The global Veterinary Electrosurgery Market is estimated to be valued at USD 630.2 million in 2025 and is projected to reach USD 1,205.3 million by 2035, registering a compound annual growth rate of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 630.2 million |

| Market Value (2035F) | USD 1,205.3 million |

| CAGR (2025 to 2035) | 6.7% |

The veterinary electrosurgery market is experiencing robust growth, driven by the increasing adoption of companion animals, advancements in surgical technologies, and a heightened focus on animal health and welfare. The rising demand for minimally invasive procedures has positioned electrosurgery as a preferred method in veterinary practices due to its precision and reduced recovery times.

Technological innovations, such as the integration of advanced imaging techniques with electrosurgical tools, are enhancing surgical outcomes and expanding the scope of procedures that can be performed. Furthermore, the growing availability of pet health insurance is making advanced surgical options more accessible to pet owners, thereby fueling market expansion. The market is also benefiting from the increasing number of veterinary practitioners and the expansion of veterinary clinics and hospitals, particularly in emerging economies where pet ownership is on the rise.

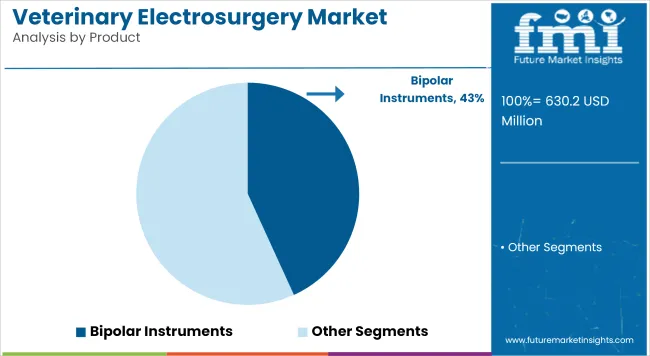

Bipolar electrosurgical instruments are anticipated to maintain dominance with a 43.2% revenue share in 2025, owing to their enhanced tissue targeting and minimized collateral damage during procedures. This growth has been facilitated by the increasing demand for safer surgical modalities across veterinary practices.

In bipolar systems, energy is transmitted between two closely spaced electrodes, which restricts the current flow to a localized area. The preference for bipolar systems has been reinforced by veterinary hospitals and specialty clinics where complex surgeries and soft-tissue procedures are routinely conducted.

Technological refinements in electrode designs and integration with real-time imaging systems have significantly improved procedural outcomes. Training modules and workshops sponsored by manufacturers have also played a pivotal role in building practitioner confidence.

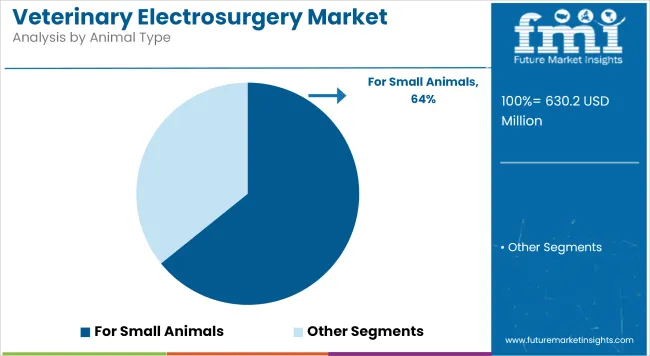

The small animal segment is projected to account for 64.2% of the veterinary electrosurgery market’s revenue in 2025, driven largely by the expanding pet population and increasing veterinary visits for domestic animals such as dogs, cats, and rabbits.

This segment’s ascendancy has been reinforced by growing urbanization and heightened emotional attachment between pet owners and their animals, resulting in increased spending on pet wellness and preventive care. The market penetration of advanced electrosurgical tools in small animal practices has been strengthened by the high frequency of routine procedures such as neutering, dental extractions, and skin lesion removal.

These surgeries benefit significantly from the use of electrosurgical modalities, which offer minimal blood loss and faster recovery times. Additionally, advancements in compact, clinic-friendly electrosurgical units have made these tools more accessible for small and medium-sized veterinary practices.

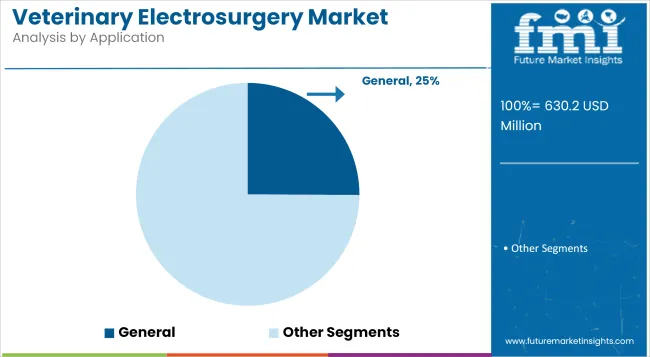

General surgery is set to lead the veterinary electrosurgery market with a 25.1% revenue share in 2025, supported by its broad applicability across various animal types and conditions. This segment’s prominence has been shaped by the routine nature of procedures such as tumor excision, wound debridement, soft tissue resections, and sterilization surgeries, all of which are commonly conducted across veterinary facilities globally.

The versatility of electrosurgical devices in general surgery has enabled faster adoption, especially in first-opinion practices where cost-effective and time-efficient solutions are valued. Veterinary hospitals and clinics have increasingly standardized electrosurgery for general procedures, owing to its reliability and favorable patient outcomes. With continual innovation and growing procedural volume, general surgery is expected to remain a cornerstone application in the veterinary electrosurgery landscape.

High Equipment Cost and Skill Barriers

In particular, veterinary electrosurgery systems are often a costly upfront investment, with a price range designed for complex modular systems including integrated safety and monitoring systems. Because larger hospitals have the resources and procedures in place to purchase them, small clinics and rural practitioners might have difficulty affording them or have underutilized them.

On top of that, experience gaps in managing electrosurgical tools (like energy modulation and waveform selection) may hamper procedural effectiveness. The equipment itself suffers from a lack of longevity and safe deployment due to regulatory hurdles and inconsistent maintenance standards.

Expanding Surgical Training and Multi-Species Applications

Minimally invasive procedures in veterinary medicine represent growing opportunity for electrosurgery equipment manufacturers. With increased demand for soft tissue, dental and oncological procedures in pets, livestock and zoo animals, there is growing adoption of multipurpose ESUs.

To help veterinarians acquire these skills,veterinary associations and equipment suppliers are spending more on workshops, online certifications and simulator-based training. The market is also being driven by developments in ergonomic hand pieces, integrated suction-irrigation systems, and electrosurgery-compatible endoscopy tools.

Some major factors driving the growth of the USA veterinary electrosurgery market include high pet ownership rate, increase in veterinary healthcare expenditure, and inclination towards minimally invasive surgical technologies in animal care. Advanced hospitals and specialty clinics are switching over to bipolar and monopolar instruments for precise surgical applications. Increase in chronic animal diseases such as tumours and internal injuries among animals will propel the demand for electrosurgical devices across small and large animal segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The veterinary electrosurgery market is supported by trends such as pet humanization among pet owners in Canada, and active pet humanization trends and increasing companion animal surgeries in the UK. Growing investments in veterinary clinics and rising awareness among pet parents about the safety and recovery from surgical procedures is driving equipment upgradation. Increased usage of advanced bipolar electrosurgery devices by veterinary surgeons to enhance procedural efficiency and mitigate intraoperative haemorrhage.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.0% |

The Germany, France and Italy country holding veterinary electrosurgical devices market share is the most dominating country holding veterinary electrosurgical devices market in the region. Animal clinics are increasingly investing in modern surgical technologies, as there is growing focus on animal welfare and standardization of veterinary procedures. Livestock and companion animal practitioners are using consumables and accessories from the same manufacturer (return pads, electrodes, cables) to both enhance precision and safety in both routine and complex surgeries.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

Japan’s growing demand for veterinary electrosurgery is fuelled by its aging pet population and focus on veterinary solutions. Hometomeansmallanimalpractices, which represent a high number-outfittinggeneralpracticeswithcompact,portableelectrosurgicalsystemsmadeforcats, dogsandexoticpets. As a result, Japan's veterinary equipment distributors collaborating with global OEMs are introducing multifunctional systems with integrated safety and monitoring properties.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

With growing disposable income and rising adoption of pet insurance, South Korea is witnessing higher veterinary surgical procedure demands. Monopolar systems and electrosurgical accessories are being incorporated into high-tech urban clinics in major cities such as Seoul and Busan for providing basic animal care. Regional penetration is being bolstered by training programs for veterinarians and the growing local manufacture of veterinary instruments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

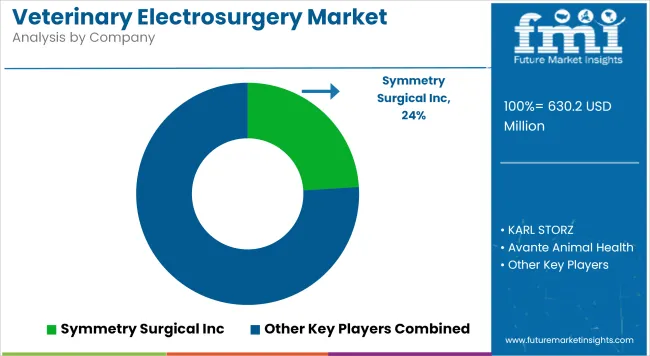

The veterinary electrosurgery market is witnessing moderate to high competition, shaped by rapid technological innovation and strategic market consolidation. Key players are actively focusing on advancing electrosurgical units with improved safety profiles, energy efficiency, and integration capabilities with imaging systems.

There is a strong emphasis on R&D to develop minimally invasive tools tailored for both small and large animal surgeries, which is fostering competitive differentiation. Strategic collaborations with veterinary hospitals, expansion of product distribution networks, and educational outreach programs for veterinary professionals are being prioritized to strengthen brand presence. In addition, companies are introducing modular systems and portable units to cater to smaller clinics and emerging markets.

Key Development

The market size in 2025 was USD 630.2 million.

It is projected to reach USD 1,205.3 million by 2035.

Key growth drivers include increasing pet ownership, growing prevalence of animal diseases requiring surgical intervention, and the preference for minimally invasive surgical techniques in veterinary care.

The top contributors are United States, Germany, United Kingdom, Australia, and Japan.

The bipolar instruments segment is anticipated to dominate due to its enhanced precision, reduced risk of tissue damage, and broad applicability in both soft tissue and orthopedic procedures.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Pregnancy Test Kit Market Size and Share Forecast Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Lasers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Hospital Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Regenerative Medicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Eye Care Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Wound Cleansers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA