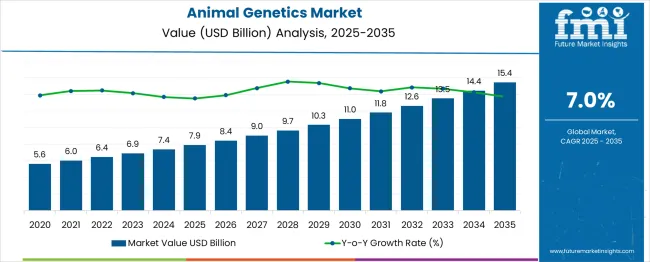

The animal genetics market is estimated to grow from USD 7.9 billion in 2025 to USD 15.4 billion in 2035, achieving a compound annual growth rate (CAGR) of 7%, representing an absolute dollar opportunity of USD 7.5 billion over the decade. Incremental market value rises steadily, from USD 8.4 billion in 2026 to USD 11.0 billion by 2030 and USD 14.4 billion in 2034. Growth is driven by increasing adoption of genomic selection, livestock breeding programs, and precision animal husbandry technologies. The expanding demand for high-yield and disease-resistant livestock presents substantial revenue potential, underscoring strong long-term opportunities for genetics service providers and biotechnology firms.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 7.9 billion |

| Forecast Value in (2035F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 7% |

The animal genetics market exhibits consistent expansion from USD 7.9 billion in 2025 to USD 15.4 billion in 2035, reflecting a CAGR of 7% and an absolute dollar opportunity of USD 7.5 billion over the decade. Early-decade growth between 2025 and 2028 contributes roughly USD 0.5–0.6 billion annually, with values increasing from USD 7.9 billion to USD 9.0 billion by 2028, driven primarily by adoption of genomic selection in cattle and swine breeding programs. Mid-decade growth from 2028 to 2032 accelerates, with the market rising from USD 9.0 billion to USD 11.8 billion, reflecting heightened investments in precision animal husbandry technologies, disease-resistance traits, and AI-driven breeding analytics. Late-decade expansion between 2032 and 2035 is even stronger, with values climbing from USD 11.8 billion to USD 15.4 billion, supported by scaling of livestock improvement initiatives and increased penetration in emerging markets.

Proportional contributions indicate that early-decade growth accounts for approximately 25% of the total incremental value, mid-decade growth for 35%, and late-decade growth for 40%, emphasizing higher revenue accumulation in the latter half of the forecast period. Segmentally, bovine genetics contribute around 40–45%, swine 20–25%, poultry 15–20%, and other livestock types 10–15%, reflecting a balanced adoption across livestock types.

Market expansion is being supported by the increasing global demand for animal protein and the corresponding need for efficient livestock production systems that can meet growing food security requirements. Modern farmers are increasingly focused on genetic improvement strategies that can enhance productivity, reduce production costs, and improve animal welfare standards. Advanced breeding technologies' proven efficacy in improving traits like milk production, meat quality, and disease resistance makes them preferred solutions in commercial livestock operations.

The growing emphasis on sustainable agriculture and environmental stewardship is driving demand for genetic solutions that can reduce the environmental footprint of livestock production while maintaining high productivity levels. Producer preference for comprehensive genetic services that combine breeding technologies with data analytics and management support is creating opportunities for integrated livestock improvement programs. The rising influence of precision agriculture trends and biotechnology advancements is also contributing to increased adoption of genetic testing and selective breeding across different livestock species and production systems.

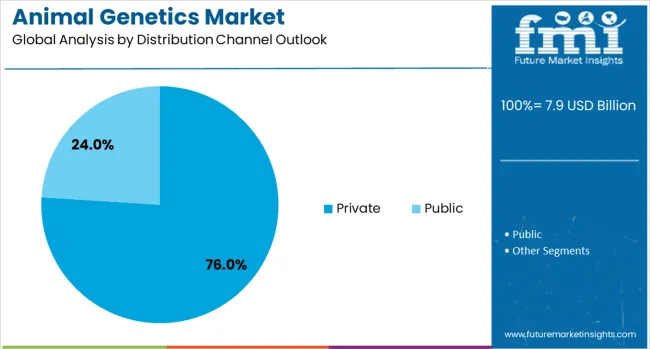

The market is segmented by animal type, technology type, distribution channel, and region. By animal type, the market is divided into cattle, pigs, sheep & goats, companion animals, and others. Based on technology type, the market is categorized into assistive reproduction technologies, live animals, and genomic/genetic testing. In terms of distribution channel, the market is segmented into private and public sectors. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The assisted reproductive technologies segment is projected to account for 50% of the animal genetics market in 2025, reaffirming its position as the leading technology solution. Livestock producers increasingly rely on artificial insemination, embryo transfer, and in vitro fertilization to accelerate genetic gain and optimize herd performance. These technologies’ proven effectiveness addresses efficiency challenges by enabling rapid propagation of superior genetics and reducing generation intervals across breeding programs. This technology forms the cornerstone of modern livestock improvement initiatives, offering a cost-effective and scalable approach to genetic advancement. Veterinary validation and continuous research in reproductive biotechnology reinforce trust in these methods. As producers aim to enhance reproductive efficiency and accelerate genetic progress, assisted reproductive technologies remain central to market growth and adoption across multiple livestock species.

Cattle are projected to represent 41% of animal genetics market demand in 2025, highlighting their prominence in global livestock breeding programs. Producers focus on cattle genetics for both dairy and beef production due to their high economic value and the potential for measurable productivity gains. Genetic improvements enhance milk yield, meat quality, and feed conversion efficiency, making cattle breeding programs highly profitable. The segment benefits from well-established breeding networks, extensive genetic evaluation databases, and active R&D aimed at identifying superior genetic markers. Increasing global protein demand and the drive for enhanced herd performance reinforce cattle as the primary focus of genetics investment. Cattle genetics maintains its central role in shaping the animal genetics market while supporting long-term improvements in livestock productivity and profitability.

The private distribution channel is forecasted to contribute 76% of the animal genetics market in 2025, reflecting the commercialized nature of livestock breeding services. Private companies dominate by providing end-to-end genetic solutions, integrating advanced reproductive technologies, and ensuring high service quality for commercial producers. Their market-driven focus allows for performance-based offerings that align with profitability objectives in livestock production. This channel benefits from strong producer trust in private providers’ ability to deliver measurable genetic improvements, expert advisory support, and innovative breeding programs. As livestock operations increasingly emphasize productivity, efficiency, and competitive advantage, private distribution channels remain essential partners in implementing genetic improvement strategies and driving market innovation.

The animal genetics market is advancing rapidly due to increasing global protein demand and growing adoption of precision breeding technologies in livestock production. However, the market faces challenges including high initial investment costs, regulatory complexities, and limited access to advanced genetic services in developing regions. Innovation in genomic selection and biotechnology applications continue to influence breeding program development and market expansion patterns.

The growing adoption of genomic testing platforms is enabling producers to make more accurate breeding decisions based on genetic markers and predictive analytics. DNA testing services offer detailed genetic profiles, disease resistance markers, and performance predictions that influence breeding strategies. Advanced genomic tools and bioinformatics platforms are driving genetic improvement accuracy and reducing generation intervals in livestock breeding programs.

Modern animal genetics companies are incorporating artificial intelligence and machine learning algorithms to optimize breeding decisions and enhance genetic selection accuracy. These technologies improve the analysis of complex genetic data while providing predictive insights for breeding outcomes and livestock performance. Advanced data analytics systems also enable precision breeding approaches that deliver targeted genetic improvements in specific traits and production characteristics.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 9.4% |

| India | 8.7% |

| Germany | 8% |

| France | 7.3% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

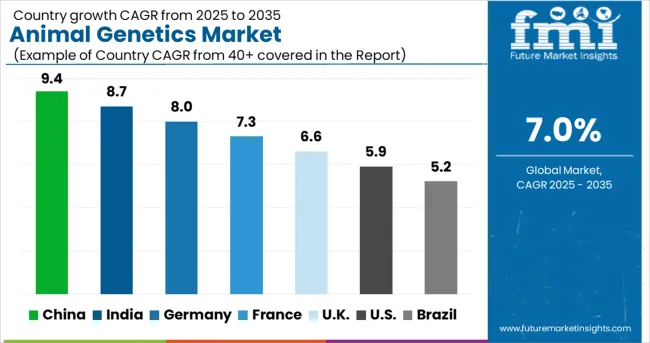

The animal genetics market is experiencing robust growth globally, with China leading at a 9.4% CAGR through 2035, driven by expanding livestock production, increasing protein consumption, and government support for agricultural modernization programs. India follows closely at 8.7%, supported by growing dairy industry, rising meat demand, and increasing adoption of modern breeding technologies. Germany shows steady growth at 8.0%, emphasizing sustainable livestock production and advanced genetic improvement systems. France records 7.3%, focusing on premium livestock genetics and agricultural innovation. Australia and UK both show 6.6% growth, prioritizing export-oriented livestock genetics and breeding excellence. The USA demonstrates 5.9% growth through established breeding infrastructures and technological advancement. Brazil shows 5.2% growth, driven by expanding livestock exports and genetic improvement investments.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Animal genetics services in China are expected to witness significant expansion with a CAGR of 9.4% through 2035, fueled by rapid growth in commercial livestock operations and increasing governmental support for agricultural biotechnology initiatives. Rising protein demand, an expanding middle-class population, and modernization of livestock farms are driving the adoption of advanced breeding and genetic improvement solutions. Both domestic and international breeding companies are strengthening service networks to provide comprehensive genetic support to commercial producers across developed and emerging agricultural regions. Increasing collaboration between research institutions and private enterprises is accelerating the deployment of genomics-based breeding programs and enhancing overall livestock performance.

Animal genetics services in India are projected to grow at a CAGR of 8.7%, driven by expanding dairy production, rising meat consumption, and increasing acceptance of modern livestock management practices. The country’s substantial livestock population and initiatives for productivity enhancement are encouraging adoption of genetic improvement solutions and professional breeding services. International breeding firms and domestic organizations are setting up distribution and service networks to cater to commercial and smallholder farmers alike. Integration of genomic testing, artificial insemination, and precision breeding programs is enabling higher livestock performance, disease resistance, and product quality, strengthening India’s position in competitive dairy and meat production markets.

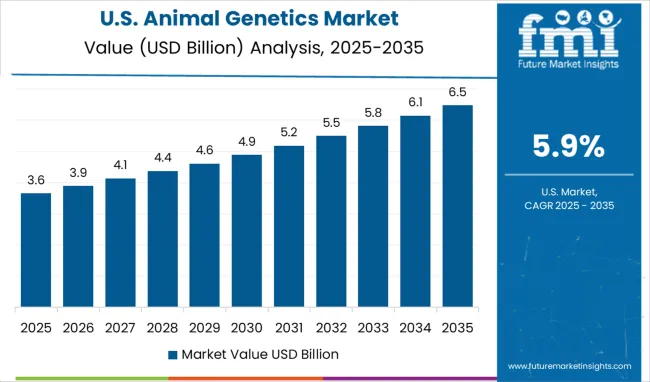

The USA animal genetics market is expected to expand at a CAGR of 5.9%, supported by mature breeding infrastructure, technological innovation, and a focus on data-driven livestock improvement. Producers are emphasizing efficiency, economic returns, and integration of genomic selection programs alongside conventional breeding methods. The market is characterized by strong demand for comprehensive genetic services that provide measurable productivity gains across cattle, swine, and poultry operations. Advanced laboratories, AI-assisted breeding models, and collaborative research programs are enhancing the accuracy of selection and improving herd health and performance, positioning the United States as a global leader in precision livestock genetics.

Animal genetics services in Germany are anticipated to grow at a CAGR of 8.0% through 2035, fueled by high standards of livestock production, emphasis on productivity improvement, and commitment to environmental stewardship. German producers consistently seek breeding services that balance efficiency, animal welfare, and climate-adapted livestock genetics. Collaborative initiatives between research institutes and breeding companies are accelerating the adoption of advanced selection tools, genomic evaluation, and environmentally friendly genetic programs. Demand for high-quality milk, meat, and poultry is motivating producers to integrate innovative breeding solutions that ensure long-term sustainability, traceability, and resilience of livestock populations across both conventional and organic production systems.

Animal genetics services in the United Kingdom are projected to expand at a CAGR of 6.6% through 2035, driven by strong livestock heritage, producer focus on breeding accuracy, and adoption of genomic technologies. British livestock farmers are increasingly using genetic evaluation, selective breeding, and precision livestock management to improve herd performance, reproductive efficiency, and product quality. Cooperative networks and advisory programs are supporting adoption of advanced genetics across dairy, beef, and poultry production systems. Investment in technology-driven breeding practices and farm data analytics is enabling producers to implement tailored breeding strategies, improving profitability, competitiveness, and livestock resilience in domestic and export-oriented markets.

Animal genetics services in France are anticipated to grow at a CAGR of 7.3% through 2035, supported by the country’s long-standing agricultural heritage, emphasis on livestock quality, and investment in genetic innovation programs. French producers prioritize efficiency, performance, and sustainability in breeding operations, creating demand for comprehensive and scientifically validated genetic solutions. Integration of cooperative systems, advisory services, and research-backed breeding programs is enhancing livestock productivity, disease resistance, and product quality. Expansion of selective breeding initiatives and genomic testing across dairy, swine, and poultry sectors is enabling producers to optimize herds while maintaining compliance with national and EU agricultural standards, reinforcing France’s position as a leader in livestock genetics.

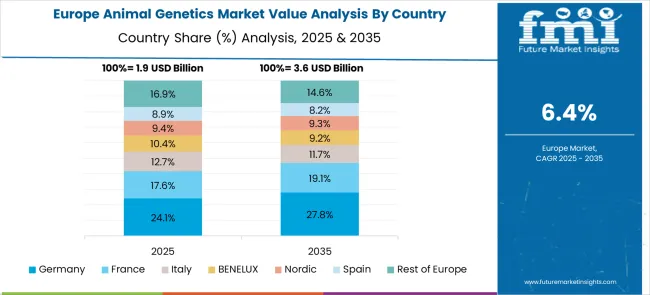

The animal genetics market in Europe demonstrates mature development across major agricultural economies with Germany showing strong presence through its advanced livestock production systems and consumer appreciation for high-quality genetic improvement services, supported by companies leveraging agricultural research to develop effective breeding programs that enhance productivity and sustainability in dairy and beef operations. France represents a significant market driven by its agricultural heritage and sophisticated understanding of animal breeding science, with companies pioneering premium genetic services that combine French agricultural expertise with advanced reproductive technologies for enhanced livestock performance and genetic advancement.

The UK exhibits considerable growth through its focus on evidence-based breeding and genetic transparency, with organizations leading the development of comprehensive genetic evaluation programs and producer education about breeding benefits. Germany and France show expanding interest in sustainable livestock production solutions, particularly in genomic testing and selective breeding programs targeting environmental adaptation and productivity improvement. BENELUX countries contribute through their focus on intensive livestock systems and advanced breeding technologies, while Eastern Europe and Nordic regions display growing potential driven by increasing awareness of genetic improvement benefits and expanding access to modern breeding services across diverse agricultural systems.

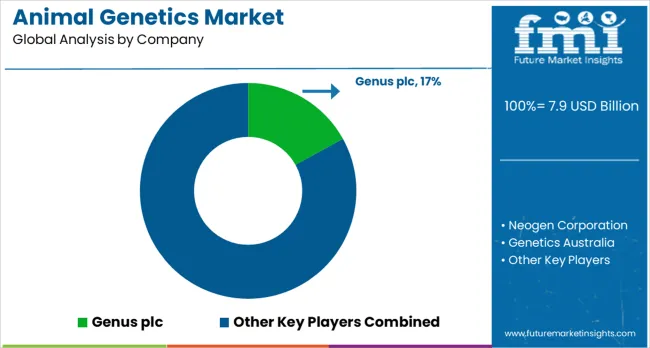

Genus plc, UK-based, leads the market with 17% global value share, offering comprehensive breeding services with focus on genetic improvement and livestock productivity enhancement. Neogen Corporation provides advanced genetic testing and breeding solutions with emphasis on genomic technologies and data analytics. Hendrix Genetics BV delivers specialized breeding programs with focus on genetic advancement and performance improvement. URUS Group LP focuses on artificial insemination services and reproductive technologies for commercial livestock operations.

The animal genetics market is characterized by competition among established breeding companies, biotechnology firms, and emerging genetic service providers. Companies are investing in genomic technologies, artificial intelligence applications, global breeding networks, and comprehensive service delivery systems to provide effective, reliable, and accessible genetic improvement solutions. Brand reputation, technological innovation, and service expansion are central to strengthening breeding programs and market presence.

CRV operates globally, providing comprehensive genetic services across multiple species and production systems with emphasis on sustainable breeding practices. Semex offers international breeding solutions with focus on dairy genetics and reproductive efficiency. Swine Genetics International specializes in pig breeding and genetic improvement programs. STgenetics provides cattle breeding services with emphasis on genetic advancement and productivity enhancement. Animal Genetics Inc., Generatio GmbH, and Zoetis Services LLC deliver specialized genetic solutions with focus on specific livestock species and breeding applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7.9 billion |

| Animal Type | Cattle, Pigs, Sheep & Goats, Companion Animals, Others |

| Technology Type | Assistive Reproduction Technologies, Live Animals, Genomic/Genetic Testing |

| Distribution Channel | Private, Public |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Genus plc, Neogen Corporation, Hendrix Genetics BV, URUS Group LP, CRV, Semex, Swine Genetics International, STgenetics, Animal Genetics Inc., Generatio GmbH, Zoetis Services LLC |

| Additional Attributes | Revenue analysis by genetic service type and species focus, regional breeding trends, competitive landscape, producer preferences for breeding technologies, integration with sustainable agriculture practices, innovations in genomic selection, artificial intelligence applications, and precision breeding methodologies |

The global animal genetics market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the animal genetics market is projected to reach USD 15.4 billion by 2035.

The animal genetics market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in animal genetics market are cattle, pigs, sheep & goats, companion animals and others.

In terms of type outlook , assistive reproduction technologies segment to command 49.5% share in the animal genetics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Companion Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA