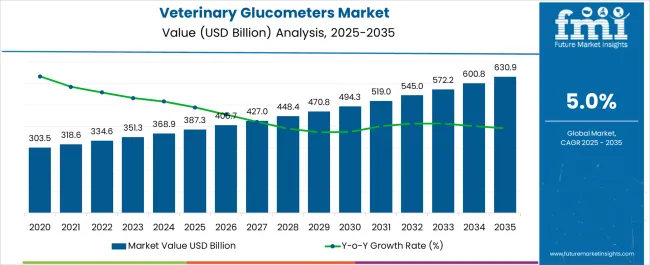

The Veterinary Glucometers Market is estimated to be valued at USD 387.3 billion in 2025 and is projected to reach USD 630.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Veterinary Glucometers Market Estimated Value in (2025 E) | USD 387.3 billion |

| Veterinary Glucometers Market Forecast Value in (2035 F) | USD 630.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The veterinary glucometers market is expanding steadily due to the rising prevalence of diabetes in companion animals, particularly dogs and cats, and the growing awareness among PET owners about the importance of regular glucose monitoring. Advances in point of care veterinary diagnostics have enabled faster and more accurate blood glucose measurement, enhancing treatment outcomes and quality of life for animals.

The willingness of PET owners to invest in chronic disease management, coupled with improvements in veterinary healthcare infrastructure, is driving wider adoption of glucometers across both developed and emerging markets. Increasing product innovation, such as portable, easy to use, and species specific devices, is further supporting uptake.

The outlook for the market remains positive as technological integration, including smartphone connectivity and data tracking features, continues to align with the demand for improved veterinary care and monitoring precision.

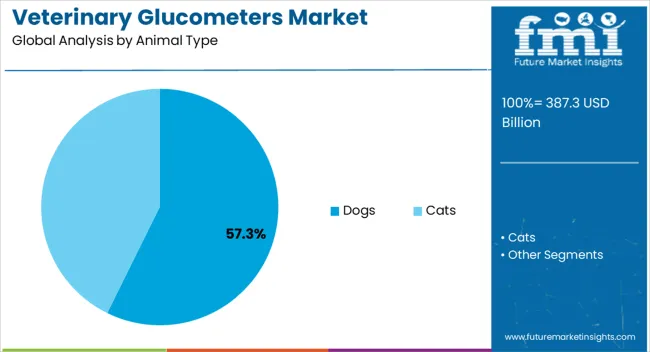

The dogs segment is projected to hold 57.30% of total market revenue by 2025, positioning it as the leading animal type category. This dominance is being driven by the higher prevalence of diabetes in dogs compared to other companion animals and the increasing veterinary emphasis on early diagnosis and consistent monitoring.

The willingness of dog owners to adopt advanced healthcare solutions and the availability of species calibrated glucometers have accelerated adoption.

The growing trend of personalized treatment and improved awareness of PET wellness are further strengthening the position of this segment.

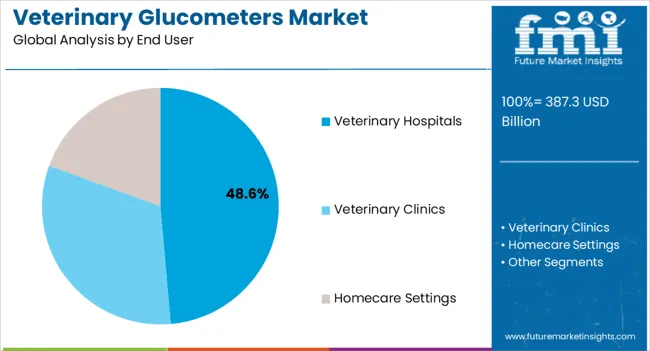

The veterinary hospitals segment is expected to account for 48.60% of market revenue by 2025, making it the leading end user category. This growth is attributed to the availability of advanced diagnostic infrastructure, trained veterinary professionals, and the capacity to manage chronic conditions effectively in clinical settings.

Veterinary hospitals are preferred for precise glucose monitoring, treatment adjustments, and long term management of diabetic animals.

The integration of modern diagnostic tools, coupled with the trust PET owners place in veterinary professionals, has reinforced the leadership of this segment in the overall market landscape.

Market to Witness an absolute dollar Growth of USD 238.7 million between Comparison Periods

During the period from 2020 to 2025, the veterinary glucometers market experienced significant growth, driven by factors such as the increasing prevalence of diabetes in animals, rising PET ownership, and growing awareness about animal health. Further, the market witnessed a steady increase in demand for veterinary glucometers as PET owners and veterinarians recognized the importance of monitoring blood glucose levels in animals.

Looking ahead, the growth forecast for the market from 2025 to 2035 remains positive. The market is expected to continue its upward trajectory, propelled by factors such as the expanding PET population, advancements in veterinary care, and the increasing adoption of glucose monitoring devices in animal healthcare settings.

The forecast indicates that the market is likely to witness substantial growth during the forecast period. This growth can be attributed to the rising incidence of diabetes and other metabolic disorders in animals, which necessitates effective monitoring and management of blood glucose levels. Additionally, the growing awareness among PET owners about the importance of regular glucose monitoring is expected to contribute to the market's expansion.

North America is expected to lead the market with better healthcare facilities and growing advancing technology in the region. North America’s market holds a significant share in the veterinary glucometers market with 44.5% of the global market share. Further, the rising demand is mainly rising in the North American region due to the changing lifestyle of pets and animals, especially the native lifestyle being the big problem.

The European veterinary glucometers market expands at a steady CAGR for veterinary glucometers with a global market share of 32.7%. The second large market is held by the Europe market followed by Asia Pacific due to increasing awareness of veterinary diseases.

The market in this region is anticipated to be one of the significantly growing markets due growing animal population and rising diseases among animals due to inactive lifestyles and poor management. Covid-19 has also fueled the sales, as they are convenient for homes, especially when other animal clinics were closed.

The country's expanding PET population, increasing awareness about animal health, and the growing prevalence of diabetes in animals have contributed to the rising demand for veterinary glucometers.

Furthermore, advancements in veterinary care and the availability of technologically advanced glucometers have also played a role in driving the market growth in China. These innovative devices offer features such as accurate glucose measurement, user-friendly interfaces, and convenient data management, catering specifically to the needs of veterinary professionals and PET owners.

Dogs require regular monitoring of their blood glucose levels, especially those with diabetes or at risk of developing the condition as it is one of the most common pets and a popular choice among households.

Given the significant role that dogs play in the veterinary glucometers market, manufacturers and suppliers continually strive to develop innovative products tailored to meet the specific needs of canine diabetes management. The aim is to provide reliable and user-friendly glucometers that enhance the monitoring and care of dogs with diabetes, ultimately improving their health outcomes and overall well-being.

Veterinary hospitals hold a prominent share of 41.60% in the veterinary glucometers market. These establishments play a crucial role in providing healthcare services to animals, including diagnosis, treatment, and monitoring of various medical conditions.

Veterinary hospitals prioritize the well-being and health of animals, and glucometers play a vital role in facilitating effective diabetes management. By accurately measuring blood glucose levels, veterinary hospitals can provide optimal care and support to animals with diabetes, ensuring their overall health and improving their quality of life.

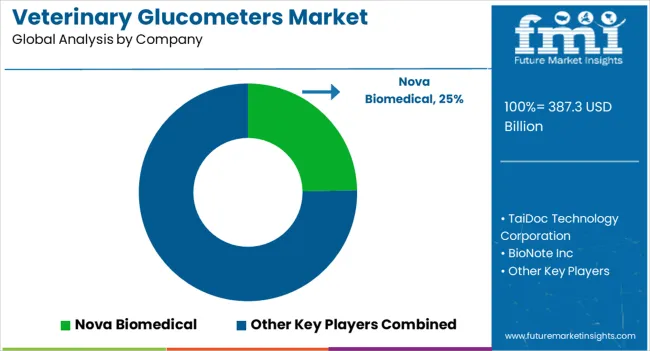

Key participants have added cutting-edge technology along with the latest animal healthcare technology like fast results. COVID-19 has also pushed brands to adopt the technology to make monitoring convenient. As the market rises and thrives on its growth prospects, the competition among the key players keeps on increasing, making the market dynamic.

Recent Mergers and Product Launches

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Countries Covered | The United States, Canada, Germany, The United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Türkiye, Northern Africa, and South Africa |

| Key Segments Covered | End User, Animal Type, Region |

| Key Companies Profiled | Neogen, Zoetis, Merck, Boehringer Ingelheim, Elanco, Dechra Pharmaceuticals, IDEXX Laboratories, B. Braun Vet Care, and Medtronic |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global veterinary glucometers market is estimated to be valued at USD 387.3 billion in 2025.

The market size for the veterinary glucometers market is projected to reach USD 630.9 billion by 2035.

The veterinary glucometers market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in veterinary glucometers market are dogs and cats.

In terms of end user, veterinary hospitals segment to command 48.6% share in the veterinary glucometers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA