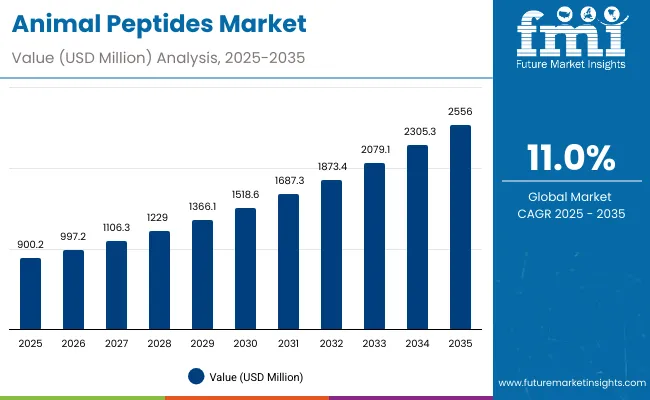

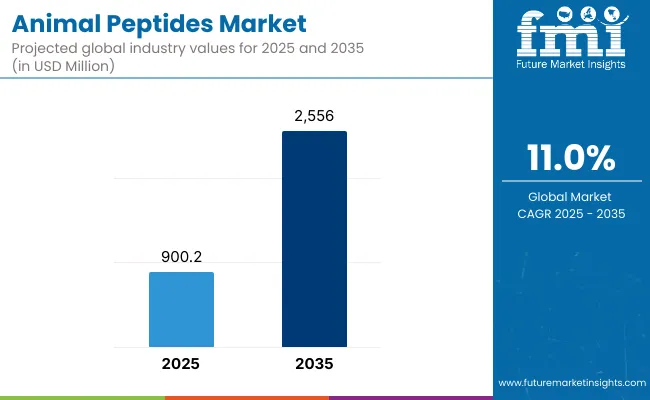

The Animal Peptides Market is projected to be valued at USD 900.2 million in 2025, expanding to USD 2,556.0 million by 2035. This increase of over USD 1,655.8 million reflects a growth of nearly 2.8X over the decade, with an overall CAGR of 11.0%. The forecast underscores the growing centrality of animal-derived peptides in functional health, nutraceutical, and biopharmaceutical applications.

Animal Peptides Market Key Takeaways

| Metric | Value |

|---|---|

| Animal Peptides Estimated Value in (2025E) | USD 900.2 million |

| Animal Peptides Forecast Value in (2035F) | USD 2,556.0 million |

| Forecast CAGR (2025 to 2035) | 11.0% |

During the initial phase from 2025 to 2030, the market is expected to advance from USD 900.2 million to approximately USD 1,518.6 million, accounting for nearly 38% of the total forecast-period growth. This period is likely to be characterized by steady adoption in nutraceuticals, sports nutrition, and functional foods, where collagen and milk-derived peptides are expected to dominate. Enhanced consumer awareness of bioactive properties, coupled with regulatory support for natural formulations, is anticipated to anchor demand during this stage.

The second half from 2030 to 2035 is forecast to contribute an additional USD 1,037.4 million, representing 62% of total decade growth. This accelerated trajectory is projected to be driven by the rise of precision hydrolysates, antimicrobial peptides for animal health, and the integration of advanced enzymatic processing technologies. By the end of the decade, animal peptides are expected to transition from niche bioactive ingredients into mainstream health solutions, reinforced by clinical validation, sustainability-driven sourcing, and broader acceptance in both developed and emerging markets.

From 2020 to 2024, the Animal Peptides Market expanded steadily from USD 820.3 million to USD 900.2 million, supported by growing adoption in pet wellness, functional feed, and antibiotic-free livestock programs. During this period, the competitive landscape was dominated by collagen peptide producers, who controlled nearly 65% of revenue, with leaders like PB Leiner, Gelita, and Rousselot focusing on hydrolyzed collagen, gelatin, and food-grade peptides for livestock and companion animals. Competitive differentiation relied primarily on ingredient quality, sourcing traceability, and application breadth, while therapeutic peptides and performance blends remained in nascent stages. Specialty peptide formulations (e.g., antimicrobial peptides, encapsulated peptides) accounted for less than 15% of total market value in 2024.

Demand for animal peptides is projected to reach USD 2,556.0 million by 2035, as value shifts toward microencapsulated actives, injectable veterinary peptides, and recombinant peptide platforms. Traditional collagen suppliers are facing growing competition from biotech-driven entrants offering species-specific peptide APIs, fermentation-based production, and functional formulations for targeted delivery. The competitive advantage is transitioning from commodity hydrolysates to customized, evidence-backed peptide solutions, supported by partnerships in veterinary care, pet nutrition, and sustainable protein systems.

Growth in the Animal Peptides Market is being driven by an expanding recognition of peptides as multifunctional bioactive ingredients in animal health, nutrition, and therapeutic applications. Rising demand for sustainable and biologically effective alternatives to synthetic growth promoters and antibiotics has redirected innovation toward enzymatically derived peptides with proven immunomodulatory and antimicrobial effects. The adoption of collagen, milk-derived, and fish-based peptides has been accelerated by their validation in improving joint mobility, gut function, and skin health in both livestock and companion animals.

Technological advancements in peptide extraction, microencapsulation, and recombinant fermentation have allowed for enhanced stability, bioavailability, and species-specific delivery. These innovations are enabling functional peptides to be more effectively integrated into compound feeds, veterinary products, and pet nutraceuticals. Moreover, growing awareness among pet owners regarding preventive care and wellness has encouraged the uptake of cosmeceutical-grade and therapeutic peptide formulations.

Regulatory openness toward bioactive peptides and rising investments in peptide-focused R&D by key manufacturers have further strengthened market momentum. Expansion in aquaculture, poultry, and ruminant nutrition programs has positioned animal peptides as key components in performance feeds and disease resilience strategies. As biologically targeted nutrition and precision veterinary care continue to evolve, the role of peptides is expected to become increasingly central across global animal production systems.

The Animal Peptides Market has been segmented based on Peptide Type, Form, Animal Species, Function/Application, Source, End-Use, Distribution Channel, and Geography. Each segment captures a distinct set of biological functionalities, delivery mechanisms, and target beneficiaries across livestock, aquaculture, and companion animal sectors. By peptide type, a broad spectrum of protein hydrolysates, bioactive peptides, and specialty molecules have been categorized based on their physiological benefits and origin. The form-based segmentation reflects the growing diversity in peptide delivery formats including powders, liquid suspensions, microencapsulated actives, and injectable therapeutics. Segmentation by animal species reveals the evolving needs of poultry, ruminants, swine, aquaculture, and pet categories each of which requires tailored peptide formulations to meet performance, immunity, and wellness goals. This structured segmentation enables a focused understanding of demand hotspots and future innovation priorities, especially as scientific validation, regulatory clarity, and precision nutrition continue to shape product development pipelines across global markets.

| Peptide Type Segment | Market Value Share, 2025 |

|---|---|

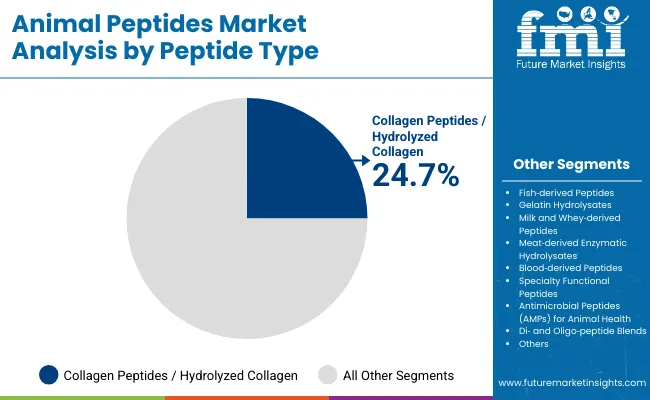

| Collagen peptides / hydrolyzed collagen (non fish, non specialty) | 24.7% |

| Fish derived peptides (e.g., fish collagen peptides) | 17.8% |

Collagen peptides are anticipated to lead the peptide type segment with a 24.7% market share in 2025. Their dominance is being sustained by wide-scale integration into joint, skin, and mobility-focused formulations across livestock, pets, and equine applications. Despite a modest CAGR of 6.5%, collagen’s market stability is being reinforced by its proven bioavailability, consumer trust, and ease of formulation. Fish-derived peptides and gelatin hydrolysates are also expected to see rising demand due to their cleaner labeling and functional advantages. Meanwhile, specialty peptides and antimicrobial peptides are forecast to outpace in CAGR due to rising demand in performance feeds and therapeutic applications. As clinical validation deepens and health outcomes are quantified, diversification into targeted peptide categories is expected to intensify, gradually balancing the segment’s current reliance on commodity collagen-based peptides.

| Form | 2025 Share% |

|---|---|

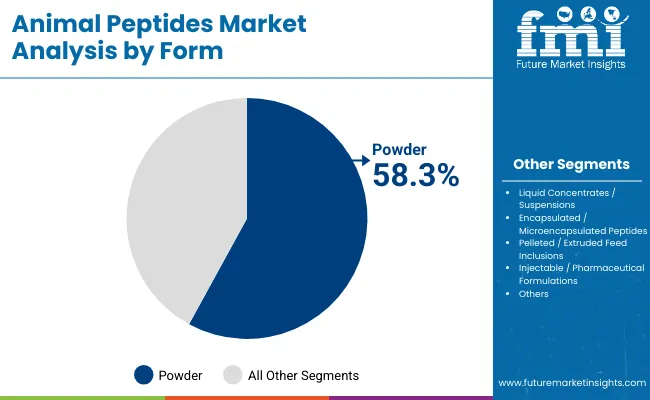

| Powder | 58.3% |

| Liquid concentrates / suspensions | 14.7% |

| Encapsulated / Microencapsulated peptides | 7.9% |

The powder form segment is projected to contribute 58.3% of total animal peptide sales in 2025, reflecting its processing ease, cost-effectiveness, and versatility across feed and supplement applications. Powders have remained the preferred delivery format for peptides due to their shelf stability, compatibility with premixes, and high loading capacity. However, injectable formulations and microencapsulated peptides are expected to register faster growth owing to rising demand for veterinary precision therapies and targeted nutrient delivery in performance animals. Liquid concentrates and pelleted inclusions are increasingly being adopted by aquafeed and integrated poultry sectors, where fast dispersion and uniform dosing are prioritized. As formulation technologies mature and bioavailability optimization becomes more critical, encapsulated and injectable formats are expected to gain prominence, especially in the therapeutic and companion animal segments.

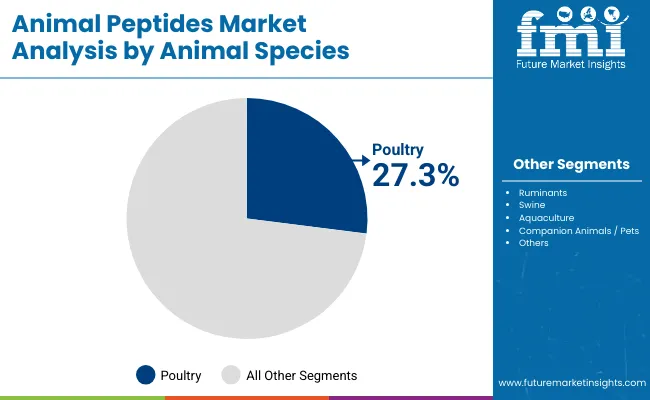

| Animal Species | 2025 Share% |

|---|---|

| Poultry (broilers, layers) | 27.3% |

| Ruminants (dairy, beef) | 21.6% |

| Swine (weaners, growers, sows) | 18.9% |

Poultry is expected to be the largest animal species segment, contributing 27.3% of market revenue in 2025. This leadership is being driven by the intensive nature of broiler and layer production systems, where peptides are used for feed conversion efficiency, immune support, and gut health. Ruminants and swine follow closely behind, with a combined share exceeding 40%, as peptides gain ground in improving nutrient utilization, reducing antibiotic reliance, and supporting metabolic resilience. Companion animals, while accounting for a smaller share, are projected to exhibit one of the fastest growth rates due to the rising humanization of pet health. Aquaculture, too, is being viewed as a high-growth vertical, supported by peptides that enhance disease resistance and reduce environmental stress in fish and shrimp. As demand diversifies across geographies, species-specific peptide solutions are expected to define the next wave of formulation innovation.

The Animal Peptides Market is being influenced by a combination of regulatory, scientific, and consumer-driven forces. While demand for functional feed additives and bioactive ingredients continues to rise, strategic integration into animal health protocols remains complex. Nevertheless, increased precision in peptide design and species-specific formulations are reshaping how peptides are adopted across livestock, aquaculture, and pet nutrition ecosystems.

Rise of Antibiotic-Free Animal Nutrition Strategies

Global pressure to reduce antibiotic use in animal farming has created sustained momentum for peptide-based alternatives. Animal peptides are being increasingly positioned as immunomodulatory and antimicrobial agents that support disease resistance without inducing microbial resistance. As regulations surrounding antibiotic growth promoters tighten particularly in Europe, North America, and parts of Asia bioactive peptides have been explored as preventive tools in feed and therapeutic settings. Functional peptides from milk, meat, and microbial sources have demonstrated efficacy in enhancing gut integrity and innate immunity. This shift is expected to drive not only increased peptide adoption but also innovation in precision feed formulations, aligning with One Health and antimicrobial stewardship initiatives globally.

Convergence of Pet Humanization and Functional Peptide Nutrition

Growing consumer emphasis on pet wellness is reshaping the companion animal segment of the animal peptides market. Peptides previously used in livestock are being reformulated into high-purity, cosmeceutical-grade ingredients for joint health, coat condition, and digestive support in dogs, cats, and equines. Injectable peptides and encapsulated formats are gaining popularity in pet nutraceuticals, reflecting trends in human supplementation. The line between veterinary care and lifestyle wellness is becoming increasingly blurred, as veterinary clinics, pet brands, and supplement formulators converge on biologically active, clean-label peptide products. As trust in ingredient transparency and efficacy deepens, the pet segment is expected to serve as a high-margin growth frontier.

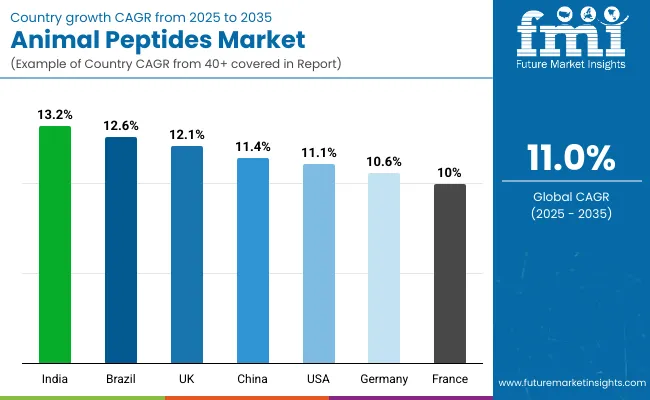

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 11.4% |

| India | 13.2% |

| Germany | 10.6% |

| France | 10.0% |

| UK | 12.1% |

| USA | 11.1% |

| Brazil | 12.6% |

The global animal peptides market exhibits notable regional and country-level variation in adoption patterns, shaped by livestock production intensity, functional feed regulations, and innovation maturity in veterinary nutrition. Asia-Pacific is expected to lead in market expansion, with India projected at 11.2% CAGR driven by increasing peptide inclusion in commercial poultry and aquafeed, alongside rising investments in veterinary infrastructure and pet health products. China, with a CAGR of 11.4%, is expected to witness strong uptake of antimicrobial and blood-derived peptides, supported by large-scale protein farming, regulatory shifts away from antibiotics, and strategic peptide sourcing from marine and bovine waste streams.

In Europe, France (10.0%) and Germany (10.6%) are forecast to maintain growth through the integration of functional peptides in dairy and swine segments, where sustainability-linked certifications and traceability standards are accelerating bioactive ingredient adoption. The UK, growing at 12.1%, is anticipated to see demand centered on cosmeceutical-grade pet formulations and recombinant peptide R&D.

North America is expected to exhibit moderate growth, with the USA at 11.1% CAGR, where demand is increasingly skewed toward therapeutic veterinary peptides and high-value pet applications. Brazil (12.6%) is likely to gain prominence as a key emerging market, with growth driven by intensive livestock farming, export-focused aquaculture, and peptide integration into value-added feed systems.

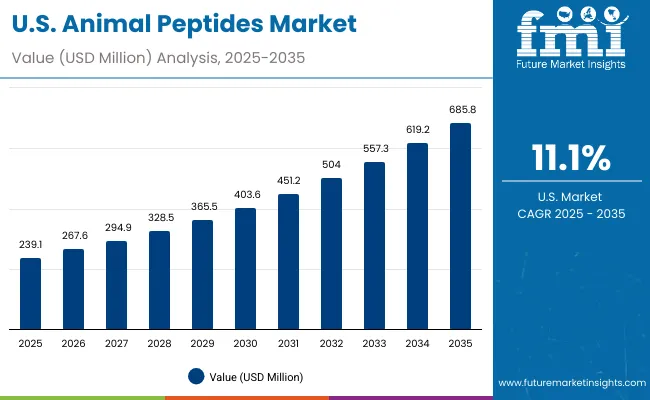

| Year | USA Animal Peptides Market (USD Million) |

|---|---|

| 2025 | 239.1 |

| 2026 | 267.6 |

| 2027 | 294.9 |

| 2028 | 328.5 |

| 2029 | 365.5 |

| 2030 | 403.6 |

| 2031 | 451.2 |

| 2032 | 504.0 |

| 2033 | 557.3 |

| 2034 | 619.2 |

| 2035 | 685.8 |

The Animal Peptides Market in the United States is valued at USD 239.1 million in 2025, supported by innovation in functional nutrition and therapeutic peptides. Veterinary peptide applications are being prioritized in response to rising demand for alternatives to conventional antimicrobials and non-steroidal drugs, particularly in companion animal health. Joint, skin, and gut-targeted peptide formulations are gaining market share in veterinary clinics, pet wellness brands, and e-commerce channels.

Peptides are also being increasingly adopted in livestock production systems to align with antibiotic-free protocols and improve feed efficiency. Product development has been focused on precision delivery technologies-such as microencapsulation and injectables to enhance peptide stability and bioavailability. USA-based manufacturers are forming partnerships with biotech and pet nutrition firms to co-develop differentiated peptide portfolios with high therapeutic and nutritional value.

The Animal Peptides Market in the United Kingdom is projected to grow at a CAGR of 12.1% between 2025 and 2035, supported by a growing demand for clean-label, bioactive ingredients in both companion animal and livestock segments. The UK’s highly regulated animal nutrition landscape is being increasingly aligned with functional and therapeutic-grade peptides, especially in veterinary-prescribed products and pet supplements. Premiumization trends in pet food are expected to fuel demand for peptides targeting joint, skin, and digestive health. Moreover, the shift toward antibiotic-free animal production is encouraging early adoption of immunomodulatory peptides in poultry and swine feed programs.

China’s Animal Peptides Market is expected to value at USD 169.2 million in 2025, anchored by its expansive livestock and aquaculture industries. Government support for antibiotic-alternative strategies is driving the integration of antimicrobial peptides (AMPs) and enzymatic hydrolysates in swine and poultry nutrition. The pet segment is emerging as a key growth pillar, where high-purity peptides are being formulated into therapeutic and wellness products. Strong demand for marine and bovine-derived peptides is also being seen in aquafeed formulations aimed at reducing disease incidence and improving feed conversion.

India’s Animal Peptides Market is forecast to expand at a CAGR of 13.4% from 2025 to 2035, driven by rapid industrialization of livestock production and growth in aquaculture. Adoption is being accelerated by government-led initiatives to reduce antibiotic dependency in feed and integrate performance-enhancing peptide blends in commercial poultry, dairy, and shrimp farming. Domestic peptide manufacturing capabilities are being scaled through enzymatic hydrolysis and recombinant fermentation technologies. Pet food expansion in urban centers is further expected to open new revenue streams for functional peptides targeting joint health, immunity, and coat condition in dogs and cats.

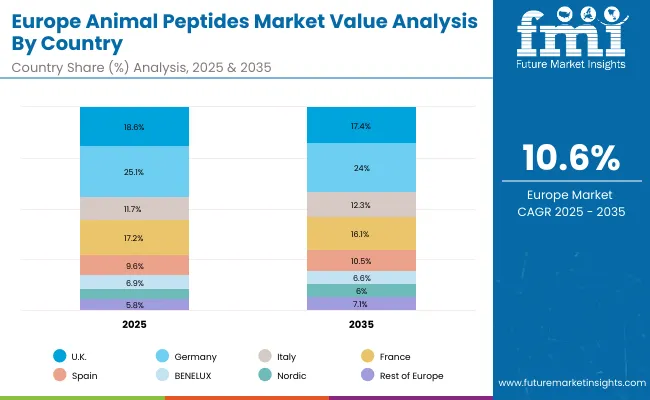

| Countries | 2025 |

|---|---|

| UK | 18.6% |

| Germany | 25.1% |

| Italy | 11.7% |

| France | 17.2% |

| Spain | 9.6% |

| BENELUX | 6.9% |

| Nordic | 5.1% |

| Rest of Europe | 5.8% |

| Countries | 2035 |

|---|---|

| UK | 17.4% |

| Germany | 24.0% |

| Italy | 12.3% |

| France | 16.1% |

| Spain | 10.5% |

| BENELUX | 6.6% |

| Nordic | 6.0% |

| Rest of Europe | 7.1% |

Germany’s Animal Peptides Market is projected to register a CAGR of 6.0% through 2035, supported by its leadership in sustainable livestock production and precision animal nutrition. Peptides are being adopted as part of Germany’s transition toward antibiotic-free feed systems, with a strong focus on dairy cattle, pigs, and poultry. The country’s advanced regulatory framework is encouraging early integration of functional peptides in compound feed, veterinary drugs, and pet nutrition. Premium pet food manufacturers are actively deploying collagen and microencapsulated peptides for aging pets, mobility support, and gut health.

| Peptide Type | Market Value Share, 2025 |

|---|---|

| Collagen peptides / hydrolyzed collagen (non fish, non specialty) | 24.7% |

| Fish derived peptides (e.g., fish collagen peptides) | 17.8% |

| Gelatin hydrolysates | 14.5% |

| Milk and whey derived peptides | 9.6% |

| Meat derived enzymatic hydrolysates (beef, poultry) | 7.2% |

| Blood derived peptides (hemoglobin / serum hydrolysates) | 5.1% |

| Specialty functional peptides (joint/cartilage, skin & coat, gut health) | 6.3% |

| Antimicrobial peptides (AMPs) for animal health | 4.0% |

| Di and oligo peptide blends (performance / feed / sports blends) | 5.9% |

| Venom / biologically active peptides (research / therapeutics) | 4.9% |

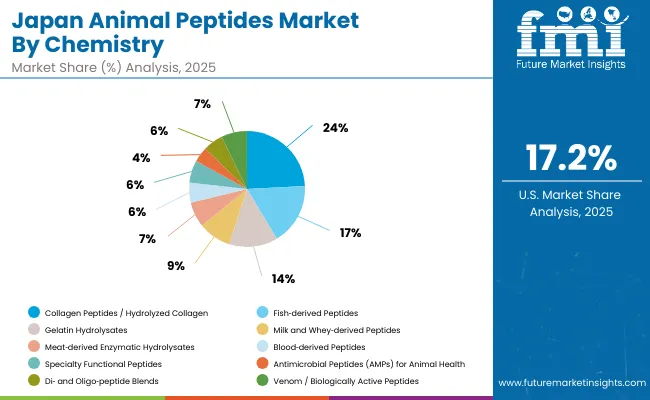

The Animal Peptides Market in Japan is projected to reach USD 59.2 million in 2025, led by its longstanding tradition in functional nutrition and advanced veterinary care. Collagen peptides are expected to hold the highest share at 24.2%, reflecting their integration into pet health products, equine mobility solutions, and cosmetic-grade pet supplements. Fish-derived peptides, at 17.2%, are being prioritized due to Japan’s marine sourcing advantage and the rising popularity of fish-collagen-based functional foods for animals. Notably, venom and biologically active peptides are projected to gain traction at 10.5%, with growth fueled by Japan’s biotech research infrastructure and interest in novel therapeutic peptide molecules.

Product innovation is being driven by Japan’s focus on precision veterinary applications, where joint health, skin rejuvenation, and digestive balance are being addressed through peptide customization. Rising consumer demand for high-purity, traceable ingredients has intensified the shift toward fermentation- and recombinant-produced peptides. In the livestock sector, AMPs and performance blends are being trialed in pilot programs to phase out antibiotic usage in swine and poultry feed systems.

| Form | Market Value Share, 2025 |

|---|---|

| Powder | 59.2% |

| Liquid concentrates / suspensions | 15.0% |

| Encapsulated / Microencapsulated peptides | 8.2% |

| Pelleted / Extruded Feed Inclusions (pre mix or compound feed) | 9.3% |

| Injectable / pharmaceutical formulations (veterinary therapeutics) | 8.3% |

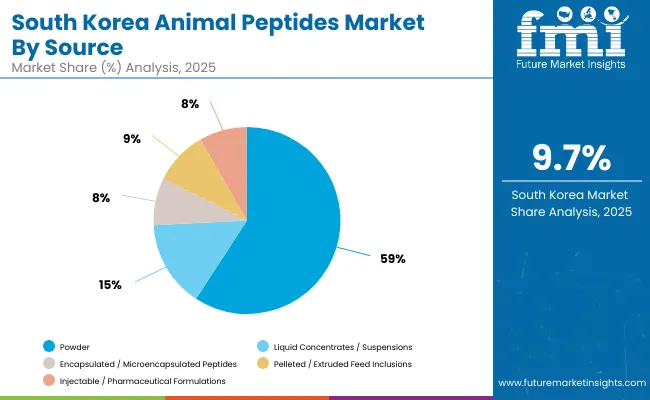

The Animal Peptides Market in South Korea is projected to reach USD 38.9 million in 2025, with powder-based formulations accounting for the dominant 59.2% share. This preference is being driven by their cost efficiency, storage stability, and compatibility with compound feed and veterinary premix systems. However, the most dynamic growth is expected in injectable peptide therapeutics and encapsulated formats, which are projected at 9.7% and 11.5% respectively, due to rising demand in companion animal care and high-value veterinary interventions.

Formulation innovation in South Korea is being accelerated by the country's strong pharmaceutical manufacturing infrastructure and R&D ecosystem. Injectable peptides are being prioritized in the treatment of musculoskeletal, inflammatory, and dermatological conditions in dogs, cats, and equines. Meanwhile, encapsulated peptides are being explored for controlled-release delivery in poultry and swine feed to enhance absorption and reduce enzymatic degradation.

South Korean pet owners demonstrate a high willingness to pay for precision health products, making the market particularly attractive for specialty peptide brands. As demand for antibiotic-free meat and fish grows, pelleted inclusions and microencapsulated actives are expected to be deployed more widely in performance feed formulations.

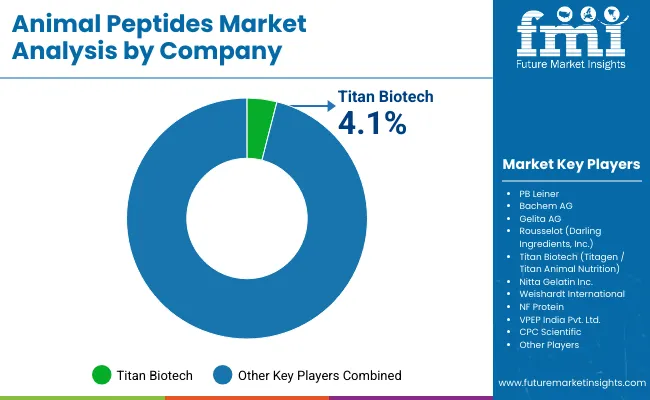

| Company | Global Value Share 2025 |

|---|---|

| Titan Biotech | 4.1% |

| Others | 95.9% |

The Animal Peptides Market is moderately fragmented, featuring a mix of multinational collagen producers, peptide contract manufacturers, and regionally focused innovators catering to diverse end-use segments. Global leaders such as PB Leiner, Gelita AG, Rousselot (Darling Ingredients, Inc.), and Nitta Gelatin Inc. are estimated to hold substantial market share, supported by their vertically integrated operations, global supply networks, and expansive collagen peptide portfolios. These companies have been actively investing in food-grade and cosmeceutical-grade peptide offerings for companion animal health and livestock wellness.

Mid-sized firms like Weishardt International, Titan Biotech (Titagen), and NF Protein have been focused on feed-grade hydrolysates and specialty performance peptides. Their strength lies in cost-effective production, regional distribution efficiency, and rapid formulation flexibility especially in emerging markets across Asia and Latin America.

Niche players such as CPC Scientific, Bachem AG, and VPEP India Pvt. Ltd. are increasingly engaged in research-grade and therapeutic peptide manufacturing, targeting veterinary prescription drugs and custom peptide synthesis. Their competitive edge is being shaped by innovation in microencapsulation, injectable delivery systems, and fermentation-based peptide expression.

Competitive differentiation is being redefined by sourcing transparency, species-specific efficacy data, and bioavailability optimization. Strategic partnerships with veterinary networks and pet health brands are expected to intensify, as companies shift from bulk supply to value-added, application-specific peptide solutions.

Key Developments in Animal Peptides Market

| Item | Value |

|---|---|

| Quantitative Units | USD 900.2 million |

| Peptide Type | Collagen peptides, Gelatin hydrolysates, Fish-derived peptides, Milk & whey peptides, Blood-derived peptides, Meat-based hydrolysates, Functional peptides, AMPs. |

| Source | Fish, Bovine, Porcine, Poultry, Dairy (milk, whey) sources, Egg-derived peptides, Synthetic / chemically synthesized peptides, Recombinant / fermentation-produced peptides (microbial expression) |

| Form | Powder, Liquid concentrates, Encapsulated peptides, Pelleted feed inclusions, Injectable/veterinary formulations |

| Functionality | Growth performance, Immune modulation, Gut health, Joint/mobility support, Skin & coat health, Therapeutic peptides, Feed palatability, Veterinary prescription products |

| Animal Species | Poultry (broilers, layers), Ruminants (dairy, beef), Swine (sows, growers), Aquaculture (fish, shrimp), Companion animals (dogs, cats), Specialty livestock (rabbits, etc.) |

| End-Use Application | Pet Food & Treats, Aquafeed, Vet Prescriptions, Feed Premix, Direct Farm Supplements, Functional Feed Additives |

| Distribution Channel | B2B ingredient supply (direct to feed manufacturers), Pet food brands & co-packers, Animal health dis tributors & veterinary channels, On line & direct-to-farm suppliers, Specialty ingredient distributors / brokers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arla Foods amba, Ehrmann GmbH, NJIE (ProPud), Bariatrix Europe, Valio Ltd., Zott Dairy, UFIT Drinks, Bernard Food Industries, My protein (The Hut Group), Danone ( Alpro ) |

| Additional Attributes | Peptide-specific dollar sales by form, species, and use case; rise of veterinary peptides; demand for recombinant and encapsulated formats; regional regulation trends; pet humanization; feed-to-pharma product integration; microbial fermentation sourcing; antibiotic-free feed strategies; functional peptide expansion in aquaculture and pet nutrition |

The global Animal Peptides is estimated to be valued at USD 900.2 million in 2025.

The market size for the Animal Peptides is projected to reach USD 2,556.0 million by 2035.

The Animal Peptides is expected to grow at an 11.0% CAGR between 2025 and 2035.

The key peptide types in the animal peptides market include collagen peptides, gelatin hydrolysates, milk and meat-derived peptides, blood-derived peptides, fish collagen peptides, antimicrobial peptides (AMPs), and specialty functional peptides.

In terms of form, the powder segment is projected to command the largest share in 2025 at 58.3%, due to its broad use in feed premixes, supplements, and easy formulation across livestock and pet nutrition.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA