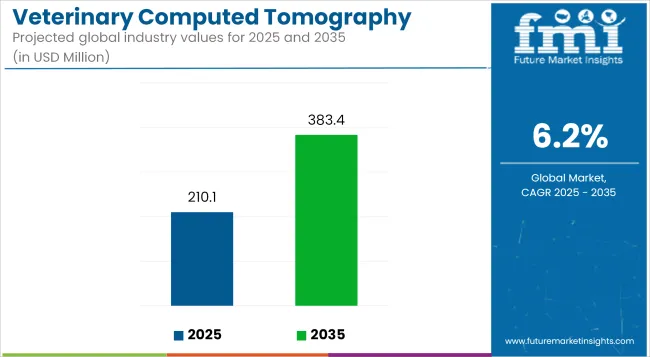

The Veterinary Computed Tomography Scanner Market is estimated to reach USD 210.1 Million by 2025. Between 2025 and 2035, the market is expected to grow at a CAGR of 6.2%, reaching a total value of USD 383.4 Million by the end of the assessment period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 210.1 Million |

| Market Value (2035F) | USD 383.4 Million |

| CAGR (2025 to 2035) | 6.2% |

The veterinary computed tomography (CT) scanner market is experiencing steady expansion, supported by growing demand for advanced diagnostic capabilities in companion animal care. Rising pet ownership and increased spending on veterinary services have encouraged practices to invest in high-resolution imaging systems to improve diagnostic accuracy and treatment planning.

Veterinary hospitals and specialty clinics are adopting CT technology to address complex clinical cases involving oncology, neurology, and orthopedics, where conventional imaging modalities have limitations. Regulatory approvals and safety certifications have further supported adoption across developed regions, while emerging markets are gradually investing in modern imaging infrastructure. Ongoing technological innovation in image reconstruction software and multi-slice configurations is expected to drive performance improvements and workflow efficiency.

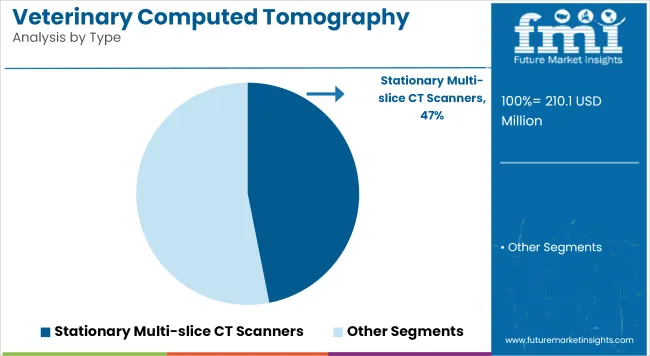

In 2025, stationary multi-slice CT scanners are anticipated to hold a 46.9% revenue share in the veterinary computed tomography scanner market. This leadership has been attributed to their superior imaging resolution and the capability to capture detailed cross-sectional images rapidly. Clinical demand for accurate visualization of complex anatomical structures has been observed to drive investment in multi-slice configurations, which enable faster throughput and improved diagnostic confidence.

Veterinary facilities have favored stationary systems for their compatibility with high-volume workflows and their ability to support a broad range of applications, including trauma assessment and oncology staging. Additionally, advancements in workstation integration and 3D rendering capabilities have reinforced the segment’s appeal. Collectively, these factors have established stationary multi-slice CT scanners as the preferred modality in practices seeking comprehensive imaging solutions.

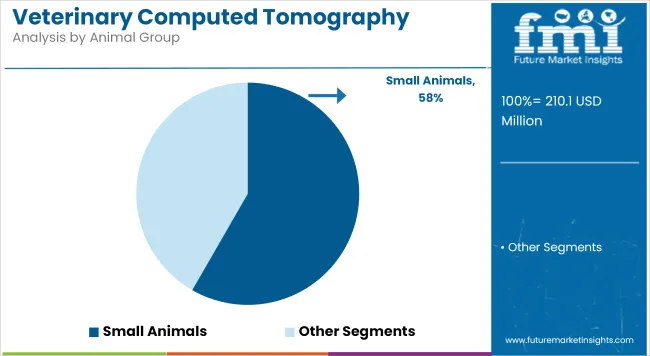

Small animals are projected to account for 58.3% of the market share in 2025. This dominance has been supported by the rising prevalence of chronic conditions in companion animals and a heightened emphasis on preventive and specialty care. Practices have increasingly adopted CT imaging for small animal patients to improve early diagnosis and treatment planning in neurological, orthopedic, and oncological cases.

The segment has benefited from increased pet insurance penetration and higher discretionary spending by owners on advanced diagnostics. Manufacturers have developed CT systems specifically configured for small animal anatomy, enhancing positioning accuracy and reducing anesthesia time. These developments, coupled with heightened clinical awareness of the benefits of cross-sectional imaging, have strengthened the segment’s growth trajectory.

In 2025, veterinary hospitals are expected to hold a dominant 57.9% revenue share in the veterinary computed tomography (CT) scanner market. This segment's growth has been driven by the increasing demand for advanced imaging techniques to diagnose a variety of animal health conditions.

Veterinary hospitals are equipped with specialized CT scanners that provide detailed, high-resolution images, enabling accurate diagnoses for conditions such as trauma, cancer, and neurological disorders in animals. The integration of CT scanning into veterinary hospitals has allowed for more precise and non-invasive diagnostic capabilities, which is critical in providing comprehensive care for both companion animals and livestock.

Moreover, as veterinary medicine continues to adopt more sophisticated technologies, CT scanners have become essential tools in emergency and specialty veterinary care, facilitating faster decision-making and treatment planning. Increased investment by veterinary hospitals in advanced diagnostic technologies, combined with the growing recognition of the importance of early and accurate disease detection, has further contributed to the expansion of this segment.

High Equipment Costs and Limited Awareness in Emerging Markets

High cost of equipment and maintenance is one of the major challenges of the veterinary CT scanner market, which makes it inaccessible to smaller veterinary practices and emerging markets. Lack of awareness about the benefits of advanced diagnostic imaging also holds back adoption in less economically developed countries.

Technological Innovations and Growing Preventive Care Demand

Emerging developments like compact and cost-effective CT scanners which are meant for veterinary use would benefit growth in this field. Preventive health care and early disease detection almost propel the application areas even wider. Collaboration between developing world manufacturers and veterinary services to provide affordable solutions and teaching would open up new market opportunities.

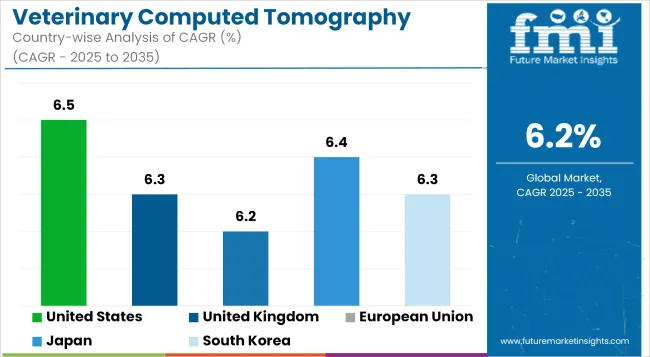

A rapid expansion in the veterinary CT scanner market is occurring in the USA due to increases in pet ownership and advances in understanding diagnostic imaging for animals. More and more veterinarians are resorting to CT scanning for the precise diagnosis of specific diseases, including tumors, fractures, and trauma, in pets as well as livestock.

Market growth is spurred by advanced veterinary healthcare facilities coupled with investment in the technology of animal health. Further, the existing trend toward pet insurance provision and much more spending on pet healthcare is anticipated to propel the market demand for ultra-modern imaging systems. Safety and effectiveness measures by regulatory bodies like the FDA add to market confidence toward CT scanners in veterinary applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The UK veterinary ct scanner market is experiencing a steady growth path propelled by the increasing acceptance of high-tech veterinary diagnostic techniques. The willingness of pet owners to spend on animal healthcare and the proliferation of specialty veterinary clinics are also factors promoting market growth.

Regulatory safety and compliance of the devices concerned are taken care of by the veterinary medicines directorate (VMD). Rapid improvements in CT imaging technology, including shorter scan time and enhanced image resolution, have enabled better diagnostic and treatment planning accuracy for veterinary personnel. This trend is now boosted further by interest in pet health insurance and awareness of animal health.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

The veterinary computed tomography market is almost steady in the European Union primarily due to the increase in pet ownership and the rise in acceptability of advanced veterinary care facilities. The contributions of Germany, France, and the Netherlands in this bright field of development in veterinary healthcare make this market grow on a larger scale. European Medicines Agency (EMA) regulations state the high standards that are needed for safety and efficacy in veterinary CT scanners as they were approved.

Promising advancements in their technology such as 3D imaging and low-radiation exposure have been awe-inspiring in the ranks of the profession of veterinary diagnostics. This has led to the huge growth of the market because of increased demand for quick diagnosis and treatment of animal diseases across the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.2% |

The growing number of companion animals and increased awareness about pet health and well-being are some of the factors driving growth in the veterinary CT scanner market in Japan. The regulation of veterinary medical devices in the country is done by the Ministry of Health, Labour, and Welfare and ensures that there are strict safety standards and quality as well. Implementation of advanced imaging technology in veterinary clinics and hospitals has been increasing, so diagnostics and outcomes from treatment improved.

The Japanese veterinary professional has focused on precision medicine and minimally invasive diagnostics, which increases the market for such instruments, including CT scanners. In addition, increased investments in veterinary healthcare infrastructure and research stimulate the expansion of markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The South Korea market for veterinary CT scanning has been growing due to the increasing ownership of pets on the one hand and advancements in veterinary healthcare services on the other. Medical devices, including veterinary imaging systems, are regulated for safety and efficacy under the Ministry of Food and Drug Safety (MFDS).

Owing to the sound electronics and IT sectors, advanced imaging technologies are integrated into veterinary diagnostics among all other low fields. CT scanners are also increasingly used in animal healthcare practice to get highly detailed images for diagnosis of difficult health conditions in pets and livestock.

Growing public awareness on health matters and increasing spending on pet care are key market drivers. Furthermore, the state promotion of animal welfare and smart health care technologies is beneficial in developing the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

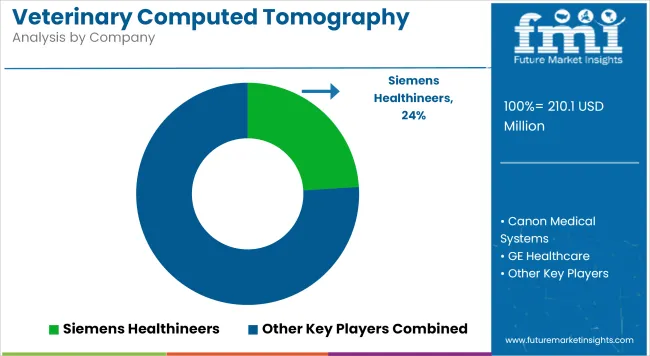

The veterinary computed tomography scanner market is increasingly competitive as pet ownership grows and demand rises for advanced imaging in companion animal and equine care. Leading manufacturers are investing in compact, high-resolution systems designed specifically for veterinary practices, as well as large-bore scanners for livestock and equine applications.

Strategic collaborations with specialty clinics, regulatory clearances, and product line expansions are strengthening competitive positioning. Additionally, emphasis on faster scan times, lower radiation doses, and integration with veterinary PACS and 3D planning software is driving innovation. Companies are also focusing on affordability and service contracts to support adoption in mid-sized practices and emerging markets.

The overall market size for the veterinary computed tomography scanner market was USD 210.1 million in 2025.

The market is expected to reach USD 383.4 million in 2035.

Demand will be driven by increasing pet ownership, rising prevalence of animal diseases, advancements in veterinary imaging technologies, and growing adoption of advanced diagnostic tools.

The top 5 contributing countries are USA, UK, Europe, Japan, and South Korea.

The Stationary Multi-slice CT Scanners segment is expected to lead the market due to its faster imaging capabilities and better image resolution.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA