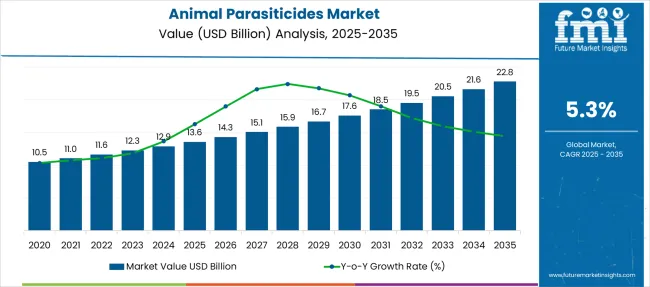

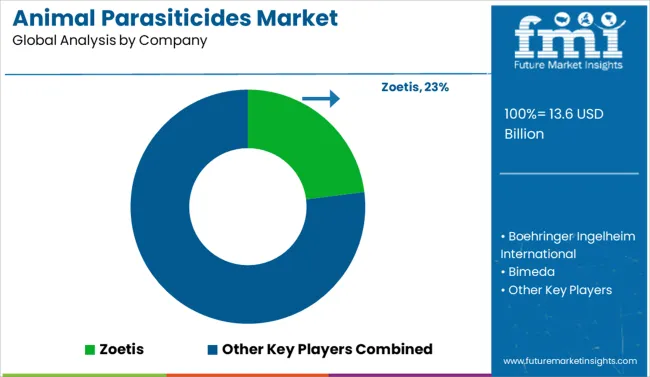

The Animal Parasiticides Market is estimated to be valued at USD 13.6 billion in 2025 and is projected to reach USD 22.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The growth curve follows a compound acceleration pattern during the early phase where YoY growth remains strong between 2025 and 2030. This phase adds nearly USD 4.0 billion, supported by rising livestock health investments, increased pet ownership, and regulatory pressure for parasite control. The contribution from this block represents more than half of the total expansion before the inflection point.

After 2031, YoY growth starts to decelerate despite continuous absolute value gains, signaling demand maturity in developed regions. The late phase from 2031 to 2035 contributes an additional USD 4.3 billion, driven by biologics-based parasiticides and smart delivery mechanisms rather than volume. This marks an inflection near 2031, making innovation-driven differentiation critical for sustaining growth.

Cyclicality is minimal since the demand pattern remains relatively stable, with slight fluctuations linked to livestock population cycles and regulatory approval timelines. Elasticity to macroeconomic trends is low because preventive veterinary care is considered essential. Future value accumulation will rely on digital monitoring, resistance management, and extended-release formulations to boost efficacy and compliance.

| Metric | Value |

|---|---|

| Animal Parasiticides Market Estimated Value in (2025 E) | USD 13.6 billion |

| Animal Parasiticides Market Forecast Value in (2035 F) | USD 22.8 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The animal parasiticides market is undergoing strong expansion driven by the rising awareness of zoonotic disease control, growth in global livestock populations, and increased expenditure on veterinary care. Regulatory support for food safety and mandatory parasite prevention protocols in farm animals is further shaping demand.

Innovations in active ingredient formulations, delivery systems, and resistance management strategies are enabling more targeted and effective parasite control. Additionally, shifts in pet ownership trends and expanding commercial animal husbandry are fostering broader access to parasiticides across both rural and urban distribution channels.

The integration of diagnostics with treatment regimens and rising preference for end-user-friendly applications are setting the stage for continued growth. Future market advancement is likely to be influenced by precision veterinary medicine, sustainable residue control standards, and preventive animal health programs.

The market is segmented by product type, type, animal type, drug class, and region. By product type, it includes ectoparasiticides such as pour-ons and spot-ons, oral tablets, sprays, dips, ear tags, collars, and other ectoparasiticides, as well as endoparasiticides in the form of oral liquids, oral solids, injectables, feed additives, and other variants, along with endectocides. In terms of type, the market is divided into over-the-counter (OTC) and prescription-based products. Based on animal type, it covers farm animals such as swine, cattle, poultry, sheep and goats, and other farm species, along with companion animals including dogs, cats, horses, and other pets. By drug class, segmentation includes chemical synthetic, macrocyclic lactones, pyrethroids, organophosphates, benzimidazoles, and other classes. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Ectoparasiticides are projected to account for 49.0% of the total animal parasiticides market revenue in 2025, making it the leading product type. The high prevalence of external parasites such as ticks, fleas, lice, and mites across livestock and companion animals is driving the segment’s growth.

Increased vector-borne disease risk and the need for visible, fast-acting control solutions have made ectoparasiticides a first line of defense in parasite management protocols. These products offer flexible formulations including sprays, pour-ons, and spot-on applications, enabling ease of use for farmers and pet owners.

Ectoparasiticides also benefit from faster regulatory approvals compared to internal treatment drugs due to lower systemic absorption, encouraging broader commercial availability and innovation.

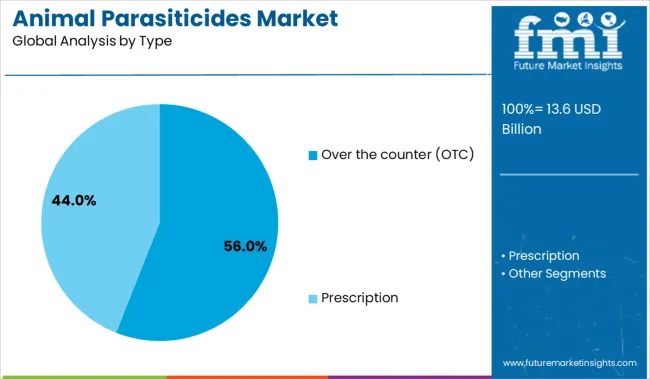

Over-the-counter (OTC) products are anticipated to hold a 56.0% share of the total market by 2025, establishing themselves as the leading distribution type. This dominance is attributed to increasing end-user demand for direct access to preventive animal health solutions without veterinarian prescriptions.

Growing retail and e-commerce penetration has enabled wider product availability, especially in developing regions with limited veterinary infrastructure. OTC parasiticides offer convenience, affordability, and faster access-factors that resonate with cost-sensitive pet owners and small-scale livestock operators.

Moreover, improved packaging, instructions for use, and safety labeling have enhanced consumer trust, reinforcing the role of OTC products in expanding market reach and compliance in routine parasite prevention.

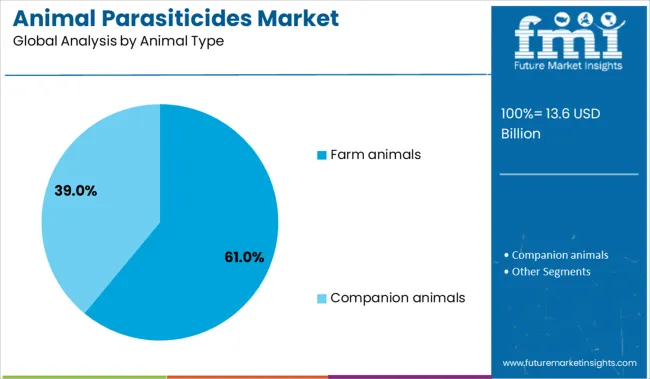

Farm animals are expected to contribute 61.0% of the total animal parasiticides market revenue in 2025, leading the animal type segment. This share is supported by intensive livestock farming practices and the critical need to control parasitic infestations that impact animal productivity, weight gain, milk yield, and disease transmission.

Regulatory mandates around food chain safety and residue monitoring have heightened the importance of proactive parasite control in cattle, poultry, and swine populations. Moreover, large-scale farming operations rely on consistent parasiticide programs to maintain animal welfare and prevent economic losses.

As export-oriented meat and dairy producers aim to meet global standards, demand for high-efficacy parasiticides in farm animals continues to strengthen.

Demand for animal parasiticides continues to expand as livestock and companion animals are managed for parasite control, veterinary health, and productivity. Endectocides, insect growth regulators, and topical sprays have been commonly adopted for managing tick infestations, flea prevention, and gastrointestinal nematode suppression. Uptake has increased across veterinary clinics, commercial farms, and pet owners, driving stronger penetration of prescription and over-the-counter parasiticides throughout production and care sectors.

Veterinary protocols have been formalized through regulatory mandates aimed at reducing production losses, mitigating zoonotic transmission, and managing resistance. Health authorities and livestock boards have promoted periodic suppression regimens for both food-producing and companion species. This has supported procurement of broad-spectrum endectocides, ivermectin injectables, and topical abamectin-based treatments. Performance benchmarks such as egg reduction rates and flea mortality have been reported in veterinary literature to reinforce efficacy. Deworming frequency has increased under dairy, equine, and small ruminant herd programs coordinated by cooperatives and veterinary networks. Prescription parasiticides are now supported through veterinarian-led dosing models and refill-based subscription platforms. To combat resistance, veterinarians are rotating active ingredients and integrating insect growth regulators. As more clinical protocols gain national standardization, parasiticide use is expanding in both acute care and preventative treatment regimens.

Market opportunities are being shaped by species-specific delivery technologies and digital management systems. Companion animal formats now include oral gels, slow-release collars, and long-acting injectable suspensions to support easier administration and owner compliance. In livestock, biodegradable implants are being developed to reduce rehandling and stress. Veterinary networks and farm managers are adopting treatment-tracking platforms that log parasite surveillance, dosage intervals, and weight-adjusted applications. Feed-integrated microdosing of parasiticides has gained traction in ruminant nutrition strategies. Rising demand for organic-compatible antiparasitic chews and botanical formulations has emerged in response to shifting farm standards. Awareness campaigns by veterinary associations and e-commerce pet health portals are broadening reach into rural and underserved breeder communities, enabling more structured adoption of preventive parasite management solutions.

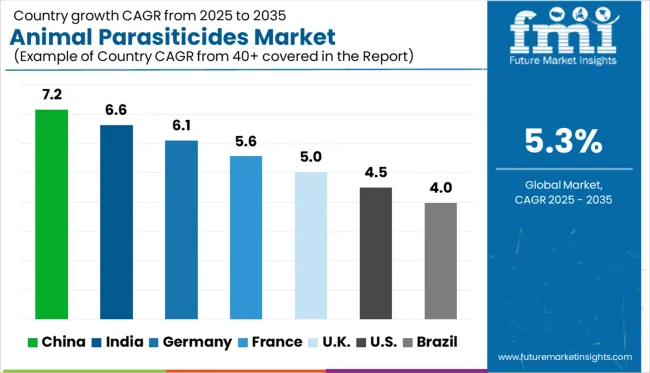

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global animal parasiticides market is projected to grow at a CAGR of 5.3% from 2025 to 2035, shaped by the intensification of livestock farming, disease vector control, and companion animal health programs. China leads with a 7.2% CAGR, driven by government-endorsed veterinary healthcare coverage and broader use across poultry and swine sectors. India follows at 6.6%, supported by dairy herd treatment, cattle vector control, and rural animal health missions.

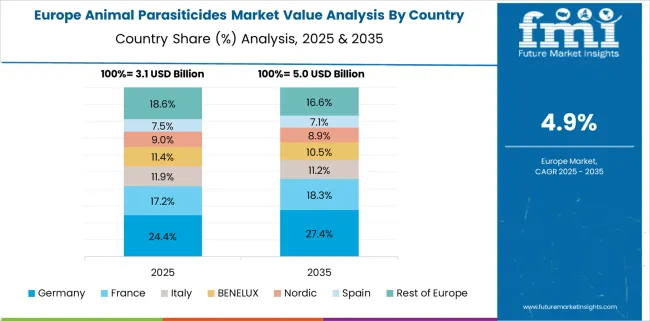

Germany posts 6.1%, anchored in regulated dosing in swine and bovine farms under stringent EU residue directives. France grows at 5.6%, led by vet-supervised companion animal treatment protocols and on-farm biosecurity adoption. The United Kingdom, at 5.0%, emphasizes regulatory refinement and dual-use parasiticide delivery systems across companion and livestock categories.

Animal parasiticide demand in China is forecast to rise at a 7.2% CAGR through 2035, exceeding the global average. National mandates for veterinary drug coverage across poultry, swine, and aquaculture have driven growth. China’s Ministry of Agriculture promotes scheduled deworming and ectoparasite treatment cycles, with strict residue monitoring for meat exports.

Provinces such as Sichuan and Shandong have adopted livestock vector control plans using macrocyclic lactone-based injectables. Feed mills now incorporate endoparasiticides in premix formulations for broilers and piglets. Companion pet owners in urban centers are increasingly subscribing to monthly spot-on flea and tick treatments, further widening market penetration.

Demand for animal parasiticides in India is expanding at a 6.6% CAGR, driven by dairy herd treatment programs, livestock mobility, and periodic vector outbreaks. State veterinary networks are coordinating campaigns to control tick-borne diseases and intestinal worms, especially in crossbred cattle and backyard poultry.

Pour-on and oral dewormers are commonly dispensed through government camps and mobile units. Growth is anchored in the National Animal Disease Control Program (NADCP) and rural animal health initiatives. Indian firms are innovating combination therapies suited to tropical climates and high field resistance. Penetration in smallholder segments is growing through subsidized distribution.

Germany is expected to expand its animal parasiticides market at a 6.1% CAGR, anchored by rigorous EU-aligned dosing policies for pigs and cattle. Farmers are adopting scheduled parasiticides with withdrawal periods aligned to European residue safety standards.

Companion pet formulations continue to see growth, particularly in chewable and collar formats. Demand is driven by monthly flea and tick management protocols enforced through veterinarian-issued treatment logs. Poultry operations have incorporated parasiticides in rotation with probiotics for coccidial control. German pharmaceutical CDMOs are supporting API formulation changes to meet EU residue and environmental risk directives, especially for pasture-applied treatments.

France is projected to grow at a 5.6% CAGR, led by parasite prevention across small ruminants, dairy cows, and companion animals. Vet-supervised treatment regimes are expanding in mixed farms and rural communes, where flukes and gastrointestinal worms present seasonal challenges.

Companion pet parasiticides are gaining volume through e-commerce platforms and in-clinic dispensing. France emphasizes antimicrobial stewardship, prompting broader acceptance of non-antibiotic parasite control. Academic research is supporting precision dosing tools and targeted parasite diagnostics. Local firms are advancing endectocide formulations suited to pasture-based systems. Market regulations enforce record-keeping of antiparasitic use on farms.

The United Kingdom is expected to grow at a 5.0% CAGR, shaped by post-Brexit regulatory updates, livestock welfare emphasis, and pet ownership trends. Livestock parasiticide usage is adapting to new farm assurance scheme requirements that prioritize targeted selective treatment.

Veterinary practices are increasing use of fecal egg count monitoring and resistance testing before prescribing. Oral and spot-on treatments dominate the companion animal channel, where preventative regimens are being promoted via subscription-based pet plans. Retailers are expanding anti-parasitic portfolios under the VMD's simplified categories. Demand is shifting toward products with reduced environmental runoff and compliance to Red Tractor and Soil Association standards.

Zoetis leads the animal parasiticides market, supported by a broad-spectrum portfolio covering both ectoparasiticides and endoparasiticides for livestock and companion animals. The company’s strength lies in lifecycle management of active ingredients and expanded distribution partnerships across veterinary networks.

Boehringer Ingelheim International maintains a strong presence in bovine and equine care through its focused antiparasitic injectables and internal parasite control products. Elanco Animal Health emphasizes dual-mode combination therapies and species-specific delivery formats targeting compliance and efficacy.

Merck remains competitive through global livestock deworming programs and a robust injectable range adapted for herd-level interventions. Ceva Santé Animale and Virbac have prioritized companion animal solutions, focusing on convenience-based spot-on applications and chewable forms.

Dechra Pharmaceuticals and Bimeda cater to veterinary practices with regionally optimized parasiticides, particularly in sheep, swine, and equine sectors. Vetoquinol, Ourofino Saúde Animal, and Phibro Animal Health enhance access in Latin America and Asia through locally manufactured actives and affordable dosing kits. Competitive advantage in this sector is defined by regulatory alignment, product traceability, and formulation innovation tailored to species and geography.

In April 2025, Zoetis received FDA approval for a new indication for Simparica Trio®, making it the only canine parasiticide approved to prevent flea tapeworm infections by eliminating the vector fleas. This development expands the product's spectrum of action, reinforcing Zoetis' leadership in integrated parasite protection for dogs.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.6 Billion |

| Product Type | Ectoparasiticides, Pour-ons and spot-ons, Oral tablets, Sprays, Dips, Ear tags, Collars, Other ectoparasiticides, Endoparasiticides, Oral liquids, Oral solids, Injectables, Feed additives, Other endoparasiticides, and Endectocides |

| Type | Over the counter (OTC) and Prescription |

| Animal Type | Farm animals, Swine, Cattle, Poultry, Sheep and goats, Other farm animals, Companion animals, Dogs, Cats, Horses, and Other companion animals |

| Drug Class | Chemical synthetic, Macrocyclic lactones, Pyrethroids, Organophosphates, Benzimidazoles, and Other drug classes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis, Boehringer Ingelheim International, Bimeda, Biogénesis Bagó, Ceva Sante Animal, Dechra Pharmaceuticals, Elanco Animal Health, Merck, Norbrook Laboratories, Neogen Corporation, Ourofino Saúde Animal, Phibro Animal Health, PetIQ, Virbac, and Vetoquinol |

| Additional Attributes | Dollar sales of animal parasiticides are segmented by product type including flea and tick control, dewormers, and endectocides, with spot-on topical treatments capturing notable share. Demand is increasing for broad-spectrum, residue-free formulations in chewable and oral formats. OEMs and CDMOs play a necessary role in turnkey development, scale-up, and dosage customization. Adoption is highest in North America, Europe, and Latin America, supported by livestock health mandates and companion animal care protocols. |

The global animal parasiticides market is estimated to be valued at USD 13.6 billion in 2025.

The market size for the animal parasiticides market is projected to reach USD 22.8 billion by 2035.

The animal parasiticides market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in animal parasiticides market are ectoparasiticides, pour-ons and spot-ons, oral tablets, sprays, dips, ear tags, collars, other ectoparasiticides, endoparasiticides, oral liquids, oral solids, injectables, feed additives, other endoparasiticides and endectocides.

In terms of type, over the counter (otc) segment to command 56.0% share in the animal parasiticides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA