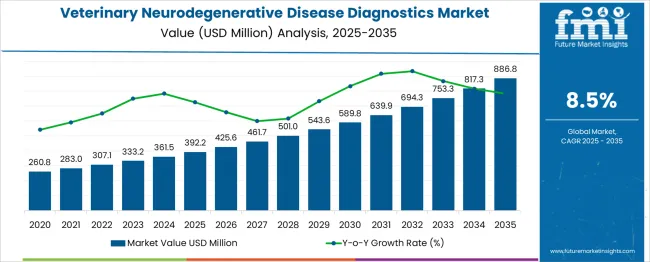

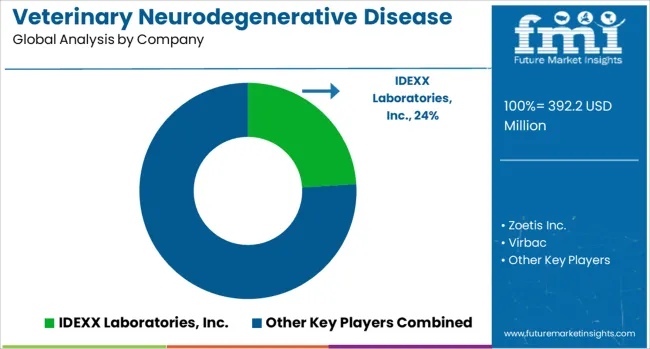

The Veterinary Neurodegenerative Disease Diagnostics Market is estimated to be valued at USD 392.2 million in 2025 and is projected to reach USD 886.8 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

Market share erosion or gain analysis indicates significant shifts driven by technological innovation and competitive repositioning across diagnostic modalities. In the early phase (2025–2030), the market advances from USD 392.2 million to USD 589.8 million, adding nearly USD 197.6 million, where traditional imaging and biochemical assays retain dominant share but begin losing ground to molecular diagnostics and biomarker-based solutions offering higher sensitivity for early disease detection. During this stage, share gain is concentrated among companies introducing AI-driven imaging analytics, portable testing kits, and next-generation sequencing platforms integrated with veterinary practice management systems. From 2030 onward, as the market expands to USD 868.8 million by 2035, advanced diagnostics such as liquid biopsy and proteomic profiling erode the share of conventional assays, shifting growth toward players investing in precision medicine approaches for companion animals. Market leaders focusing on rapid, minimally invasive diagnostics, cloud-based data integration, and tele-veterinary partnerships will consolidate share, while legacy systems face erosion due to limited adaptability in a segment prioritizing early intervention and predictive disease management.

| Metric | Value |

|---|---|

| Veterinary Neurodegenerative Disease Diagnostics Market Estimated Value in (2025 E) | USD 392.2 million |

| Veterinary Neurodegenerative Disease Diagnostics Market Forecast Value in (2035 F) | USD 886.8 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The veterinary neurodegenerative disease diagnostics market occupies a specialized position within these broader diagnostic and healthcare segments. In the overall veterinary diagnostics market, it accounts for 5–6%, reflecting its niche but essential role in comprehensive animal care. Within the companion animal aging diagnostics segment, its share rises to 25–28%, driven by increased diagnosis of cognitive dysfunction and degenerative conditions in senior pets. In the neurological imaging and biomarker testing category, the market contributes 40–42%, as imaging methods such as MRI dominate neuro-assessment procedures. Within the veterinary hospital and diagnostic laboratory services sector, neurodegenerative testing represents 8–10%, with specialized neurology-focused hospitals leading adoption.

In the preventive health and wellness services segment, it holds 7–9%, reflecting growing inclusion of neurocognitive screening in wellness plans. Market expansion is fueled by the rise in pet lifespans, greater awareness of aging-related disorders, and technological improvements in imaging and molecular diagnostics. Emerging trends include integration of advanced imaging with AI-assisted interpretation, use of biomarker assays for early-stage detection, and inclusion of neuro-assessment in preventive care programs, positioning this segment as a critical element of veterinary neurology and pet wellness strategies.

The Veterinary Neurodegenerative Disease Diagnostics market is experiencing a steady expansion as the prevalence of age-related neurological conditions in animals continues to rise. Increased awareness among pet owners regarding cognitive decline and movement disorders has contributed to early diagnostic testing and timely intervention. Veterinary clinics and animal hospitals have begun prioritizing advanced diagnostic workflows to manage neurodegenerative conditions more effectively.

The development of sophisticated imaging technologies and biomarker-based assays is supporting greater diagnostic accuracy. Additionally, as the human-animal bond strengthens and pet lifespans increase, there has been an observable shift toward preventive and personalized veterinary care. Research into comparative neurology has further aligned veterinary diagnostics with human standards, opening new opportunities for innovation.

Veterinary neurologists and clinicians are increasingly utilizing specialized tests to detect early-stage disorders, improving outcomes and quality of life for affected animals. The market is expected to remain on a growth trajectory due to technological advancements and heightened clinical focus on animal neurological health..

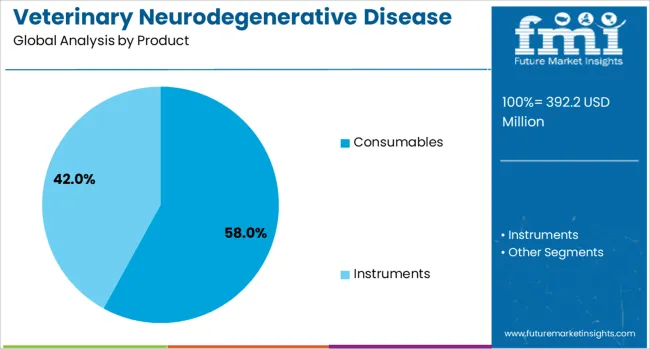

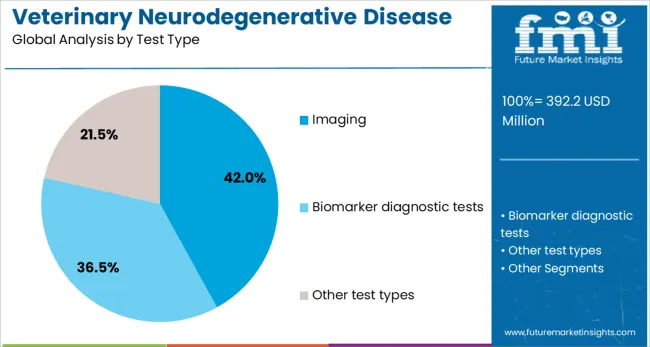

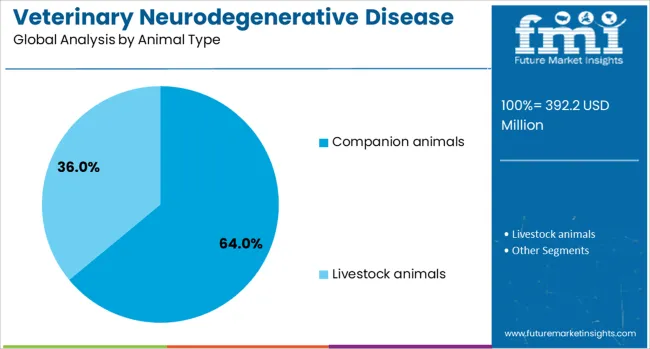

The veterinary neurodegenerative disease diagnostics market is segmented by product, test type, animal type, indication, end use, and geographic regions. The veterinary neurodegenerative disease diagnostics market is divided into Consumables and Instruments. In terms of test types, the veterinary neurodegenerative disease diagnostics market is classified into Imaging, Biomarker diagnostic tests, and Other test types. Based on animal type, the veterinary neurodegenerative disease diagnostics market is segmented into Companion animals and Livestock animals. The veterinary neurodegenerative disease diagnostics market is segmented into Cognitive dysfunction, Cerebellar abiotrophy, Spongiform encephalopathies, and Other indications. By end use of the veterinary neurodegenerative disease diagnostics market is segmented into Veterinary hospitals and clinics, Diagnostic laboratories, and Other end use. Regionally, the veterinary neurodegenerative disease diagnostics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The consumables product segment is projected to hold 58% of the Veterinary Neurodegenerative Disease Diagnostics market revenue share in 2025, making it the dominant product category. This leadership position has been driven by the recurring nature of consumable use in diagnostic procedures, including reagents, assay kits, and sample preparation materials. Veterinary laboratories and clinics rely heavily on these components to perform tests efficiently and consistently.

The demand for high-throughput and rapid diagnostic workflows has further supported increased utilization of consumables. Their availability across a broad range of diagnostic platforms and compatibility with various sample types have reinforced their significance in both research and clinical settings.

Furthermore, as new biomarker-based assays enter the market, the reliance on specialized consumables has intensified. Frequent reordering cycles and the need for replenishment contribute to the segment’s sustained revenue generation, while innovation in diagnostic chemistry continues to expand their application scope across companion and livestock species..

The imaging test type segment is expected to account for 42% of the Veterinary Neurodegenerative Disease Diagnostics market revenue share in 2025, positioning it as the leading test method. This dominance is attributed to the pivotal role that advanced imaging technologies play in the early and accurate detection of neurological disorders in animals. Techniques such as MRI and CT scans allow for detailed visualization of structural changes in the brain and spinal cord, which are critical for diagnosing degenerative conditions.

The growing availability of in-house imaging equipment in veterinary facilities has enabled clinicians to make real-time diagnostic decisions. Additionally, imaging tests offer noninvasive diagnostic options, which are increasingly favored by veterinarians and pet owners alike.

The capacity to track disease progression and evaluate therapeutic outcomes has further cemented the relevance of imaging in ongoing care protocols. The segment continues to benefit from equipment innovation, digital integration, and rising clinical demand for high-resolution diagnostic tools..

The companion animals segment is anticipated to capture 64% of the Veterinary Neurodegenerative Disease Diagnostics market revenue share in 2025, establishing it as the leading animal type. This leadership has been reinforced by the growing recognition of cognitive dysfunction and age-related neurological disorders in pets such as dogs and cats. Increased pet ownership, especially in urban regions, coupled with higher veterinary care spending, has accelerated demand for diagnostics tailored to companion animals.

The emotional bond between owners and their pets has led to a rise in early veterinary consultations and regular health screenings. Diagnostic tools have become more accessible and specialized, enabling veterinarians to identify neurodegenerative conditions during routine checkups.

The longevity of companion animals has also improved due to better nutrition and healthcare, which in turn raises the likelihood of late-onset neurological conditions. As awareness of these diseases grows, companion animals are increasingly receiving timely, evidence-based diagnostics, reinforcing the segment’s dominant market position..

Veterinary neurodegenerative disease diagnostics encompass tools and assays used to detect conditions such as canine cognitive dysfunction, feline dementia, and neurodegenerative disorders in other companion or farm animals. Diagnostic approaches include advanced imaging (MRI, PET), cerebrospinal fluid biomarker analysis, and cognitive function testing. Growing awareness of age-related neurological conditions in pets has driven demand for accurate, early-stage detection. Providers offering validated biomarker assays, portable testing formats, and minimally invasive sample collection methods have been well positioned. Diagnostics that enable proactive care plans, reliable progression tracking, and veterinarian-guided interpretation continue to guide adoption in clinics and specialty hospitals.

Adoption of veterinary neurodegenerative diagnostics has been supported by increased lifespan and improved care in companion animals, leading to a higher incidence of age-associated cognitive decline. Veterinary professionals and informed pet owners have begun seeking early confirmation of neurological symptoms to guide treatment or lifestyle adjustment. Growth in data linking pet behavior changes to measurable biomarkers such as amyloid beta levels or tau protein fragments has enhanced diagnostic validity. Tools enabling objective cognitive assessment and regular monitoring without sedation have proven attractive. Emphasis on preventive veterinary care protocols and wellness check integrations has raised demand in referral and general practice settings.

Adoption has been restrained by high cost of advanced imaging equipment and laboratory-based biomarker assays. Many small veterinary clinics may lack infrastructure or technical expertise to conduct MRI or cerebrospinal fluid analysis. Standardization of testing protocols remains limited, with variability in biomarker cut-offs and test interpretation between labs. Non-invasive diagnostics such as behavioral tests may be perceived as subjective in absence of validated scoring systems. Regulations governing pet diagnostic submissions and invasive sample collection protocols vary by region. Training of veterinary teams to administer tests and interpret results adds operational burden. These factors have combined to slow broader market penetration.

Opportunities are being created through development of in-clinic point-of-care test kits using saliva or blood biomarkers for neurodegeneration markers. Digital cognitive assessment apps for vet-assisted remote monitoring and owner engagement offer scalable diagnosis pathways. Collaborative research between veterinary schools, animal neurologists, and diagnostic companies is building evidence-based diagnostic standards. Partnership models in senior pet wellness programs or geriatric screening initiatives are enabling regular disease surveillance. Customized monitoring subscription services for aging pets, including cognitive evaluation intervals and tele-vet support, are poised to enhance clinic-client relationships. Targeted diagnostics for working dogs or cognitive function-sensitive breeds offer niche growth channels.

Technology trends include adoption of wearable sensors and activity tracking for early detection of behavioral decline and sleep pattern changes. Remote analysis dashboards aggregated from multiple test modalities are enabling integrated cognitive health profiles. Advancement in antibody-based immunoassays and lab-on-chip diagnostics improves sample throughput and cost efficiency. Efforts to harmonize veterinary neurodiagnostic protocols across labs and clinics are gaining traction within professional associations. Development of database-backed cognitive performance tracking enables benchmark comparison over time. AI-assisted image analysis platforms for subtle brain structure changes are under exploration. Integration of cognitive health screening into routine annual or senior wellness check-ups is shaping practi ce workflows.

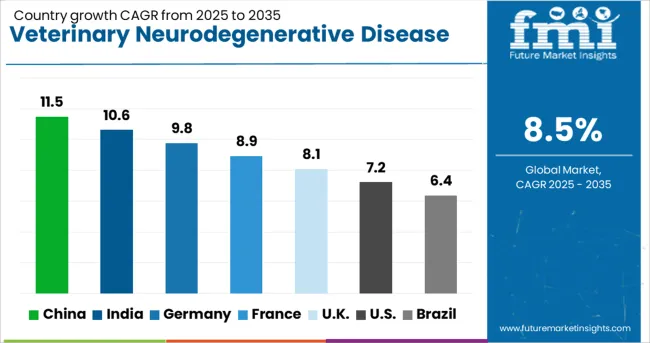

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

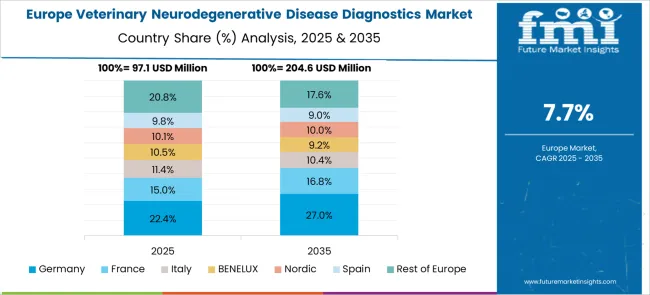

The veterinary neurodegenerative disease diagnostics market is projected to grow at a CAGR of 8.5% from 2025 to 2035, fueled by rising pet ownership, increased prevalence of neurological disorders in companion animals, and technological progress in diagnostic imaging and biomarker testing. China leads with 11.5%, supported by higher pet healthcare expenditure and advanced veterinary clinics, followed by India at 10.6%, driven by the growing awareness of animal health and expansion of veterinary infrastructure. Among developed markets, Germany posts 9.8%, the United Kingdom records 8.1%, and the United States grows at 7.2%, with emphasis on advanced diagnostic solutions and integration of AI-enabled imaging tools. The analysis includes over 40 countries, with the top five detailed below.

China is projected to achieve a CAGR of 11.5% through 2035, supported by a significant rise in companion animal ownership and increasing prevalence of neurodegenerative diseases among pets. The availability of advanced MRI and CT imaging technologies across veterinary clinics is accelerating early detection. Domestic companies are investing in diagnostic equipment tailored for smaller clinics, while international players expand partnerships with specialty hospitals. Demand for biomarker-based diagnostic kits is growing due to faster turnaround times and accuracy in identifying disorders like epilepsy and degenerative myelopathy. Growing disposable income among pet owners and improved access to pet insurance further strengthen China’s leadership in the market.

India is forecasted to post a CAGR of 10.6% through 2035, driven by increased awareness about neurological health in pets and the rapid growth of the veterinary services sector. Companion animal owners are increasingly seeking advanced care for conditions such as canine cognitive dysfunction and epilepsy, creating strong demand for affordable diagnostic imaging systems and rapid diagnostic kits. Veterinary colleges and diagnostic laboratories are adopting digital radiology and telemedicine platforms, improving access to diagnostic expertise in semi-urban areas. Local manufacturers are focusing on low-cost imaging solutions, while global companies target premium segments through collaborative programs with veterinary hospitals.

Germany is projected to grow at a CAGR of 9.8% through 2035, supported by its advanced veterinary care infrastructure and strong focus on high-accuracy diagnostics. The adoption of MRI scanners, computed tomography, and AI-driven image interpretation is shaping next-generation veterinary practices. Clinics are increasingly offering genetic testing and biomarker panels for early identification of neurodegenerative disorders in pets. Research collaborations between veterinary universities and diagnostic technology companies are fostering innovation in point-of-care testing devices. The growing trend of pet humanization in Germany reinforces demand for premium care solutions, making advanced neuro-diagnostic services a mainstream offering in veterinary hospitals.

The United Kingdom is expected to achieve a CAGR of 8.1% through 2035, driven by the growing role of specialized veterinary neurology practices and early screening programs for companion animals. Demand for MRI-based diagnostics and electroencephalography (EEG) monitoring is increasing in referral hospitals, particularly for managing complex neurological conditions. Manufacturers are focusing on portable and compact imaging devices to support small and mid-sized veterinary clinics. Insurance coverage for diagnostic procedures and regulatory emphasis on animal welfare further accelerate adoption. Online veterinary consultations integrated with diagnostic imaging reviews provide additional opportunities for market expansion in the UK.

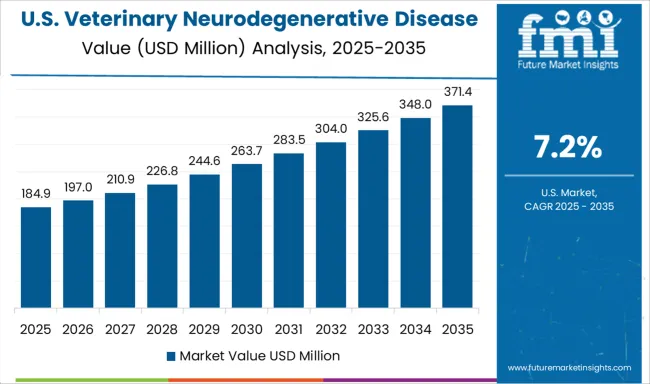

The United States is projected to post a CAGR of 7.2% through 2035, supported by the widespread adoption of digital imaging platforms, advanced laboratory diagnostics, and AI-enabled interpretation tools for companion animals. Large veterinary chains and specialty hospitals are leading the shift toward in-house MRI and CT imaging capabilities, improving diagnostic turnaround times. Increasing demand for genetic and biomarker testing aligns with a growing preference for preventive and personalized veterinary care. Veterinary telehealth services that integrate diagnostic review are becoming common, supported by expanding infrastructure for cloud-based imaging data storage and analysis.

The veterinary neurodegenerative disease diagnostics market is driven by established veterinary diagnostic and pharmaceutical companies such as IDEXX Laboratories, Inc., Zoetis Inc., Virbac, Thermo Fisher Scientific Inc., Neogen Corporation, and Antech Diagnostics. IDEXX Laboratories leads the segment with comprehensive diagnostic platforms, offering advanced blood-based biomarker panels and imaging solutions for early detection of neurological disorders in companion animals. Zoetis focuses on integrating diagnostic tools with therapeutic strategies, leveraging its strong veterinary presence to deliver customized neuro-diagnostic services.

Virbac specializes in companion animal health diagnostics, emphasizing affordable screening and preventive testing for neurological conditions. Thermo Fisher Scientific contributes through high-precision laboratory instruments and molecular diagnostic technologies, supporting advanced neurodegenerative disease research in veterinary settings. Neogen Corporation provides genetic and biochemical testing solutions, helping veterinarians identify predispositions to neurodegenerative disorders in specific breeds. Antech Diagnostics, with a vast veterinary laboratory network, emphasizes rapid turnaround times for diagnostic tests including advanced imaging and cerebrospinal fluid analysis. Competitive differentiation centers on diagnostic accuracy, integration with digital platforms for result interpretation, and the availability of advanced imaging and molecular tools. Entry barriers are high due to regulatory compliance, technical complexity, and the need for specialized veterinary expertise. Strategic priorities include expanding tele-diagnostics, developing biomarker-based test panels, and leveraging AI for early disease prediction. Partnerships with veterinary clinics and hospitals, combined with investments in R&D, are key to strengthening market presence.

| Item | Value |

|---|---|

| Quantitative Units | USD 392.2 Million |

| Product | Consumables and Instruments |

| Test Type | Imaging, Biomarker diagnostic tests, and Other test types |

| Animal Type | Companion animals and Livestock animals |

| Indication | Cognitive dysfunction, Cerebellar abiotrophy, Spongiform encephalopathies, and Other indications |

| End Use | Veterinary hospitals and clinics, Diagnostic laboratories, and Other end use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IDEXX Laboratories, Inc., Zoetis Inc., Virbac, Thermo Fisher Scientific Inc., Neogen Corporation, and Antech Diagnostics |

| Additional Attributes | Dollar sales by diagnostic type (molecular diagnostics, imaging tests, biomarker-based panels) and application (canine, feline, equine), with demand fueled by increased awareness of neurological health in companion animals and the rise in age-related disorders. Regional dynamics show strong adoption in North America and Europe due to advanced veterinary care infrastructure, while Asia-Pacific experiences growing demand driven by pet ownership and expanding veterinary services. Innovation trends include AI-driven diagnostic interpretation, point-of-care molecular testing, and integration of genetic screening with cloud-based veterinary health platforms for precision diagnostics. |

The global veterinary neurodegenerative disease diagnostics market is estimated to be valued at USD 392.2 million in 2025.

The market size for the veterinary neurodegenerative disease diagnostics market is projected to reach USD 886.8 million by 2035.

The veterinary neurodegenerative disease diagnostics market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in veterinary neurodegenerative disease diagnostics market are consumables and instruments.

In terms of test type, imaging segment to command 42.0% share in the veterinary neurodegenerative disease diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA