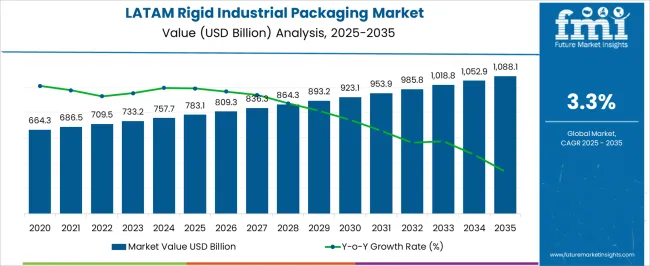

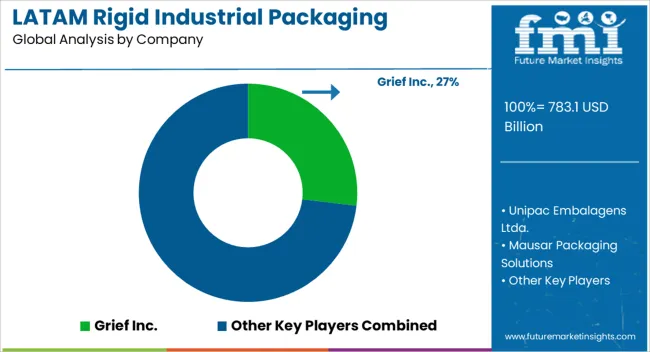

The Latin America Rigid Industrial Packaging Market is estimated to be valued at USD 783.1 billion in 2025 and is projected to reach USD 1088.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Latin America Rigid Industrial Packaging Market Estimated Value in (2025 E) | USD 783.1 billion |

| Latin America Rigid Industrial Packaging Market Forecast Value in (2035 F) | USD 1088.1 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The Latin America rigid industrial packaging market is witnessing consistent growth driven by the region’s expanding industrial base, rising agricultural exports, and growing demand for safe and durable packaging formats. Increasing focus on efficient supply chain operations and strict regulatory requirements for the storage and transport of chemicals, food, and agricultural products are strengthening the adoption of rigid packaging solutions.

Innovations in materials that enhance durability, chemical resistance, and recyclability are supporting wider market penetration. The region’s push toward sustainable industrial practices and the rising adoption of reusable and recyclable packaging formats are also playing a crucial role.

With continued investment in industrial production, trade, and sustainable packaging infrastructure, the outlook for rigid industrial packaging in Latin America remains positive, supported by a balance of operational efficiency, compliance, and environmental responsibility.

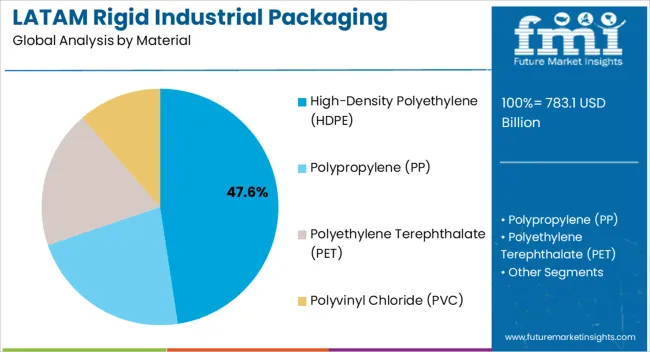

The high density polyethylene segment is expected to account for 47.60% of total market revenue by 2025 within the material category, making it the leading segment. This dominance is driven by its superior strength to weight ratio, resistance to moisture and chemicals, and recyclability.

Its adaptability across diverse industrial applications and cost effectiveness have further reinforced its preference among manufacturers and end users.

The material’s ability to ensure product safety while aligning with sustainable packaging mandates has established its leadership in the material category.

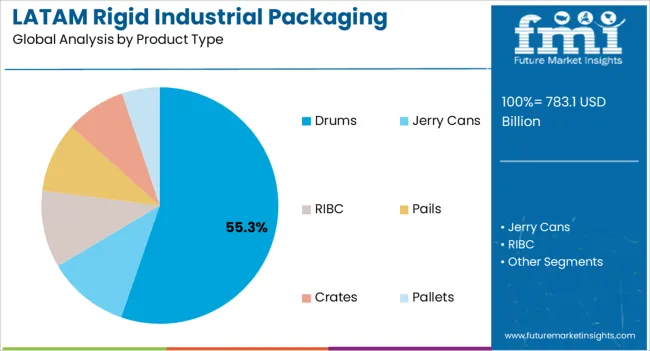

The drums segment is projected to contribute 55.30% of overall revenue by 2025 within the product type category, positioning it as the most prominent segment. The widespread use of drums in transporting and storing bulk liquids and chemicals has underpinned their dominance.

Their durability, reusability, and compliance with industrial safety standards have made them indispensable in logistics and industrial operations.

Additionally, advancements in manufacturing techniques have improved the performance and reliability of drums, further enhancing their adoption in the rigid industrial packaging sector.

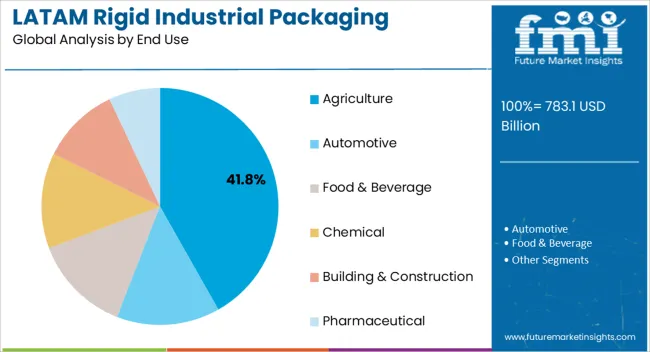

The agriculture segment is anticipated to hold 41.80% of market revenue by 2025 within the end use category, making it the largest application area. This share is being driven by the high demand for safe storage and efficient transportation of fertilizers, pesticides, and bulk agricultural commodities.

Packaging solutions that ensure protection against contamination, maintain product integrity, and support large scale distribution have been particularly valued in this sector.

With the agriculture industry playing a critical role in the Latin American economy, the need for robust and sustainable packaging solutions continues to position this segment as the leading end use category.

The Latin America rigid industrial packaging market has anticipated a CAGR of 1.5% during the historic period with a market value of USD 783.1 million in 2025 from USD 664.3 million in 2020.

The Latin American rigid industrial packaging market has grown steadily over the last decade, owing to the region's developing industrial and manufacturing sectors. Increased demand from industries such as food and beverage, chemicals, and pharmaceuticals, which require dependable and long-lasting packaging solutions for their products, has propelled the market.

The expansion of the region's construction industry has also been a significant driver of the market, as rigid packaging materials are required for the transportation and storage of building supplies.

With the development of sustainable and ecologically friendly packaging solutions, the Latin America rigid industrial packaging market has evolved over the years to satisfy changing customer needs. The growing concern for the environment and sustainability has prompted a greater emphasis on recyclable and biodegradable packaging materials in the market.

Key Factors Driving Growth in Latin America

The expansion of the automotive sector in Latin America is augmenting revenues in the region's rigid industrial packaging market. The automotive industry is a big user of rigid industrial packaging, especially for transporting and storing vehicle parts and components.

As the automobile industry expands in Latin America, so does the demand for rigid packaging solutions. Rigid industrial packaging is a dependable and long-lasting solution for transporting car parts, which are frequently huge and heavy and require particular handling and protection throughout transit.

Furthermore, the region's automotive industry's expansion has resulted in increasing international investment and the creation of new production facilities. As a result, the supply chain has grown and there is a greater requirement for packaging solutions to secure and transport car parts and components.

As demand from the electrical and automotive sectors surges, the Latin American rigid industrial packaging market is predicted to rise at an exponential rate. Rigid industrial packaging is a suitable solution for the electronics and automotive industries, which require specific packaging solutions to transport and store their products.

To preserve electrical components during shipment and storage, the electronics sector requires specialized packaging. Rigid industrial packaging is a dependable and durable solution for ensuring the safe shipping of electronic components. The growing demand for electronics in Latin America is propelling the rigid industrial packaging industry forward.

High-Density Polyethylene (HDPE) is the Leading Segment

High-Density Polyethylene (HDPE) is the most commonly utilized material type because of its unique qualities and versatility. HDPE is a lightweight yet sturdy and durable material that is ideal for rigid industrial packaging applications.

HDPE is also impact, moisture, and chemical resistant, making it excellent for storing and transporting a variety of things such as chemicals, food, and pharmaceuticals. Furthermore, HDPE is a low-cost material, making it an appealing choice for both manufacturers and end users.

HDPE is a recyclable material, making it an environmentally beneficial choice for rigid industrial packaging. The growing emphasis on sustainability and environmental friendliness has increased demand for HDPE packaging solutions in the Latin American market.

The Agricultural Sector is Projected to Fuel the Market

The expansion of the agricultural business in South America is assisting the region's rigid industrial packaging market. The agriculture industry uses a lot of hard industrial packaging, especially for transporting and storing crops and other agricultural products. As the South American agriculture business expands, so does the demand for rigid packaging solutions.

Rigid industrial packaging offers a dependable and long-lasting solution for agricultural product transportation and storage, safeguarding them from damage and ensuring safe delivery to their final destination.

Furthermore, the growing emphasis on sustainability and environmentally friendly packaging solutions is propelling the development of eco-friendly packaging materials such as biodegradable and recyclable plastics, which are especially important in the agriculture industry. The use of sustainable packaging solutions can aid in the reduction of waste and the reduction of the environmental impact of agricultural operations.

| Country | Brazil |

|---|---|

| Market Share (2025) | 36% |

| Market Share (2035) | 35.5% |

| BPS Analysis | -50 |

| Country | Mexico |

|---|---|

| Market Share (2025) | 28% |

| Market Share (2035) | 31.7% |

| BPS Analysis | +370 |

| Country | Rest of LA |

|---|---|

| Market Share (2025) | 36% |

| Market Share (2035) | 32.9% |

| BPS Analysis | -320 |

Mexico’s Robust Construction Sector to Provide Steady Demand for Rigid Industrial Packaging Solutions

According to Future Market Insights (FMI), Brazil reached a valuation of USD 162,932.3 million by 2025-end. It is further expected to cross a valuation of USD 256,873.3 million by the beginning of 2035.

Construction activities in Mexico are fueling the expansion of the Latin American rigid industrial packaging market. To suit the packaging needs of building materials, rigid industrial packaging solutions are in demand in Mexico, one of Latin America's largest construction markets.

To transport and store hefty, bulky products like cement, bricks, and tiles, the construction sector needs specific packaging solutions. For the safe transportation of these commodities, rigid industrial packagings options like pallets, crates, and containers offer a dependable and durable solution.

Rigid Packaging Solutions for International Export of Agricultural Produce Driving Sales in Brazil

Brazil market for rigid industrial packaging was valued at USD 205,448.3 million at 2025-end. It is further expected to cross a valuation of USD 286,484.3 million by the time 2035 rolls around. The demand for rigid industrial packaging solutions in the nation is being driven by the rising demand for food and agricultural products coming from Brazil.

Agricultural products must be transported and stored in rigid industrial packaging solutions including crates, pallets, and containers. The demand for rigid industrial packaging solutions in Brazil is increasing as a result of the country's status as a major international exporter of agricultural goods and the expansion of its construction industry. This is fueling the expansion of the Latin American rigid industrial packaging market.

The key players in the market are gaining market value by developing innovations and advancements in the Latin America rigid industrial packaging market.

Key manufacturers are directing toward growth strategies such as mergers and acquisitions, and product development to enhance their customer base. Recent activities and mergers implemented by the leading player in the market are:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.3% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material, Product, End-use |

| Regions Covered | Latin America |

| Key Countries Covered | Brazil, Mexico, Rest of Latin America |

| Key Companies Profiled | Grief Inc.; Unipac Embalagens Ltda.; Mausar Packaging Solutions; ALPLA Group; Kautex Textron GmbH & Co. KG; Berry Global Group, Inc.; Schutz Container Systems, Inc.; Plásticos Novel; Schoeller Allibert; Dolav Plastic Products; Textron Inc. |

The global Latin America rigid industrial packaging market is estimated to be valued at USD 783.1 billion in 2025.

The market size for the Latin America rigid industrial packaging market is projected to reach USD 1,088.1 billion by 2035.

The Latin America rigid industrial packaging market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in Latin America rigid industrial packaging market are high-density polyethylene (hdpe), polypropylene (pp), polyethylene terephthalate (pet) and polyvinyl chloride (pvc).

In terms of product type, drums segment to command 55.3% share in the Latin America rigid industrial packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA