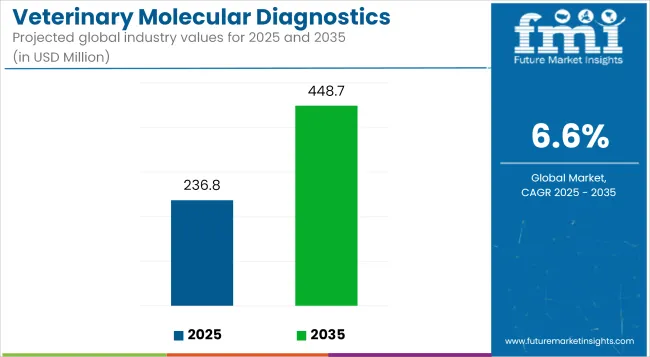

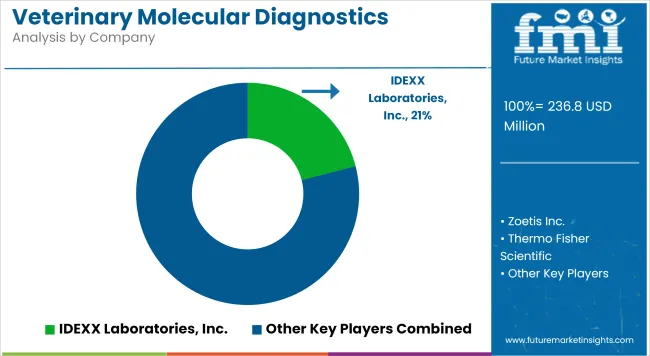

The global Veterinary Molecular Diagnostics Market is estimated to be valued at USD 236.8 Million in 2025 and is projected to reach USD 448.7 Million by 2035, registering a CAGR of 6.6% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 236.8 Million |

| Projected Market Size in 2035 | USD 448.7 Million |

| CAGR (2025 to 2035) | 6.6% |

The veterinary molecular diagnostics market is experiencing strong expansion, driven by heightened awareness of zoonotic diseases, the rise in companion animal ownership, and the need for early and accurate pathogen detection in livestock.

Advancements in PCR and next-generation sequencing technologies have improved diagnostic precision, allowing veterinarians to implement targeted treatment protocols and strengthen biosecurity measures. Regulatory authorities have increasingly supported the adoption of molecular testing frameworks to improve disease surveillance and outbreak control.

Veterinary healthcare providers are prioritizing diagnostic tools that enable rapid turnaround times and multiplex detection of pathogens, which has accelerated the integration of molecular assays into routine veterinary workflows. Continued investment in molecular assay development, strong veterinary infrastructure growth in emerging economies, and expansion of livestock disease management programs are expected to sustain market momentum and create new avenues for innovation and market penetration.

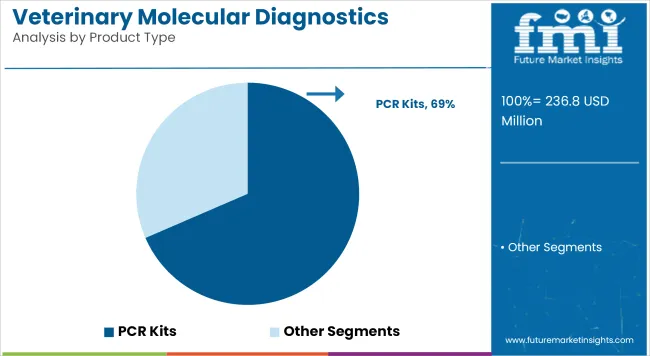

In 2025, PCR kits are anticipated to account for 68.5% of the revenue share in the veterinary molecular diagnostics market. This segment’s leadership has been attributed to their high sensitivity, specificity, and adaptability across a broad range of infectious diseases affecting companion and production animals.

The growth trajectory has been supported by regulatory endorsement of PCR-based testing as a standard of care in veterinary diagnostic laboratories. Veterinarians have demonstrated a clear preference for PCR assays due to their rapid turnaround times and capability for multiplex pathogen detection in a single workflow.

Additionally, the scalability and consistent performance of PCR kits have made them indispensable in both centralized laboratories and point-of-care settings. Continuous product innovation, including lyophilized reagents and user-friendly workflows, has reinforced PCR kits’ position as the primary diagnostic modality in the market.

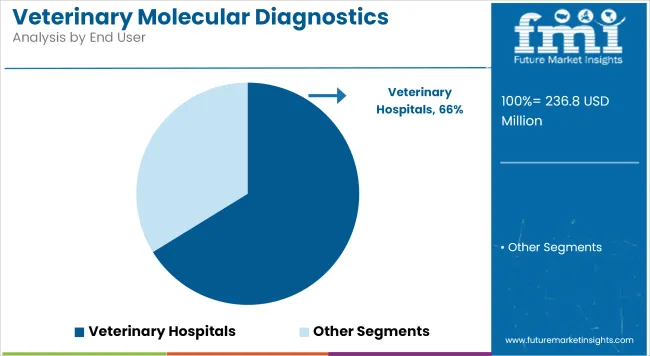

Veterinary hospitals are projected to contribute 66.2% of the end-user revenue share in 2025. This dominance has been driven by their comprehensive diagnostic capabilities, strong purchasing power, and established infrastructure for high-throughput molecular testing. Veterinary hospitals have increasingly integrated molecular assays into standard diagnostic protocols to improve clinical outcomes and reduce treatment delays.

Additionally, collaborations between veterinary hospitals and diagnostic companies have enabled access to customized testing panels and specialized training programs. This environment has strengthened the role of veterinary hospitals as primary centers for molecular diagnostic services, supporting sustained growth and continuous technology uptake.

In 2025, companion animals are expected to account for 38.9% of the revenue share in the veterinary molecular diagnostics market. This segment's dominance has been attributed to the increasing pet ownership globally, along with the growing demand for advanced diagnostic tools for companion animals, particularly dogs and cats.

The rise in the prevalence of infectious diseases, genetic disorders, and chronic conditions in companion animals has led to an increased reliance on molecular diagnostics for accurate and timely diagnosis. Technologies such as PCR, sequencing, and other molecular methods allow for the detection of pathogens, genetic mutations, and infectious agents with high sensitivity, driving their adoption in veterinary practices.

Moreover, companion animal owners' increasing focus on their pets' health and well-being, paired with the growing trend of personalized care, has led to a surge in demand for molecular diagnostics. The rising number of veterinary clinics and hospitals offering specialized diagnostic services and the integration of molecular diagnostics into routine check-ups have further bolstered the market.

High cost of molecular testing, limited infrastructure especially in rural areas, and shortage of competent workforce

Despite the ever-increasing demand, veterinary molecular testing is very expensive and out of reach for many small clinics or farms with a limited number of livestock. Laboratory infrastructure is inadequate in many regions, but mainly in terms of cold-chain dependent PCR and NGS based platforms.

There is, therefore, continued technologic restrain of adoption due to the shortage of trained veterinary molecular biologists as well as diagnostic technicians. WHO has stated that capacity building through improved veterinary laboratories and a trained workforce is vital for zoonotic disease control and early outbreak response.

Zoonotic surveillance, portable diagnostics, and livestock genomics

Better opportunities were opened for veterinary molecular diagnostics with the global drive around One Health and the prevention of disease caused through zoonosis. These had resulted in funding of molecular surveillance for diseases such as rabies, avian influenza, or African swine fever by national governments and international health agencies.

In the areas of clinical and field point-of-care testing, portable PCR analyzers, isothermal amplification devices, and lab-on-chip platforms have seen further developments. Furthermore, under the auspices of breeding programs such as the International Institute for Animal Health, molecular diagnostics have also been used for assessing disease resistance and wellness testing for companion animals. WHO states that early molecular detection of animal diseases aids in the prevention of cross-species transmission and in safeguarding global health.

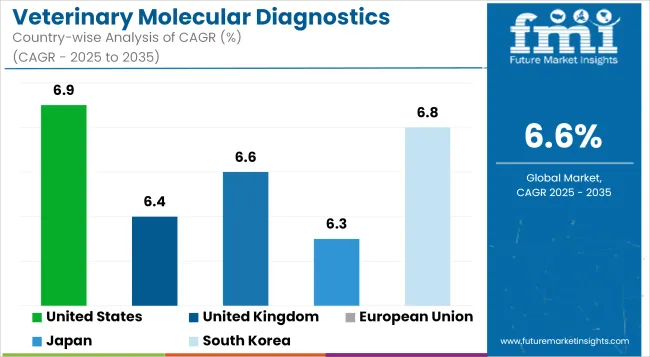

As with most markets in the United States, the veterinary molecular diagnostics market is slowly developing. Increased pet ownership, heightened vigilance for livestock diseases, and rising demand for rapid, accurate diagnosis tools have been key factors drawing investments into the veterinary molecular diagnostics arena.

Mostly deployed to detect zoonotic diseases, parasitic infections, and genetic diseases in companion and farm animals, molecular techniques such as PCR, RT-PCR, and DNA sequencing have seen heavy use. The USA has made significant investments through the OECD in developing veterinary laboratory networks and biosecurity infrastructure and has made their operations smoother and faster in responding to any animal health threat. Their scope is further aided by expanding applications in precision animal health and herd management systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.9% |

UK veterinary molecular diagnostics are thus given impetus by the government welfare initiatives that become accessory in animal health surveillance and disease eradication in livestock. The Animal and Plant Health Agency and the private laboratories are putting in place molecular modalities for both antimicrobial resistance surveillance and infections at farms.

Expansion of equine and companion animal care is driving demand for diagnostic innovation, particularly PCR-based testing, according to OECD. Rapid diagnostics for respiratory, dermatological and vector-borne diseases are being developed from collaborative efforts between veterinary colleges and biotech startups.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.4% |

The EU veterinary molecular diagnostics market shows favorable development, particularly with the health safety regulation directed to agriculture, disease control programs, and public funding. Countries such as Germany, France, and the Netherlands are main consumers of the technologies, namely, PCR, qPCR, or next-generation sequencing (NGS), with regards to livestock and poultry health monitoring.

According to UN, the EU Food Safety Authority promotes molecular diagnostics for real-time disease tracing as well as antibiotic stewardship. An increasing awareness of zoonosis and traceability in food production from animals also drives the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.6% |

Emerging pet ownership and priority given by the Japanese veterinary molecular diagnostics market attention for food safety and emerging animal diseases control have brought the much-needed boost to this market. Molecular surveillance systems are being developed under the Japanese Ministry of Agriculture, Forestry and Fisheries for avian influenza, swine fever, and infectious diseases in companion animals.

As per OECD, high-welfare standards in veterinary services and the increasing care given to pets enhanced the adoption of real-time PCR and genetic panels. Domestic companies are also innovating multiplex testing platforms for point-of-care veterinary clinics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

The veterinary molecular diagnostics market in South Korea is undergoing rapid development thanks to biosecurity programs funded by the government and the expanding veterinary diagnostic infrastructure. According to OECD, the authorities in Korea have increased genomic-based surveillance tools to cope with livestock disease emergencies, including zoonotic threats.

In such diagnosis, molecular assays for canine parvovirus, feline leukemia, and tick-borne diseases are now routine practice in veterinary clinics. Local diagnostic companies are developing portable PCR analyzers and kits perfectly adapted to both field and clinical diagnostics.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

The veterinary molecular diagnostics market is specialized and rapidly evolving, driven by increasing demand for early, accurate detection of infectious diseases, genetic disorders, and zoonoses in companion and production animals. Leading companies are investing in PCR assays, real-time qPCR platforms, syndromic panels, and next-generation sequencing solutions to expand their test menus and improve diagnostic accuracy.

Strategic acquisitions, veterinary laboratory partnerships, and regulatory approvals are key factors towards broadening market reach and building customer loyalty among clinics and reference labs. Additionally, rising awareness of antimicrobial stewardship and biosecurity is fueling adoption globally. Emphasis on automation, faster turnaround times, and integration with practice management software is reshaping competitive differentiation.

The overall market size for the veterinary molecular diagnostics market was approximately USD 236.8 million in 2025.

The veterinary molecular diagnostics market is expected to reach approximately USD 448.7 Million by 2035.

The demand for veterinary molecular diagnostics is rising due to the increasing prevalence of zoonotic diseases, growing awareness among pet owners about animal health, and advancements in molecular diagnostic techniques. The rising demand for animal-derived food products and the need for early disease diagnosis in livestock have also contributed to the growth of this market.

The top 5 countries driving the development of the veterinary molecular diagnostics market are the United States, Germany, France, Japan, and China.

PCR kits and veterinary hospitals are expected to command significant shares over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA