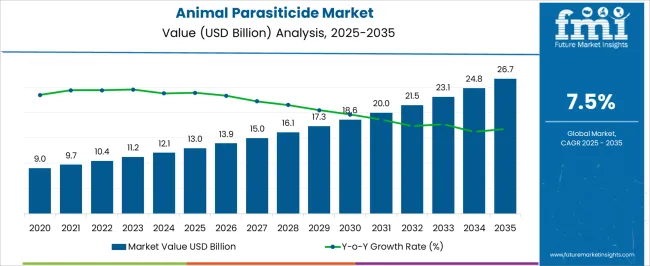

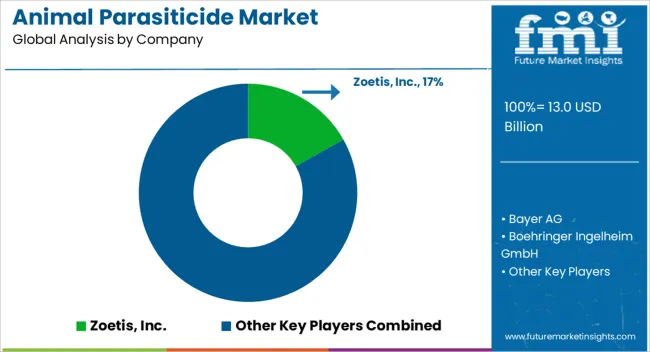

The Animal Parasiticide Market is estimated to be valued at USD 13.0 billion in 2025 and is projected to reach USD 26.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Animal Parasiticide Market Estimated Value in (2025 E) | USD 13.0 billion |

| Animal Parasiticide Market Forecast Value in (2035 F) | USD 26.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The animal parasiticide market is experiencing significant growth driven by the increasing focus on animal health and wellness across both companion and livestock sectors. Rising awareness of parasitic infections and their economic and health impact is fueling demand for effective prevention and treatment solutions. The market is being supported by advances in veterinary medicine, including the development of broad-spectrum parasiticides that offer targeted and efficient control of endoparasites and ectoparasites.

Companion animal ownership is rising globally, particularly in urban areas, creating higher demand for parasitic treatments that ensure animal health and hygiene. Regulatory frameworks are increasingly supporting preventive veterinary care, incentivizing pet owners and livestock managers to adopt parasiticides as part of routine animal care.

Technological advancements in formulation, such as long-acting oral and topical treatments, are improving treatment compliance and efficacy As awareness of zoonotic risks and animal welfare continues to grow, the market is positioned for sustained expansion, with manufacturers focusing on innovative solutions, broader coverage, and easy-to-administer products to meet evolving needs.

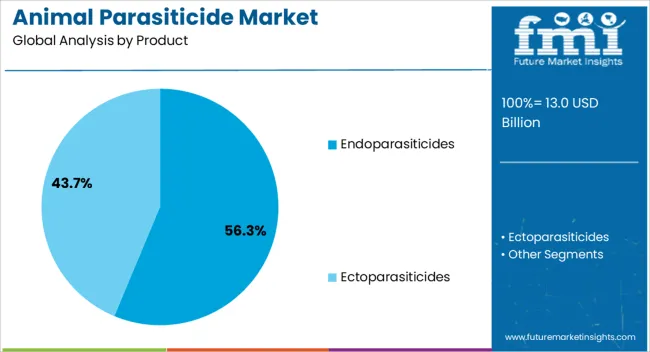

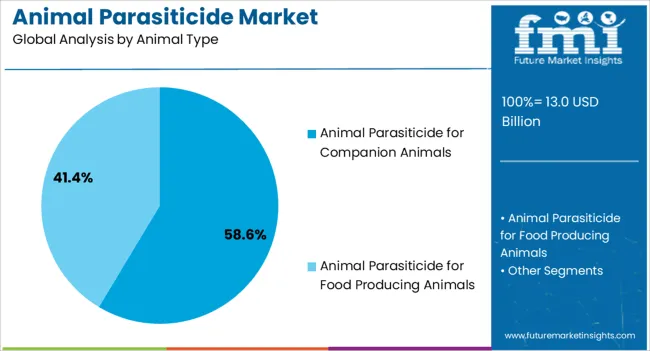

The animal parasiticide market is segmented by product, animal type, and geographic regions. By product, animal parasiticide market is divided into Endoparasiticides and Ectoparasiticides. In terms of animal type, animal parasiticide market is classified into Animal Parasiticide for Companion Animals and Animal Parasiticide for Food Producing Animals. Regionally, the animal parasiticide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The endoparasiticides product segment is projected to hold 56.3% of the animal parasiticide market revenue share in 2025, making it the leading product category. Its growth is being driven by the increasing prevalence of internal parasitic infections in both companion and farm animals, which can significantly impact health, productivity, and longevity.

Endoparasiticides are preferred due to their broad-spectrum efficacy, ability to target multiple internal parasites, and convenience in administration via oral, injectable, or feed-based formulations. This segment is also benefiting from growing adoption of preventive health programs and regular veterinary check-ups, which emphasize early detection and treatment of internal parasites.

Advancements in drug formulations and combination therapies have further improved treatment outcomes, ensuring reduced reinfection rates and higher owner compliance Rising awareness of the economic and welfare impact of internal parasites, coupled with stricter veterinary care guidelines, is reinforcing the dominance of endoparasiticides as the preferred product type in the global animal parasiticide market.

The companion animal segment is anticipated to represent 58.6% of the animal parasiticide market revenue share in 2025, making it the leading end-use category. This leadership is being supported by the rising global pet population, growing awareness of pet health, and the increasing willingness of owners to invest in preventive and therapeutic care.

Parasitic infections in pets can cause significant health issues, reduce quality of life, and increase veterinary treatment costs, which has driven adoption of specialized parasiticides. Companion animal products are also benefiting from the availability of user-friendly formulations such as chewables, spot-on treatments, and palatable oral solutions, which enhance compliance and convenience.

Preventive veterinary programs and increasing education about zoonotic disease transmission are further driving demand The rising importance of pet wellness, coupled with ongoing innovation in effective and safe parasiticides, has reinforced the companion animal segment as the primary revenue contributor within the animal parasiticide market.

The increasing importance of animal healthcare accompanied by governmental protocols is driving the global animal parasiticide market. The increased number of animal livestock in the emerging markets, developments in the parasiticide products, an upcoming new offering by the leading players, execution of welfare acts in the developing and developed regions worldwide increment in the number of animals like dogs and cats are some of the growth drivers of global parasiticide market.

Along with the increasing awareness, the increasing rate of GDP in the regions like Asia-pacific and Latin America and thereby increasing per capita spending on animal husbandry products are also responsible for the growth of the market.

Apart from significant growth factors there exists some restraints to the market including high-cost R&D activities, strict regulations for approval for animal parasiticides, and restricting the use of parasiticide in some animals (especially the food producers) in some regions.

The increasing number of parasites are also contributing to the restraints that are market from growing.

Asia-pacific is projected to endure its control in terms of growth in the global animal parasiticide market. The market is predominantly affected by the increasing trend towards pet adoption. Moreover, increasing expenditure on animal health and increasing GDP have reinforced the demand for the animal parasiticide market across the region.

Aspects such as the rapid rise in the livestock population, growing awareness about animal health, and the growing frequency of animal disease outbreaks are likely to drive the growth of the APAC animal health market.

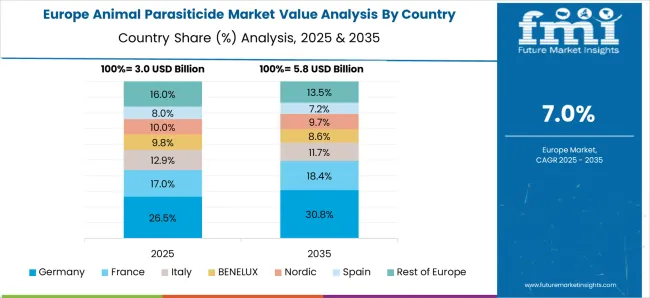

In terms of regional share, Germany likely to maintain its dominance in Europe for the animal parasiticide market, with an estimated market share of nearly 30%. This can amount to one-third of the overall European market share.

Market growth is mostly through the CNS agents segment owing to the non-availability of branded drugs with the desired proportion of active constituents for specified medication treatment for companion animals.

Currently, the Veterinary Medicinal Products Regulation (Regulation (EU) 2025/6) has directed new measures. It contains new norms for encouraging innovation and increasing the availability and access to secure and high-quality veterinary medicines for veterinarians, farmers, and pet caretakers.

The primary objective is to treat and prevent animal diseases and also backs the European Union (EU) action against antimicrobial resistance. These factors are likely to expand the market for an animal parasiticide in the region.

A new and improvised system was formulated by the USA Food and Drug Administration’s Center for Veterinary Medicine (CVM) for measuring system on its FDA-TRACK portal. This system will improve FDA’s performance management system that supervises, analyzes, and reports key performance parameters & projects.

Likewise, the USA government launched the ‘Feed the Future’ initiative that offers training to public and private veterinary clinicians. This program also assisted in initiating breeding programs and gaining investments in the development of the animal healthcare system in the USA

Also, numerous funding programs by government organizations to boost the R&D activities for progressing the research on the treatment of various animal diseases are set to favor industry growth in the future.

Some of the key participants present in the global demand of the animal parasiticide market include Bayer AG, Bimeda Animal Health, Boehringer Ingelheim GmbH, Ceva Santé Animale, Elanco (Eli Lilly and Company), Merck & Co., Inc., Vetoquinol, Zoetis, Inc., Virbac, The Chanelle Group, among others.

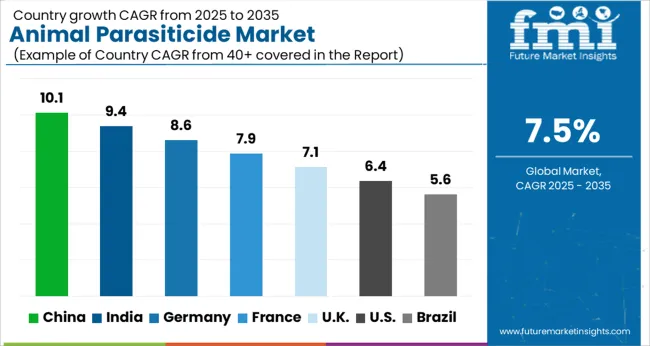

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

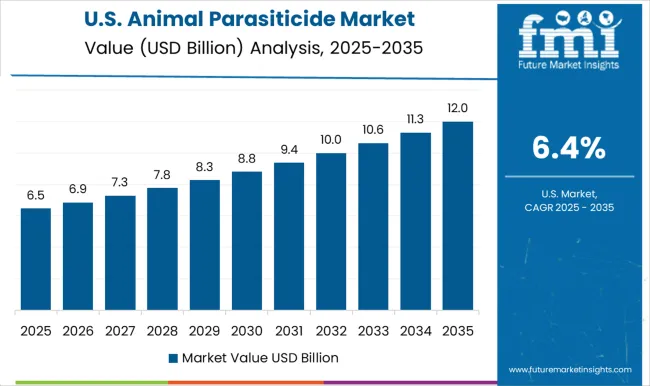

The Animal Parasiticide Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.1%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Animal Parasiticide Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%. The USA Animal Parasiticide Market is estimated to be valued at USD 4.5 billion in 2025 and is anticipated to reach a valuation of USD 8.4 billion by 2035. Sales are projected to rise at a CAGR of 6.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 591.5 million and USD 408.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.0 Billion |

| Product | Endoparasiticides and Ectoparasiticides |

| Animal Type | Animal Parasiticide for Companion Animals and Animal Parasiticide for Food Producing Animals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis, Inc., Bayer AG, Boehringer Ingelheim GmbH, Elanco (Eli Lilly and Company), Merck & Co., Inc., Ceva Santé Animale, Virbac, Vetoquinol, Bimeda Animal Health, and The Chanelle Group |

The global animal parasiticide market is estimated to be valued at USD 13.0 billion in 2025.

The market size for the animal parasiticide market is projected to reach USD 26.7 billion by 2035.

The animal parasiticide market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in animal parasiticide market are endoparasiticides, _animal parasiticide additives, _animal parasiticide injectables, _animal parasiticide drenches, _animal parasiticide tablets/pills, _others animal parasiticides, ectoparasiticides, _animal parasiticide collars and _animal endectocides.

In terms of animal type, animal parasiticide for companion animals segment to command 58.6% share in the animal parasiticide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA