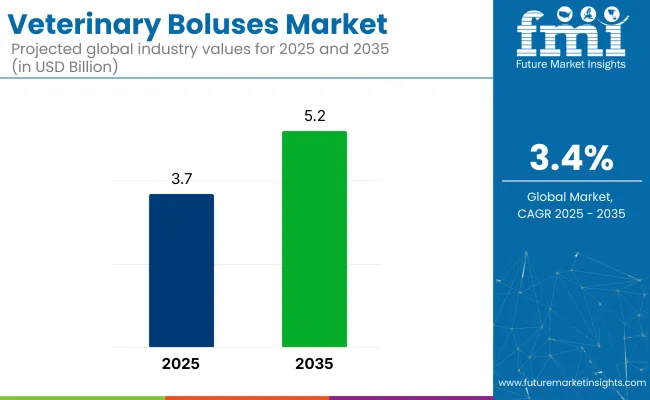

The veterinary boluses market is anticipated to witness steady growth over the next decade, with its industry value projected to rise from approximately USD 3.7 billion in 2025 to USD 5.2 billion by 2035. This growth corresponds to a CAGR of 3.4% during this period.

The increase in industry size reflects the growing importance of veterinary boluses in maintaining animal health and improving livestock productivity. They are widely used to deliver essential nutrients and medications efficiently to animals, which has made them a crucial component in the animal healthcare sector.

In a joint statement, NOAH CEO Dawn Howard emphasized that an agreement on veterinary medicines is ‘achievable and urgently needed,’ while Animal Health Europe's Roxane Feller highlighted the importance of guaranteed access to veterinary medicines in safeguarding animal health, food security, and public health.

The industry holds a specialized share within its parent markets. In the animal health market, its share is approximately 3-5%, as veterinary boluses are a specific form of medication used for various animal health issues. Within the veterinary pharmaceuticals market, the share is around 2-3%, as boluses represent one of the many pharmaceutical products used for treating animals.

In the livestock market, the share is about 5-7%, as boluses are commonly used to improve the health and productivity of livestock. Within the animal feed market, the share is approximately 1-2%, as veterinary boluses are often used alongside feed to address deficiencies. In the veterinary diagnostics market, the share is around 1-2%, as boluses may be used in conjunction with diagnostic treatments.

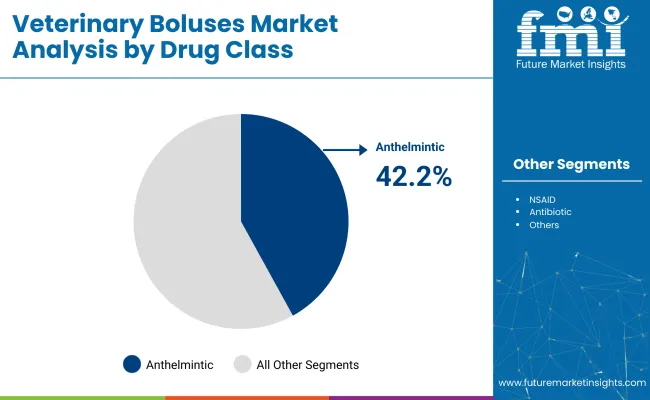

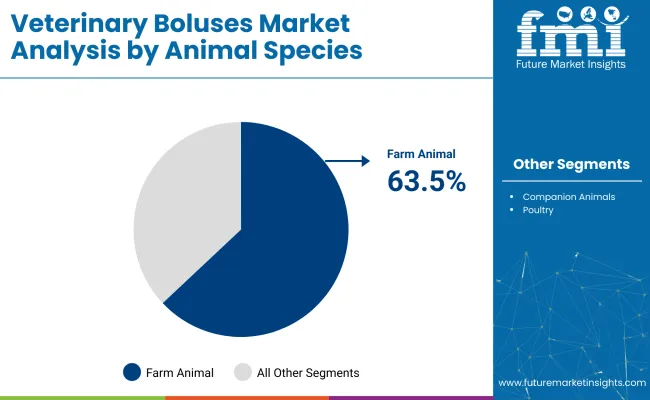

The industry is projected to grow, with anthelmintic boluses leading the drug class with 42.2% industry share in 2025. Immediate-release boluses will capture 48.9%, farm animals will dominate species at 63.5%, and commercial livestock farms will account for 41% of the sales channel share.

Anthelmintic boluses are expected to dominate the industry, capturing 42.2% of the industry share in 2025. These boluses are essential for controlling parasitic infections, which can severely impact livestock health and productivity. Worms and other parasites cause weight loss, reduced milk production, and, in extreme cases, death.

The growing demand for animal products and the expansion of livestock farming further increase the demand for anthelmintic boluses. Stringent regulations regarding animal health reinforce the preference for anthelmintic treatments, making these boluses the most widely used and trusted segment in the industry.

Immediate-release boluses are projected to capture 48.9% of the industry share in 2025, making them the dominant formulation type. These boluses provide quick delivery of essential nutrients and medications, which is crucial in urgent animal health situations. The rapid dissolution of these boluses ensures that animals receive necessary treatments without delay, improving their health outcomes.

The preference for immediate-release boluses is driven by their ease of use, fast results, and the growing emphasis on animal welfare. Timely treatment of health complications through immediate-release boluses helps improve livestock productivity, contributing to their widespread adoption.

Farm animals are expected to dominate the species segment, holding 63.5% of the industry share in 2025. The large scale of livestock farming globally contributes to the industry’s growth, as the health and productivity of farm animals such as cattle, sheep, goats, and buffalo are critical for food security and agricultural economies.

Veterinary boluses are widely used to provide essential nutrients, prevent diseases, and improve growth and digestion in farm animals. The increasing demand for high-quality animal products has driven farmers to adopt advanced health solutions like boluses, which ensure optimal animal care in large-scale operations.

The commercial livestock farms segment is projected to hold 41% of the industry share in 2025. These farms operate on a large scale, requiring efficient and effective animal health management solutions to maintain herd productivity and profitability.

The boluses are particularly suited for these farms, as they allow for systematic management of animal health, preventing disease outbreaks and nutritional deficiencies without frequent handling. By providing a reliable method for delivering essential nutrients and medications over time, boluses support the health of large animal populations while ensuring minimal disruption to farm operations.

The industry is growing due to rising demand for improved animal health and productivity, driven by global needs for animal-derived products. Innovations in bolus formulations and strong regulatory support are enhancing treatment efficiency and adoption, particularly in commercial farming.

Growing Demand for Animal Health and Productivity

The industry is expanding due to rising global demand for meat, milk, and other animal products, driving farmers to adopt effective solutions for improving livestock health and productivity. Boluses help prevent diseases, control parasitic infections, and supplement essential nutrients, leading to enhanced animal growth and output. As awareness of preventive care and animal welfare increases among farmers and veterinarians, the demand continues to grow, supporting industry expansion.

Advancements in Formulation and Regulatory Support

Continuous innovations in bolus formulations, such as immediate-release and controlled-release types, are providing tailored treatment options to meet diverse animal health needs. These advancements improve treatment efficiency and ease of administration, particularly in large-scale commercial farms. Strong regulatory support and initiatives aimed at promoting livestock health and food safety are fostering the adoption. As livestock farming becomes more commercialized, these factors contribute to steady industry growth.

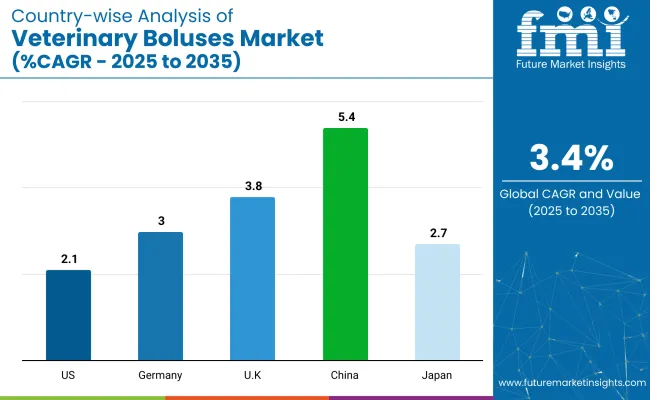

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.1% |

| Germany | 3% |

| United Kingdom | 3.8% |

| China | 5.4% |

| Japan | 2.7% |

The industry demand is projected to rise at a 3.4% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, China leads at 5.4%, followed by the United Kingdom at 3.8%, and Germany at 3%, while the United States posts 2.1% and Japan records 2.7%.

These rates translate to a growth premium of +59% for China, +12% for the United Kingdom, and -11% for Germany versus the baseline, while the United States and Japan trail with slower growth. Divergence reflects local catalysts: expanding agricultural and livestock sectors in China, increasing demand in livestock care, and more steady growth in developed industries such as the United States and Japan, where established industries and demand stability lead to slower growth.

Sales of veterinary boluses in the United States are projected to grow at a CAGR of 2.1% between 2025 and 2035. Growth has been supported by a highly mechanized livestock sector, particularly in dairy operations, where long-acting veterinary dosage forms reduce labor input and dosing variability.

Regulatory frameworks that govern animal welfare and drug residue thresholds in meat and milk encourage preventive healthcare strategies. Adoption of boluses is accelerating as herd sizes increase and producers seek shelf-stable, precision-release formats that support productivity across dairy and beef supply chains.

Demand for veterinary boluses in Germany is expected to grow at a CAGR of 3% from 2025 to 2035. Veterinary practice in Germany increasingly emphasizes antimicrobial stewardship, encouraging bolus formats as an alternative to repeated antibiotic use. Dairy cooperatives in Bavaria and Lower Saxony are investing in biosecurity measures that include traceable veterinary interventions.

Boluses deliver standardized, long-term mineral supplementation, improving livestock resilience under rotational grazing systems. Adoption is further driven by research grants and public-private collaborations focused on smart farming tools.

Industry demand in the United Kingdom is projected to rise at a CAGR of 3.8% during 2025 to 2035. Uptake is influenced by modernization in livestock management, where boluses address seasonal nutritional gaps and parasite control across hill grazing zones. Post-Brexit regulatory reforms have encouraged traceability and on-farm medication recording, fostering interest in long-duration veterinary formats. Adoption is being seen across mixed-farming systems, particularly where smallholder operations prioritize low-intervention animal care practices.

Industry in China is set to record a CAGR of 5.4% between 2025 and 2035. Industrial-scale pig and cattle operations are incorporating bolus delivery to manage health protocols with fewer labor inputs. National policy supporting safe meat production and antimicrobial resistance control has boosted usage. Boluses are preferred in regions with workforce shortages, offering compliance-friendly dosage control. Expansion of dairy clusters in provinces like Heilongjiang and Inner Mongolia has driven volume growth.

Veterinary boluses demand in Japan is forecasted to grow at a CAGR of 2.7% through 2035. Strong traceability regulations and emphasis on food safety standards have supported adoption of controlled-dose veterinary formats. Boluses are favored for reducing dosing frequency in regions with a declining farm workforce. Usage has expanded across small dairy operations and high-value beef farms aiming to meet stringent meat export standards. Veterinary manufacturers are localizing bolus formulations to match Japanese dietary and climatic requirements.

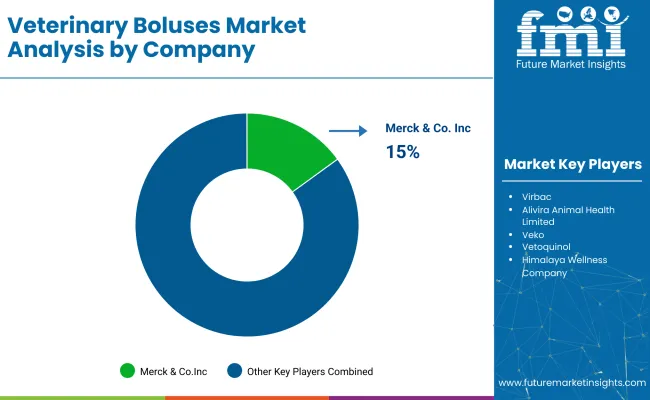

Leading Company - Merck & Co., Inc.

Industry Share - 15%

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Merck & Co., Inc., Zoetis Services LLC, and Boehringer Ingelheim Animal Health lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across livestock, poultry, and companion animal sectors.

Key players including Virbac, Vetoquinol, and Alivira Animal Health Limited offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as AHV International B.V., AdvaCare Pharma®, and Himalaya Wellness Company, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 3.7 billion |

| Industry Size (2035) | USD 5.2 billion |

| CAGR (2025 to 2035) | 3.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and units for volume |

| Drug Class Analyzed (Segment 1) | Anthelmintic, Antibiotic, NSAID, Probiotic/Prebiotic, Hormonal Boluses, Nutritional Boluses, And Combination Boluses. |

| Formulation Covered (Segment 2) | Slow-Release Boluses, Immediate-Release Boluses, and Effervescent Boluses. |

| Animal Species Covered (Segment 3) | Farm Animals (Cattle, Sheep & Goats, Swine), Companion Animals (Canine, Feline, Equine), And Poultry. |

| Sales Channel Analyzed (Segment 4) | Veterinary Hospitals, Veterinary Clinics, Commercial Livestock Farms, Retail Pharmacy Chains, And Online Pharmacies. |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, Italy, Spain, Netherlands, China, Japan, South Korea, India, Pakistan, Bangladesh |

| Key Players Influencing the Industry | Merck & Co., Inc., AdvaCare Pharma®, Virbac, Alivira Animal Health Limited, Veko, Vetoquinol, Himalaya Wellness Company, AHV International B.V., Zoetis Services LLC, Boehringer Ingelheim Animal Health, and Bio-Vet. |

| Additional Attributes | Dollar sales, industry share, growth trends, key segments, regional demand, competitive landscape, pricing strategies, customer preferences, regulatory impact, and innovation opportunities to optimize product development and industry positioning. |

The industry is segmented into anthelmintic, antibiotic, NSAID, probiotic/prebiotic, hormonal boluses, nutritional boluses, and combination boluses.

The industry covers slow-release boluses, immediate-release boluses, and effervescent boluses.

The industry is categorized into farm animals, companion animals, and poultry. Farm animals are subdivided into cattle, sheep & goats, and swine. Companion animals are subdivided into canine, feline, and equine.

The industry is divided into veterinary hospitals, veterinary clinics, commercial livestock farms, retail pharmacy chains, and online pharmacies.

The industry spans North America, Western Europe, East Asia, and South Asia.

The industry is expected to reach USD 5.2 billion by 2035.

The industry size is projected to be USD 3.7 billion in 2025.

The industry is expected to grow at a CAGR of 3.4% from 2025 to 2035.

China is expected to be the fastest-growing with a CAGR of 5.4%.

Farm animal, accounting for over 63.5% of the industry in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA