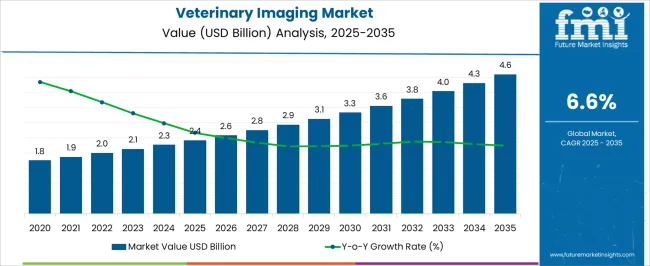

The Veterinary Imaging Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

The veterinary imaging market is expanding steadily, driven by rising companion animal ownership, increasing pet healthcare expenditure, and advancements in diagnostic imaging technologies. Veterinary clinics and animal hospitals are adopting advanced imaging equipment to improve diagnostic accuracy and enable earlier intervention for a variety of animal health conditions.

Clinical reports and industry presentations have highlighted the growing use of digital radiography, ultrasound, and MRI in veterinary settings, particularly for chronic disease monitoring and orthopedic assessments. Additionally, the demand for imaging services has risen due to the growing awareness of preventive care among pet owners and the expanding scope of veterinary specialties.

Investments in portable imaging devices and cloud-based imaging platforms have further improved diagnostic access in rural and mobile veterinary practices. Looking forward, market growth is expected to be supported by increased clinical training in veterinary radiology, broader insurance coverage for pet diagnostics, and ongoing innovations in AI-powered image analysis tools. Segmental expansion is being led by equipment sales, small animal imaging services, and orthopedic applications due to their high frequency of use and clinical importance in companion animal healthcare.

| Metric | Value |

|---|---|

| Veterinary Imaging Market Estimated Value in (2025 E) | USD 2.4 billion |

| Veterinary Imaging Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

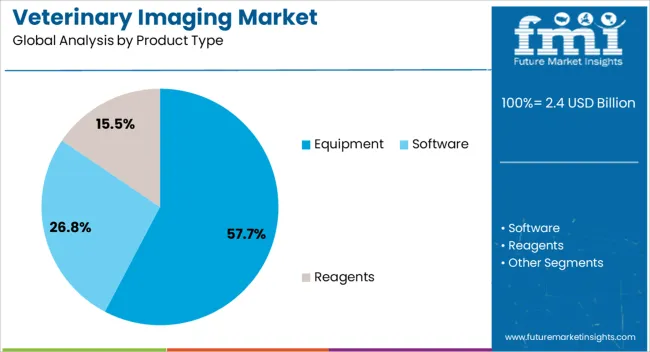

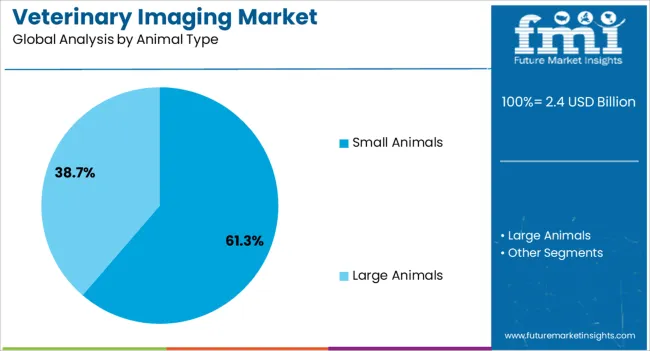

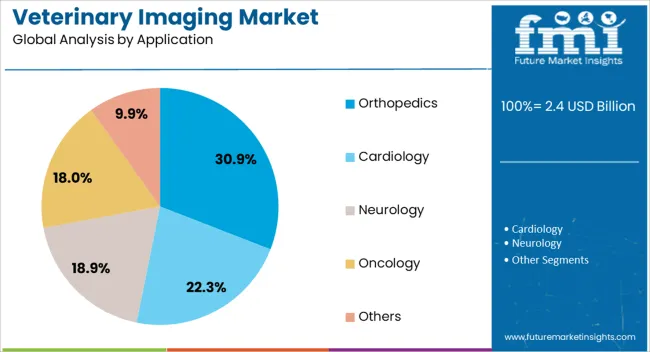

The market is segmented by Product Type, Animal Type, Application, and End User and region. By Product Type, the market is divided into Equipment, Software, and Reagents. In terms of Animal Type, the market is classified into Small Animals and Large Animals. Based on Application, the market is segmented into Orthopedics, Cardiology, Neurology, Oncology, and Others. By End User, the market is divided into Veterinary Clinics, Veterinary Hospitals, Veterinary Institutes, and Research Centres. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Equipment segment is projected to account for 57.7% of the veterinary imaging market revenue in 2025, maintaining its leadership among product categories. This dominance has been attributed to the widespread use of diagnostic imaging systems such as digital X-ray, ultrasound, CT, and MRI across veterinary practices.

The segment has been supported by increasing capital investment in veterinary clinics and hospitals aiming to expand service offerings and improve diagnostic capabilities. Equipment manufacturers have introduced compact, high-resolution systems tailored for veterinary applications, contributing to the segment’s growth.

Furthermore, digital transformation in animal healthcare has encouraged the replacement of analog systems with advanced imaging technologies, enhancing workflow efficiency and image storage capabilities. As demand for point-of-care and portable imaging solutions grows, especially in ambulatory practices, the Equipment segment is expected to remain a key driver of market growth.

The Small Animals segment is projected to contribute 61.3% of the veterinary imaging market revenue in 2025, reflecting its leading share across animal categories. This segment’s strength has been supported by the increasing number of pet adoptions and a strong emotional and financial commitment by owners toward companion animal health.

Diagnostic imaging is routinely performed in dogs and cats for conditions such as arthritis, tumors, and organ diseases, increasing the demand for reliable and non-invasive imaging solutions. Veterinary clinics and urban animal hospitals have prioritized imaging investments to cater to the rising clinical visits for small animal diagnostics.

Additionally, pharmaceutical and research studies involving small animals have required consistent imaging support, further reinforcing segmental demand. With continuous development in compact imaging technologies and increasing awareness of early disease detection, the Small Animals segment is expected to dominate the veterinary imaging landscape.

The Orthopedics segment is projected to hold 30.9% of the veterinary imaging market revenue in 2025, establishing itself as the top clinical application area. Growth in this segment has been driven by the high incidence of musculoskeletal injuries, joint disorders, and age-related mobility issues in both pets and working animals.

Imaging modalities such as radiography, CT, and ultrasound have been routinely employed to diagnose fractures, evaluate joint function, and monitor post-surgical recovery. Veterinary surgeons have emphasized the critical role of imaging in treatment planning and outcome assessment for orthopedic procedures.

Market demand has been supported by rising pet obesity rates, which contribute to joint stress and degenerative conditions requiring detailed musculoskeletal evaluation. The availability of high-definition, weight-bearing imaging systems has further improved diagnostic precision in orthopedic assessments. As surgical procedures become more advanced and rehabilitation programs grow, the Orthopedics segment is expected to maintain its strong position within veterinary imaging applications.

High Adoption of Companion Animals

Ownership of companion animals, especially cats and dogs, has gained immense attention, fueling the demand surge for veterinary healthcare services.

This increasing adoption in emerging economies has facilitated the veterinary imaging market in various parts of the world. Post-COVID scenarios have shown a significant rise in the pet population. Thus, pet owners are willing to spend heavily on their care and diagnostics.

Ascent of Zoonotic Disease has Ignite Clamor for Accurate Diagnosis Techniques

Increasing prevalence of animal diseases and the advancement of animal healthcare also backs up industry growth. The need for early diagnosis and treatment of animal diseases and injuries is met with advancements in imaging technologies. Growing requirements have propelled researchers to delve into more accurate algorithms, leading to sectoral growth.

AI Integration has Boosted the Landscape

Adoption of digital imaging technologies is also a key factor driving the development of this sector. Efficient sharing and analysis of images, integration of AI, and miniaturization of devices have sped up diagnosis and improved treatment outcomes. Cloud-based platforms for remote consultations and affordable imaging systems paint a clear picture of the future uptake of this sector.

Resilience of Veterinary Imaging Market

Talking about challenges, the high cost of equipment and initial investments in this equipment pose significant hurdles to the sector's growth. Secondly, practitioners face financing constraints. Lastly, technological advancements require skilled workers and revenue to scale up, all of which impede industry growth.

Comparing the sector position in 2020 to 2025, the veterinary imaging market was not very developed but had a hold of development with advancements going on. In 2020, the industry size was USD 1,630 million, and for 2025, it was USD 2,132.7 million. A CAGR of 5.5% from 2020 to 2025 shows the adoption of various technologies and the start of the imaging era for animal welfare.

Looking at the broader picture from 2025 to 2035, the estimated CAGR of 6.6% shows a significant shift toward high-tech machines like magnetic resonance imaging and ultrasound. Adoption of cloud-based platforms and affordable imaging systems also has the potential to boost industrial growth.

Post-COVID impact on the market has a big change in the scenario with more number of pet owners and the government focusing on animal welfare. Historical period did not create a suitable environment for collaborations among big players.

But the upcoming decade is set to see investment and partnership play a bigger role. Even awareness and keen interest in companion pets' health in today's time has contributed a big portion to the success of the veterinary imaging market more than ever before.

The section covers information about the prominent segments in the industry. In terms of product type, the equipment segment is estimated to account for a share of 57.7% in 2025. By application, the orthopedic category is projected to dominate by holding a share of 30.9% in 2025.

Advancements in technology have accelerated the accuracy and efficiency of veterinary imaging equipment. This has made it an essential tool for veterinarians. Ongoing developments in digital imaging technology enable veterinarians to treat a wide range of conditions in animals.

Rising prevalence of chronic diseases in animals is also soaring the industrial scope. A significant share of 57.7% in 2025 has shown substantial growth as pet owners seek specialized care.

| Segment | Equipment (Product Type) |

|---|---|

| Value Share (2025) | 57.7% |

Need for advanced imaging technology has led to a surge a number of veterinary clinics and hospitals that offer the preeminent imaging services. This ultimately has spurred the demand for veterinary imaging equipment.

Fractures, sprains, and ligament tears are the most common orthopedic conditions. Conditions like this require accurate and detailed imaging to diagnose and treat. This, in turn, has spurred the clamor for orthopedic imaging equipment.

Orthopedics is, therefore, one of the most frequently used applications in veterinary imaging, with veterinarians encountering orthopedic applications as the most common practice, accounting for a share of 30.9% in 2025.

| Segment | Orthopedic (Application) |

|---|---|

| Value Share (2025) | 30.9% |

Advancements in digital radiography, computed tomography, and magnetic resonance imaging have boosted the diagnosis to new levels. Veterinarians can get detailed images of bones, joints, and soft tissues through advanced orthopedic imaging.

This results in more accurate and precise diagnosis and treatment. Accordingly, this has driven the growth of the veterinary imaging market in parallel with the veterinary orthopedic imaging sector.

North American countries with advanced technology and huge spending on healthcare are ruling in the animal welfare sector, too. Canada is reported to cover a CAGR of 10% from 2025 to 2035, which is commendable and higher than that of the United States.

Other countries like Malaysia, Indonesia, and the United Kingdom are in line to expand through collaborations, the development of specialized technologies, and the search for more precise imaging devices. To cope, every country competes to make a strong industrial presence both locally and internationally.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Canada | 10% |

| Malaysia | 7.8% |

| Indonesia | 7.1% |

| United Kingdom | 6.1% |

| United States | 5.4% |

Growing demand for livestock health monitoring and disease prevention has spurred the industry's success in Canada. Remarkable CAGR of 10% through 2035 projects Canada as a key player in the global livestock industry.

With increasing emphasis on maintaining the health and productivity of livestock herds, the veterinary imaging market is skyrocketing here. This has curated the need for advanced imaging techniques like MRI and ultrasound for livestock diagnosis.

Trend of pet ownership is one of the key factors in soaring sectoral success. This has increasingly boosted the clamor for high-quality healthcare services. The industry has curated lucrative opportunities for industry players specializing in both livestock and small and large animal diagnosis systems.

Introduction of groundbreaking imaging technologies tailored for veterinary applications is the credit score of the United Kingdom veterinary imaging market growth. Companies are focused on making portable and user-friendly systems to cover the surging need for diagnostics.

The innovation is likely to revolutionize imaging practices in the United Kingdom and beyond. Thus, they are expected to soar in the foreseen future with an accounted CAGR of 6.1% through 2035.

Acquisitions like Hallmarq Veterinary Imaging by Mars Petcare have introduced innovative imaging solutions in the sector. Key players in the United Kingdom are IDEXX Laboratories, Inc., Fujifilm Holdings Corporation, Carestream Health, Inc., Esaote SpA, and others. With mergers, research, and ongoing developments, the United Kingdom is poised to expand broadly in the foreseeable future.

Growing trend of pet ownership and heightened spending on pet healthcare in the United States increases the demand for veterinary services. Integration of artificial intelligence and miniaturization of imaging devices has fueled the industry development and requirements of this sector in the United States.

With a 5.4% CAGR from 2025 to 2035, the United States veterinary imaging market is set to improve diagnostic capabilities and enhance patient care.

Mounting pet population has barked the requirement for veterinary diagnostics. Pet owners are seeking advanced medical services for their animals. This simultaneously facilitates the adoption of imaging systems in veterinary clinics.

Manufacturers are expanding distribution channels. Well, some companies are aimed at more advanced features and miniaturization of devices. Research on developing more advanced technologies in animal healthcare and awareness through campaigns are boosting sales.

Many key companies are focused on livestock monitoring and imaging techniques as it stands in the human care sector.

The government is also contributing to the veterinary imaging market expansion. For example, the Indian and North American governments are allocating substantial funds for the development of veterinary healthcare services, including diagnostics facilities.

Industry Updates

Based on product type, the sector is primarily divided into equipment, software, and reagents. Veterinary imaging equipment is further categorized as radiography (X-ray), ultrasound imaging, magnetic resonance imaging, computed tomography, video endoscopy imaging, and other systems.

Radiography systems are also further bifurcated into computed and film-based radiography. Ultrasound imaging systems are divided into 2D and 3D US imaging. Computed tomography systems are also parted into two single and multi-slice CT.

Small and large animals are two categorized sections of animal type in this industry.

Veterinary imaging is applied for cardiology, orthopedics, neurology, oncology, and others.

Clinics, hospitals, institutes, and research centers are top end users of veterinary imaging.

A regional analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe.

The global veterinary imaging market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the veterinary imaging market is projected to reach USD 4.6 billion by 2035.

The veterinary imaging market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in veterinary imaging market are equipment, _radiography (x-ray) systems, _ultrasound imaging systems, _magnetic resonance imaging systems, _computed tomography systems, _video endoscopy imaging systems, _others, software, reagents, _ultrasound contrast reagents, _mri contrast reagents, _x-ray/ct contrast reagents and _nuclear imaging reagents.

In terms of animal type, small animals segment to command 61.3% share in the veterinary imaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA