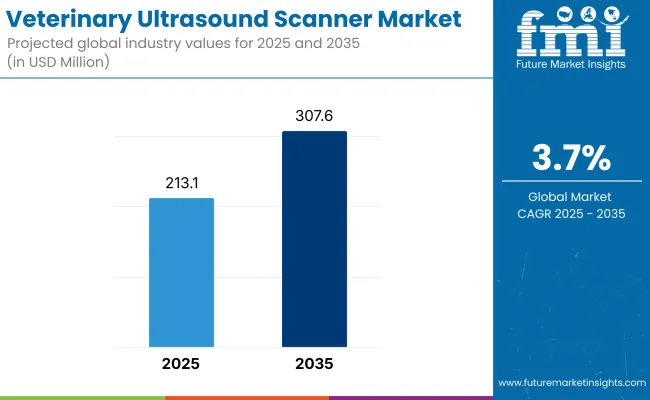

The Veterinary Ultrasound Scanner Market is estimated to reach USD 213.1 million by 2025. Between 2025 and 2035, the market is expected to grow at a CAGR of 3.7% reaching a total value of USD 307.6 million by the end of the assessment period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 213.1 million |

| Industry Value (2035F) | USD 307.6 million |

| CAGR (2025 to 2035) | 3.7% |

The veterinary ultrasound scanner market is witnessing sustained growth as veterinary practices increasingly prioritize advanced diagnostic imaging to improve animal care outcomes. The market is driven by rising pet ownership, growing awareness of preventive care in companion animals, and the expansion of livestock management practices emphasizing herd health monitoring.

Digital transformation across veterinary clinics has also influenced purchasing decisions, with more practices adopting portable and high-resolution imaging systems to enable faster diagnoses and better workflow efficiency.

Manufacturers have responded by investing in product innovation, integrating features such as wireless connectivity, touch-screen interfaces, and cloud-based image storage. Regulatory frameworks have remained supportive of technological upgrades, with standards evolving to encourage adoption of equipment aligned with modern data management practices.

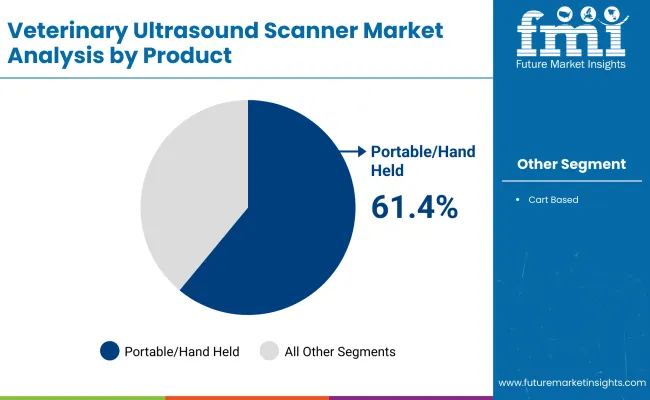

In 2025, portable and handheld ultrasound scanners are anticipated to hold a 61.4% revenue share in the veterinary ultrasound scanner market. This dominance has been driven by the growing need for flexible, point-of-care imaging that supports both field-based and in-clinic applications.

Veterinary practitioners have increasingly favored portable systems due to their ease of transport, rapid setup times, and ability to deliver real-time assessments in diverse animal health settings. Advances in miniaturization and battery life have further improved the usability and reliability of handheld devices, while wireless data transfer capabilities have streamlined integration into clinic record systems. Favorable clinician feedback regarding ergonomic design and workflow benefits has reinforced confidence in portable scanners as a first-line diagnostic solution.

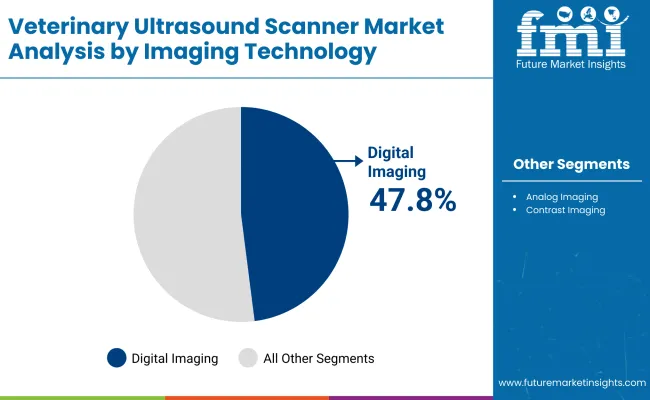

Digital imaging technology is projected to account for 47.8% of the market share in 2025. The segment’s leadership has been underpinned by its ability to provide superior image resolution, enhanced diagnostic accuracy, and efficient data storage compared to conventional analog systems.

Veterinary clinics have prioritized digital solutions to meet the demands of higher throughput and to improve communication with pet owners through clearer visual documentation. Integration of digital platforms with practice management software has further strengthened adoption by enabling seamless reporting and image archiving. Continuous improvements in transducer design and image processing algorithms have also contributed to clinical confidence in digital imaging.

High Initial Investment and Maintenance Costs Associated with Advanced Ultrasound Scanners Could be the Key Barrier in the Veterinary Ultrasound Scanner Market

High initial investment & maintenance costs of advanced ultrasound scanners are one of the major challenges faced. Portable and handheld units have lower prices, but high-end machines and resulting imaging capabilities are still costly. For many small and independent veterinary clinics, budget constraints make this approach difficult to adopt. Access to funding & financial support is less in developing regions, and the cost factor impacts veterinary practices there as well.

The other major challenge is the deficit of trained manpower in ultrasound imaging. In human healthcare, radiology is a trained field, but many veterinarians are left to their own devices when it comes to using imaging machines. In certain areas, where formal training programs do not exist, this can result in variability in the accuracy of diagnosis as well as suboptimal use of ultrasound technology.

This poses a direct challenge to the efficacy of veterinary imaging and limits its availability for application across the board.

Moreover, there are differences in regulatory requirements and compliance across regions, which make device approval and distribution more complex. This is especially true in countries with strict import regulations or burdensome certification processes, which can delay the introduction of state-of-the-art ultrasound scanners to the industry.

Technological limitations constitute another barrier with regard to some ultrasound devices, especially low-cost models. Imaging resolution that is not consistent, a limited probe in your hand, and poor compatibility with other diagnostic tools all lead to less effective veterinary diagnostics.

This results in reluctance among Veterinary professionals to adopt new ultrasound solutions. Also, to make it possible will require greater investment into training, affordability, better streamlining of regulation, as well as continued improvement of imaging technology, all of which can expand access to better veterinary diagnostics.

Advancement in Battery-powered and Ultra-Portable Ultrasound Scanners Creating Opportunity for the Market

Innovation and accessibility evolution in the veterinary ultrasound scanner industry. One major opportunity is in the development of AI-supported imaging interpretation.” Ultrasound images are complex, and many veterinarians have difficulty diagnosing conditions. Combining smart imaging software that offers rapid review and automated outlier detection, weaves ultrasound technology into the everyday practice of veterinarians with differing experience levels, ultimately improving diagnostic accuracy and workflow efficiency.

An added area of great opportunity is the growing need for multi-species ultrasound solutions. Ultrasound technology is well-established in small animal and livestock care, but interest is growing in its applications for exotic animals, marine life, and wildlife conservation. Custom approaches will allow for scanners with specialized probes and additional imaging abilities for wildlife, along with pets and livestock, as far as veterinary diagnostics extends.

The development of battery-operated nail tip forms and portable ultrasound scanners is also providing new options, particularly for field veterinarians and those working in more remote locations. Classically trained mobile ultrasound solution for on-site diagnostics is very useful for regions without fully equipped veterinary facilities. These compact, rugged, and wireless devices improve veterinary outreach programs and emergency treatment of large and mobile animals.

Plus, the integration of telemedicine in the veterinary diagnostic process is changing how ultrasound technology is used. Vet specialists who tackle ultrasound images are further away from them; for vet professionals, the need for human contact is still an aspect, as they help to diagnose the actual issues for their patients (animals) as well. These are international innovations that position ultrasound technology as a particularly valuable tool in the future of veterinary care.

Market Outlook

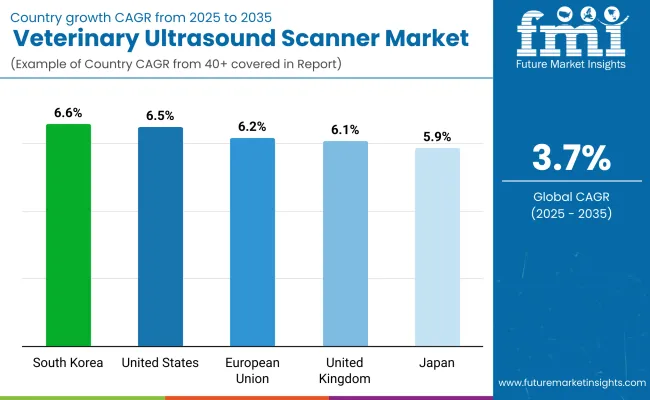

The veterinary ultrasound scanner market in the United States is growing due to a well-established veterinary healthcare system and high spending on pet wellness. One of the key growth-driving factors is the increasing number of specialty veterinary hospitals and referral centers.

These centers have the latest imaging technology, from high-resolution ultrasound scanners capable of accurate diagnosis, to complex medical solutions; Meanwhile, advances in ultrasound technology, as well as the increased availability of veterinary insurance that covers the costs of many diagnostic procedures, have made it easier (and less costly) for pet owners to opt for more advanced diagnostics, and ultrasound has become both a routine and emergency diagnostic tool.

Moreover, the presence of key players in the imaging technology space provides a continuous flow of product innovations, helping the veterinary ultrasound solutions to be more widely adopted, ultimately making a difference in terms of accessibility and efficiency.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.2% |

Market Outlook

Germany’s veterinary ultrasound market is booming due to the country’s focus on precision diagnostics and high standards of animal care. The sound veterinary education system guarantees that specialists are trained in modern methods of diagnosis, which in turn is followed by a wider use of ultrasound imaging in everyday life.

Germany’s livestock sector is also well-trained on ultrasound technologies, which are able to help herds ensure managed health and breeding programs. The evolution and accessibility of state-of-the-art ultrasound equipment are also facilitated by regulatory environments encouraging innovation in veterinary medical devices.

The veterinary imaging field continues to grow with advancements that enhance diagnostic accuracy, thanks to the country’s focus on research in the area of animal healthcare.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.0% |

Market Outlook

Trends in Veterinary Ultrasound in the United Kingdom Markets in October 2023. The veterinary ultrasound market in the United Kingdom is growing modestly, with the increasing demand for specialized care of companion animals as the primary growth driver. Increased interest in preventive diagnostics due to increased interest in pet wellness programs has made ultrasound another integral tool to be used to identify disease at an early stage.

In addition, there is an increasing number of mobile veterinary services that appeal to pet owners who want at-home diagnostics, thus driving the growth of portable ultrasound devices. The shift toward multidisciplinary veterinary care, which uses multiple diagnostic approaches in conjunction with one another, has also accelerated the use of ultrasound scanners in both urban and rural veterinary practices.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.6% |

Market Outlook

China’s veterinary ultrasound scanner industry is thriving, thanks to a burgeoning livestock and pet healthcare market. Ultrasound is increasingly used for reproductive management and disease prevention on modern large-scale livestock farms. Moreover, the increase of the middle-class population has led to a pet owning boom with more emphasis on veterinary healthcare services.

These ultrasound scanners are cost-efficient, providing a boost to the manufacturing of technological innovations in China, and hence, offer such equipment at a more affordable price to veterinarians in the respective countries. In addition, ultrasound imaging is now widely taught in veterinary schools, and there is a growing number of animal clinics, only further adding to the increased accessibility of ultrasound equipment.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.8% |

Market Outlook

The increasing demand for veterinary services in rural and urban areas is driving growth for India’s veterinary ultrasound market. The relatively innovations in imaging farm and ranch animals have found a new home in government - or federally led - livestock healthcare initiatives. Portable ultrasound scanners are becoming increasingly popular, allowing vets to perform field diagnostics, especially in less accessible areas with low animal treatment facilities.

In addition, the rise in the number of veterinary colleges and training programs emphasizing modern imaging motivated the awareness and adoption of ultrasound technology. Further, as the dairy and poultry farming across the country is being organized; the need for efficient diagnostic tools has increased, especially across the veterinary ultrasound solutions landscape in the country.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.3% |

The veterinary ultrasound scanner market is moderately consolidated and technology-driven, fueled by demand for high-resolution, portable imaging systems across companion animal, equine, and livestock practices. Leading companies are investing in compact cart-based and handheld devices with advanced Doppler capabilities, wireless connectivity, and intuitive touch interfaces to improve diagnostic confidence and workflow efficiency.

Strategic partnerships with veterinary distributors, training initiatives, and product bundling with practice management software are central to expanding market share. Additionally, rising pet ownership, increasing expenditure on animal health, and growing adoption of point-of-care imaging are driving sustained growth globally. Emphasis on multi-species presets, battery-powered portability, and integration with cloud-based archiving is shaping competitive differentiation.

In 2024, Esaote North America launched MyLab™FOX, their latest veterinary ultrasound. Inspired by the fox, this adaptable, multi-faceted solution sets a new standard for diagnostic imaging, promising clever, fast, and intelligent scanning

Portable/Hand Held Ultrasound Scanners and Cart Based Ultrasound Scanners

Digital Imaging Technology, Analog Imaging Technology and Contrast Imaging Technology

In-center Dialysis, Hospitals, Independent Dialysis Centers and Home Dialysis

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for veterinary ultrasound scanner market was USD 213.1 million in 2025.

The veterinary ultrasound scanner market is expected to reach USD 307.6 million in 2035.

The increasing number of varieties of livestock and equine care has raised the need for efficient diagnostic tools are enhancing market penetration the demand for veterinary ultrasound scanner market.

The top key players that drives the development of veterinary ultrasound scanner market are Mindray Medical International Limited, General Electric Company, Fujifilm Holdings Corporation, Canon Inc. and Samsung Electronics Co. Ltd.

Portable/Hand Held Ultrasound Scanners, is by product type leading segment in veterinary ultrasound scanner market is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA