ideal solution for packaging products containing chemicals and solvents. Polypropylene segment is estimated to dominate as it is inexpensive and have high flexural strength compared to others. It is expected to hold a dominant Latin America in-mold labels market share of more than 71.1% in 2025.

Food Manufacturing Firms to Make Use of In-mold Labeling Production Process

Food sector is one of the largest consumers of in-mold labels in Latin America. In-mold labelling fulfills the requirements of sterilized and tamper evident packaging. It also offers durability and permanence for food packaging.

It delivers maximum print quality and high resolution for enhancing brand recognition and branding. Food segment is set to hold a market share of more than 41.6% in 2025.

It is projected to create an incremental opportunity worth USD 84.1 million during the forecast period. Online food delivery ecosystem has witnessed significant growth in recent years, driven by changing preferences and advancements in technology.

In response to growing demand for sustainable packaging solutions, companies in Latin America in-mold labels industry are increasingly adopting eco-friendly practices. They would develop labels using recyclable materials, incorporate bio-based or compostable materials, and implement environmentally conscious manufacturing processes. They are doing so to reduce their carbon footprint.

Collaborations, partnerships, and acquisitions might play a significant role in growth strategies of key companies. They might form alliances with other market players, raw material suppliers, or technology providers. They would aim to enhance their product offerings, market reach, or manufacturing capabilities with collaborations.

Recent activities and mergers implemented by leading players in the market are:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 311.6 million |

| Projected Market Valuation (2035) | USD 547.9 million |

| Value-based CAGR (2025 to 2035) | 5.8% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (Sq. Mt.) |

| Segments Covered | Process, Material, Printing Method, End Use, Country |

| Key Countries Covered | Brazil, Mexico, Argentina, Chile, Colombia, Peru, Puerto Rico, Ecuador, Rest of Latin America |

| Key Companies Profiled | CCL Industries Inc.; Constantia Flexibles Group GmbH; Coveris Holding S.A.; Avery Dennison Corp.; Multicolor Corporation; Fuji Seal International Inc.; Huhtamäki Oyj; Sonoco Products Company; Berry Global; Duratech Industries Inc.; Grupo Phoenix; Winpak Ltd.; Serigraph Inc.; Gráfica Rami; Xiang In Enterprise Co., Ltd.; Inland Label and Marketing Services LLC; IML Containers; UPM Raflatac |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global Latin America in-mold labels market is estimated to be valued at USD 348.8 billion in 2025.

The market size for the Latin America in-mold labels market is projected to reach USD 613.0 billion by 2035.

The Latin America in-mold labels market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in Latin America in-mold labels market are blow molding, injection molding and thermoforming.

In terms of material, pp segment to command 39.6% share in the Latin America in-mold labels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA