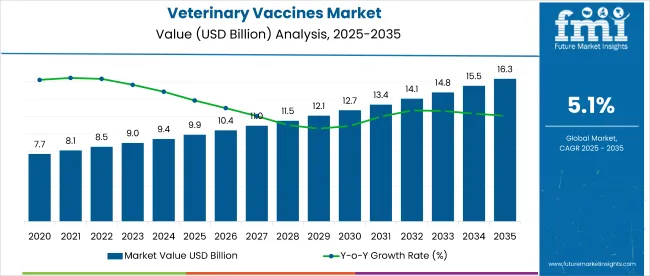

The global veterinary vaccines market is projected to expand from USD 9.92 billion in 2025 to USD 16.34 billion by 2035, reflecting a CAGR of 5.2%. This steady growth is driven by the rising demand for animal health products, increasing livestock populations, and heightened awareness of zoonotic diseases-those that can be transmitted from animals to humans.

Vaccination plays a vital role in preventing infectious diseases among livestock, companion animals, and poultry. The rapid expansion of intensive farming and animal husbandry worldwide has amplified the need for effective vaccines to safeguard animal health, productivity, and ensure food safety. Governments and regulatory agencies are promoting vaccination programs to control outbreaks and improve overall animal welfare standards.

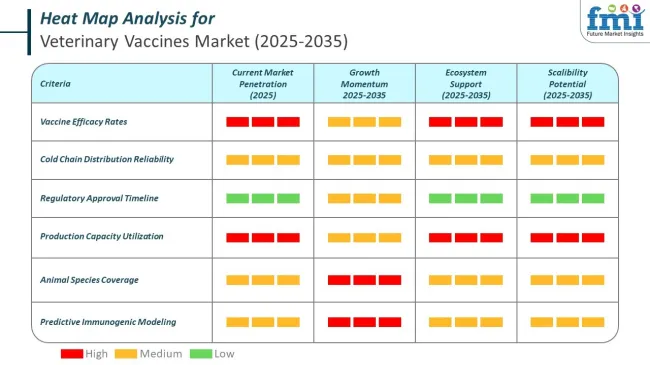

Technological innovations are enhancing vaccine development and delivery. The advent of recombinant vaccines and DNA-based immunizations offers targeted immune responses with fewer side effects. In 2024, key industry players such as Zoetis and Boehringer Ingelheim introduced new vaccine formulations utilizing viral vector technologies and nanoparticle delivery systems. These innovations increase protection against emerging pathogens and improve vaccine stability.

Improvements in diagnostics and cold chain logistics are further bolstering vaccine efficacy and distribution. Enhanced refrigeration and transport solutions help maintain vaccine potency, especially in remote and developing regions, enabling broader immunization coverage essential for large-scale disease control.

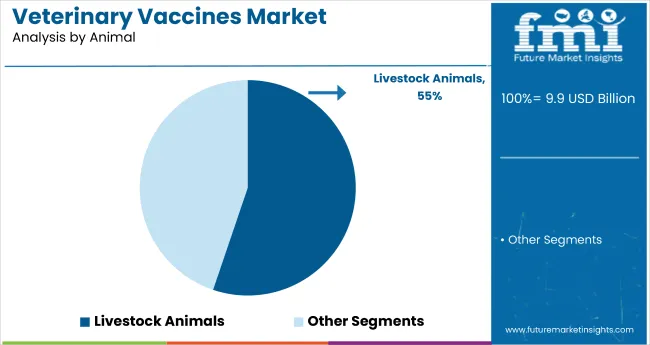

The market is segmented by animal type, including livestock, companion animals, and poultry, each driving demand in distinct ways. Livestock vaccinations are critical in meat and dairy production, while rising pet ownership globally boosts demand for companion animal vaccines.

Regionally, North America and Europe dominate the veterinary vaccines market, supported by advanced veterinary healthcare infrastructure, high investment levels, and strict regulatory frameworks. The Asia Pacific region is poised for the fastest growth, fueled by expanding livestock farming, increased pet ownership, and government initiatives to strengthen animal healthcare services in countries like China and India.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 9.92 billion |

| Projected Size, 2035 | USD 16.34 billion |

| Value-based CAGR (2025 to 2035) | 5.2% |

In North America, veterinary vaccine regulation is primarily handled by the United States Department of Agriculture (USDA). The USDA’s Center for Veterinary Biologics (CVB) ensures that all veterinary biological products meet strict safety, potency, and efficacy standards. These regulations support disease control, protect animal health, and uphold public safety through veterinary oversight.

In Europe, veterinary vaccines are regulated at the European Union level by the European Medicines Agency (EMA). Under the Veterinary Medicinal Products Regulation, all vaccines undergo a centralized approval process. This ensures consistent evaluation of product quality and environmental impact before any vaccine is allowed in the EU market.

In Asia-Pacific, veterinary vaccine regulations differ by country but increasingly align with global standards. Nations like Japan and India have established authorities that monitor vaccine development, manufacturing, and post-market safety. These agencies emphasize quality assurance and compliance with evolving standards such as GMP and pharmacovigilance.

Zoetis, one of the largest global veterinary vaccine manufacturers, prioritizes regulatory compliance to support the safe and effective use of its products across global markets. The company follows strict USDA and EMA standards and invests in quality systems, field trials, and documentation processes to meet all licensing and safety requirements.

Boehringer Ingelheim Animal Health actively collaborates with global regulatory authorities to ensure its veterinary vaccines meet required safety, quality, and efficacy standards. The company closely follows European regulatory frameworks and integrates pharmacovigilance practices to track vaccine performance and detect adverse effects after commercial distribution.

Merck Animal Health embeds regulatory compliance throughout the vaccine development and production lifecycle. From early formulation to global distribution, the company meets the expectations of USDA, CDSCO, and international agencies through robust testing, documentation, and facility certification to ensure consistency and safety across markets.

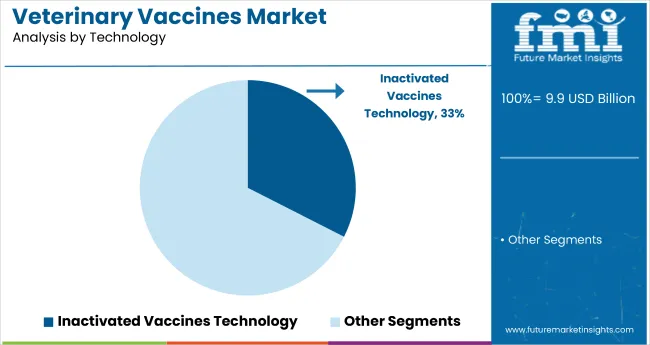

The inactivated vaccines technology segment is forecasted to capture approximately 32.5% market share by 2025, driven by their superior safety and stability compared to other vaccine types. Unlike live attenuated vaccines, inactivated vaccines use non-replicating antigens, eliminating the risk of reversion to virulence that can lead to outbreaks. This makes them essential in controlling infectious diseases across various animal populations.

Another key advantage of inactivated vaccines is their stability under temperature variations, which facilitates easier storage and transport, especially in regions with unreliable cold chain infrastructure. Despite requiring multiple doses and having limitations such as higher dosages and shorter immunization intervals, their safety profile makes them highly preferred.

The increasing demand for reliable, safe vaccines in veterinary healthcare supports their growing adoption. As livestock and poultry industries expand globally, and biosecurity measures tighten, inactivated vaccines are poised to maintain a leading role in the veterinary vaccines market through 2025.

Livestock animals are projected to dominate the veterinary vaccines market with an estimated 55.2% market share by 2025. Vaccinating livestock plays a vital role in maintaining animal health, improving productivity, and ensuring food security worldwide. Healthy animals yield higher quantities of milk, meat, and wool, contributing to farmers’ incomes and the overall economy.

Moreover, many livestock diseases are zoonotic, meaning they can transfer from animals to humans, posing serious public health risks. Vaccination helps reduce the spread of these diseases, protecting both animal and human populations.

The growing awareness among farmers and governments about the economic and health benefits of vaccination is driving investments in livestock vaccines. Increasing global demand for animal protein and stringent regulatory measures are also boosting the segment’s growth, ensuring its continued dominance in the veterinary vaccines market through 2025.

Rising Poultry Farms and Vaccination Programs Aiding in Market Growth

An uptick in chicken farms around the world will drive the growth of veterinary vaccine industry further forward with particular emphasis on Asia where there has been noted an increase in the demand for meat consequently leading to more output.

In 2022, Asia was the first producer of chicken meat with 38% of total world production according to FAO (Food and Agricultural Organization) statistics. This is likely to be a growing dominance encouraged by continuous financial investments as well as governments’ motivations to boost agricultural growth.

These subsidies are essential in order to decrease production costs, hence rendering poultry farms economically feasible. Nonetheless, it should be noted that even though they increase output, social and environmental costs are usually overlooked in their implementation.

Thus, there is need for more attention on disease prevention strategies that could be implemented so as to prevent possible health hazards of intensive poultry farming activities.

In responding to the upsurge in chicken industry, veterinary vaccine demand is predicted to increase dramatically. Vaccination programs are critical for keeping chicken stocks healthy and protecting them from any disease outbreak risks. It is the veterinary vaccine industry that will help sustainable and resilient poultry farming practices as the poultry industry expands.

Impact of Nanotechnology on Vaccine Developments to Propel the Market Growth

Self-assembled protein nanoparticles (SAPNs) are an advanced tool with considerable potential to innovate the methodology of vaccine design and administration in veterinary medicine. They provide a promise for high throughput discovery of novel veterinary vaccines that have better efficacy as well as safety using nanotechnology.

SAPNs and virus-like particles Infectious diseases (VLPs) are now employed as very adaptive platforms used in the development of vaccines and they have got many advantages over traditional vaccine composition. These particles are able to take the form and behave like pathogens, making them able to stir up strong immune mechanisms if need be without necessarily involving any disease forming activities themselves.

Besides, by their mimicry nature where they self-assemble, it is possible to direct the way in which the vaccine is made up as well as how antigens get introduced which in turn raises vaccine effectiveness.

There is a great opportunity for the veterinary vaccine industry with regards to the replacement of SAPNs and VLPs by veterinarians. A solution to the problems of animal health that are not met yet is possible through use of these modern platforms. This is because they offer new ways of controlling infectious diseases among farm animals and pets.

Moreover using them can lead into more effective methods for vaccinating animals that would eventually enhance their welfare and productivity.

Expansion of Manufacturing Facilities in the Vaccines Development to Gain the Market Opportunity

An important trend promoting the growth of the veterinary vaccines industry is the extension of the core players’ production facilities. This has resulted in the top players in the sector investing in expanding and refining their manufacturing capacity in a bid to meet the rapidly increasing demand for animal health solutions.

This growth is caused by the ongoing animal health solution requirement rising faster and the leading companies making extra investments to outperform others in making their production systems perfect.

One of key example of this is the investments for development of an animal vaccine production plant in the province of Brabant in the Netherlands by MSD Animal Health on a date called January 26th, 2023. This center, which is located in Boxmeer, is the biggest in the world in the field of animal vaccine production, with a capacity of 55 billion doses produced every year at a minimum.

In conclusion, the increasing investment in factories is a clear indication that industry players are ready to meet the high demand for veterinary vaccines. Furthermore, in addition to expanding their manufacturing capabilities, companies’ investments go into sophisticated production technologies so as to maintain high levels of quality as well as improve efficiency when manufacturing vaccines.

This is essential when it comes to both meeting industry requirements which continue to increase every day, and also improving animal health.

Rising Vaccine Hesitancy and Its Impact on the Veterinary Vaccine Market

One principle element that hinders the growth of the veterinary vaccine industry is the rising occurrence of vaccine hesitancy and refusal to inoculate among pet owners. Especially in developed countries, this apathy is becoming increasingly apparent and is motivated by numerous fears and misapprehensions regarding vaccine safety and need.

As of April 2019, one in four British dogs and one in three cats are either not vaccinated or even complete their primary vaccination schedules, according to data from the Federation of European Companion Animal Veterinary Associations (FECAVA). Though many animals receive their initial injections, only around two-thirds get subsequent ones.

The vaccination rates are at their lowest ever in the UK, possibly going below the herd immunity threshold. As indicated by vets, developed nations like the USA and Australia also have the same scenario where a growing number of pet parents are hesitant to vaccinate their animals as a result of anti-vaccination sentiments.

The veterinary vaccine business is experiencing a major problem with the rising trend of people declining vaccinations. Fewer animals receive immunization and this results in decreased efficiency of vaccination programs, consequently raising the epidemic chances.

Thus, the only way to curb the menace is by educating pet owners on the importance and safety of vaccines while at the same time demystifying the notion as well as phobias against vaccination.

The veterinary vaccines industry recorded a CAGR of 3.5% between 2020 and 2024. According to the industry, veterinary vaccines generated USD 9.43 billion in 2024, up from USD 8.21 billion in 2020 .

Several factors are responsible for the consistent or gradual growth the veterinary vaccine sector has experienced over the past ten years. New products take longer time to be introduced into the market because producing and validating animal vaccines requires thorough processes while facing stringent regulatory barriers.

In addition, it is expensive and time-consuming for innovations in the product due to the high costs of research and development, which also contributed to this venture being established. Additionally, in certain regions, a lack of understanding of the significance of animal vaccination has slowed down adoption rates.

Several factors are anticipated to fuel significant growth in the veterinary vaccine market in the near future. For example, there has been increased demand for efficient vaccines to prevent outbreaks for various animal diseases because their risks are on the rise, including those transmitted from animals to humans and those affecting livestock.

Development in the field of biotechnology and that of vaccine production is also leading to a greater variety and quality in terms of effectiveness. Furthermore, the market for companion animals is expanding due to an increase in the number of people who own pets in developing nations.

Government's partnerships and the support they provide, such as funds, and the simplifying of the licensing process, are some other ways that are believed to enhance industry growth. More convincing promotional activities encouraging people to get their pets vaccinated, emerging-market economic growth and the livestock industry are a part of the factors that will lead to the stable growth of the veterinary vaccine industry in the long run.

Companies in the Tier 1 sector account for 66.1% of the global market, ranking them as the dominant players in the industry. Tier 1 players offer a wide range of vaccines for the livestock as well as companion animals, have an established industry presence, offer continuous innovation, and have a significant influence in the field.

Prominent companies within Tier 1 include Merck & Co., Inc. (MSD Animal Health), Zoetis Services LLC., Boehringer Ingelheim International GmbH and Elanco (Eli Lilly)

Tier 2 players dominate the industry with a 24.2% market share. Tier 2 firms concentrate on its reputation for quality, regulatory compliance, and continuous innovation, combined with comprehensive support services and strategic partnerships. Tier 2 companies include Ceva, Kemin Industries, Inc., Virbac, Jinyu Biotechnology Co., Ltd., Vaxxinova, Indian Immunologicals Ltd., Phibro Animal Health Corporation and Others.

Compared to Tiers 1 and 2, Tier 3 companies with smaller revenue spouts and less influence. Prominent players in this tier are Biogénesis Bagó, Ourofino, HESTER BIOSCIENCES LIMITED, Bioveta, Inc., HIPRA, LETI Pharma and Others

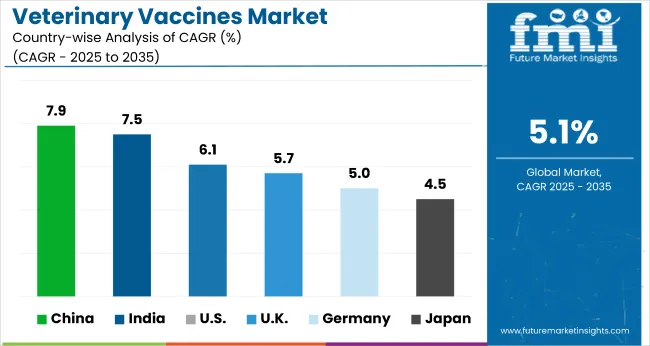

An analysis of the veterinary vaccines industry is provided in various countries. Several regions throughout the world are examined, including Asia Pacific, North America, Europe and Middle East. China is forecast to remain the leader of Asia Pacific with a 7.9% CAGR through 2035. The United States is predicted to exhibit a 6.1% CAGR by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| China | 7.9% |

| Germany | 5.0% |

| UK | 5.7% |

| Japan | 4.5% |

| India | 7.5% |

The USA was observing a rapid growth in veterinary vaccines because of the growing number of dogs suffering from arthritis. There is a major concern associated with diseases such as osteoarthritis had become very common diseases that affect dogs in veterinary industry. A study published in NCBI in the year 2022 showed that veterinarians confirmed 188(38%) out of 500 diagnosed dogs with the disease arthritis.

An urgent necessity for impactful veterinary interventions is increasingly becoming apparent with regard to the rising case of osteoarthritis and is driving up the veterinary vaccines industry in the USA as more pet owners show keen interest in controlling or preventing joint diseases from happening to their pets hence escalating demand for elaborate veterinary treatment that includes vaccination among other things.

This trend is driving innovation and expansion in the veterinary healthcare market, ensuring that more pets receive the necessary preventive and therapeutic treatments to maintain their quality of life.

A CAGR of 5.0% is predicted for the forecast period due to rising pet ownership. In 2024, a report by the Association of Zoological Specialist Companies (ZZF) indicated that 45% of German households had at least one pet. The recent increase in demand for veterinary vaccines in Germany is due to the large number of pet owners in the country.

Therefore, the number of families that keep pets has been increasing, which results in the growing concern about animal health and welfare.

However, despite the increased number of families living with pets, preventing illness among domestic animals remains crucial to an overwhelming majority of pet owners. Rising consciousness and dedication to animal welfare result in an increased need for animal vaccinations, driving their use within veterinary practice as well as animal husbandry in general.

Concomitantly, stringent legal provisions with respect to animal wellbeing alongside high levels of veterinary expertise present in Germany propel expansion as well as creativeness throughout these sectors. This serves to ensure that pets remain healthy by keeping them safe from illnesses.

The increasing meat production Self-assembled protein nanoparticles in China is significantly boosting the veterinary vaccine market. According to the National Bureau of Statistics China, China produced 57.94 million tonnes of pig meat in 2023, which represented a 5% increase from the previous year.

A rise in slaughter rates led to overstocking of the domestic industry whereas shrinking margins force most of the animals to be slaughtered, thus increasing the outputs that require strict veterinary and husbandry practices.

The increased demand for efficacious veterinary health measures emphasizes the importance of vaccinations to prevent occurrences of diseases that may negatively affect the quality of the animals. Additionally, the expanding meat industry underlines the necessity of veterinary vaccines in maintaining animal well-being and health.

Healthy livestock keep the industry going and enable it to grow thereby assisting to meet production demands and keeping the agricultural economy stable in general in China.

The veterinary vaccines industry is consolidated with the presence leading manufacturers. Key players in the livestock vaccination industry are increasingly focusing on product development, including obtaining approvals from regulatory bodies and launching new products.

The launch of new vaccines following regulatory approvals not only addresses emerging disease threats but also meets the growing demand for advanced veterinary solutions, thereby strengthening the industry presence of these companies.

Recent Industry Developments in the Veterinary Vaccines Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 9.92 billion |

| Projected Market Size (2035) | USD 16.34 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million doses for volume |

| Technologies Analyzed (Segment 1) | Attenuated Live Vaccines, Inactivated Vaccines, Subunit Vaccines, Toxoid Vaccines, DNA Vaccines |

| Animals Analyzed (Segment 2) | Companion Animals (Canine, Avian, Feline), Livestock Animals (Ruminants, Camels, Sheep, Goats, Poultry - Breeders, Broilers, Layers, Equine, Bovine, Porcine), Aquaculture |

| Disease Indications Analyzed (Segment 3) | Foot & Mouth Disease (FMD), Newcastle Disease, Porcine Reproductive & Respiratory Syndrome (PRRS), Canine Parvovirus, Brucellosis, Avian Influenza, Others |

| Distribution Channels Analyzed (Segment 4) | Veterinary Hospital Pharmacies, Veterinary Clinics, Retail Pharmacies, Online Pharmacies |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Veterinary Vaccines Market | Bioveta, Inc., Merck & Co., Inc. (MSD Animal Health), Zoetis Services LLC., Elanco (Eli Lilly), Ceva, Boehringer Ingelheim International GmbH, Kemin Industries, Inc., HESTER BIOSCIENCES LIMITED, Phibro Animal Health Corporation, Virbac, LETI Pharma, Ourofino, HIPRA, Jinyu Biotechnology Co., Ltd., Indian Immunologicals Ltd., Vaxxinova, Biogénesis Bagó |

| Additional Attributes | Dollar sales by animal type (livestock vs companion), Adoption of DNA and subunit vaccines, Use of vaccines in commercial poultry and swine operations, Trends in zoonotic disease prevention, Government livestock immunization programs across emerging markets |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of technology, the industry is segregated into attenuated live vaccines technology, inactivated vaccines technology, subunit vaccines technology, toxoid vaccines technology, and DNA vaccines technology

In terms of animal, the industry is segregated into companion animals (canine, avian, and feline), livestock animals [ruminants, camels, sheep, goats, poultry (breeders, broilers, and layers), equine, bovine, porcine], and aquaculture.

In terms of disease indication, the industry is segregated into Foot & Mouth Disease (FMD), Newcastle Disease, Porcine Reproductive & Respiratory Syndrome (PRRS), Canine Parvovirus, Brucellosis, Avian Influenza, and others

In terms of distribution channel, the industry is segmented into veterinary hospital pharmacies, veterinary clinics, retail pharmacies, and online pharmacies.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, and Middle East & Africa have been covered in the report.

Dental fluorescence analyzers are expected to increase at a CAGR of 5.2% between 2025 and 2035.

The inactivated vaccine technology segment is expected to occupy a 32.5% market share in 2025.

The market for veterinary vaccines is expected to reach USD 16.34 billion by 2034.

The United States is forecast to see a CAGR of 6.1% during the assessment period.

The key players in the veterinary vaccines industry include Merck & Co., Inc. (MSD Animal Health), Zoetis Services LLC., Boehringer Ingelheim International GmbH and Elanco (Eli Lilly), Ceva, Kemin Industries, Inc., Virbac, Jinyu Biotechnology Co., Ltd., Vaxxinova, Indian Immunologicals Ltd., Phibro Animal Health Corporation and Others

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Middle East Veterinary Vaccine Market Analysis - Size, Share, and Forecast 2025 to 2035

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA