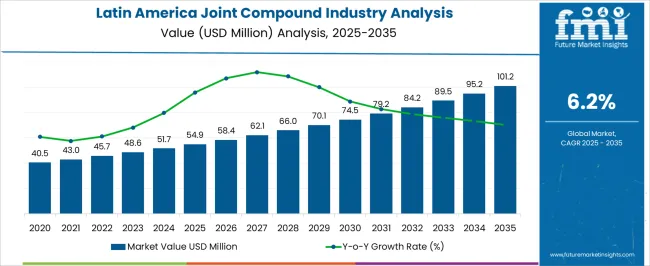

The Latin America Joint Compound Industry Analysis is estimated to be valued at USD 54.9 million in 2025 and is projected to reach USD 101.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Latin America Joint Compound Industry Analysis Estimated Value in (2025 E) | USD 54.9 million |

| Latin America Joint Compound Industry Analysis Forecast Value in (2035 F) | USD 101.2 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The Latin America joint compound industry is expanding steadily, supported by rising construction activity, urbanization trends, and the modernization of residential and commercial building infrastructure. Joint compounds are increasingly used in finishing drywall installations, repairing cracks, and achieving smooth interior surfaces, making them essential materials in construction projects.

Market growth is reinforced by the preference for ready-to-use products that reduce application time and improve work efficiency. Rising disposable incomes, coupled with expanding real estate development, are contributing to higher consumption in both new and renovation projects.

The competitive landscape is shaped by multinational and regional players investing in product innovations, such as low-dust and quick-drying compounds, tailored to regional construction practices. With continuous growth in residential housing and infrastructure modernization across key Latin American economies, the joint compound industry is expected to sustain long-term expansion.

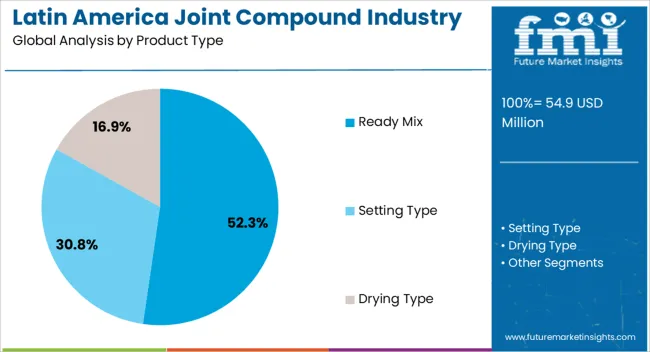

The ready mix segment dominates the product type category with approximately 52.30% share, supported by its convenience, uniform consistency, and reduced preparation requirements compared to powdered alternatives. Its pre-formulated nature allows contractors and builders to save time and achieve consistent results across projects.

The segment has gained traction in large-scale commercial and residential projects where efficiency and surface quality are prioritized. The growing trend toward labor-saving construction materials has further boosted demand for ready mix formulations.

With rising adoption in both urban and suburban developments, and continued product innovations improving application performance, the ready mix segment is expected to maintain its dominant share.

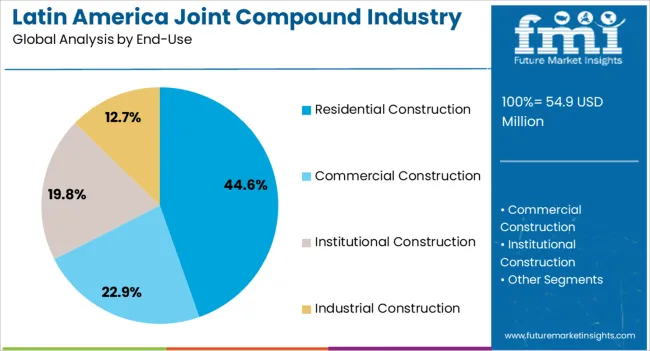

The residential construction segment leads the end-use category with approximately 44.60% share, reflecting the sector’s significant demand for joint compounds in wall finishing and repair applications. Expanding urban populations, government-backed housing initiatives, and increased middle-class income levels are driving residential building projects across Latin America.

Joint compounds are extensively used in interior finishing to ensure aesthetic appeal and durability, making them indispensable in housing construction. The segment also benefits from rising renovation and remodeling activity, particularly in metropolitan areas.

With ongoing housing demand and a consistent pipeline of residential projects, the residential construction segment is projected to retain its strong market position.

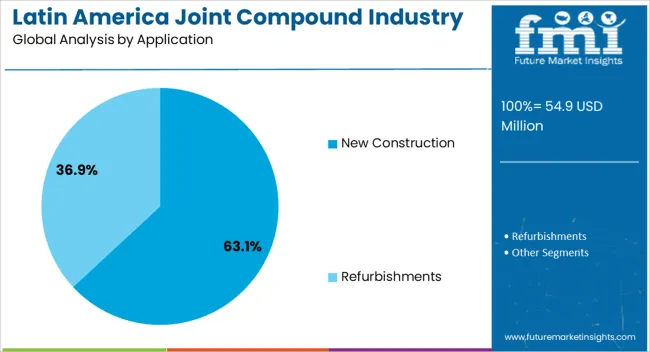

The new construction segment dominates the application category with approximately 63.10% share, reflecting its critical contribution to joint compound consumption. Rapid urban expansion and government investment in infrastructure and housing projects are creating a steady stream of demand for joint compounds during initial construction phases.

The segment benefits from high-volume requirements where joint compounds are applied across multiple structural installations. Emerging economies in Latin America, such as Brazil and Mexico, are experiencing robust activity in real estate and infrastructure, further supporting segment growth.

With sustained investment in urban housing and commercial development, the new construction segment is expected to hold its leading share over the forecast horizon.

Industry to Expand Over 2.1x through 2035

Latin America's joint compound industry is projected to expand by over 2.1 times through 2035, driven by a 5.1% increase in expected CAGR compared to the historical rate. This is due to the growing demand for construction and infrastructure development. By 2035, the total industry revenue is set to reach USD 89.5 million.

Brazil to Lead Latin America Joint Compound Industry

Brazil is expected to dominate the joint compound industry during the forecast period. It is set to hold around 27.4% of Latin America’s industry share in 2035. This is attributed to the following factors:

Based on End-use, Residential Construction is Grabbing the Opportunity

The residential construction segment is expected to dominate Latin America’s joint compound industry with a volume share of 44.7% in 2025. Residential construction is expected to remain the key end-use sector for joint compounds in the region, owing to the significant scope of high consumption from the renovation sector.

Joint compound sales in Latin America grew at a CAGR of 1.2% between 2020 and 2025. The industry reached USD 54.9.0 million in 2025. During the forecast period, the joint compound industry is expected to grow at a CAGR of 6.3%.

| Historical CAGR (2020 to 2025) | 1.2% |

|---|---|

| Forecast CAGR (2025 to 2035) | 6.3% |

The joint compound industry witnessed moderate growth between 2020 and 2025. This was due to economic growth in emerging industries leading to increased construction and infrastructure development.

The COVID-19 pandemic has had a negative impact on several industries, including the joint compound sector, in terms of supply and demand. The pandemic disrupted the supply chains, leading to shortages of raw materials and finished goods. This, in turn, led to a shortage of joint compounds. The pandemic further reduced the demand for joint compounds as the construction industry slowed down due to lockdowns and restrictions.

Future Scope of the Latin America Joint Compound Industry

Over the forecast period, Latin America’s joint compound industry is poised to exhibit healthy growth, reaching a valuation of USD 101.2 million by 2035. The construction industry is expected to showcase growth stability primarily due to rising urbanization in emerging countries across Latin America.

The resurgence of the construction industry in Latin America, along with notable growth and prospects for new construction in developing and emerging economies, is expected to drive the industry forward. This is set to create a high demand for joint compounds in Latin America.

The ready-mix type of joint compound is expected to dominate the market in terms of product type throughout the forecast period. A ready-mix joint compound is designed for fast application. It has easy maintenance, spreads smoothly, and dries up if left unattended for a long period.

Government investments in infrastructure projects, such as roads, bridges, and public buildings, are further expected to amplify the demand for joint compounds. The construction boom associated with urbanization positions joint compound manufacturers at the forefront, shaping the urban landscape in Latin America. These factors are expected to surge the demand for joint compounds by 2035.

The table below shows the estimated growth rates of the top five countries. Mexico, Colombia, and Peru are set to record high CAGRs of 7.3%, 6.9%, and 6.6%, respectively, through 2035.

| Countries | Projected Joint Compound CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.6% |

| Mexico | 7.3% |

| Colombia | 6.9% |

| Argentina | 5.4% |

| Peru | 6.6% |

Over the assessment period, demand for joint compounds in Brazil is projected to rise at a 4.6% compound annual growth rate (CAGR). Here are the trends enhancing the industry in Brazil:

Over the forecast period, the joint compound industry in Mexico is expected to grow at a robust compound annual growth rate (CAGR) of 7.3%. A handful of the trends are as follows:

By 2035, the demand for joint compound in Colombia is expected to surge at a CAGR of 6.9%. A handful of the factors are as follows:

The section below shows the ready mix segment dominating based on product type. It is forecast to thrive at a 6.5% CAGR between 2025 and 2035. Based on application, the new construction segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 6.6% during the forecast period.

| Top Segment (Product Type) | Ready Mix |

|---|---|

| Predicted CAGR (2025 to 2035) | 6.5% |

Convenience is a key benefit of ready-mix joint compounds. They save building time and effort by eliminating the need for on-site mixing. By using these chemicals directly, contractors can reduce labor-intensive preparatory work.

Ready-mix joint compounds are produced in a controlled environment to provide a reliable and homogeneous result. This uniformity plays a crucial role in the joint compound's dependability in terms of workability, drying properties, and adhesion.

Ready mix joint compounds come in a range of formulas to suit different requirements. They can be divided into groups according to how quickly they dry, such as lightweight or quick-setting compounds.

As these materials are so versatile, contractors select this ideal compound for several applications. Over the forecast period, the ready-mix segment is expected to grow at a CAGR of 6.5%.

| Top Segment (Application) | New Construction |

|---|---|

| Projected CAGR (2025 to 2035) | 6.6% |

To eliminate significant gaps and create a seamless look, a joint compound is applied over joint tapes to produce a smooth, continuous surface. In new construction, drywall surfaces sometimes need to be repaired due to dents, nicks, or other flaws.

The surfaces are patched and repaired with joint compounds. Joint compound is widely used in new construction due to its adaptability, cost-effectiveness, and versatility. The new construction segment is projected to grow at a 6.6% compound annual growth rate (CAGR) during the forecast period.

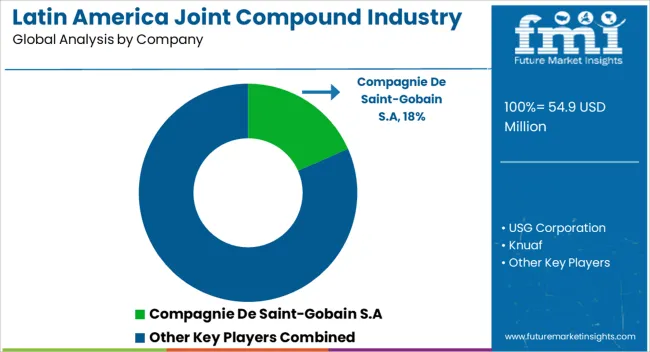

The joint compound industry in Latin America is highly consolidated, with leading players accounting for 35.1% share. Companies such as de Saint-Gobain S.A., USG Corporation, Knauf, Dryvitex, Supermastick S.A.S., Durlock, and ProForm Finishing Products LLC are the leading manufacturers and suppliers of joint compounds listed in the report.

Key joint compound companies are investing in ongoing research to develop new products and expand their capacity to meet end-user demand. They are also inclined to adopt strategies that strengthen their footprint, including acquisitions, partnerships, mergers, and facility expansions.

Leading Companies

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 48.6 million |

| Projected Value (2035) | USD 89.5 million |

| Anticipated Growth Rate (2025 to 2035) | 6.3% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (metric tons) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, End-use, Application, Region |

| Key Countries Covered | Argentina, Brazil, Mexico, Chile, Colombia, Peru, Ecuador, Paraguay, Uruguay, Guatemala, Bolivia, Costa Rica, Rest of Latin America |

| Key Companies Profiled | Compagnie de Saint-Gobain S.A; USG Corporation; Knuaf, Dryvitex; Supermastick S.A.S, Durlock; Votorantim Cimentos; Plaka Group; ASG Plaster; Cemix Mexico S.A. DE C.V; Promat, Gyplac; DAP Products Inc.; Solid Products, Inc.; ProForm Finishing Products LLC |

The global Latin America joint compound industry analysis is estimated to be valued at USD 54.9 million in 2025.

The market size for the Latin America joint compound industry analysis is projected to reach USD 101.2 million by 2035.

The Latin America joint compound industry analysis is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in Latin America joint compound industry analysis are ready mix, setting type and drying type.

In terms of end-use, residential construction segment to command 44.6% share in the Latin America joint compound industry analysis in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA