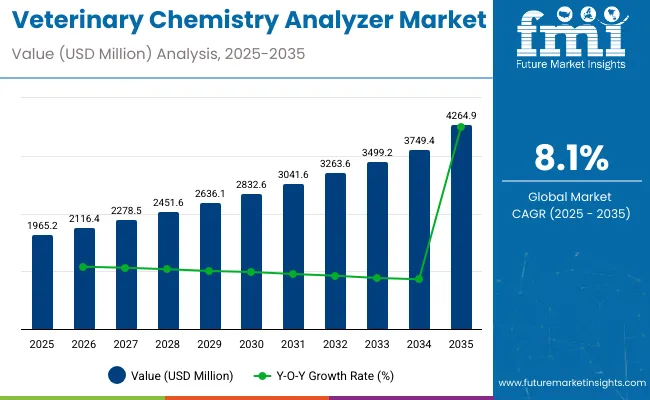

The global veterinary chemistry analyzer market is set for substantial growth between 2025 and 2035, driven by the rising prevalence of animal diseases, increasing pet ownership, and advancements in veterinary diagnostics. The market is projected to reach USD 1,965.2 million in 2025 and expand to approximately USD 4,264.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 8.1% over the forecast period.

Veterinary Chemistry Analyzers are highly critical diagnostic devices employed in pet clinics, veterinary hospitals, research laboratories, and stock management for the problems concerned with animal blood chemistry, electrolyte status, and organ function. The primary factor behind the rise in the market is the fast-growing demand for point-of-care testing (POCT), and the mounting pressure on pet health, along with the enlargement of the stock disease surveillance program.

In addition, the technological advances have also modernized veterinary diagnostics, e.g., the implementation of automated analyzers, artificial intelligence-based interpretation of data, and cloud-based diagnostic management systems that have significantly simplified and accurate. With the help of the growing use of pet insurance, attention towards animal health has also increased, and the requirement of the healthcare infrastructure has increased the demand for the reliable veterinary chemistry analyzers to a great extent.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,965.2 million |

| Industry Value (2035F) | USD 4,264.9 million |

| CAGR (2025 to 2035) | 8.1% |

The market growth is being driven by growing applications of in-clinic diagnostic instruments, pet diagnostics expansion into new markets, and growing demand for surveillance of livestock diseases. In addition, with advancements made on biochemical and immunoassay-based veterinary analyzers, manufacturers are looking for faster, more precise, and simpler diagnostic solutions to meet the needs of veterinarians and livestock operators.

The integration of the current research work in the area of molecular diagnostics, AI-based interpretation tools, and the use of portable veterinary chemistry analyzers is likely to make the market highly dynamic over the next decade.

The veterinary chemistry analyzer market is advancing through smart technologies that improve accuracy, speed, and connectivity. Key players are integrating features like automation, cloud data, AI analytics, and remote monitoring to enhance veterinary diagnostics.

Government initiatives worldwide play a crucial role in enhancing veterinary services, promoting animal health, and supporting livestock productivity. These efforts include funding, infrastructure development, disease control programs, and innovation support.

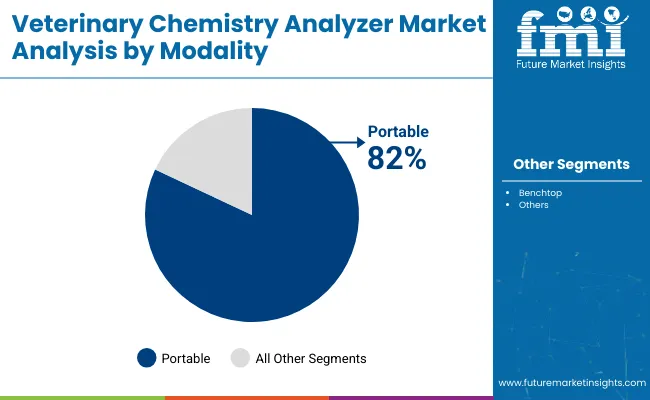

Portable veterinary chemical analyzers are in high demand due to the growing need for rapid, on-site diagnostic testing in animal healthcare. These devices enable veterinarians to quickly assess biochemical markers in blood or fluids, leading to faster diagnosis and treatment, especially in rural or field settings.

The rise in pet ownership, livestock monitoring, and equine care has increased demand for efficient, real-time diagnostics. Portability enhances convenience and reduces the need for lab-based infrastructure.

Additionally, advances in technology have made these analyzers more accurate, compact, and user-friendly, supporting their adoption in both clinics and mobile veterinary practices.

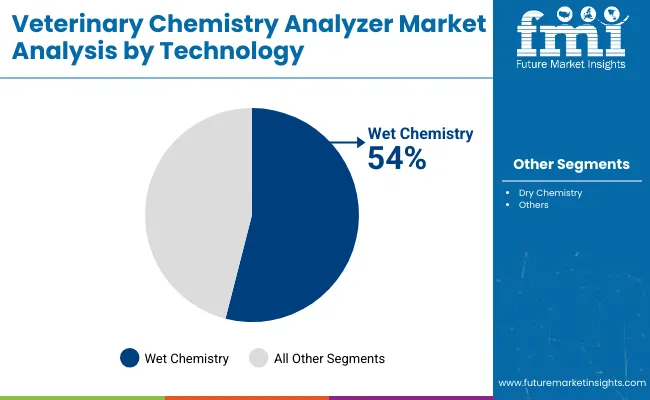

Veterinary chemical analyzers are in demand for wet chemistry because they provide accurate and comprehensive analysis of animal blood and fluids using proven, standardized methods.

Wet chemistry techniques enable detailed measurement of key biochemical parameters such as liver enzymes, electrolytes, glucose, and proteins, which are critical for diagnosing and monitoring various animal health conditions.

These analyzers offer high precision and reliability, making them essential in both clinical and research settings. Their ability to handle a wide range of species and test types increases their versatility. As veterinary care becomes more advanced, the demand for precise diagnostic tools like wet chemistry analyzers continues to grow.

High Equipment Costs and Maintenance Expenses

Veterinary chemistry analyzers are advanced biochemical testing devices whose user requires electrical communication, AC and DC power, communication cables, adapters, and propagation media. They must be purchased in pre-configured sets, including the hardware and software unit pre-installed on the machine, which are quite costly to buy and are better suited for medium and large veterinary clinics rather than independent doctors or small ones.

High-precision sensors, reagents, and automated processes result in these analyzers' being much costlier than traditional tests. The long-term expenses are furthered by regular calibration, software updates, and reagents refills. Some small and mid-size veterinary facilities find it hard to explain the ever-increasing cost of this diagnostic device, thus they rather divert such tests to third parties.

This situation is more obvious in poor areas, where budget constraints leave no chance fort the latest veterinary diagnostic tools. To explore new markets, manufacturers are leasing equipment, supplying refurbished analyzers, and providing subscription models of reagents.

Shortage of Skilled Veterinary Technicians

Having trained professionals to handle the rigging of veterinary chemistry analyzers is vital, as these are the people who know how to interpret results, troubleshoot technical issues, and assure the test accuracy. The reality is that there is a lack of veterinary technicians in the market, especially in remote areas and developing countries.

It is the insufficient training programs and the intricate nature of multi-parameter diagnostic testing that make it overly difficult for the veterinary professionals to easily embrace the diagnostic technologies. New technologies for treatment and control of animal diseases require facilities to start using advanced diagnostic equipment, which, in its turn, requires funding for these technologies.

At their part, constructors are adopting automation with the help of AI, the user-friendliness for the interfaces, and remote diagnostic on their analyzers. However, the broad acceptance of advanced diagnostic technologies can only be achieved through practical investments in training and veterinary education.

Rising Pet Ownership and Demand for Animal Healthcare

Having trained professionals to handle the rigging of veterinary chemistry analyzers is vital, as these are the people who know how to interpret results, troubleshoot technical issues, and assure the test accuracy. The reality is that there is a lack of veterinary technicians in the market, especially in remote areas and developing countries.

It is the insufficient training programs and the intricate nature of multi-parameter diagnostic testing that make it overly difficult for the veterinary professionals to easily embrace the diagnostic technologies. New technologies for treatment and control of animal diseases require facilities to start using advanced diagnostic equipment, which, in its turn, requires funding for these technologies.

At their part, constructors are adopting automation with the help of AI, the user-friendliness for the interfaces, and remote diagnostic on their analyzers. However, the broad acceptance of advanced diagnostic technologies can only be achieved through practical investments in training and veterinary education.

Advancements in Point-of-Care Diagnostic Technologies

Rapid technical changes in point-of-care veterinary diagnostics are the driving forces for the growth of the veterinary chemistry analyzer market. Newer analyzers are small in size, portable, and provide real-time diagnosis, which helps veterinarians to conduct the tests on-site with results immediately available.

This is of special importance in emergency cases, remote farms, and mobile veterinary clinics where centralized laboratories are unreachable. Additionally, the synergy of AI, cloud-based data sharing, and wireless connectivity facilitates veterinarians in their tasks by creating a patient history record, making faster diagnosis, and enhancing diagnostic accuracy.

The rising availability of OOC analyzers which are cheap and easy to use will lead to their penetration into both small clinics and big animal hospitals. The veterinary industry will benefit tremendously from the continuous funding of robots and artificial intelligence diagnostic solution systems, hence the increased speed and reliability of diagnostic tests.

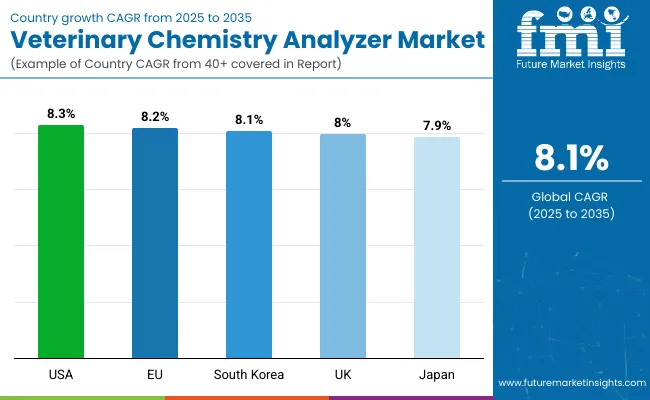

The United States veterinary chemistry analyzer market is currently characterized by tremendous upswing, which can be attributed to the increase in pet ownership, the consumption boost on animal healthcare and the technological advancements in veterinary diagnostics.

The increased attention towards preventive veterinary care and the detection of diseases at the early stage has considerably raised the need for high-precision chemistry analyzers in veterinary clinics, research labs, and animal hospitals.

The segment of companion animal diagnostics and the rise of veterinary telemedicine are also positively affecting market expansion with the demand for point-of-care (POC) analyzers that deliver fast and accurate results for blood chemistry and electrolyte analysis. Furthermore, the livestock sector is driving the need for analyzers used in herd health management and disease surveillance.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.3% |

The United Kingdom veterinary chemistry analyzer market is witnessing an exponential increase, fueled by awareness of pet healthcare, quick diagnostic solution costs, and new technology in animal disease. The UK’s veterinarian healthcare’s strong regulatory framework along with the government’s livestock disease prevention initiatives are the major drivers towards the high-precision chemistry analyzers market penetration.

The small animal veterinary practice expansion and mobile veterinary clinics that have sprung up in this area, become the basis for the upsurge in the trade of portable and mini chemical analyzers. Notably, the existing ratio of zoonotic diseases and consumer food safety represents an important impetus for the development of diagnostic formulations in livestock farming.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.0% |

The European Union veterinary chemistry analyzer market is growing at a remarkable pace, mainly driven by the increasing pet diagnostics demand, rigid animal health regulations, and the introduction of modern veterinary laboratory equipment. Countries like Germany, France, and Italy are prominent in adopting cutting-edge veterinary diagnostics solutions for both pet and farm animals.

The EU has been putting animal welfare and zoonotic disease control as their most significant priority objectives, thus increasing the demand for high-throughput and automated veterinary chemistry analyzers. Along with this, the livestock and dairy products sector is driving the need for blood chemistry and biochemical analysis to manage the herd’s health.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.2% |

The Japan veterinary chemistry analyzer market is likely on the rise due to increasing pet adoption, demand for high-end veterinary diagnostics, and new technologies in animal healthcare. Japan boasts a well-developed veterinary industry with specialized pet hospitals and medical laboratories invested in cutting-edge chemistry analyzers.

Japan’s aging pet population is another main driver stimulating the request for more progressive diagnostic solutions. Veterinarians routinely need accurate blood chemistry results for early detection of kidney and liver disease as well as other health conditions. Alongside, the growth of Japan's livestock and aquaculture sectors brings about the need for high-throughput veterinary analyzers in food safety and disease surveillance applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.9% |

The South Korea veterinary chemistry analyzer market will move up the slope due to urbanization, greater pet ownership rates and increased demand for premium veterinary services. The municipal's strong technological base and healthcare infrastructure have led to the rise of high technological veterinary diagnostic equipment including chemistry analyzers.

Humanization with animals is being discussed more and more, which is making the veterinary field in South Korea to focus on the high-precision diagnostic. As a result of this, there is a higher demand for the point-of-care and in-clinic chemistry analyzers.In addition to that, the government is taking initiative in order to put down more livestock disease control and food protection.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.1% |

The worldwide veterinary chemistry analyzer market is constantly climbing up due to the increasing number of pets, more demand for animal diagnostics, and an increase in the veterinary healthcare devices used. Specifically, veterinary chemistry analyzers are important as they help to detect diseases, monitor the health of pets and do many tests including biochemical and hematology for companion animals, livestock, and research animals.

The dynamic nature of the market is influenced primarily by the breakthroughs in point-of-care (POC) testing, the integration of AI-based diagnostic tools, and the increasing need for portable and automated analyzers. Key players are mainly focusing on the improvement of diagnostic efficiency, the increase of accuracy, and the reduction of costs of animal health solutions offered to veterinary clinics, diagnostic labs, and research institutions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1,965.2 million |

| Projected Market Size (2035) | USD 4,264.9 million |

| CAGR (2025 to 2035) | 8.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Modalities Analyzed (Segment 1) | Portable, Benchtop |

| Technologies Analyzed (Segment 2) | Dry Chemistry, Wet Chemistry |

| Applications Analyzed (Segment 3) | Blood Chemistry Analysis, Urinalysis, Electrolyte Analysis, Hematology Analysis, Immunodiagnostics |

| Animal Types Analyzed (Segment 4) | Companion Animals, Livestock Animals, Zoo & Exotic Animals |

| End Users Analyzed (Segment 5) | Veterinary Clinics, Veterinary Hospitals, Veterinary Diagnostic Labs, Point-of-Care Centers, Research & Academic Institutions |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

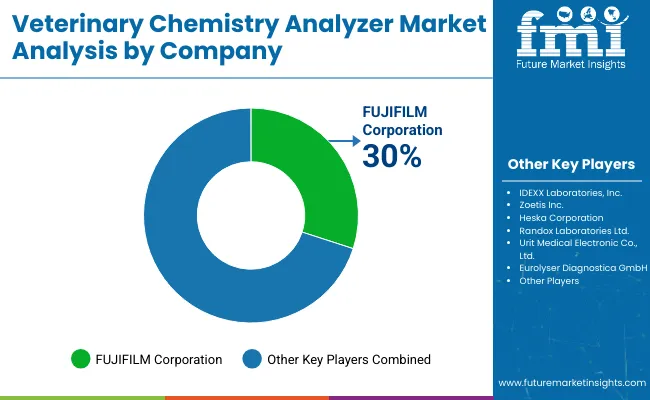

| Key Players influencing the Veterinary Chemistry Analyzer Market | IDEXX Laboratories, Inc., Zoetis Inc., Heska Corporation, Randox Laboratories Ltd., Urit Medical Electronic Co., Ltd., Eurolyser Diagnostica GmbH, Abaxis, Inc. (A Zoetis Company), Scil Animal Care (Heska Corporation), FUJIFILM Corporation, Woodley Equipment Company Ltd., DiaSys Diagnostic Systems GmbH, BPC BioSed Srl, Skyla Corporation, Agrolabo S.p.A., Shenzhen Mindray Animal Medical Technology Co., Ltd. |

| Additional Attributes | Market share by modality (portable vs benchtop), Adoption of dry chemistry analyzers in POC testing, Application demand in livestock vs companion animals, Veterinary lab digitization and diagnostic automation trends, Regional veterinary care investments |

| Customization and Pricing | Customization and Pricing Available on Request |

Portable, Benchtop

Dry Chemistry, Wet Chemistry

Blood Chemistry Analysis, Urinalysis, Electrolyte Analysis, Hematology Analysis, Immunodiagnostics

Companion Animals, Livestock Animals, Zoo & Exotic Animals

Veterinary Clinics, Veterinary Hospitals, Veterinary Diagnostic Labs, Point-of-Care Centers, Research & Academic Institutions

North America, Latin America, Wesrtern Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global veterinary chemistry analyzer market is projected to reach USD 1,965.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.1% over the forecast period.

By 2035, the veterinary chemistry analyzer market is expected to reach USD 4,264.9 million.

The companion animal diagnostics segment is expected to dominate the market, driven by the increasing adoption of pets, rising awareness of animal healthcare, and advancements in diagnostic technologies for early disease detection in pets and livestock.

Key players in the veterinary chemistry analyzer market include IDEXX Laboratories, Heska Corporation, Abaxis (a Zoetis company), Randox Laboratories, and Sysmex Corporation.

Table 01: Global Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 02: Global Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 03: Global Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 04: Global Market Size Volume ('000 Units) Analysis and Forecast By Region, 2018 to 2033

Table 05: Global Market Size(US$ Million) Analysis and Forecast By Region, 2018 to 2033

Table 06: North America Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 07: North America Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 08: North America Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 09: North America Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 11: Latin America Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 12: Latin America Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 13: Latin America Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) and Volume (Million '000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 15: Western Europe Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 16: Western Europe Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 17: Western Europe Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) and Volume (Million '000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 19: Eastern Europe Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 20: Eastern Europe Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 21: Eastern Europe Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 22: Central Asia Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 23: Central Asia Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 24: Central Asia Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 25: Russia & Belarus Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 26: Russia & Belarus Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 27: Russia & Belarus Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 28: Balkan & Baltic Countries Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 29: Balkan & Baltic Countries Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 30: Balkan & Baltic Countries Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) and Volume (Million '000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 32: East Asia Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 33: East Asia Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 34: East Asia Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) and Volume (Million '000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 36: South Asia & Pacific Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 37: South Asia & Pacific Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 38: South Asia & Pacific Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Table 39: Middle East & Africa Market Value (US$ Million) and Volume (Million '000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 40: Middle East & Africa Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Product Type, 2018 to 2033

Table 41: Middle East & Africa Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By Modality, 2018 to 2033

Table 42: Middle East & Africa Market Size (US$ Million) and Volume ('000 Units) Analysis and Forecast By End User, 2018 to 2033

Figure 01: Global Market Historical Volume ('000 Units), 2018 to 2022

Figure 02: Global Market Volume ('000 Units) Forecast, 2023 to 2033

Figure 03: Global Market Historical Value (US$ Million), 2018 to 2022

Figure 04: Global Market Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Global Market Absolute $ Opportunity, 2023 to 2033

Figure 06: Global Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 07: Global Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 09: Incremental $ Opportunity By Material, 2023 to 2033

Figure 10: Global Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 11: Global Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 12: Global Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 13: Global Incremental $ Opportunity By Product Type, 2023 to 2033

Figure 14: Global Market Share and BPS Analysis By End User, 2023 & 2033

Figure 15: Global Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis By End User, 2023 to 2033

Figure 17: Incremental $ Opportunity By Material, 2023 to 2033

Figure 18: Global Market Share and BPS Analysis By Region, 2023 & 2033

Figure 19: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 20: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 21: Global Incremental $ Opportunity By Sales Channel, 2023 to 2033

Figure 22: North America Market Share and BPS Analysis By Country- 2023 & 2033

Figure 23: North America Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 24: North America Market Attractiveness Index By Country, 2023 to 2033

Figure 25: North America Absolute $ Opportunity By Country, 2023 to 2033

Figure 26: North America Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 27: North America Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 29: North America Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 30: North America Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 31: North America Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 32: North America Market Share and BPS Analysis By End User, 2023 & 2033

Figure 33: North America Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 34: North America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 35: Latin America Market Share and BPS Analysis By Country- 2023 & 2033

Figure 36: Latin America Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 37: Latin America Market Attractiveness Index By Country, 2023 to 2033

Figure 38: Latin America Absolute $ Opportunity By Country, 2023 to 2033

Figure 39: Latin America Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 40: Latin America Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 41: Latin America Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 42: Latin America Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 43: Latin America Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 44: Latin America Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 45: Latin America Market Share and BPS Analysis By End User, 2023 & 2033

Figure 46: Latin America Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 48: Western Europe Market Share and BPS Analysis By Country- 2023 & 2033

Figure 49: Western Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 50: Western Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 51: Western Europe Absolute $ Opportunity By Country, 2023 to 2033

Figure 52: Western Europe Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 53: Western Europe Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 54: Western Europe Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 55: Western Europe Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 56: Western Europe Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 57: Western Europe Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 58: Western Europe Market Share and BPS Analysis By End User, 2023 & 2033

Figure 59: Western Europe Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 60: Western Europe Market Attractiveness Analysis By End User, 2023 to 2033

Figure 61: Eastern Europe Market Share and BPS Analysis By Country- 2023 & 2033

Figure 62: Eastern Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 63: Eastern Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 64: Eastern Europe Absolute $ Opportunity By Country, 2023 to 2033

Figure 65: Eastern Europe Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 66: Eastern Europe Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 67: Eastern Europe Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 68: Eastern Europe Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 69: Eastern Europe Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 70: Eastern Europe Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 71: Eastern Europe Market Share and BPS Analysis By End User, 2023 & 2033

Figure 72: Eastern Europe Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness Analysis By End User, 2023 to 2033

Figure 74: Central Asia Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 75: Central Asia Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 76: Central Asia Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 77: Central Asia Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 78: Central Asia Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 79: Central Asia Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 80: Central Asia Market Share and BPS Analysis By End User, 2023 & 2033

Figure 81: Central Asia Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 82: Central Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 83: Russia & Belarus Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 84: Russia & Belarus Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 85: Russia & Belarus Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 86: Russia & Belarus Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 87: Russia & Belarus Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 88: Russia & Belarus Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 89: Russia & Belarus Market Share and BPS Analysis By End User, 2023 & 2033

Figure 90: Russia & Belarus Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 91: Russia & Belarus Market Attractiveness Analysis By End User, 2023 to 2033

Figure 92: Balkan & Baltic Countries Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 93: Balkan & Baltic Countries Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 94: Balkan & Baltic Countries Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 95: Balkan & Baltic Countries Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 96: Balkan & Baltic Countries Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 97: Balkan & Baltic Countries Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 98: Balkan & Baltic Countries Market Share and BPS Analysis By End User, 2023 & 2033

Figure 99: Balkan & Baltic Countries Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 100: Balkan & Baltic Countries Market Attractiveness Analysis By End User, 2023 to 2033

Figure 101: East Asia Market Share and BPS Analysis By Country- 2023 & 2033

Figure 102: East Asia Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 103: East Asia Market Attractiveness Index By Country, 2023 to 2033

Figure 104: East Asia Absolute $ Opportunity By Country, 2023 to 2033

Figure 105: East Asia Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 106: East Asia Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 107: East Asia Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 108: East Asia Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 109: East Asia Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 110: East Asia Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 111: East Asia Market Share and BPS Analysis By End User, 2023 & 2033

Figure 112: East Asia Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 113: East Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 114: South Asia and Pacific Market Share and BPS Analysis By Country- 2023 & 2033

Figure 115: South Asia and Pacific Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 116: South Asia and Pacific Market Attractiveness Index By Country, 2023 to 2033

Figure 117: South Asia and Pacific Absolute $ Opportunity By Country, 2023 to 2033

Figure 118: South Asia & Pacific Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 119: South Asia & Pacific Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 120: South Asia & Pacific Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 121: South Asia & Pacific Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 122: South Asia & Pacific Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 123: South Asia & Pacific Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 124: South Asia & Pacific Market Share and BPS Analysis By End User, 2023 & 2033

Figure 125: South Asia & Pacific Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 126: South Asia & Pacific Market Attractiveness Analysis By End User, 2023 to 2033

Figure 127: Middle East & Africa Market Share and BPS Analysis By Country- 2023 & 2033

Figure 128: Middle East & Africa Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 129: Middle East & Africa Market Attractiveness Index By Country, 2023 to 2033

Figure 130: Middle East & Africa Absolute $ Opportunity By Country, 2023 to 2033

Figure 131: Middle East & Africa Market Share and BPS Analysis By Product Type, 2023 & 2033

Figure 132: Middle East & Africa Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 133: Middle East & Africa Market Attractiveness Analysis By Product Type, 2023 to 2033

Figure 134: Middle East & Africa Market Share and BPS Analysis By Modality, 2023 & 2033

Figure 135: Middle East & Africa Market Y-o-Y Growth Projections By Modality, 2023 to 2033

Figure 136: Middle East & Africa Market Attractiveness Analysis By Modality, 2023 to 2033

Figure 137: Middle East & Africa Market Share and BPS Analysis By End User, 2023 & 2033

Figure 138: Middle East & Africa Market Y-o-Y Growth Projections By End User, 2023 to 2033

Figure 139: Middle East & Africa Market Attractiveness Analysis By End User, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Lasers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Regenerative Medicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Hospital Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA