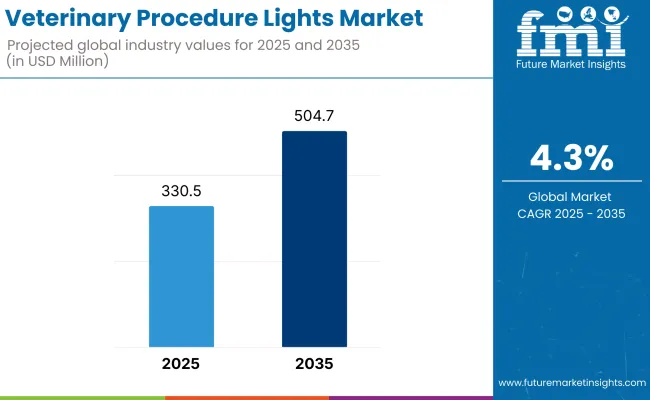

The veterinary procedure lights market is expected to reach approximately USD 330.5 million in 2025 and expand to around USD 504.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.3% over the forecast period.

With clinics and surgical centers looking to precision, hygiene, and efficient processes while treating animals, the veterinary procedure lights market is changing. Traditional setups are not integrated with the advanced illumination technologies needed for veterinary-specific procedures. Improved visibility in surgical and diagnostic procedures is directly linked to treatment accuracy, making lighting systems a primary investment.

Clinics are being modernized to reduce procedural mistakes, limit shadows cast during treatment and cope with the high-volume caseloads required (particularly in urban and speciality practices). As multispecialty veterinary centers proliferate and competition has grown, premium lighting technology has become a key strategic differentiator, resulting in a steady increase in adoption across both developed and developing veterinary markets.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 330.5 million |

| Industry Value (2035F) | USD 504.7 million |

| CAGR (2025 to 2035) | 4.3% |

Between 2020 and 2024, the veterinary procedure lights market witnessed a distinct transition from legacy halogen systems to high-performance LED-based lighting. This shift was largely driven by operational efficiency and cost-effectiveness, as LED systems offered longer lifespan, lower energy consumption, and superior color rendering-key for accurate tissue differentiation during surgeries.

Independent veterinary clinics initially led the transition, especially those offering orthopedic and dental procedures, where precision lighting is non-negotiable. Additionally, an uptick in specialty pet hospitals and referral centers created a ripple effect in demand for ceiling-mounted and mobile lighting configurations to support surgical suites and diagnostic zones.

The period also saw significant growth in private-equity-backed veterinary group acquisitions, leading to standardization of high-quality lighting across newly consolidated facilities. Procurement teams increasingly opted for modular and ergonomic designs that reduce staff fatigue and enhance procedural turnaround. The market matured as vendors started bundling lights with integrated camera systems and sterile handle options, reflecting a new era of innovation shaped directly by practice-level performance metrics.

North America continues to lead the veterinary procedure lights market with a strong focus on workflow-integrated lighting systems tailored to high-volume companion animal practices. Veterinary consolidators and corporate-owned animal hospitals are standardizing advanced LED lighting systems that enhance procedural throughput and technician visibility.

One of the key drivers is the optimization of surgical suite layouts, where lighting ergonomics directly impact staff efficiency and turnaround times. Companies like Midmark and Burton Medical are pioneering modular designs with adaptive lighting intensity based on procedure types.

Additionally, the integration of camera-ready lights for tele-veterinary consultations and surgical streaming is creating new monetization channels, especially in specialist practices. Veterinary teaching hospitals across the USA are also playing a pivotal role in early-stage adoption of smart-lighting technologies, incorporating adjustable color temperatures and hands-free controls to improve surgical precision in varied animal anatomies.

Increasing focus towards compact and multi-functional lighting sets that conform to the limited operational space in clinics and stringent safety and hygiene protocols are expected to influence the demand for veterinary procedure lights in Europe.

In Germany, the UK and the Netherlands, ceiling-mounted units equipped with shadow-reduction optics for elaborate procedures like dental surgeries and exotic animal care are also seeing increased installations. As anesthesia-heavy procedures create ambient distractions, lighting models that are noise-free are becoming more important in regional procurement decisions.

Residential lighting would be easy to understand in this context, as such installations tend to be time and labor intensive. Veterinary regulatory bodies are also now promoting traceability and compliance documentation, therefore moving clinics towards light systems with inbuilt usage logging and scheduled maintenance alerts.

Eastlowen divides 3000 square kilometres with hundreds of clients, a scattered community that is driving demand for portable lighting kits with rugged construction and rapid-deployment capabilities as just one of the increasing number of mobile veterinary units spreading across some of rural Europe.

Asia-Pacific is witnessing dynamic growth in the veterinary procedure lights market, driven by the booming pet care economy and expansion of high-end animal hospitals in urban corridors. Markets such as China, India, and Australia are seeing fast-paced adoption of high-lumen LED systems with customizable beam shapes, tailored to multi-species usage in compact surgical spaces.

One standout factor is the emergence of franchised veterinary chains, which are driving bulk procurement of lighting systems with centralized configuration management and energy-saving modes to optimize cost per location.

In Southeast Asia, startup clinics targeting affluent pet owners are investing in aesthetic-forward lighting units that match modern, glass-walled surgical suites-enhancing both function and visual branding.

Additionally, smart lighting controls integrated with mobile apps are gaining popularity among tech-native veterinary professionals, enabling real-time adjustment of brightness and color rendering during complex treatments. Local manufacturers in countries like South Korea are now competing by offering feature-rich lights at accessible price points, accelerating market penetration in tier-2 urban zones.

Customization Barriers and Procedural Workflow Misalignment Limiting Broader Adoption

One of the core challenges constraining the veterinary procedure lights market is the lack of species-specific design considerations in mainstream lighting solutions. Many lighting systems are still modeled after human surgical environments, which do not account for the anatomical diversity, movement patterns, or procedural workflows unique to veterinary practice.

This mismatch results in excessive glare, shadow casting, and suboptimal field illumination during surgeries involving small animals, reptiles, or avian species. Additionally, the variability in clinic infrastructure-from single-table practices to multi-suite specialty centers-makes it difficult to implement a one-size-fits-all lighting solution. Smaller clinics often lack ceiling height or power configurations required for premium units, leading to compromise purchases.

Further compounding the challenge is the shortage of trained biomedical staff for on-site installation and calibration, which slows deployment and reduces perceived ROI. Without increased modularity and practice-type alignment, manufacturers risk losing traction in a market that demands clinical agility over standardization.

Growth of Vet-Centric Surgical Training and Tech-Forward Clinics Fueling Demand for Smart Lighting Ecosystems

A key opportunity emerging in the veterinary procedure lights market lies in the rising influence of advanced surgical training programs and the expansion of digitally equipped, tech-forward veterinary clinics. As hands-on surgical courses and simulation-based learning become integral to veterinary education, institutions are investing in high-fidelity procedural lighting to replicate real-world operating conditions.

This not only fosters early brand exposure but also shapes practitioner preferences for premium lighting post-graduation. Moreover, urban specialty clinics and veterinary surgery centers are seeking integrated lighting ecosystems that sync with digital cameras, recorders, and cloud-based case management platforms-turning traditional lights into surgical intelligence tools.

The demand for voice-controlled brightness adjustment, tunablecolor temperature for tissue contrast, and lighting presets for recurring procedures presents untapped potential for differentiation. Forward-looking manufacturers that offer scalable, software-integrated lighting solutions will find significant competitive edge, especially as vet clinics evolve into multi-disciplinary surgical hubs with a growing focus on clinical excellence and brand identity.

From 2020 to 2024, the veterinary procedure lights market transitioned from basic functional lighting toward performance-optimized systems tailored to veterinary workflows. Early adoption of LED lighting systems was driven by the need for energy efficiency and lower maintenance costs.

However, deeper market momentum came from practices performing advanced proceduresorthopedic, dental, ophthalmic where high-CRI (Color Rendering Index), shadowless illumination became essential. Clinics also began favoring mobile and articulating arm designs to accommodate smaller treatment spaces and diverse animal positioning.

The rise of veterinary group practices and specialty centers led to bulk procurement trends, creating demand for scalable, standardized lighting setups. Looking forward, the market is expected to shift toward smart lighting ecosystems that integrate with digital surgical platforms, enabling features such as gesture or voice activation, pre-set procedural modes, and intraoperative recording.

The growth of veterinary telemedicine and surgical broadcasting will drive interest in camera-integrated lights. Sustainability is also set to become a key differentiator, with eco-certified, low-heat emission systems gaining traction in new builds and green-certified vet clinics.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Minimal oversight; basic compliance with lighting safety standards |

| Technological Advancements | Widespread LED adoption; fixed and wall-mounted designs dominate |

| Consumer Demand | Predominantly from urban and mid-size vet clinics |

| Market Growth Drivers | Companion animal ownership, veterinary clinic expansion, improved surgical standards |

| Sustainability | LED systems with moderate energy efficiency |

| Supply Chain Dynamics | Regional distributors; product bundling with surgical equipment |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Growing enforcement of lighting ergonomics, energy standards, and surgical safety |

| Technological Advancements | Portable, wireless systems; adjustable color temperature; sensor-based activation |

| Consumer Demand | Broader demand from mobile clinics, rural facilities, and specialty animal hospitals |

| Market Growth Drivers | Demand for precision care, mobile vet growth, enhanced workflow integration |

| Sustainability | Ultra-efficient lighting, recyclable housings, RoHS-compliant components |

| Supply Chain Dynamics | Direct-to-clinic models, modular kits, online veterinary equipment platforms |

Market Outlook

The United States remains the most commercially mature market for veterinary procedure lights, driven by its high penetration of multispecialty animal hospitals and aggressive expansion of corporate veterinary chains. These large networks are prioritizing OR-grade lighting systems with integrated video, surgical presets, and antimicrobial coatings to maintain brand consistency and procedural excellence across locations.

The demand for ergonomic, technician-friendly lighting is also rising in mobile surgery units and teaching hospitals. Additionally, tech-forward practices are investing in camera-integrated lights to support teleconsultation, surgical livestreaming, and remote mentoring-a growing trend in veterinary continuing education.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

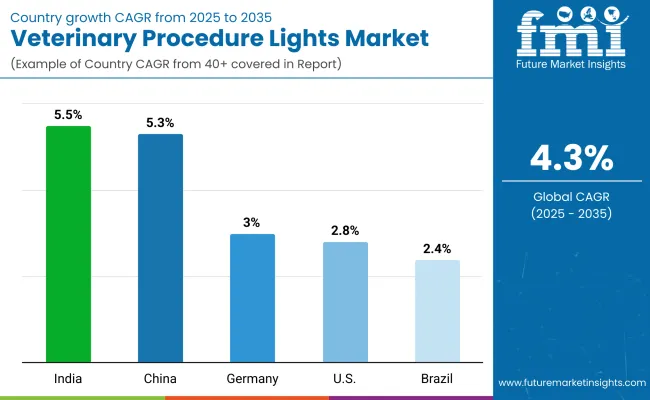

| 2025 to 2035 | 2.8% |

Market Outlook

India is emerging as a high-opportunity market for veterinary procedure lights, largely due to the rapid modernization of pet care clinics in metropolitan cities. A growing class of small-animal specialty practices is driving demand for high-lumen, space-efficient lighting systems. The rise of tier-1 and tier-2 cities as pet care hubs has also boosted installations of ceiling-mounted and mobile units in veterinary surgery suites.

Many practices seek budget-conscious yet durable lighting options, prompting local OEMs to innovate in low-cost, high-performance segments. Additionally, the surge in veterinary education institutes is creating demand for modular lights with camera mounts for practical demonstrations and e-learning modules.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.5% |

Market Outlook

China is experiencing accelerated growth in the veterinary procedure lights market, driven by a new wave of corporate pet hospital chains and rising consumer expenditure on high-end pet care. Lighting systems with programmable brightness, low heat output, and precision optics are becoming standard in large animal hospitals and university-affiliated veterinary clinics.

The market is also seeing a trend toward lights embedded with digital displays and recording capabilities, used for documentation, training, and surgical reviews. Domestic manufacturers are rapidly scaling to meet demand, offering smart, cost-competitive alternatives to imported brands. Additionally, animal surgery livestreaming via social platforms is gaining traction in China’s digitally native clinics.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.3% |

Market Outlook

Germany represents a precision-driven veterinary procedure lights market, where clinical performance, build quality, and compliance with stringent safety regulations dominate procurement decisions. Veterinary surgical centers, especially those handling exotic or orthopedic cases, are adopting shadow-free, dimmable, and tunablecolor temperature lighting to improve procedural accuracy.

Integration with centralized surgical control systems is becoming more common in referral hospitals. German veterinary clinics also place emphasis on hygienic design, preferring fanless models and sealed light surfaces. Furthermore, clinics in rural areas are increasingly equipping mobile surgical units with foldable, battery-supported lighting solutions.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.0% |

Market Outlook

Brazil's veterinary procedure lights market is growing rapidly, led by increased investments in private pet clinics and the expansion of companion animal care in suburban and semi-urban regions. Mid-sized clinics are driving demand for mobile and wall-mounted units that are both cost-effective and easy to service.

With the country’s rising veterinary surgery rates, particularly in orthopedic and reproductive care, clinics are upgrading to higher-lumen, anti-glare lighting systems to improve surgical outcomes. Additionally, Brazil is seeing an influx of refurbished lighting imports, appealing to clinics balancing performance needs with budget constraints. There is also increasing demand for rugged lights with moisture and dust resistance for rural and outdoor setups.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.4% |

Surgery Lights Continue to Dominate Due to Precision Illumination and Multi-Specialty Compatibility

Veterinary procedure lights for surgery remain the top product type in the veterinary procedure lights market, owing to their clinical non-replaceability for a wider category of high-stakes veterinary procedures. Whether for orthopedic surgeries, abdominal interventions, or tumor resections, surgery lights will provide brighter, shadow control, and the ability to focus-all essential for vision accuracy in elaborate veterinary processes.

The devices provide stable luminous intensity, regardless of movement in both dim rooms and bright offices, which has made the devices favorites among specialty and emergency animal hospitals. In multi-table surgical suites, the trend of integrating dual-arm ceiling-mounted surgical lights with high-definition camera systems to allow documentation and live case discussions is emerging.

Further demand is driven by increasing investments from corporate veterinary chains and teaching establishments focusing on OR-grade infrastructure. With rising surgical caseloads across species, from companion animals to exotics, clinics are turning away from generic lighting, opting for application-specific, high-performance surgical light systems that offer durability, ergonomic handling, and best-in-class color rendering for tissue differentiation.

Frontal Binocular Microscopes and Headlights Emerge as Preferred Tools for Micro-Procedures and Mobile Use

Frontal binocular microscopes and surgical headlights in particular is becoming a high-growth segment, particularly in veterinary procedures within dental, ophthalmic, and dermatologic specialties. These directed and magnifying lighting tools are also valuable in close-proximity work and surgical procedures for small animals and exotic species, making them useful during minimally invasive surgical procedures or delicate surgeries.

Their portability and hands-free design enable greater mobility and responsiveness from veterinarians in nontraditional environments such as field hospitals, mobile units, or specialty exam rooms. Veterinarians operating from a dental trailer or mobile unit are more frequently using headlights, which are ergonomically designed, battery powered lighting devices that keep feet on the ground and addition, while eyelids closed on sugar.

And the affordability and ease of use of these tools means they're being integrated into hands-on training programs by veterinary teaching institutions. As these facilities grow their procedure capabilities beyond general surgery and into additional fine-detail procedures, a demand for appropriate illumination, for a variety of conditions in varied usage, is ideal for use in cities where the technical infrastructure of ceiling or wall-mounted units may not be realistic or cost-effective.

Double-Head Ceiling Mount Systems Dominate Due to Multi-Table Coverage and Shadow Reduction

Double-head ceiling mount systems are the leading modality in the veterinary procedure lights market, driven by their operational flexibility and ability to deliver consistent illumination across multi-table setups. Veterinary surgery centers and teaching hospitals often deal with variable patient positioning, multiple procedures in one OR, or the need to accommodate large animals-scenarios where dual-head systems provide seamless light coverage.

These systems allow independent articulation of each head, ensuring optimal angle and intensity without repositioning the patient. Moreover, newer models offer tunablecolor temperatures and touch-free controls, aligning with sterile field standards and clinician comfort. Integration with HD cameras and monitors is also gaining traction in high-volume clinics looking to document surgeries or support remote consultations.

As procedures become more complex and surgical teams demand higher performance from infrastructure, dual-head ceiling mounts provide scalability, long-term durability, and superior ergonomics, making them the modality of choice for institutions focused on advanced care delivery.

Wall Mount Units Gain Momentum Among Mid-Sized Clinics for Cost-Efficient, Space-Saving Solutions

Wall-mounted veterinary procedure lights are emerging as a high-growth modality, particularly in mid-sized and single-table practices where space optimization and cost-efficiency are top priorities. These units strike a balance between performance and practicality, offering fixed or semi-flexible arms that can be easily maneuvered without occupying valuable floor or ceiling space.

Wall mounts are especially popular in exam rooms and minor surgical suites that require focused, adjustable lighting without the investment needed for ceiling installations. Many new-generation wall-mounted systems now feature dimmable LEDs, wide-range rotation, and high CRI ratings, giving smaller clinics access to professional-grade lighting at a manageable cost.

Their quick installation and minimal maintenance make them an attractive choice for clinics in growth or renovation phases. As more veterinary practices in emerging markets and suburban regions expand their surgical capabilities, wall-mounted lighting systems are expected to become a preferred solution for balancing quality, space, and operational efficiency.

The veterinary procedure lightsmarket is witnessing steady growth, driven by rising pet ownership, increasing demand for advanced veterinary surgical infrastructure, and technological advancements in LED and mobile lighting solutions.

The market is characterized by a mix of specialized veterinary equipment manufacturers and broader medical device companies adapting human healthcare lighting systems for veterinary use. While North America leads the market in terms of adoption, Europe and Asia-Pacific are also expanding due to rising investments in animal healthcare facilities.

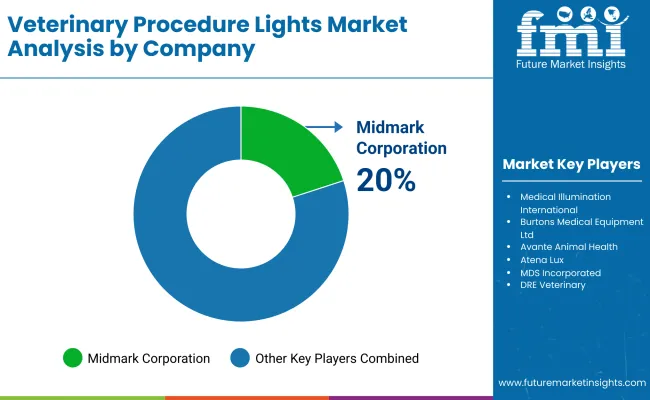

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Midmark Corporation | 20-25% |

| Medical Illumination International | 15-18% |

| Burtons Medical Equipment Ltd | 10-14% |

| Avante Animal Health | 8-12% |

| ACEM S.p.A | 5-8% |

| Company Name | Key Offerings/Activities |

|---|---|

| Midmark Corporation | Offers ceiling-mounted, wall-mounted, and portable procedure lights designed specifically for veterinary clinics. |

| Medical Illumination International | Supplies veterinary surgical lights with LED technology; known for MI-750 and MI-1000 series used in exam and OR rooms. |

| Burtons Medical Equipment Ltd | UK-based firm providing a wide range of veterinary surgical and exam lights; known for value and customization. |

| Avante Animal Health | Offers full veterinary lighting setups including portable, LED, and minor surgery lights for small to large practices. |

| ACEM S.p.A | Italian manufacturer of advanced LED operating lights; expanding presence in animal hospitals and mobile vet units. |

Key Company Insights

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

Examination lights, Surgery Lights, Frontal Binocular Microscope and Headlights

Floor Stand, Wall Mount, Single head Ceiling Mount and Double-head Ceiling Mount

Veterinary Hospitals, Veterinary Clinics, Veterinary Diagnostic Centers and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for veterinary procedure lights market was USD 330.5 million in 2025.

The veterinary procedure lights market is expected to reach USD 504.7 million in 2035.

Increasing adoption of remote surgical mentoring in veterinary teaching hospitals is accelerating the need for lights compatible with real-time video capture and streaming systems.

The top key players that drives the development of veterinary procedure lights market are Midmark Corporation, Medical Illumination International, Burtons Medical Equipment Ltd, Avante Animal Health and ACEM S.p.A

Surgery lights devices is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Modality, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Modality, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Modality, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Modality, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Modality, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Modality, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Modality, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Modality, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Modality, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Modality, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Modality, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Modality, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA